Money in the Crypto market flows in a predictably cyclical manner.

And the reason money flows this way is because these movements are underpinned by human psychology.

The Crypto Money Flow Cycle is predictable because crypto market participants are predictably irrational.

Throughout this article, we’ll discuss how the emotions of investors change throughout the Money Flow Cycle and in turn what implications these movements could have for your crypto investment and portfolio.

Perhaps most importantly, dissecting the Money Flow Cycle will help you learn about timing key moments in your investing approach, such as when to consolidate your portfolio to Bitcoin, when to diversify into certain types of assets, or when to exit the Crypto markets altogether and preserve your cash position.

In this article, we will cover:

· How money flows in Crypto

· The 2020 Crypto Money Flow Cycle

· Analysis of micro-Money Flow Cycles in 2020

How Does Money Flow In Crypto?

Fiat

The Crypto Money Flow Cycle begins with Fiat. Whether that’s the US Dollar, the British Pound, or the Euro – cash is needed in order to make a cryptocurrency investment.

Bitcoin

The typical cryptocurrency investment will start with Bitcoin as it is the world’s most notable cryptocurrency. And as more investors dedicate a portion of their income/savings into Bitcoin, the price of the asset will rise.

When Bitcoin’s price rises, it is at this point in time where investors are enjoying enough returns to start thinking about how they can build their wealth even more. Inevitably, they stand before the decision of whether to simply buy more Bitcoin…

Or to allocate some of their funds and build exposure in other cryptocurrencies. These coins that are Alternative to Bitcoin (i.e. “Altcoins) are likely offered on the very same exchange where the investor bought their Bitcoin.

Large Caps (i.e. predominantly Ethereum)

During Bitcoin uptrends, investors develop a growing need for a higher return on their cryptocurrency investment. Which is why they seek to diversify their funds into Altcoins like Ethereum.

Ethereum is arguably the most well-known cryptocurrency as an alternative to Bitcoin and is often the next logical choice to building a diversified portfolio. And though a well-established platform by now, Ethereum is still a smaller cryptocurrency by Market Capitalisation compared to Bitcoin.

So theoretically, an investment in Ethereum carries more risk than an investment in Bitcoin would. On the flip side however, an investment in Ethereum would yield higher returns compared to a Bitcoin investment.

This change in risk is important in the context of the Money Flow Cycle as it highlights not only how investors tend to lust for higher returns on their cryptocurrency portfolio but also how the risk appetite of these investors grows as the Bitcoin uptrend rises.

Mid-Cap Altcoins

That being said, many smaller Altcoin projects are built on Ethereum, which is why Ethereum is often heralded as the leading indicator for increases in the valuations of smaller Altcoins.

When Ethereum appreciates in price, the prices of smaller Altcoins rally shortly thereafter.

However, these Altcoins are less known by the general public and therefore attract less investor interest. For that reason, these Altcoins have a smaller Market Capitalisation compared to Ethereum, let alone Bitcoin itself.

Compared to Large Cap Altcoins like Ethereum, Mid-Cap Altcoins have the potential to rally even higher when they generate interest from the cryptospace, generating a far higher Return On Investment while simultaneously carrying much higher risk than Large Cap Altcoins.

Small Cap Altcoins

Small Cap Altcoins are high-risk, high-reward investments and tend to rally exponentially at the very end of the Crypto Money Flow Cycle.

As investors get in the habit of adopting more of a risk-seeking approach and circulating their profits into smaller and smaller Market Capped cryptocurrencies, inevitably they set their sights on higher-risk, higher-reward investments.

Which is why these types of Altcoins tend to rally multiple the gains that Bitcoin or Ethereum offers such as 2x, 4x, 10x or even more.

And as the prospect of reward in a seemingly never-ending uptrend appears evermore attractive, the risk appetite of investors imperceptibly grows alongside it.

Low Caps are the last Altcoins to rally in a Crypto Money Flow Cycle as investors have no other coins to circulate profits to. In fact, many investors decide to book their profits at this time, securing their profits either in Bitcoin (if they’re trading Altcoin/BTC pairs) or in Fiat (if they’re trading Altcoin/USD pairs).

Back to Bitcoin or Selling into Fiat

When Small Cap Altcoins rally exponentially (yielding investors a multiples-worth of a return on their initial investment in the process), this sort of euphoria-fuelled buy-side pressure precedes one of two things:

Money Flow back into Bitcoin or Money Flow back into Fiat.

