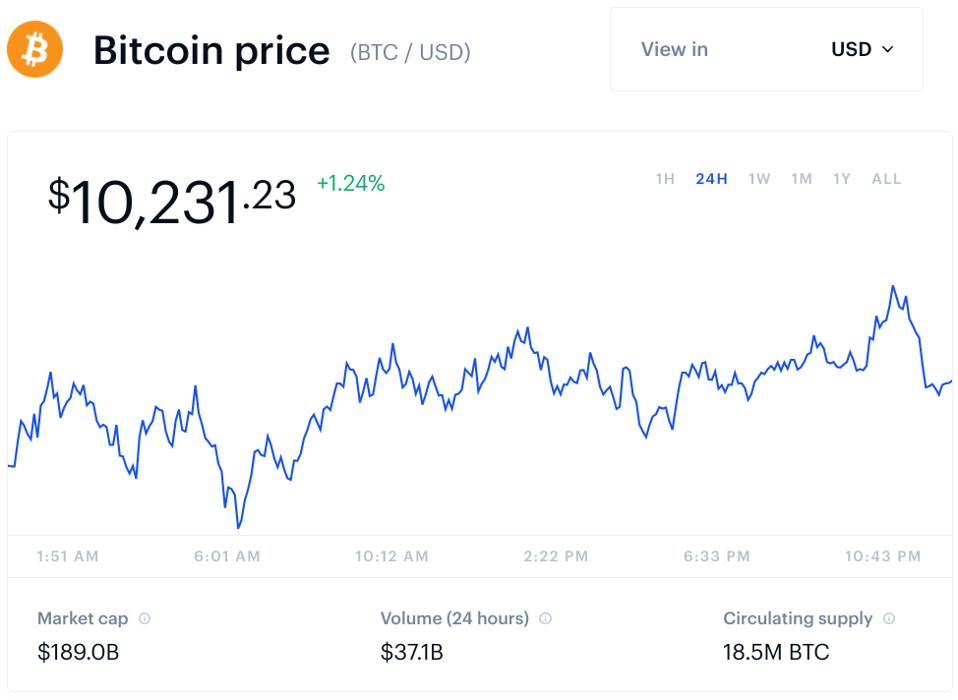

Bitcoin has struggled this week with wild price swings keeping traders on their toes.

The bitcoin price, down 12% on seven days ago, is bouncing around $10,000 per bitcoin as bullish investors jump at the opportunity to buy at under the psychological level.

With the former chief executive of Prudential Securities naming Labor Day, Monday September 7, as a potential turning point for bitcoin adoption and investment, the crypto market could be heading into a big week.

Bitcoin investors are braced for “a spark” that some think could ignite in early September.

Last month, George Ball, the chief executive of investment firm Sanders Morris Harris and former chief executive of Prudential Securities, said he expects there to be a surge of bitcoin buying “after Labor Day”—branding current global markets as stuck in the “summer doldrums,” with investors waiting for “a spark” that he thinks will ignite in early September.

Ball is the latest in a growing line of high-profile, established investors, led by the famed Paul Tudor Jones in May, who have espoused bitcoin as a potential hedge against the inflation they see coming as a result of unprecedented coronavirus-induced stimulus measures.

Bitcoin and crypto traders were spooked this week by a sell-off in equity markets that saw the S&P 500 record its first weekly loss in six weeks while the Nasdaq

The bitcoin price dipped back under the key $10,000 level on Friday for the first time since late July, dealing a blow to many bullish bitcoin investors who have increasingly claimed bitcoin has begun behaving as a so-called safe-haven asset, similar to gold.

“Bitcoin’s volatility is a key characteristic as an asset class,” Paolo Ardoino, chief technology officer at Hong Kong-based bitcoin and cryptocurrency exchange Bitfinex, said via email.

The bitcoin price has been trading around $10,200 over the last couple of days after a steep … [+]

Despite the price swings, many in the bitcoin and crypto industry remain positive about bitcoin’s outlook heading into this week.

“A drop like this won’t deter the majority of investors, who have a longer-term investment thesis,” John Kramer, trader at Hong Kong-based market maker GSR, said via email, adding “many investors will see this as an opportunity to buy the dip.”

“Nothing has changed about the fundamentals behind the bull case,” Kramer said, pointing to central banks’ continued stimulus measures, including France’s $100 billion plan announced this week.

“If there is a silver lining, it is this–that a drop back down to $10,000 could very well tempt some bulls who have been sitting on the sidelines to at last invest in bitcoin,” Simon Peters, crypto-asset analyst at multi-asset investment platform eToro, said via email.