- Ethereum soars to new yearly highs while buyers target highs above $1,400 in the short term.

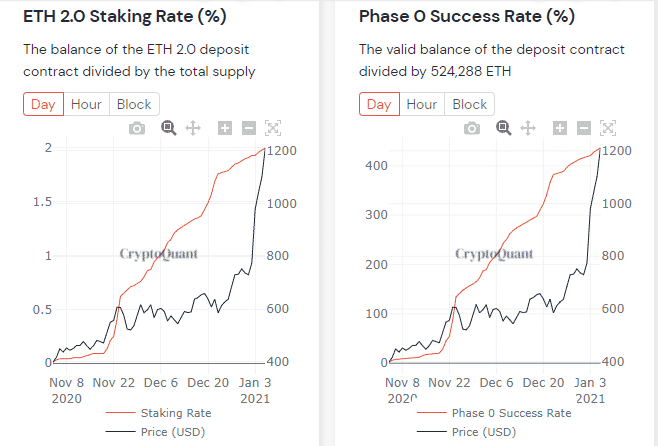

- ETH 2.0 staking hits 2% of the total Ethereum supply, thus reducing the overhead pressure.

Ethereum is currently on an incredibly bullish run after outperforming the new yearly highs. At the time of writing, the flagship token is exchanging hands at $1,260. If the bullish scenario remains intact, Ethereum is likely to hit high traded in January 2018.

Ethereum 2.0 staking now at 2% of the total ETH supply

The staking on Ethereum 2.0 began in November 2020 to ensure ample time to achieve the minimum requirements. The Genesis event of ETH 2.0 required that “at least 16,384 of 32-ETH validator deposits seven days before Dec 1. If not, the genesis event would postpone seven days after.”

Several weeks following the launch, investors are still staking their tokens. The need to stake varies from one investor to the other. Some are staking to earn rewards on the locked funds, while others would like to secure the network. At the moment, the Ether that has already been locked in the new protocol has hit nearly 2.3 million.

The weekly chart highlights a golden cross pattern, suggesting that the bullish narrative still has room for growth. A golden cross forms when a shorter-term moving average crosses above a longer-term moving average. The 50 SMA holding ground above the 100 SMA shows that buyers are generally in control.

ETH/USD weekly chart

Similarly, the Relative Strength Index has remained in the overbought region for a while. In other words, the price action can give a blind eye to the overbought situation and perhaps continue with the rally eyeing $1,400.

Ethereum Intraday chart

Spot rate: $1,269

Relative change: 56

Percentage change: 5%

Trend: Bullish

Volatility: High

To keep track of DeFi updates in real time, check out our DeFi news feed Here.

Share on Facebook

Share on Twitter

Share on Linkedin

Share on Telegram