Should investor capital flow into Fiat, it is likely that a corrective period for cryptocurrencies will lie ahead as this is a moment in the cycle where investors secure their profits and de-risk completely from their cryptocurrency investments, causing asset prices to crash.

However, sometimes this money flows back into Bitcoin, further fuelling the uptrend and preceded further Money Flow back into Large Caps, Mid-Caps, and Small-Caps once again.

Especially during bull markets, cryptocurrencies experience a handful of micro-Money Flow cycles within a larger, macro Money Flow cycle before enduring a market-wide corrective period where Money Flows out from the market and finally into Fiat.

The 2020 Crypto Money Flow Cycle is a fantastic example of how these micro Money Flow Cycles behave and will be the main focus of this article going forward.

The 2020 Crypto Money Flow Cycle

The Crypto Money Flow Cycle of 2020 is relatively easy to delineate given how the markets were given a complete reset following pandemic-induced sell-off in mid-March.

This was a tumultuous time where cash-strapped investors panic sold their assets in an effort to build much needed cash positions in preparation to deal with an unknown, highly contagious virus at the time that sent the World into lockdown.

But the moment the market reached a point of maximum pessimism towards cryptocurrencies was the same exact moment that the market had reached a point of maximum financial opportunity.

Bargain buyers began to accumulate Bitcoin at the lows after the sharp correction and incidentally became the subtle first movers that kick-started the new bull cycle for Bitcoin.

And every Crypto Money Flow Cycle begins with investor capital flowing into Bitcoin.

Money Flow Phase: Bitcoin —> Ethereum

Once Bitcoin had bottomed after the March sell-off, Bitcoin had begun its new bull trend.

That said, new uptrends don’t continue without moments of respite, which is why Bitcoin often paused into periods of sideways price movement before making new local highs.

But it was during these periods of consolidation that investors became more confident with diversifying their portfolios into Altcoins. Having enjoyed some profits from the Bitcoin uptrend, they were more willing to take on additional risk and circulate some capital into Large Cap Altcoins like Ethereum.

This is precisely why Bitcoin price consolidation is one of the most important prerequisites for investor money to flow away from Bitcoin and into Altcoins.

Let’s analyse the Money Flow between Bitcoin and Ethereum in 2020:

