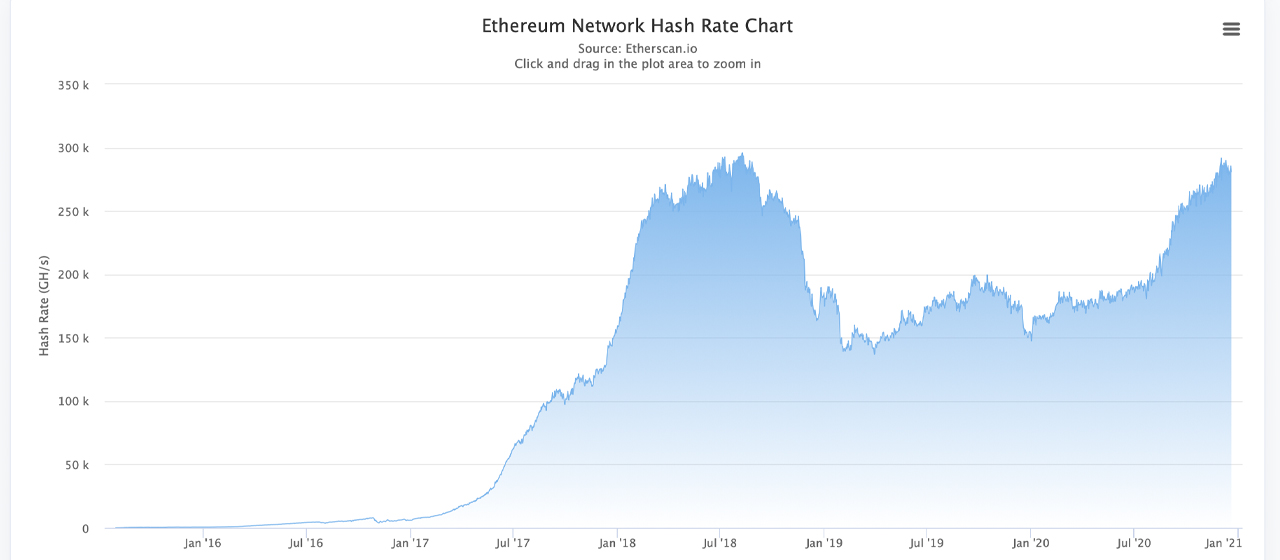

The Ethereum network’s 2.0 transition has pushed the protocol to become one of the largest staking networks in the world with 1,683,905 ether locked into the contract worth $1 billion today. According to reports from China, while proof-of-work ethereum miners have two years left to mine the leading crypto asset, ten Chinese mining rig manufacturers are reportedly racing to create a next-generation ether mining rig.

The Ethereum 2.0 project has become one of the biggest proof-of-stake (PoS) networks worldwide but while people can stake, miners still have two years to leverage ASIC mining via proof-of-work (PoW).

According to etherscan.io stats, the ETH 2.0 contract has 1,683,905 ether locked up which is equivalent to more than $1 billion USD using today’s exchange rates. This week, regional reports from China disclose that ten mining rig manufacturers are allegedly “speeding up” development for a new type of ethereum miner.

The reason for the rush to build a next-generation ethereum miner is because of the limited time left PoW will be available. Financial columnist Vincent He said that an ethereum mining rig called the “E7” was produced by Bitmain in July 2020. According to reports at the time, the E7 produced 800 megahash per second (MH/s).

However, there was never any mass production of the E7’s sales even though monitored data had shown the miners were operating in the wild. A new miner being discussed and speculated upon is called the “E9” miner and Vincent He says that theoretically, the E9 has twice the performance speeds of the E7.

