Litecoin is trading at around $64.56, up nearly 4.5% in the past 24 hours, as Bitcoin and Ethereum struggled to climb

Litecoin is the best performing top 10 digital asset at the time of writing, with the cryptocurrency’s price surging by nearly 4.5% in the last few hours.

As per CoinMarketCap, the coin is now the 7th largest cryptocurrency with a market cap of $4.17 billion, surpassing Bitcoin SV and inching closer to Bitcoin Cash.

This is impressive for Litecoin, which has so far stayed below $50 for an extended period of time; only rallying to current price levels after Bitcoin soared past $10,500 to establish strong support near $11,500.

A rally in the next few sessions could see the asset break above $70.00 for the first time since February 2020.

Other coins post higher gains

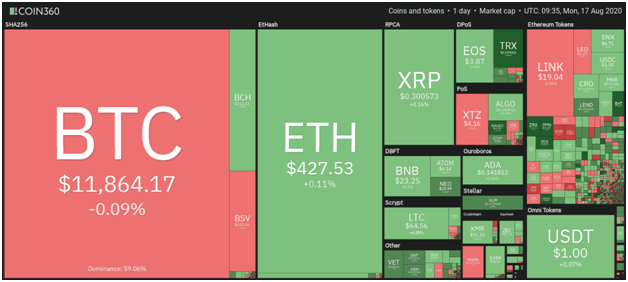

Both BTC/USD and ETH/USD pairs are seeing less than 1% upsides (-0.09% and 0.11%) as of writing. ChainLink, Tezos, and Bitcoin SV have also struggled during the Asian trading session. However, TRON, Stellar, 0x and Neo are all posting higher gains among the top 30 cryptocurrencies by market cap.

A rally by most of the smaller coins is the reason for Bitcoin dominance shrinking further to 58.4%.

Litecoin to surge against Bitcoin

According to one analyst, the price of Litecoin is likely to see a major uptick over the next few weeks. The trader shared this chart that shows the cryptocurrency has the potential to gain massively against Bitcoin due to various signals that have recently formed on the daily charts:

Litecoin price currently trends above a pivotal downtrend that has lasted well over a year; the coin’s trading on increasing buy volume and is breaching a key demand zone that could see it crack resistance after resistance to post between 45% and 175% in gains.

Litecoin is exchanging hands around $64.56 and looks to extend the gains during the next trading sessions.