Ethereum (ETH) price surged to $ 606 today, breaking a two-year record. Looking at the monthly chart of the Ethereum price, it is seen that the ETH / USD pair rose 55% from 1 November to 23 November. Part of this rise is due to individual investors and another important part to institutional investors. The record Ethereum option volume on the Delta Exchange points exactly to this.

Ethereum price saw $ 606

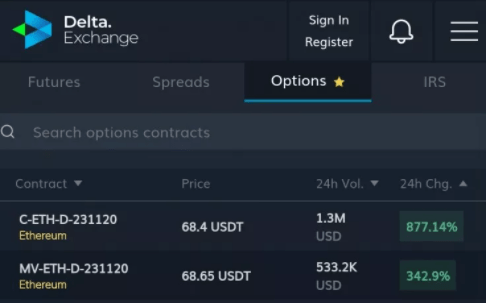

While the price of ETH before Ethereum 2.0 rose 55% in the spot market, the volume of Ethereum options products on the Delta Exchange increased by 875%. Delta Exchange, which has been active since August 2018, has an important place among the crypto currency derivative product platforms.

When looking at Delta Exchange’s 24-hour Ethereum option product volume, it is seen that call options have increased by 877%. This shows that a volume of approximately 1.3 million dollars has been reached. So what are cryptocurrency-based options and what does the record ETH call option volume on Delta Exchange mean?

What is an Ethereum option contract?

Option purchase / sale contracts, which are frequently used in traditional markets, actually enable investors to invest in the future. Investors can have the option to buy after a certain period of time through the option contract. For example, in a contract with an option of 1 month, the investor can make a purchase by fulfilling this contract at the end of the term or when he does not see the price he wants, he may stop buying. The same is true for put options.

The record volume in ETH buy options shows that investors believe the future of the second largest cryptocurrency by total market capitalization. Looking at the data transferred by Bybt, it is seen that volume records were broken not only on Delta Exchange, but also on Deribit and other option product platforms.

While Deribit has reached an option contract worth 1.41 million ETH, OKEx, struggling with problems, is in second place with a contract worth 167,000 ETH. The increased interest in ETH in option contracts and other derivative products is likely to affect the price in the long run.