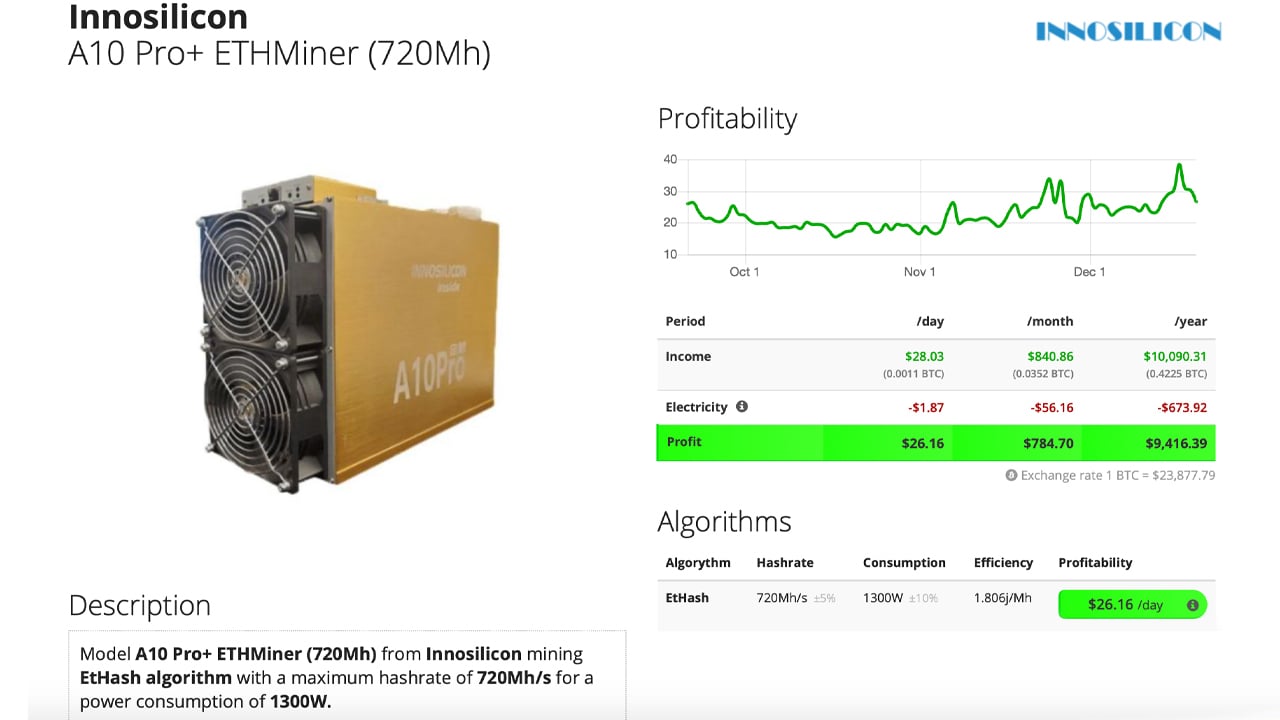

If a person was to leverage a theoretical E9 model with 1600MH/s, then the person could make $52 per day per machine with electrical rates at $0.06 per kWh. The miner would be ridiculously profitable if prices remained the same or climbed higher, as today’s top machine only has an output of 720MH/s.

The machine is manufactured by the company Innosilicon and the A10 Pro+ Ethminer was just released this month. In fact, for the ethash consensus algorithm, Innosilicon commands the top ethereum-based miners with hashrates between 485MH/s to 720MH/s.

There have also been rumors of field-programmable gate array (FPGA) ethereum mining solutions being invoked over the next two years as well. Right now, people estimate a stash of 32 ETH ($20,778) will accrue roughly 13% or $2,800 annually if ETH prices are at $650 per unit.

An Innosilicon A10 Pro+ Ethminer ranges in price between $6,500 to $7k per unit. It would take more than 250 days to pay off the machine at $0.06 per kWh and using today’s ETH exchange rates. In time, ethereum miners may find it more valuable to start staking ethereum or wait for machines like the theoretical E9.

What do you think about Chinese mining manufacturers doubling down to create a next-generation ethereum mining rig? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Innosilicon, Asicminervalue.com, etherscan.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.