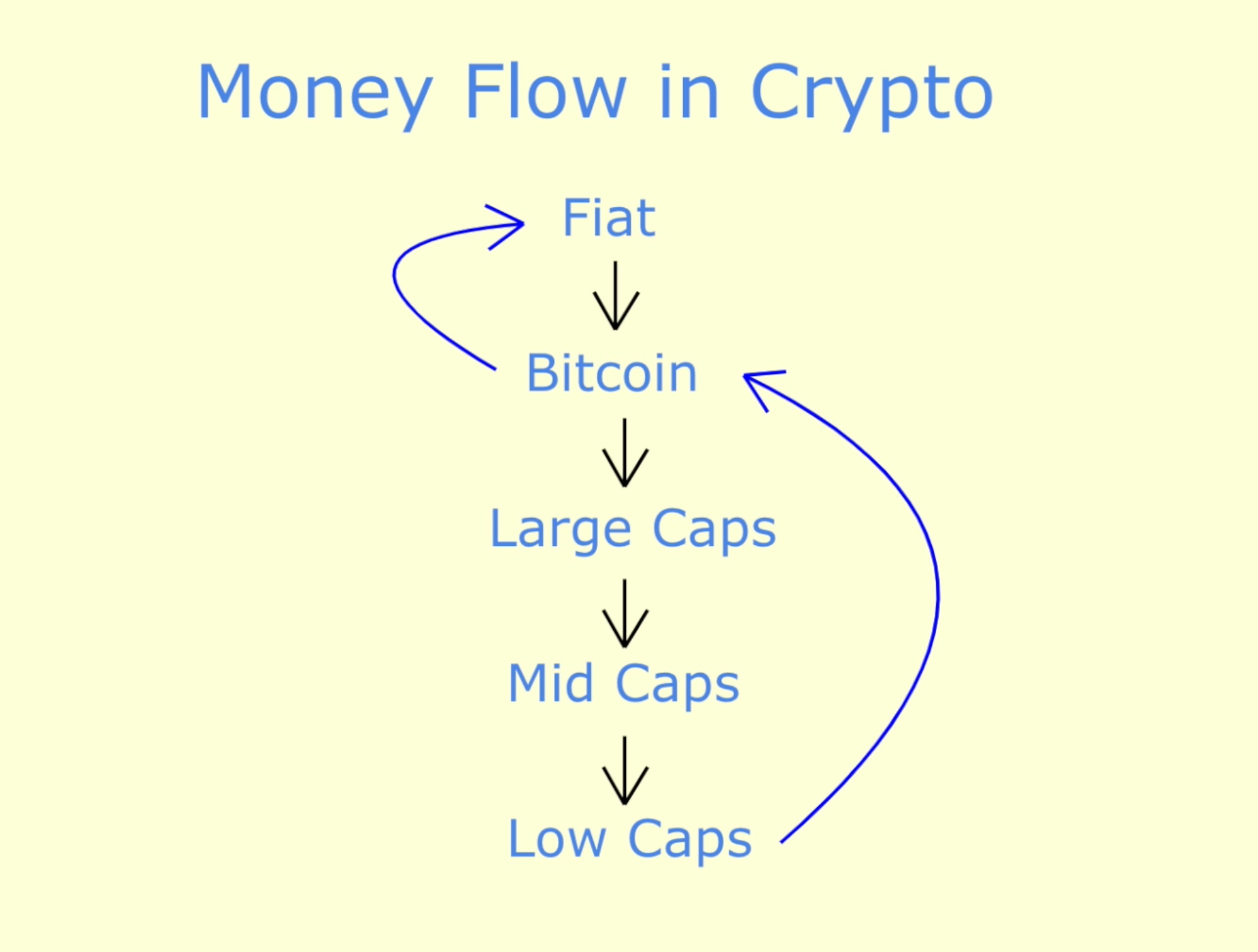

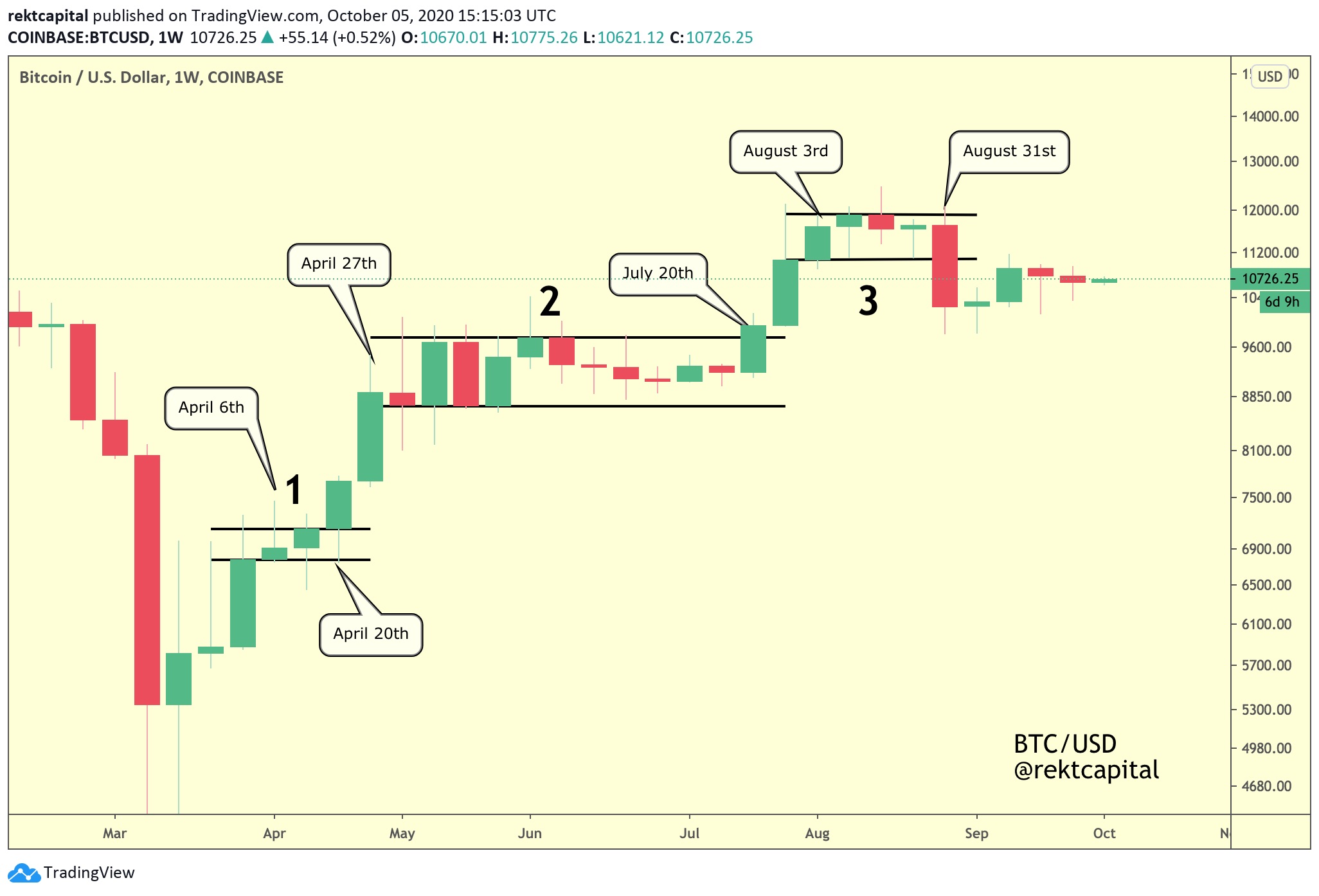

Bitcoin (BTC/USD) Money Flow Channels

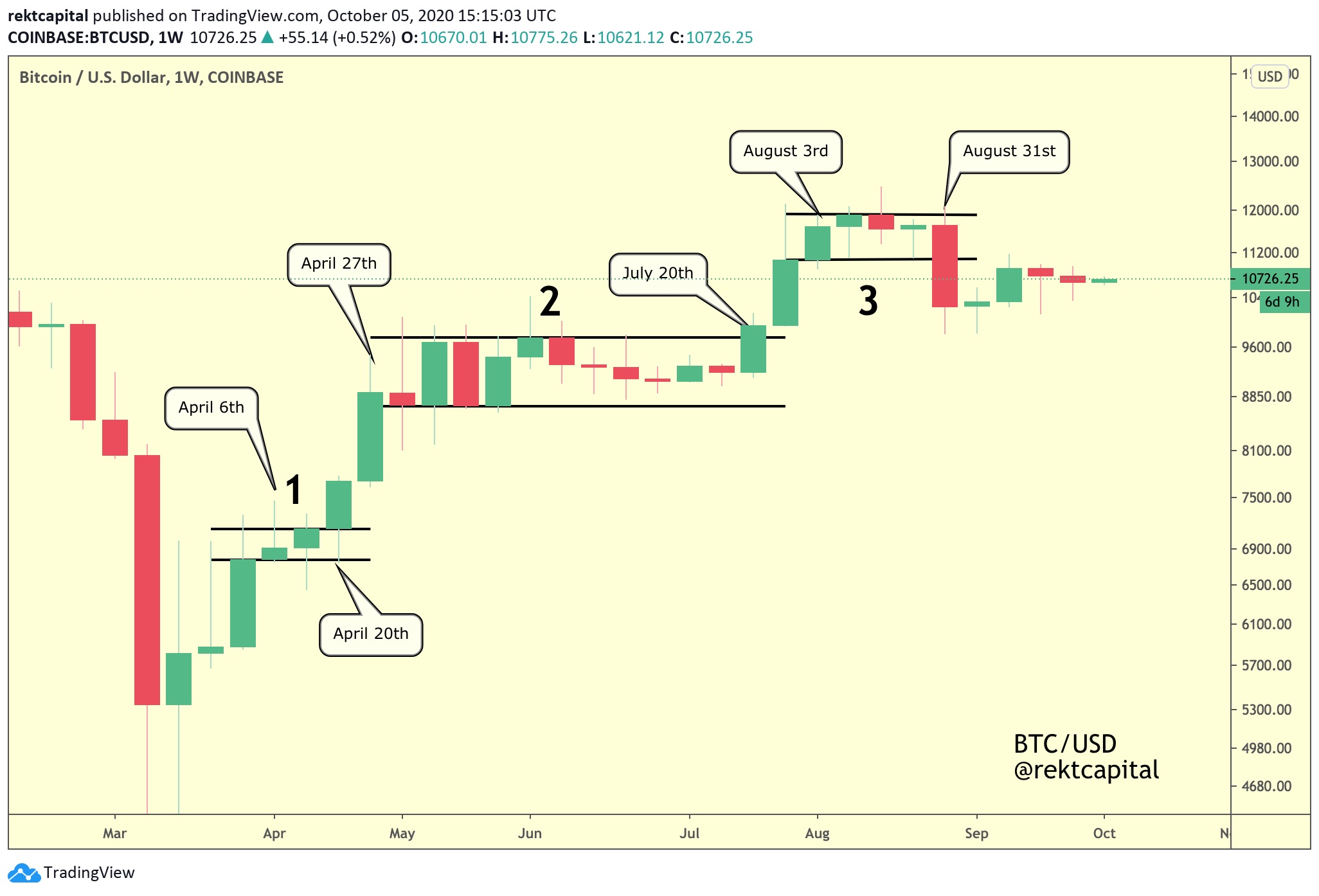

