I have a surefire way of using bitcoin

BTCUSD,

ethereum

ETHUSD,

and other digital currencies to finance your retirement—but I can’t recommend it.

Go out and buy a bunch of bitcoin (or other digital currencies), get a receipt, and then immediately sell them. Keep the receipt.

Then, when these currencies next collapse in price, as they are highly likely to do, go out and buy a bunch more. Immediately sell the ones you’ve just bought, and get another receipt.

You will now have two receipts. One will show you bought a ton of bitcoin—or whatever—when the prices were up high, as they are right now. The other will show you sold the same amount of Bitcoins when it was much cheaper.

So long as you are careful not to leave any documentary proof of the other two transactions, you can then claim these fictional “losses” on your tax return. The IRS considers these digital currencies as property or investments, and taxes them as such.

You can use these “losses” to shelter any other (real) capital gains, and up to $3,000 a year of income, from tax. Savings? As much as you can claim.

Sure, if you get caught, you’ll probably go to jail for tax evasion. I’m not recommending it. But I’m passing the information on.

(By the way, if the IRS audits you, I can only quote the Miami Herald’s Dave Barry in similar circumstances. “If you follow my advice, and the IRS asks you where you got your information,” he told readers, “remember to give them my full name, George Will.”)

OK, so technically this maneuver is illegal. But, hey, maybe you won’t get caught.

And anyway, since when has “what’s legal” mattered to investors in bitcoin or other digital currencies?

The number one utility of cryptocurrencies is breaking the law. Digital currencies are fabulous vehicles for financing terrorism, drug deals, child pornography, murder for hire, money laundering, and pretty much anything else that is illegal but which you could in theory pay for online.

A study in the Review of Financial Studies found that about half of all bitcoin transactions world-wide were associated with criminal activities. “We find that approximately one-quarter of bitcoin users are involved in illegal activity,” the researchers found. “We estimate that around $76 billion of illegal activity a year involves bitcoin (46% of bitcoin transactions), which is close to the scale of the U.S. and European markets for illegal drugs.”

For anyone who wants to take part in legal online transactions, there are much simpler mechanisms than buying cryptocurrencies and setting up “virtual wallets.” You can just use…er…your debit card and bank account. And things like Google Pay and Apple Pay and PayPal

PYPL,

Yet digital currencies are now becoming so popular as investments that you can hold them in a variety of individual retirement accounts. I received yet another news release the other day about a company allowing us to hold cryptocurrencies in IRAs.

Meanwhile hedge-fund manager Paul Tudor Jones—not to be confused with Tenpole Tudor—was promoting bitcoin on CNBC recently as an “inflation hedge” and comparing it with the great technology investments of the past.

“It’s like investing with Steve Jobs and Apple, or investing in Google early,” he said. His rationale? “bitcoin has this enormous contingent of really smart, sophisticated people who believe in it,” he said. “You’ve got this group of people…who are dedicated to seeing bitcoin succeed and becoming a commonplace store of value.”

He added, “I’ve never had an inflation hedge where you’ve had a kicker where you’ve also had great intellectual capital behind it, so that makes me even more constructive on it.”

It’s not clear how much Tudor Jones had invested in bitcoin when he went on TV to talk it up. I’ve reached out to his public relations team for clarification, but they declined to comment. Tudor Jones said during the interview he had a “small single digits”—or is it, “small, single digits”?–allocation to the cryptocurrency. A “small single digits” allocation might be as little as 1%. On the other hand, a “small, single digits” allocation could be pretty much anything below 10%.

His firm, Tudor Investment Corporation, manages around $8 billion in assets, so that could potentially be anywhere up to nearly $800 million in the cryptocurrency.

Tudor Jones’ arguments about bitcoin are interesting. Some might reply that Apple

AAPL,

and Google

GOOG,

didn’t succeed simply because they had a lot of smart people behind them, but because they provided great products and services that consumers loved. Nokia

NOK,

BlackBerry

BB,

Yahoo and the like also had lots of smart people working for them, and it didn’t save the stockholders.

Actually, there were lots of really, really smart people working at Enron, too.

It is a perennial argument of bitcoin champions that it must be a wonderful investment because the technology is so amazing. It reminds me of the old joke about the inventor who created a really clever device for scrambling eggs inside the shell. Yes, it’s very clever, but why do I need it?

