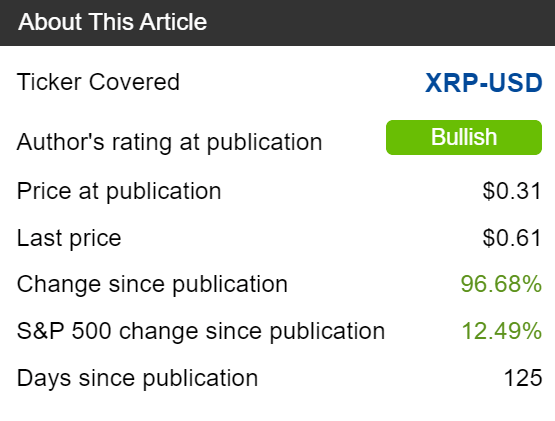

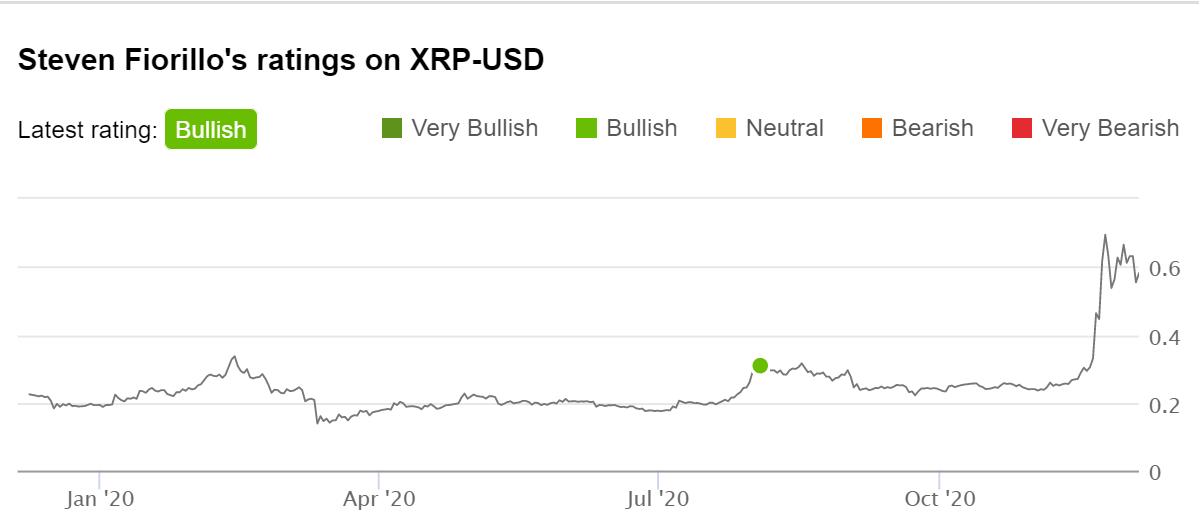

Since my last article on Ripple (XRP), it’s been an interesting four months. The value of XRP has increased by 96.68%, compared to 12.49% for the S&P 500. I am still bullish on cryptocurrencies and believe XRP represents one of the best opportunities throughout the sector. There’s a lot of speculation throughout the crypto community about how much the value of XRP will appreciate. I have seen compelling analysis predicting it will reach $1,00 in the short term to $10,000 in the long term. I believe XRP is solving a problem in cross-border payments, and that more people, businesses and countries will utilize XRP in the future. If you think XRP at $10,000 is crazy, look at BTC, whose price is above $19,000. Roughly one decade ago, on 5/22/10 – which is now known as Bitcoin Pizza Day – a British man purchased 2 pizzas for 10,000 BTC. A decade later, those 10,000 BTC are worth $190 million. I am bullish on XRP and believe that over the next 5-10 years, its adaptation will become mainstream and there is definitely a chance XRP could create a new generation of millionaires.

