PARIS, FRANCE – FEBRUARY 12: In this photo illustration, a visual representation of the digital … [+]

A core investment strategy is facing an unprecedented threat, and the solution may be to buy bitcoin.

Known as the 60/40 portfolio, adherents allocate 60 percent of their investment to equities with the balance placed into debt instruments. The rationale is to capture large gains when equities rise and rely on appreciating bond prices to protect their downside when markets correct. It is hard to argue with the results. The 60/40 portfolio has generated a compound annual growth rate of 10.2 percent in the U.S. since 1980.

However, these are not normal times and the extreme frothiness of today’s equity and bond markets resulting from unprecedented levels of government intervention represents an existential threat to the 60/40 strategy.

WASHINGTON, DC – SEPTEMBER 24: Federal Reserve Board Chairman Jerome Powell testifies during a … [+]

Simply put, the rules of the financial universe have been suspended. Major market indices such as the S&P 500 and Nasdaq

Therein lies the problem. If both debt and equities are going up at the same time, they could drop in parallel as well. This level of risk is untenable and forces investment advisors to look for new and creative solutions to diversify client portfolios.

Click here to subscribe to the Forbes CryptoAsset & Blockchain Advisor newsletter.

Where to Next?

Often times this means taking on more risk by increasing allocations towards equities or moving from treasuries into emerging market corporate debt. Renee Sewall, a financial advisor at Virginia-based Professional Financial Solutions, is acutely aware of these challenges. She expects bond yields to remain low for at least the next 5-10 years, saying that “Everyone needs to relook at their expectations for the returns of a balanced portfolio. A lot of the products or investments that have been proposed as the answer are riskier…the answer has to be tailored toward each individual and their risk tolerance.”

There is no perfect solution. Increasing exposure to equities is often a non-option for retirees or investors close to retirement. Emerging market debt may not pay a commensurate amount of interest or yield to justify the added risk, and many advisors and investors feel that commodities are too speculative in nature to trust over the long term.

Sewall summed up a number of the key challenges that come with alternative investments, saying that “They don’t always behave in predictable ways.” Speaking directly about commodities, she noted that they can be too speculative and pointed out that they do not generate any income. To her, this is a key disadvantage when compared to publicly traded companies, which have executives who are able to react to changing events.

Enter Bitcoin

Given this discussion and bitcoin’s reputation as a speculative and volatile asset, it may seem like an unorthodox choice. However, a closer look at its current performance combined with the maturation of crypto’s overall market structure suggests that it could be ready to play a major role in balanced and diversified portfolios moving forward. Let’s explore this in more detail.

First, you can make a case that bitcoin has never been healthier. It’s 180-day volatility reached a 23-month low of 0.028 on Sunday, and it has been a record 74 days since bitcoin closed below $10,000. As I wrote over the weekend in a post for Forbes CryptoAsset and Blockchain Advisor subscribers, the most impressive aspect of these feats is that this number takes into account several pieces of negative news such as a $300 million crypto exchange hack and the indictment of 4 key executives from a leading derivatives exchange.

