Bitcoin traders and investors have seen a return to volatility this month, with the bitcoin price suddenly dropping in early September.

The bitcoin price, which had broken $12,000 per bitcoin at the end of August, dropped to around $10,000 amid a broader market sell-off before somewhat rebounding.

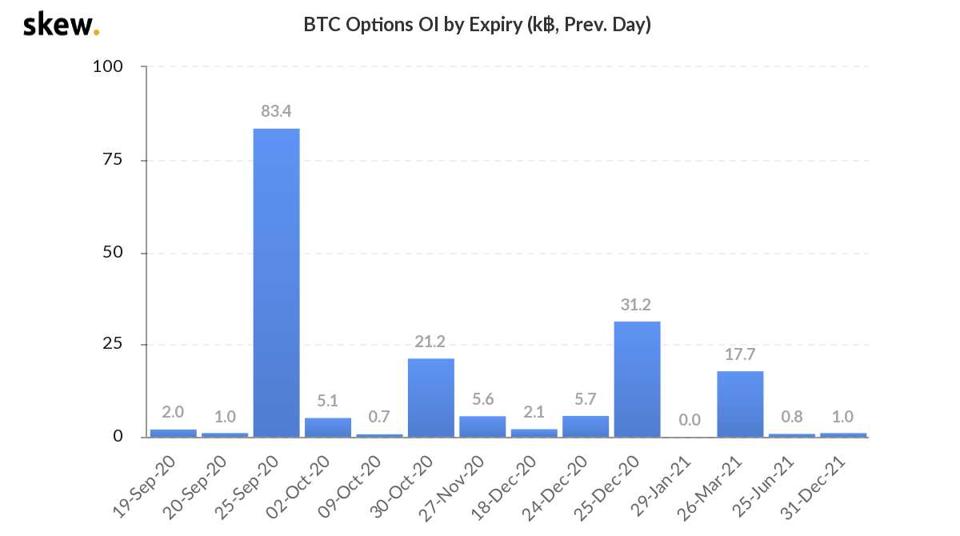

This week, the bitcoin market is braced for almost half of nearly $2 billion worth of bitcoin options to expire—something that could bring a fresh wave of volatility.

Bitcoin traders and investors are braced for almost $1 billion worth of options to expire this week. … [+]

Bitcoin open interest, effectively traders betting on what they expect the price of bitcoin to be, has climbed to $1.9 billion—around triple what it was just a few months ago, according to data from bitcoin and crypto analytics provider Skew, with some 47% of existing contracts due to expire this coming Friday.

The looming bitcoin options expiry could spark a fresh bout of price volatility. Previous large expiries have caused the market to “bounce quite aggressively,” according to some analysts.

When options expire, the trader that made the bet will either get a payout or lose their stake.

The bitcoin options market has swelled through 2020, led by Deribit, a Panama-based derivatives exchange, which accounts for the vast majority of the bitcoin options contracts.

Meanwhile, bitcoin market watchers have been buoyed recently by bitcoin’s bounce at the psychological $10,000 level.

A little over 80,000 bitcoin options contracts, worth almost $1 billion, are due to expire this … [+]

“Bitcoin has resisted the bears’ pressure below $10,000, saving itself from falling further towards $9,000 and below,” Alex Kuptsikevich, the FxPro senior financial analyst, said via email, adding the market is seeing “growing interest from institutional investors after some stagnation.”

“It is worth paying attention to the reduced volatility in bitcoin in recent days, along with cautious price growth. This is more akin to careful buying following the optimism of global markets, rather than going all-in on the prevailing optimism.”

Elsewhere, markets are nervously eyeing what has been called a second wave of coronavirus infections, with U.S. stock market futures pointing to a muted start to the week.