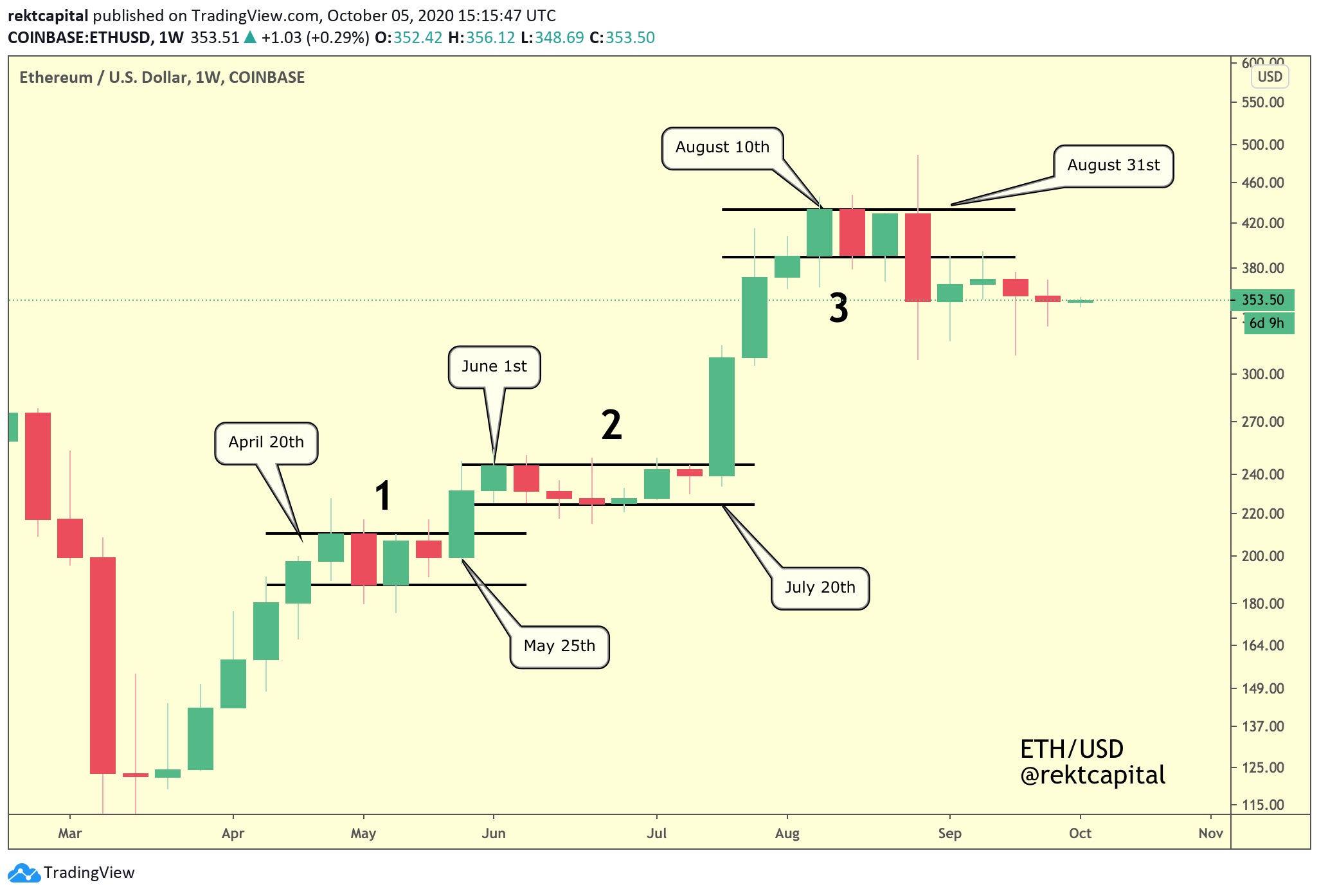

Ethereum (ETH/USD) Money Flow Channels

I’ve outlined three sideways channels in Bitcoin’s and Ethereum’s price action. The timing in the movement of the price action across these assets will give crucial insight into the earlier stages of the Crypto Money Flow Cycle.

