- Bitcoin may be witnessing large inflows of capital from sophisticated investors.

- Despite heavy rains, the 7-day average BTC hash rate has remained above 120 Terahashes since August.

- Twitter and Square CEO Jack Dorsey has called BTC the “best manifestation” of a digital currency that is native to the internet.

- ERC-20 market cap differential over Ethereum has hit an all-time high.

Bitcoin

BTC transaction volume moves off of exchanges as OTC trades spike in number

Bitcoin transaction volume is swiftly moving off exchanges. This is a positive indication as it shows that the market is being less driven by speculative trading and more by real-world utilization and long-term investing.

The reduction in exchange transactions also indicates a surge in the number of over-the-counter (OTC) trades conducted by investors, pointing to an influx of large buyers into the market. This positive indicator enhances the mid-term outlook of the market, suggesting that it may be seeing significant inflows of fresh capital despite BTC’s disappointing performance in recent times.

According to an earlier NewsBTC report, exchanges now account for only 20% of miner revenue, a drastic decline from 2018. Analytics platform Glassnode noted that exchange fee dominance hit peaks of 41% in 2018 and it has been declining ever since.

On-chain Exchange Fee Dominance shows the major role that centralized exchanges play in the Bitcoin ecosystem. 20% of all miner fees are currently used for BTC txs involving exchange activity. In 2018 after BTC peaked, this number was as high as 41%.

This decline shows that transaction volume is increasingly moving off of exchanges and likely taking place between businesses, individuals and OTC traders. Reflecting on this, CryptoQuant CEO, Ki Young Ju, said that he believes there is a rise in OTC trading volume.

The number of BTC transferred hits the year-high, and those TXs are not from exchanges. Fund Flow Ratio of all exchanges hits the year-low. Something’s happening. Possibly OTC deals… This also happened in Feb 2019, when OTC volume was skyrocketed. I think this is a strong bullish signal.

If OTC trading activity is surging, it means that Bitcoin is witnessing large inflows of capital from sophisticated investors, marking a positive sign for its near-term outlook.

Bitcoin hashrate remains unaffected by rains and power outages in China

Bitcoin hashrate has remained consistent and robust, unaffected by the power outages and rains in China, as per a Stack Funds report. Coin Metrics data shows that despite the risk of floods, the seven-day average Bitcoin hashrate has remained above 120 Terahashes (TH/s) since mid-August.

According to an earlier FXStreet report, Bitcoin’s hashrate hit an all-time high recently, breaking the 150 TH/s barrier for the first time.

An excerpt from the Stack Funds report reads:

Hash rates remained strong and could continue upward after the rainy season. Moving forward, should price stabilize above $10,500 […] a bullish continuation can be expected.

Hashrate is an essential indicator of the Bitcoin network’s health and security. China dominates around 65% of mining worldwide and the excess rainfall during the rainy season can lead to both benefits and problems by providing additional hydroelectric power at lower costs for the miners. Mining in the Sichuan region (at risk of heavy rains this month) can become more profitable, leading to a surge in the overall hashrate.

Twitter CEO calls Bitcoin the “best manifestation” of a native digital currency

In a recent interview with Reuters, Jack Dorsey, the founder of Twitter and Square, said that Bitcoin is the “best manifestation” of a digital currency that is native to the internet.

I think the internet warrants a…native currency… Bitcoin is probably the best manifestation of that thus far. I can’t see that changing given all the people who want the same thing and build it for that potential.

Dorsey explained that BTC is underpinned by several principles that the internet was built on. He reaffirmed his belief that the leading coin will garner widespread adoption as a native internet currency. The CEO further highlighted the openness of the Bitcoin community. According to him, anyone with development ideas or an interest in participating can do so without having any company-ties that are primarily needed in the traditional finance sector.

Dorsey’s Square is also taking additional steps to boost the adoption of the cryptocurrency ecosystem. The company announced a new initiative to stop “patent lockups” that stifle innovation within the ecosystem.

The way to do this is to make sure that the tech driving both is available to everyone. The success of cryptocurrencies, as with any new technology, depends on people being able to build what they want, which is not possible when every new idea gets tied up by patent litigation.

