- The technical analysis reveals that major coins are ready to exit their range-bound patterns.

- Bitcoin needs to regain ground above $10.500 for sustainable growth.

- XRP/USD will follow the lead once the market comes into motion.

The cryptocurrency market is a mixed picture on Friday, with all top-3 coins mostly unchanged in the last 24 hours. The total market capitalization of all digital assets in circulation reached $334 billion, while an average daily trading volume exceeded $350 billion, which is the highest level since March 13, the cryptocurrency market experienced a flash crash.

Cryptocurrency data provider Skew reported recently that Ethereum trading volume on Huobi Futures surpassed Bitcoin and triggered a new wave of “flippening” chatters. On a global scale, Bitcoin dominance decreased to 56.8%; however, it is still the biggest digital asset, responsible for over half of the whole market.

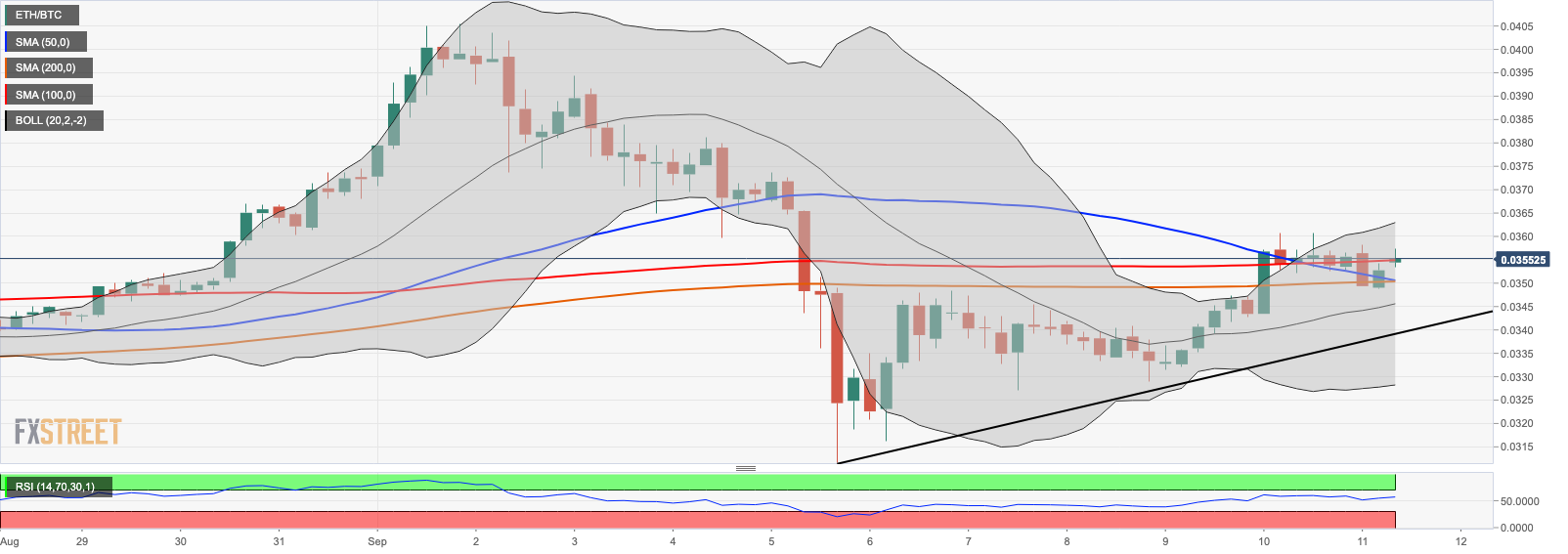

Meanwhile, a closer look at Bitcoin’s interrelationship with Ethereum implies that ETH has room for growth. The cross has recovered from the previous week’s low of $0,0311 and reached $0.0354 by the time of writing. The price settled above the daily SMA50 ($0.034) that coincides with the upside-looking trendline. This barrier serves as a strong backstop for ETH/BTC and supports the recovery towards $0.039 (the upper line of the 1-hour Bollinger Band) and the recent high of $0.0405.

ETH/BTC Daily Chart

The ETH/BTC pair is currently trading at the price level of 0.0354 and is above the top of the price range in previous weeks.

Above the current price, the first resistance level is at 0.039, then the second at 0.04 and the third one at 0.041.

Below the current price, the first support level is at 0.0315, then the second at 0.03 and the third one at 0.029.

ETH/USD 4-hour chart

The intraday charts reveal a cluster of technical barriers around the current price, meaning that ETH/BTC may have a hard time escaping from the current range. However, once the $0.036-$0.0365 area is passed, the recovery will start gaining traction.

On the downside, a sustainable move below the above-mentioned trendline at $0.034 will negate the immediate bullish scenario and bring more bears to the market. In this case, the price will continue declining towards the recent low of $0.031 and psychological $0.03.

BTC/USD Daily Chart

The BTC/USD pair is currently trading at $10290, mostly unchanged since the beginning of the day.

Above the current price, the first resistance level is at $10500, then the second at $11200 and the third one at $12000.