Let’s break down the price action sideways channels:

Consolidation Channels 1

In the first brief sideways channel for Bitcoin, Bitcoin’s price action consolidated between April 6th and April 20th whereas Ethereum consolidated within a channel of its own between April 20th and May 25th.

When Bitcoin formed the very beginnings of its sideways channel on the week of April 6th, Ethereum actually enjoyed upside movement. In fact, Ethereum kept rallying during Bitcoin’s consolidation between April 6th and April 20th.

Bitcoin and Ethereum were closely correlated with one another. Bitcoin was leading the market and Ethereum was following suit.

Consolidation Channels 2

But the moment Bitcoin exited its first sideways channel on the week of April 20th, Ethereum actually formed the very beginnings of its own sideways channel.

Bitcoin then enjoyed two straight weeks of upside before forming a 12-week sideways range (i.e. April 27th to July 20th).

While Bitcoin consolidated within this extended 12-week range, Ethereum consolidated for a while as well before breaking out on the week of May 25th into yet another consolidation range of its own.

Consolidation Channels 3

Interestingly, both Bitcoin and Ethereum broke out from their third sideways ranges at the same time: on the week of July 20th.

Not only was Ethereum’s price appreciation markedly larger than Bitcoin’s, but the July 20th range breakouts were synchronous for the first time in 2020.

An argument could be made that the DeFi-based hype of that period reached fever pitch, giving extra strength to the Ethereum rally as ETH became ever more strongly correlated to Bitcoin. Ethereum no longer lagged behind Bitcoin; it rallied in tandem and even lead to market for a brief period.

Shortly after Bitcoin’s July 20th range breakout, Bitcoin formed its third sideways range on August 3rd. Meanwhile, Ethereum continued to rally, catching up with Bitcoin’s momentum before finally building its own range on August 10th.

Both Bitcoin and Ethereum consolidated for weeks in what turned out to be a period of price distribution rather than price re-accumulation like in the earlier ranges.

Both Bitcoin and Ethereum broke down on the same week of August 31st, though still closely correlated with one another nonetheless.

Summary on the “Three Channels”:

· These three sideways channels have showed how Bitcoin tends to be a market leader in the Money Flow Cycle, whereas Ethereum figures as a strongly correlated laggard to Bitcoin’s price action.

· Every time Bitcoin rallied, investor money flow was clearly moving in to Bitcoin.

· Whenever Bitcoin consolidated, money then flowed into Ethereum (i.e. Large Cap). Ethereum lagged behind Bitcoin’s movements but ultimately followed a few weeks later.

· Once Ethereum sufficiently caught up with Bitcoin’s momentum, Ethereum would form a range of its own.

The first three bullet points illustrate how the initial stages of the Money Flow Cycle take place (i.e. Money Flow from Fiat into Bitcoin and from Bitcoin into Large Caps, predominantly Ethereum).

The final bullet point however acts as an important preface to explaining the latter stages of the Money Flow Cycle – specifically, how money flows away from Large Caps like Ethereum into Mid-Cap and Small-Cap Altcoins.

Because when Ethereum manages to catch up with Bitcoin’s price action to form a range of its own, this is where Ethereum becomes a leading indicator for the Altcoin market, especially Mid-Cap and Small-Cap Altcoins.

Money Flow Phase: Ethereum —> Mid-Cap & Small-Cap Altcoins

What happens to smaller Altcoins when Ethereum consolidates?

They significantly appreciate in value.

Investors move their money into smaller and smaller Altcoins during periods of Bitcoin and Ethereum consolidation.

Their profit circulation is driven by greed in an effort to compound their profits in smaller and smaller Altcoins. At the same time, their risk appetite grows and grows as these Altcoins tend to be higher risk, very volatile assets.

Lust for another win, chasing the next profitable coin are all important factors.