(Source: Seeking Alpha)

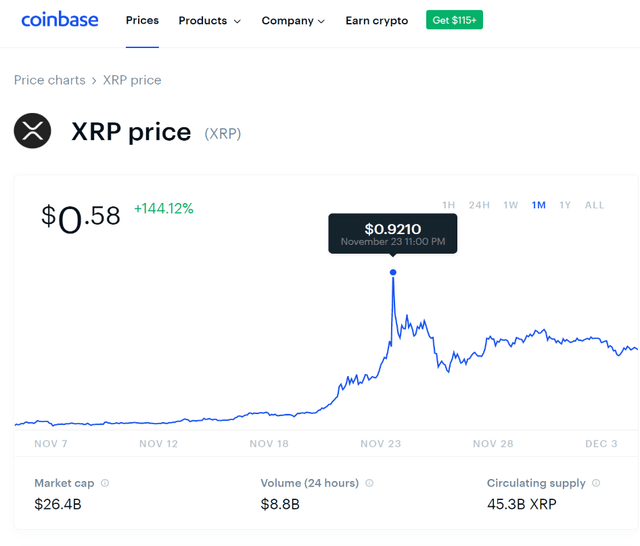

(Source: Coinbase)

Visa was the first, PayPal was the second, and I believe the banks will be next to utilize cryptocurrencies

Coinbase (COINB) is one of the largest cryptocurrency exchanges where someone can purchase and store their crypto. It has over 35 million verified users, has reached $320 billion in total volume traded, there are $25 billion worth of assets on its platform, and the Coinbase platform is available in over 100 countries. Depending on where you look, Coinbase is often regarded as the top crypto exchange in the U.S. Recently, Visa (V) and Coinbase teamed up and Coinbase launched a Coinbase Visa debit card for its European customers. This card allows users to spend their crypto anywhere where Visa is accepted. The Coinbase Visa card is also a rewards card where cardholders can earn up to 4% back in Stellar (XLM) or 1% back in BTC. Coinbase just announced that customers in the U.S can expect the Coinbase Visa debit card “coming soon”.

PayPal (PYPL), which is one of the largest digital payment platforms, is now allowing customers to purchase crypto and store it in their PayPal accounts. Currently, BTC is the only cryptocurrency PYPL is allowing its customers to purchase and store. I know someone who purchased BTC last week through PYPL, and they said it was super easy. BTC is PYPL’s initial bridge into the crypto markets, and I am going to speculate that it won’t be its last. BTC’s total supply is limited through its source code, which will never exceed 21,000,000. To date, there are just over 18.56 million BTC which have been mined and 2.44 million left to unlock. Roughly 144 blocks are solved per day, and each block unlocks 6.25 BTC, so there are about 900 new BTC mined each day.

I don’t think BTC will be PYPL’s only venture into crypto. Keep in mind, you can only purchase something if it’s for sale. The crypto market operates the same as the stock market, as you need someone to sell shares for another party to purchase them. If there are no sellers, orders can go unfilled for extended periods of time. With PYPL’s 300 million users now having access to purchase BTC, I believe this will generate a new wave of investors. Between the combination of BTC’s limited supply and investors holding BTC with a long-term time horizon, I believe this will force PYPL to list other cryptocurrencies through its platform, as orders for BTC could remain unfilled for extended periods of time. In 2021, PYPL is expected to charge a small transaction fee to purchase cryptocurrencies, so it would make sense for PYPL to offer the other major coins, such as Ethereum (ETH), Litecoin (LTC) and XRP, through its platform.

PYPL currently offers four types of credit and debit cards through Mastercard (MA). With V partnering with Coinbase to establish a card based on cryptocurrencies, I wouldn’t be surprised if MA and PYPL replicate the model. I believe once PYPL gets its user base acclimated to purchasing cryptocurrencies and adds additional coins such as ETH, LTC and XRP to purchase, there will be an MA card announced to rival V’s.

Jamie Dimon, who is the CEO of JPMorgan Chase (JPM), has previously made statements calling BTC a fraud and compared it to being worse than tulip bulbs. He was adamant during BTC’s rise that it wouldn’t survive. Today, PYPL has a market cap of $235.16 billion and Square (SQ) has a market cap of $93.86 billion. SQ was way ahead of PYPL in the crypto game, with its cash app allowing users to purchase and store BTC. JPM has a market cap of $372.92 billion, and Wells Fargo (WFC) has a market cap of $122.17 billion. I bet the big banks never thought they would see the day where digital payment platforms would be chipping away at their customer base. I will speculate that it won’t be long before the big banks such as JPM and WFC allow you to purchase and store crypto through their banking platforms.