Below the current price, the first support level is at $9500, then the second at $9000 and the third one at $8750.

BTC/USD has been locked in a tight range limited by $10,000 and $10,500 for most of the week. Several bearish attempts to break below the psychological barrier yielded no results as the market was inclined to buy on dips. As the FXStreet previously reported, Bitcoin whales may be getting ready to buy BTC around current levels, which will lead to a massive price increase.

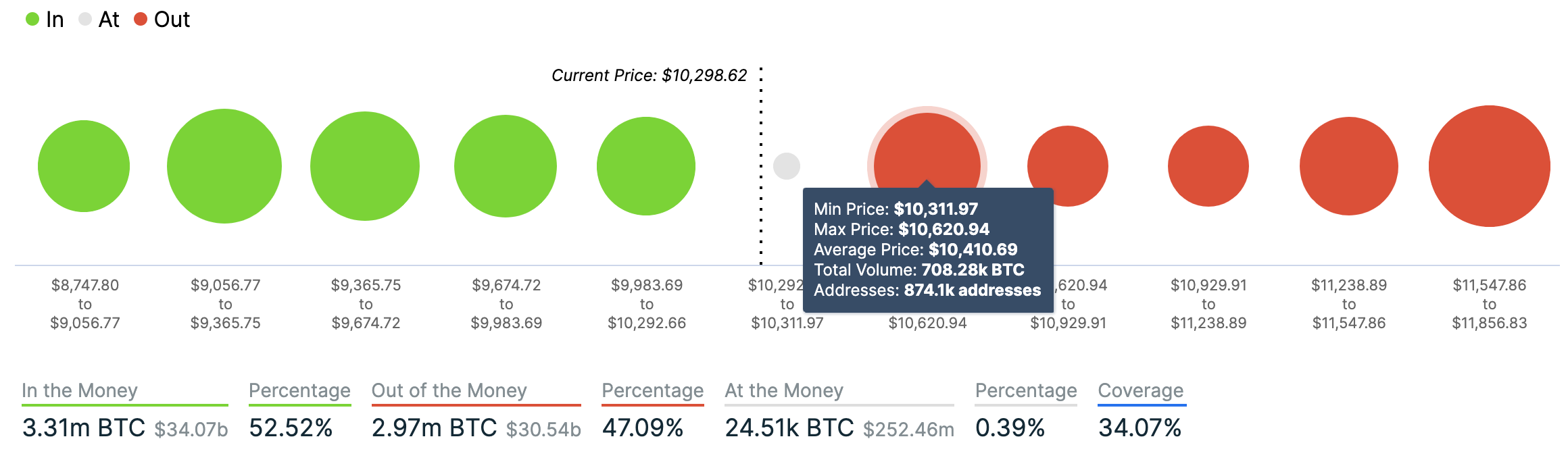

Also, Intotheblock data In/Out of the money data confirms that $10,000-$9,600 area is guarded by large clusters of BTC addresses that stand ready to defend their breakeven point. On the upside, a wall of supply comes at $10,300-$10,600.If they manage to clear in, the recovery may accelerate to $11,200.

Bitcoin’s In/Out of the money data

Source: Intotheblock

ETH/USD Daily Chart

The ETH/USD pair is currently trading at $364 and moving to the upper boundary of the recent upside-looking channel.

Above the current price, the first resistance level is $385, then the second at $410 and the third at $440.

Below the current price, the first support level is at $350, then the second at $330 and the third one at $307

ETH/USD 4-hour Chart

On the intraday charts, ETH/USD managed to move above the sloping SMA50 (4-hour). Currently, the price is trying to verify this barrier as support. If holds, the coin may rebound to $380. This resistance is created by 38.2% Fib for the downside move from September 1 high at $488 and September 5 low at $307. As we have discussed in our latest piece on Ethereum, this barrier is critical for the short-term Ethereum’s momentum. Once it is out of the way, the upside will gain traction with the next focus on $400 and $440.

On the downside, the support of $353 is reinforced by 23.6% Fib for the same move. Also, over 250k ETH addresses with over 8.5 million coins have their breakeven price around this level, which turns it into formidable support. If it is broken, the sell-off may be extended to $307 and $300.

XRP/USD Daily Chart

The XRP/USD pair is currently trading at the price level of $0.2414. The coin has barely changed since the start of the day amid decreasing trading activity.

Above the current price, the first resistance level is at $0.263, then the second at $0.27 and the third one at $0.30.

Below the current price, the first level of support is at $0.23, then the second at $0.214 and the third one at $0.20.

On a daily chart, XRP/USD is moving along the SMA100 (currently at $0.23). A sustainable move below this barrier will increase the bearish pressure and bring $0.21 into focus. This support is reinforced by the daily SMA200 that served as a backstop for the coin since the end of July.

On the other hand, if the price rebounds from the above-said barrier, the recovery may be extended to SMA50 at $0.27. A sustainable move higher will improve the short-term technical picture and allow for a rally to $0.30.

-637354208453878524.png)

-637354209961362320.png)

-637354209015971759.png)

-637354210334827755.png)