— Square Crypto (@sqcrypto) September 10, 2020

BTC/USD daily chart

BTC/USD bears have stepped in to correct the price following three straight bullish days and taken the price down from $10,394.91 to $10,358.12. Before this, the price bounced up from the $10,116.97 support line and went up to $10,394.91 over the last three days. The bulls ran out of steam before they could challenge the $10,454.70 resistance line.

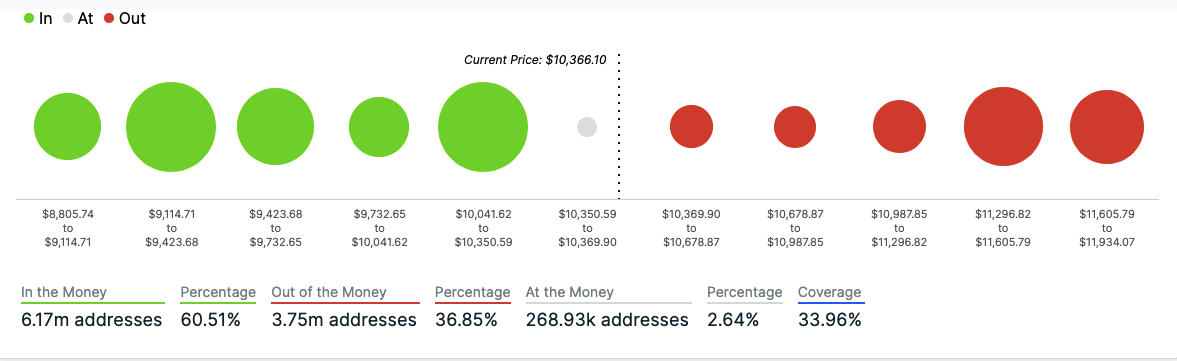

BTC IOMAP

The IOMAP shows that the current bearish movement is temporary and the buyers are bound to regain control. The price is sitting on top of healthy support, so further downward movement isn’t expected. On the upside, the price can potentially go up to $11,296.80 before it faces a strong resistance level.

Market cap of ERC-20 tokens surpasses that of Ethereum

The market capitalization for all ERC-20 based tokens has flipped that of Ethereum itself, according to Santiment. It is currently the all-time highest market cap differential of ERC-20 assets over Ethereum.

At present, the total market cap for all ERC-20 assets is $46.7 billion, whereas Ethereum’s is presently just over $41 billion. There have been a few similar brief ‘flippenings” in 2020, with the longest sustained one in July. Ethereum’s price surge in August increased the market cap to more than $50 billion, but the subsequent correction has allowed ERC-20 tokens to surpass it once again.

Tether accounts for a significant share of the ERC-20 capitalization with around $8.9 billion (or 60% of the entire USDT supply) currently on the Ethereum network, as per the Tether Transparency Report. The recent spike in popularity of DeFi yield farming has resulted in many new ERC-20 tokens entering the markets, leading to this overall capitalization increase.

DeFi and USDT have driven economic activity on Ethereum to such an extent that the seven-day average adjusted transfer value is now higher than Bitcoin’s for the first time since early 2018, as per an earlier FXSteet report.

The launch of earning opportunities for Ethereum holders, such as Yearn Finance’s yETH vault, has also contributed to the network’s economic activity.

ETH/USD daily chart

Following the same pattern as BTC, ETH has also faced bearish correction after three straight bullish. The price has so far gone down from $373.93 to $370.19. In the last three days, the price went up from $336.18 to $373.93. It looks like the price is consolidating below the SMA 50 curve.

Ethereum IOMAP

The Ethereum IOMAP is currently sandwiched between strong resistance and support levels. It looks like ETH is going to hover in a narrow range between $359.97 and $372.04 without making any wild price movements.

Ripple

XRP/USD daily chart

XRP/USD has gone down slightly from $0.2426 to $0.2425. The price has been trending horizontally for the last seven days. In the same time frame, the William’s %R has been hovering in the oversold zone. This shows that the price is presently undervalued. It looks like XRP/USD is currently consolidating and getting ready for a breakout.

While we expect this breakout to be bullish, the bears also can break below the $0.2378 support line and take the price down to $0.2273.

-637354854735006962.png)

-637354857567628188.png)

-637354858438737806.png)