Is bitcoin a credible “inflation hedge”? Sure, if you fear that the U.S. dollar is going to lose purchasing power, many things that aren’t dollars will be “inflation hedges.” Ditto real estate

DWRTF,

timberland, gold

GOLD,

art, wine, euros

EURUSD,

yen

USDJPY,

energy futures, and possibly luxuries like Rolex watches.

But what inflation are we talking about?

Gasoline, clothing and some other prices are falling. But in the past 12 months, used car and truck prices have risen 10%. Food’s up 4% and medical services 5%. Housing prices in the suburbs are up and apartment rents in the city are falling. Which ones do we want to hedge?

The official overall consumer-price index has risen 1.4% in the past year. The bond market is predicting it will rise about 1.6% a year over the next five.

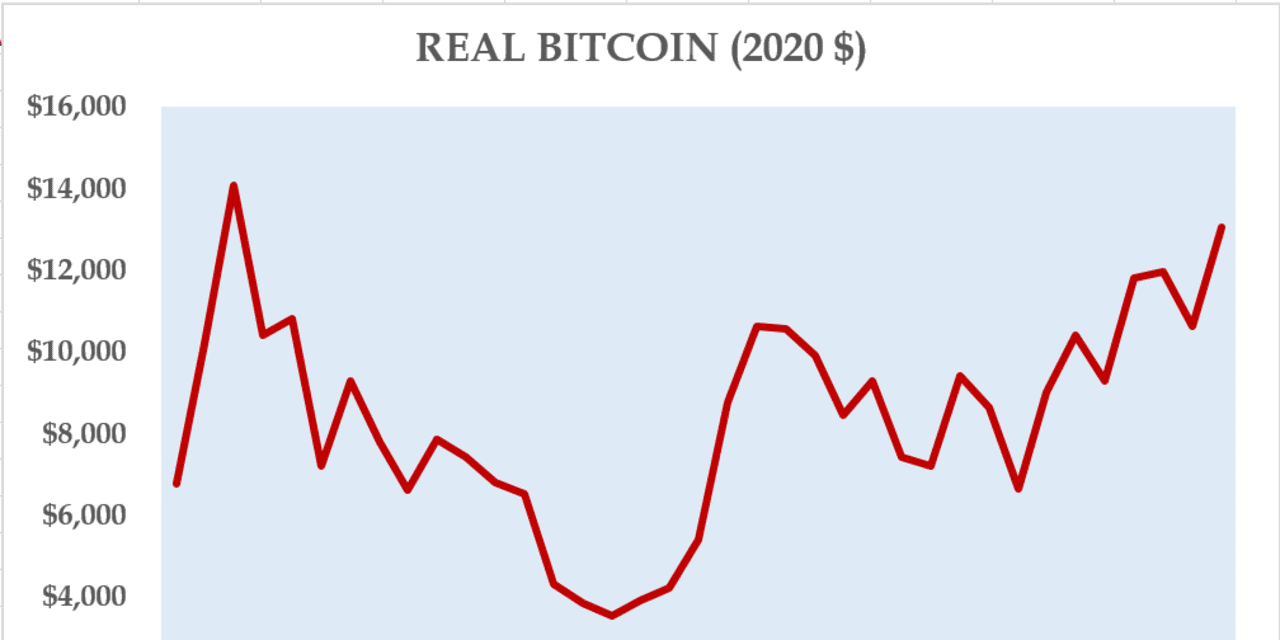

Meanwhile, a look at the price for digital currencies shows the obvious issue. Take a look at our chart. It shows the price of bitcoin adjusted for the official consumer-price index.

Even since bitcoin went mainstream, in 2017, there has been no correlation—none—with the CPI. The “real,” inflation-adjusted value fell nearly 80% at one point, and that’s just looking at month-end prices and ignoring the even greater volatility when you count daily prices. (Actually there was no correlation before it went mainstream in 2017 either.)

Hold bitcoin in an IRA and you won’t have to pay capital-gains taxes on any profits, although you will have to pay ordinary income tax on the money you eventually withdraw from the account. But if you hold bitcoin in an IRA, whether a pretax “traditional” IRA or a posttax “Roth” IRA, and you won’t be able to claim any losses on your taxes either.

The best case for holding digital currencies in an IRA is that you won’t have to track and report every single transaction on your tax return every year. That alone is valuable. On the other hand, you don’t have to own the digital currencies at all.