When you review the evolution of personal banking over the past two decades, I think everyone would agree it has advanced significantly. I don’t see any indication that this evolution will stop, as we’re still undergoing a large transition to digital banking. I believe the next frontier in banking will include the adoption of cryptocurrencies. The big banks, such as JPM and the regional bank chains, have too much to lose by not incorporating cryptocurrencies into their offerings for clients. Millennials are becoming the target audience, and the traditional banks are fighting a huge battle with digital platforms for their business. I think we’re going to see the banks either partner with an existing exchange such as Coinbase or collectively set up their own crypto exchange to facilitate crypto accounts. I believe that in the near future, banks will offer checking, savings and crypto accounts to their customers. They can’t afford to stand by and let PYPL and SQ be the only alternatives to crypto exchanges. Over time, they will lose out on a tremendous amount of revenue. If I am correct and the banks do embrace crypto, it will further legitimize them, and I would expect that they appreciate in value even quicker.

What is XRP, how much XRP is there and what does it do?

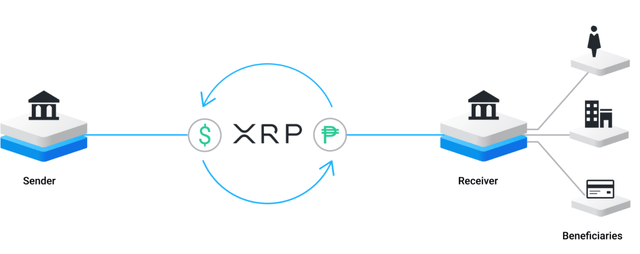

XRP is a digital asset which was built for payments. It’s the native digit asset which is basically a currency on the XRP ledger. The XRP ledger is a decentralized blockchain technology which is open source and permissionless that can settle transactions between 3 and 5 seconds. Unlike other cryptocurrencies, it was created to solve a problem in cross-border payments. XRP was designed to handle the same throughput as V, and can settle 1,500 transactions per second and operate on a continuous basis. In comparison, ETC can handle about 15 transactions per second and BTC can handle 3-6. Ripplenet is a decentralized global network which utilizes blockchain technology for global payments. Ripplenet is used in over 40 countries across 6 continents through more than 300 providers. XRP and the XRP ledger are used throughout Ripplenet for its global processing network.

One of the big advantages with Ripplenet is as regards demand liquidity. In many instances, a company would need to prefund an account in their destination market and then exchange currencies, which ties up capital rather than utilizing it to grow the business. XRP acts as a bridge between two different currencies, as it is delivered and settled instantly, eliminating the need for prefunding. Think about it like this – customers send XRP through Ripplenet to bridge two currencies in 3-5 seconds, which ensures that payments are sent and received in the local currency on both sides of the transaction.

(Source: Ripple)

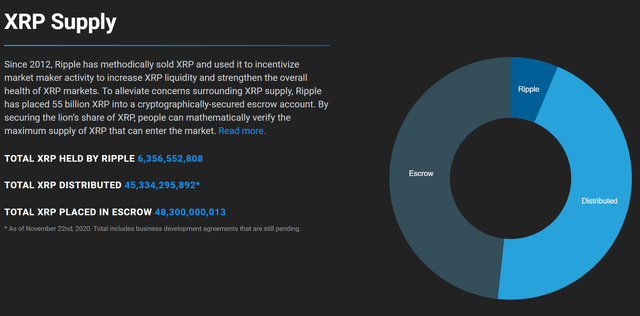

Currently, Ripple holds 6.36 billion XRP, 45.33 billion has been distributed and there is another 48.3 billion placed in escrow. Ripple had placed 55 billion XRP in a cryptographically secured escrow account. This was done to create certainty around the supply of XRP, and so, it would be mathematically possible to verify the maximum supply which can enter the market. Ripple established 55 contracts, each containing 1 billion XRP. Each established contract is set to expire on the first of the month sequentially for 55 months, as only 1 contract can expire on a monthly basis. When a contract expires, Ripple can then use the XRP, and any XRP which isn’t used goes back into escrow in the form of a new contact.