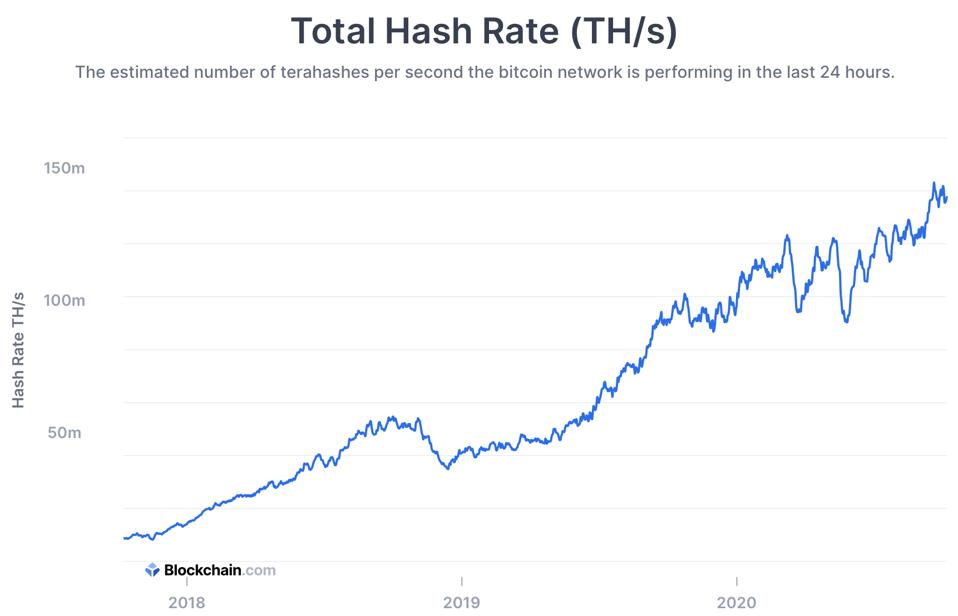

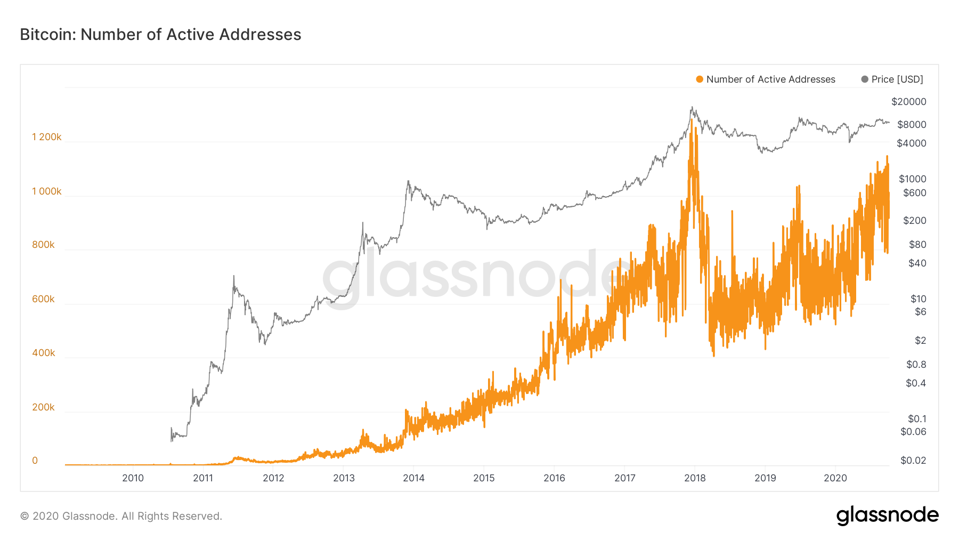

On top of those observations, network fundamentals for bitcoin also remain strong. Two commonly used metrics to gauge network health, the hash rate (amount of computing power on the network), and number of active bitcoin wallets, continue to increase apace and seem to be insulated from outside noise. For those unfamiliar with the term, hash rate is often seen as a proxy for network security. Active wallets is an important measure because it is one of the better metrics that we have to estimate usage of the network.

Blockchain.com

Glassnode

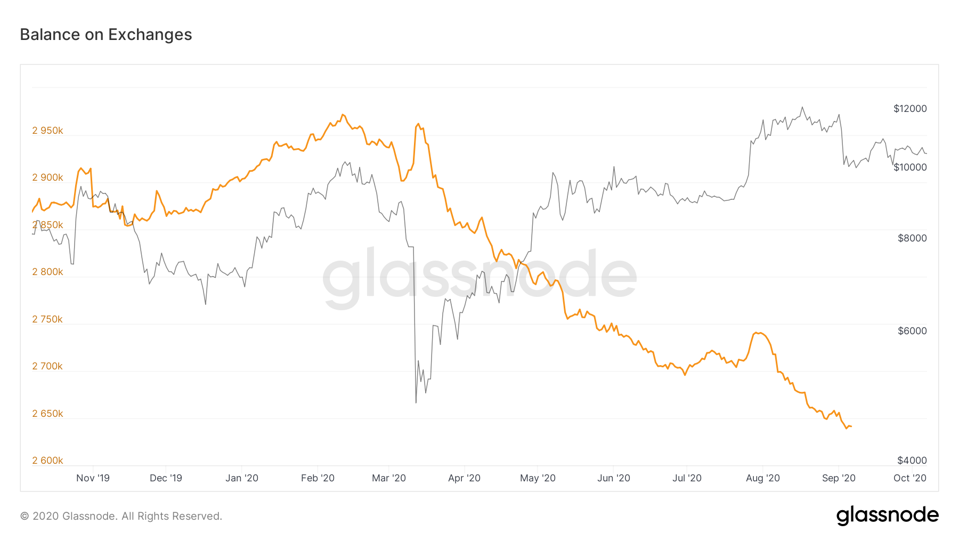

Finally, it is noteworthy to point out that the amount of bitcoin in custodial wallets on crypto exchanges is near an all-time low of 2.641 million. Inflows and outflows to exchanges are important to track because they can indicate if a large number of investors are preparing to sell their holdings. When bitcoin moves off of exchanges in large numbers, it can be a bullish indicator.

Glassnode

Second, bitcoin has recently become an income-generating asset. As the financial infrastructure surrounding crypto evolves, both centralized and decentralized platforms and companies have developed that let people lend their bitcoin and other forms of crypto to generate interest at sometimes substantially higher rates than traditional markets.

Finally, it is worth repeating that bitcoin is the best performing asset in the world over the last 10 years, and despite its fluctuating correlations with certain indices, gold, and other safe havens, many believe that in the long run it will prove to be an uncorrelated asset and linchpin of diversified portfolios. Jack Tatar, co-author of Cryptoassets: The Innovative Investor’s Guide to Bitcoin and Beyond said, “I believe that bitcoin should be classified as an alternative asset.”

One Final Challenge

The final piece of the puzzle is that even if investors want to allocate 1, 5, or 10 percent of their portfolio to bitcoin, it is not a simple transaction. Mr. Tatar spoke on this point directly, comparing the challenges of buying bitcoin with the comparative ease of acquiring gold when he said, “People have easy ways to buy gold. Nobody has to go out somewhere and buy a gold bar, they buy GLD or an ETF, and then they put it into the alternative asset sleeve of their portfolio allocation”.

Fortunately there is progress being made on this front, including a bitcoin ETP-like product being managed by a firm in Canada called 3iQ that trades on the Toronto Stock Exchange (disclosure: Jack Tatar is an advisor to 3iQ), but most investors in the U.S. are waiting with bated breath for the white whale of a bitcoin ETF.

That said, all of this progress is encouraging, and as bitcoin and crypto markets in general continue maturing, onramps for investors keep developing.

Given the challenges facing the 60/40 allocation model, they may be just in time.

Click here to subscribe to the Forbes CryptoAsset & Blockchain Advisor newsletter.