But investors aren’t only driven by greed in their profit circulation. And it is no coincidence that money flows away from Bitcoin and Large Caps like Ethereum during their periods of consolidation.

Because among other emotions, boredom is also a factor. When Bitcoin and Ethereum consolidate, investors experience boredom and seek to replicate the excitement of exponential uptrends in smaller coins.

So how can we track the price appreciation in smaller Altcoins?

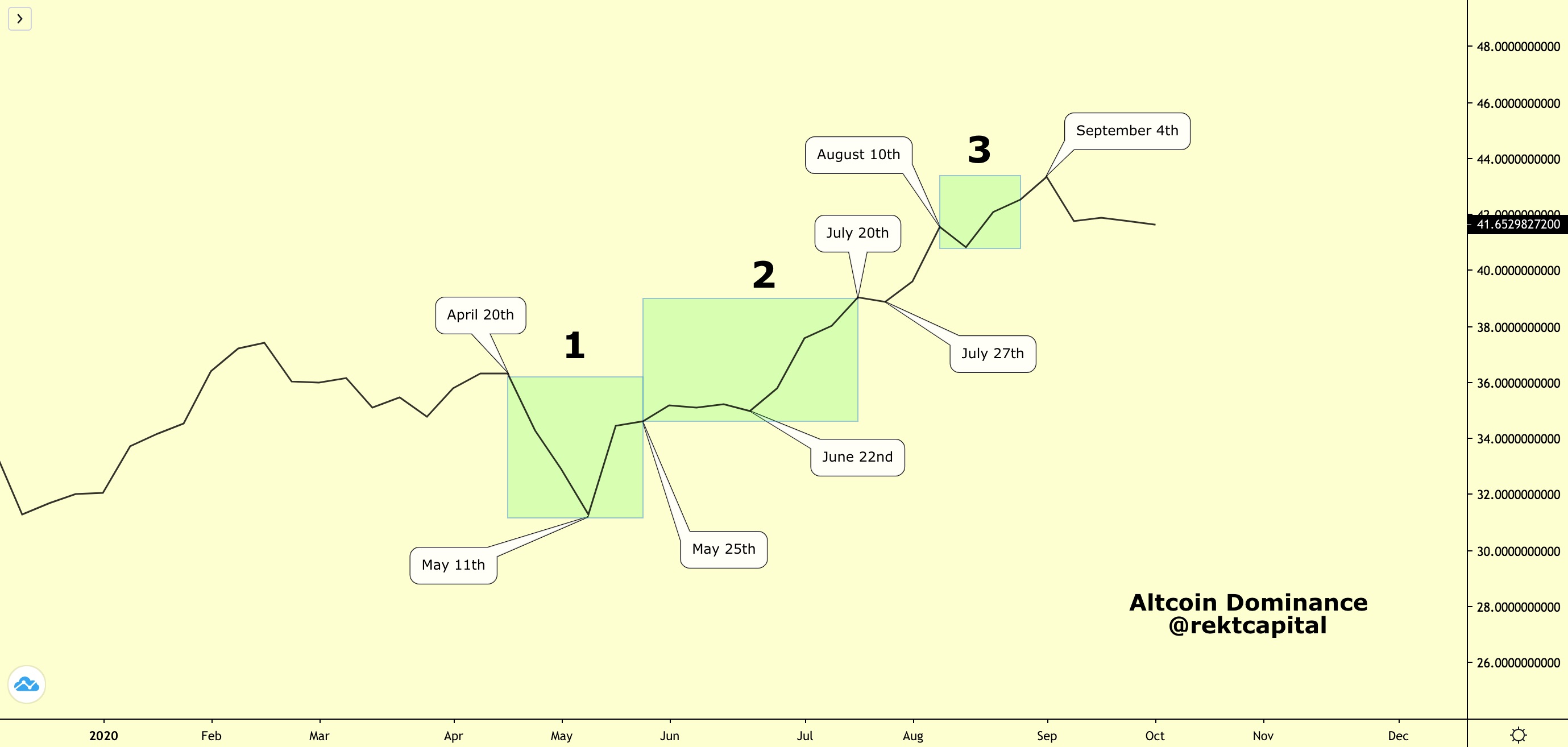

Altcoin Dominance is a useful metric for tracking the overall growth of Altcoin valuations in the cryptocurrency market.

