- Willy Woo points out that a Bitcoin indicator is showing bullish signals and concludes that BTC is undervalued.

- Bullish sentiment recorded by Santiment firm is at FOMO levels and could precede a fall in the BTC price.

Bitcoin probably closes one of its most important weeks of the year. After months of growing adoption that culminated in the announcement of PayPal’s crypto services, Bitcoin, Ethereum and the main cryptocurrencies are registering strong gains.

At the time of publication, BTC stands at $13,101 with a 1.87% gain in the last 24 hours. In the weekly and monthly graphs, BTC shows a performance of 15.80% and 28.21% respectively. Only Chainlink (68.05%), Cardano (42%), and Litecoin (37.10%) surpass Bitcoin in this last graph.

Analyst Willy Woo gave an interview for the Unconfirmed podcast and was highly bullish about Bitcoin’s performance. Woo said that Bitcoin’s network value-to-transaction ratio (NVT ratio) is giving a buy sing:

There’s a constant churn, and the higher you see that churn, the higher the velocity of Bitcoin moving to new investors, the more fundamental activity in the network. So it’s the ratio of the valuation, the market cap to that activity and that creates this price-earnings ratio for Bitcoin.

In that sense, Woo added that the activity not reflected in the price of investors is at record levels. Therefore, when comparing the NVT with the price of Bitcoin, Woo said that the cryptocurrency is undervalued. PayPal announcement will continue to act as a catalyst for BTC price and will push it on the uptrend:

(…) we’re just seeing more activity now with the PayPal announcement and many more people coming in. I’m actually seeing this in the metrics right now, that there are a lot of new entrants coming in. So, yes, it’s perfectly a great time to buy if you’re in it for the year or the multi-year period.

Bitcoin shows possibility of a correction in the short term

According to the firm Santiment, monitoring social networks shows that the bullish sentiment is at levels similar to when Bitcoin reached its peak price during 2019. Santiment is concerned about the prevalence of “FOMO” sentiment. Therefore, they warn of a possible correction and advise investors to take profits and avoid decisions that revolve around “Lambos talks”. That is, they warn against following decisions not based on a realistic expectation of price performance.

As can be seen below, high levels of FOMO sentiment historically precede a crash in the market. The last time bullish sentiment was in “FOMO mode” was in September, when the price was at $11,400 and drop to the $10,500 support level. Prior to that fall, in mid-August the FOMO level accompanied the rise of Bitcoin to $12,220, but was rejected and fell back below $11,900 in 48 hours.

Source: https://www.youtube.com/watch?v=fFveGS1E-64

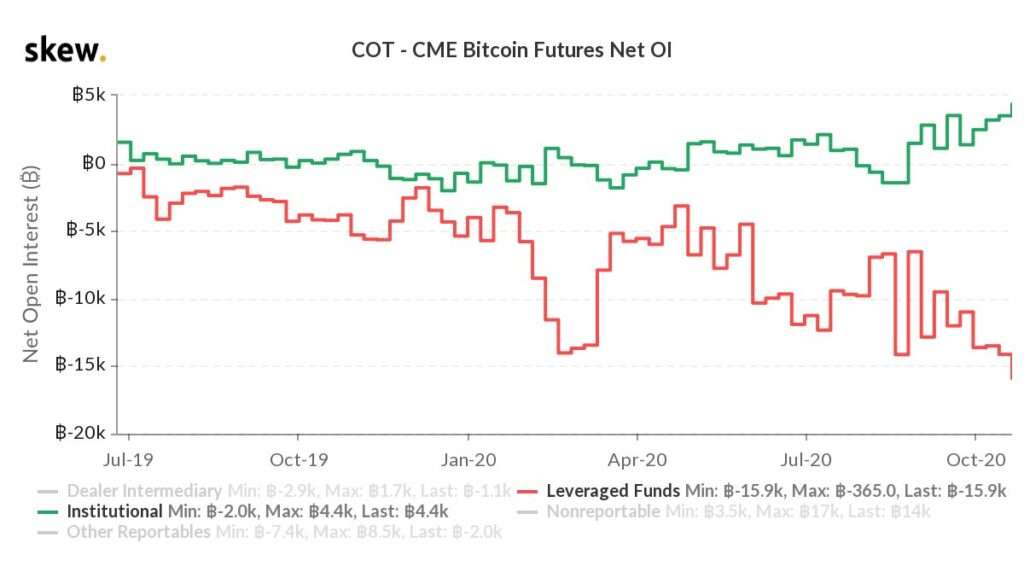

Data from the firm Skew records record levels of open interest for CME. As shown in the graph below, institutions and leveraged funds have long and short positions at record levels. Skew adds:

With the recovery of the market, basic operations are increasingly attractive for hedge funds, which currently yield more than 10%.

Source: https://twitter.com/skewdotcom/status/1319936917190868992/photo/1

As the latest evidence of the prevailing bullish sentiment in the market, analyst Josh Rager conducted a survey on Twitter. At the time of publication, of the 3,446 participants, 41.3% believe that Bitcoin will close October above $13,000; 17.4% above $14,000; 26.6% below $13,000 and 14.7% below $12,000.