Ripple’s XRP, currently the fourth biggest cryptocurrency by value, according to CoinMarketCap, is fighting for its life.

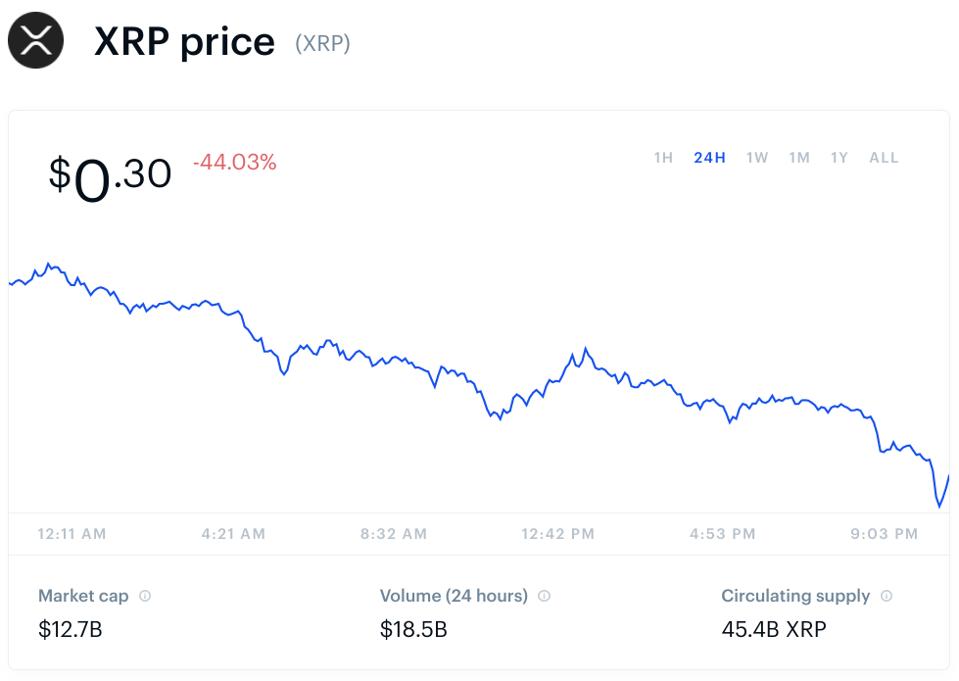

XRP, the digital token controlled by the San Francisco-based company Ripple, has lost half its value in the last 24 hours, going into free fall after the U.S. Securities and Exchange Commission (SEC) said the token had been illegally marketed to retail customers.

Now, as a number of minor cryptocurrency exchanges remove XRP from their platforms, traders and analysts are questioning the future of XRP—with one long-time critic calling it “the beginning of the end.”

Ripple, the company behind XRP, has said it will oppose a lawsuit against it by the U.S. Securities … [+]

“I think it is the beginning of the end,” said Frances Coppola, a financial analyst and commentator who has publicly criticized the company and the XRP token in the past. “Investors are already dumping XRP as quickly as they can.”

The XRP price, after soaring through November on the back of a hotly-anticipated new cryptocurrency giveaway, has crashed from $0.64 to $0.30 in under a week as traders and investors process the news.

Earlier this week, Ripple’s chief executive Brad Garlinghouse revealed the SEC had filed a lawsuit asking the company arguing the XRP token is a tradable asset, known as a security, and as such is subject to its regulations. The lawsuit alleges that Ripple has raised $1.3 billion in unregistered securities offerings since 2013.

Three smaller crypto exchanges, OSL, Beaxy and CrossTower, have either temporarily suspended XRP trading or removed it entirely. In a further blow, Bitwise Asset Management has liquidated its XRP position, it said in a statement.

Meanwhile, a spokesperson for U.S.-based Coinbase, one of the world’s largest exchanges that boasts almost 40 million users around the world and is gearing up for a mammoth IPO, said it is currently “considering [its] options” when asked how it will respond to the SEC lawsuit against Ripple.

“Any exchange that allows trading in XRP is potentially breaking the law, so exchanges are bound to delist it,” Coppola said, adding the SEC has “a very well put together case,” although couching that “the wheels of the law grind very slowly, so XRP isn’t going to disappear yet.”

“This potential court case is deadly serious for XRP, possibly even lethal,” financial author and trading veteran Glen Goodman, who has bought and sold XRP “at various times in the past,” said via email.

“The SEC doesn’t muck about—if it wants to make an example of Ripple as a warning shot to similar crypto companies, it will go all out to win this case, and XRP may have to be delisted from most crypto exchanges.”

The XRP price has lost almost half its value in just 24 hours, sparking panic among investors.

However, Ripple chief executive Brad Garlinghouse, who has also been charged with violating the U.S. Securities Act along with former chief executive Chris Larsen, has vowed to fight the lawsuit.

“The SEC is completely wrong on the facts and the law and we are confident we will ultimately prevail before a neutral fact-finder,” Garlinghouse wrote in a blog post.

“The SEC has permitted XRP to function as a currency for over eight years, and we question the motivation for bringing this action just days before the change in administration.”

Ripple’s response, combined with the SEC’s timing, coming at the end of the Trump administration, appears to have halted XRP’s sell-off, for now.

“XRP fell fast and hard, but it quickly found support at the level where it started its mammoth bull-run a month ago,” said Goodman. “So to put it in perspective, we’re still only back to November’s prices here! But it could get much worse, depending on how the SEC’s new management decide to proceed. The officials who started this court case are leaving with the Trump administration, so we can’t know what their replacements will decide to do.”

However, the outlook for Ripple and XRP in the coming year looks bleak, with some cryptocurrency investors expecting XRP to continue its long-term decline that’s seen it lose over 90% of its value since its early 2018 highs.

“Тhe prospects for a transformative 2021 for Ripple seem utopian now. Just as regulatory pressure was easing, the SEC made it clear that it delays but doesn’t forget,” Antoni Trenchev, managing partner of digital asset manager Nexo, said via email. “Throughout 2020, XRP’s price has been directly correlated with the project’s dwindling traction on social media and the SEC lawsuit has dealt a further blow to XRP’s potential for a price rebound.”