(Source: Ripple)

Why XRP and not BTC?

I own some BTC, but I am more bullish on XRP. I believe XRP has more utility than BTC, which will disrupt the future of cross-border payments and possibly rival the Swift network. XRP delivers transaction speed and throughput that is above and beyond what BTC and even ETH were designed to do. XRP is the fastest, most efficient and scalable digital asset in the world. If the price of BTC fluctuated just 1/2 of a percent at a price of $19,000, that would be equal to $95. With a settlement time of about 4 seconds, XRP almost eliminates price volatility in its entirety. XRP also solves a problem with on-demand liquidity for cross-border payments.

The SWIFT network was founded in 1973 with 239 banks, and in 1977, expanded to 518 institutions in 22 countries. The network now includes over 10,000 banks in over 200 countries. A very basic description of how a transaction through SWIFT works could be summed up like this: transfer instructions get sent from the sender’s bank to the recipient’s bank. This isn’t always directly, as in some occurrences, transfer instructions may need to go through intermediary banks throughout the process. You will also need certain information for the wire, which includes the name and address of the recipient bank, recipient’s account number, SWIFT code for the recipient bank, etc. SWIFT transactions aren’t always instant, as they can take from 1-5 business days, in some cases a fee from 3-5 banks could be applied depending on the intermediaries, and there could be poor currency exchange rates.

It is estimated that roughly $5 trillion gets moved on a daily basis through the SWIFT network. I believe the true long-term value of digital assets will be derived from their utility. One utility certainly is store of value, which is the class I would put BTC in. I would speculate BTC is 2020’s gold, but in a form which you can access and utilize digitally. Another utility for digital assets is payments, which is the class I would put XRP in. XRP has an extremely fast remittance time of around 4 seconds, and is cheap on a per transaction basis. I can send XRP to someone in Asia right now and they would get it and covert it to their local currency faster than you could make a phone call. When you think about trillions of dollars moving through the SWIFT network each day, it’s not crazy to think XRP could become a vehicle to move denominations of $100, $1,000 or $10,000 in a single XRP through a cross-border payment system.

Another thing to consider is that climate change and the environmental impact from energy usage is at the forefront of many political agendas. The backbone of BTC is proof of work and mining, which utilizes an extreme amount of power. Many mining farms have been established to facilitate mining BTC and conducting proof of work, in addition to individuals converting a room in their home or even their garage to grab a small piece of the pie. The larger-scale mining farms look like full-blown data centers with racks upon racks of equipment. I think as digital assets increase in popularity, we’re going to see more attention shift to the scalability and efficiency of digital assets such as XRP and XLM, rather than power-intensive digital assets like BTC.

(Source: WayToMine)

My personal XRP strategy

I have no clue what the price of XRP will be worth, but I believe it will appreciate a great deal from its current levels. I have been adding to my position since February 2020, and have recently developed an exit strategy. Since I haven’t reached the amount of XRP I would like to own, I plan on adding to my position at levels below $2 an XRP.

I cannot stress this enough – I do not have a significant portion of my investments tied up in crypto, and I am willing to wait decades for this investment to materialize.

Once I acquire a full position in XRP, I am planning on cashing out at the following milestones, if they occur:

- 20% of my XRP at $10

- 20% of my XRP at $100

- 20% of my XRP at $1,000

- 20% of my XRP at $10,000

I will then hold the remaining 20% until a later date. Maybe this never materializes, but when you look at BTC’s meteoric rise, anything’s possible.

Conclusion

I am long XRP and believe investors will be handsomely rewarded. Crypto is still in its infancy and has tremendous untapped future potential. Even though I am bullish, I am treating XRP as a gamble. I don’t think there is anything wrong with dabbling in crypto, but I wouldn’t make it a significant part of my investment portfolio. XRP could replicate BTC and become an investment of a lifetime, or it could simply vanish. All I know is, I am not going to be late to the party this time if history repeats itself.

Disclosure: I am/we are long XRP-USD, XLM-USD, BTC-USD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Additional disclosure: Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. Investors should conduct their own research before investing to see if the companies discussed in this article fits into their portfolio parameters