Essentially, Altcoin Dominance represents the % of money in Altcoin investments compared to the amount of money in the entire cryptocurrency market.

So whenever Altcoin Dominance trends up, Altcoin valuations are growing, and vice versa.

It is during periods of consolidation for Bitcoin and Ethereum that Altcoin valuations grow exponentially, as per the Money Flow Cycle.

So let’s compare Bitcoin’s and Ethereum’s sideways channels with changes in Altcoin Dominance:

Bitcoin (BTC/USD) Money Flow Channels

Ethereum (ETH/USD) Money Flow Channels

Altcoin Dominance (in the context of ETH/USD’s Money Flow Channels)

Altcoin Dominance will be analysed through the lens of Ethereum’s sideways channels using green boxes. After all – a sideways moving Ethereum is what enables price appreciation in smaller Altcoins.

ETH’s Consolidation Channel 1

When Bitcoin broke out on April 20th, Ethereum just began to form its consolidation range. But Altcoin Dominance shows that Mid-Cap to Small-Cap Altcoins shedded considerable valuation. After all, Altcoin Dominance dropped by a few %.

The reason for this is that in times of Bitcoin strength, Altcoins generally underperform. Investors re-allocate their money and buy into the Bitcoin uptrend, panic selling Altcoins. Money Flows back into Bitcoin, briefly.

Altcoin valuations kept declining until May 11th which marked a major turning point for the broader Altcoin market.

ETH’s Consolidation Channel 2

May 11th marked a turning point for the Altcoin market because that’s when Altcoin valuations bottomed to begin a new uptrend, entering an almost uninterrupted uptrend that lasted until July 20th.

Note how Altcoin valuations were steadily increasing during May 11th and July 20th. This is when both Bitcoin and Ethereum had enjoyed extended periods of consolidation after their initial exponential uptrends.

While Bitcoin and Ethereum consolidated, investor money was clearly flowing into Mid-Cap and Small-Cap Altcoins.

Other Key Insights

· On the week of May 25th, Bitcoin was moving sideways but Ethereum broke out from its range. It was during this period where Altcoin Dominance didn’t grow as much in the prior weeks. Money Flow was centred on Large Caps, predominantly Ethereum.

· But once Ethereum had firmly established the base of its June 1st-July 20th range (i.e. ETH’s Channel 2), Altcoin Dominance began to soar once again until July 20th.

· On the week of July 20th, Altcoin Dominance slightly dipped. This was when both Bitcoin and Ethereum broke out, investor money briefly flowing away from smaller Altcoins to chase the Bitcoin and Ethereum uptrends.

ETH’s Consolidation Channel 3

Once Bitcoin and Ethereum formed their August ranges, Altcoin Dominance soared again, showcasing that a sideways Bitcoin and Ethereum preceded money flow back into smaller Altcoins.

On August 31st however, Bitcoin and Ethereum broke down from their August ranges. What’s interesting is that Altcoin Dominance continued to grow for a few days after this, as money flowed into smaller Altcoins and clearly away from Bitcoin and Ethereum.

On the week of September 4th however, the corrective period in the market also caught up with these smaller Altcoins, as money appears to be flowing away back into Fiat.

Conclusion

Bitcoin has enjoyed a new bull market since bottoming in mid-March of 2020. And during its uptrends, Ethereum was able to follow suit.

It was especially during Bitcoin price consolidation that Ethereum was able to compensate for its lag to Bitcoin and catch up, only to form a consolidation range of its own.

It was during Ethereum’s price consolidation that ETH figured as the leader for the Altcoin market, promoting Money Flow into smaller Altcoins.

And once Bitcoin would breakout from its sideways range, Ethereum would initially lag behind but later manage to breakout itself, both setting the stage for yet another micro-Money Flow Cycle.

After all – the three sideways channels in Bitcoin’s and Ethereum’s price action each showcase micro Money Flow Cycles whereby money would flow from Bitcoin, to Ethereum (i.e. a Large Cap), to Mid- and Small-Caps before recycling back into Bitcoin to restart the cycle all over again.

Understanding how money in the crypto market is flowing at any given time is a useful skill as it will help you determine when to increase exposure to which type of cryptoasset, when to increase exposure to or de-risk from Altcoins completely, as well as when to hold only Bitcoin, and when to reduce your crypto altogether.

P.S. Thank you for reading and feel free to sign up to my newsletter for more crypto insights.

Also published on Substack.