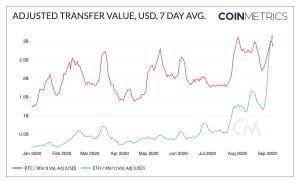

The 7-day average adjusted transfer value of Ethereum’s native ETH token has for the first time since early 2018 surpassed that of bitcoin (BTC), a new report from crypto analytics firm Coin Metrics showed.

According to the report, the ‘flippening’ is due to ETH increasingly being used for transfers between DeFi applications, which overwhelmingly are built on the Ethereum blockchain. Also, Coin Metrics pointed to the launch of yearn.finance’s yETH vault, which allows users to earn interest on their ETH holdings, as contributing to the increased transfer value of ETH.

At the time of writing, the yETH vault contained ETH 217,289, or close to 0.2% of the entire ETH supply, per Etherscan.

@adam3us @ReserveBitcoin Meanwhile in the real world: https://t.co/IHmFCS6oDH

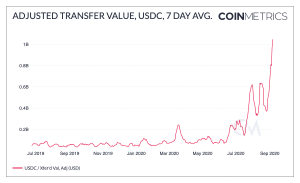

However, ETH is not the only Ethereum-based token that is being used by yield farmers and others in the current DeFi craze. The same also goes for USD Coin (USDC), an Ethereum-based stablecoin backed jointly by Coinbase and Circle, which is also used heavily in DeFi applications like Uniswap and Curve Finance, according to Coin Metrics.

Meanwhile, Coin Metrics also noted in the report that network fundamentals of both Bitcoin and Ethereum “continue to look strong despite a drop in market cap.” It also said that daily transaction fees have grown “across the board,” which it noted that leads to higher profits for miners, with rising hash rates as a result.

“BTC hash rate grew another 4.2% week-over-week and is on pace to once again reach new all-time highs,” the report said, adding that Ethereum’s hash rate has also shown “strong growth,” with a rise of 7% week-over-week.

At pixel time (12:37 UTC), BTC trades at USD 10,351 and is up by 1.6% in a day, trimming its weekly losses to less than 5%. ETH jumped by 7% in the past 24 hours, to USD 370, which is 9% less than a week ago.

___

Learn more:

Why the Bitcoin vs. Ethereum ‘Rivalry’ Benefits Both Tokens