Last week, Mastercard partnered with UK-based Wirex to increase its crypto card base

Bitcoin and Ethereum prices are at $10,948.92 and $316.6, respectively

India’s Bitcoin transactions stood at $3.4 Mn, followed by Ghana, Philippines, Argentina and others

Global financial services giants, Visa and Mastercard have been bullish about cryptocurrencies. Both the companies, in the recent past, have been aggressively promoting the nuances of the digital asset and its technology to disrupt the financial landscape, globally.

While Mastercard partnered with UK-based Wirex in a bid to increase its crypto card base last week, Visa began working with cryptocurrency firms like Coinbase and invested in Anchorage, a startup that secures cryptocurrency holdings for institutional investors. Both Visa and Mastercard have been focusing on cryptocurrency and blockchain technology for some time now.

Mastercard and Visa have registered close to 80 and 24 patents. However, it is unclear if both the companies plan to release their own cryptocurrency. But industry experts believe that they are most likely to work with existing coins, particularly stablecoins.

Unlike Bitcoin, which is volatile, stablecoins are a class of cryptocurrencies which are backed by reserve assets. That explains its initial partnership with Facebook’s Libra stablecoin. Though Mastercard and Visa dropped out of the project, the cryptocurrency excitement seems to continue.

In a recent blog post ‘Advancing our approach to digital currency,’ Visa highlighted its existing works in the digital asset and stated that digital currencies have the potential to extend the value of digital payments. The company believes in shaping and supporting the role it plays in the future of money. In the coming months, it will be sharing more details on the work around cryptocurrency and blockchain. Besides investing in Anchorage last year, Visa has been closely working with other cryptocurrency startups, including Zether and FlyClient among others.

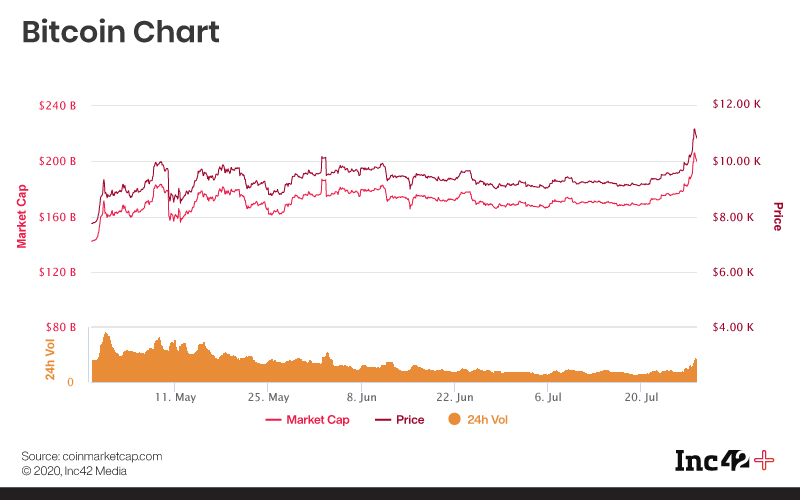

The Bitcoin price seems to have hit an all-time high. The price of Bitcoin (BTC) at the time of writing was $10,948.92 with a market cap of $201.94 Bn, compared to last week (July 21, 2020) which stood at $9,172.20, with a market cap of $169.11 Bn.

Kevin Rooke, an independent crypto researcher, revealed on Twitter that India led the race with $3.4 Mn transactions, followed by Ghana ($1.7 Mn), Philippines ($1 Mn), Argentina ($1 Mn), Mexico ($700K) and Egypt ($150K).

P2P Bitcoin volume hit all-time highs this week in…

– India ($3.4M)

– Ghana ($1.7M)

– Phillipines ($1M)

– Argentina ($1M)

– Mexico ($700K)

– Egypt ($150K)The world wants Bitcoin ??? pic.twitter.com/x8T7mdQfEg

— Kevin Rooke (@kerooke) July 21, 2020

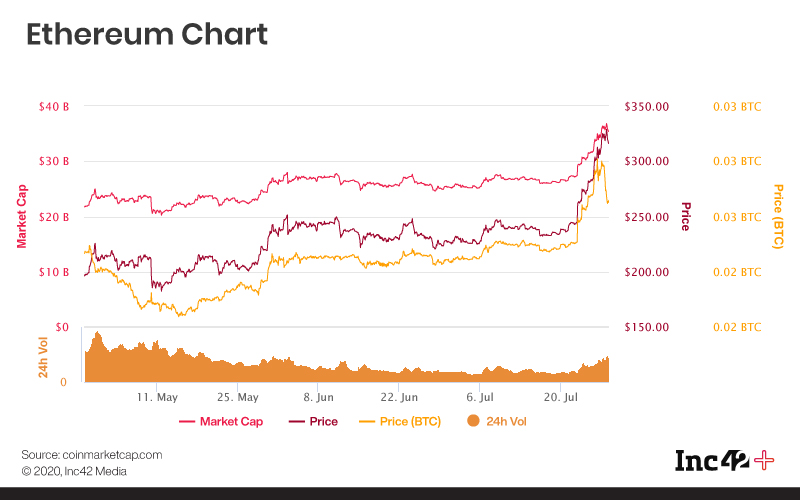

Ethereum (ETH), on the other hand, was priced at $316.6, with a market cap of $35.44 Bn at the time of writing, compared to last week (July 21, 2020), where the price of the cryptocurrency was $237.35, with a market cap of $26.54 Bn. The prices of ETH have also reached a new all-time high. At this rate, Bitcoin and Ethereum are bound to reach $12,948 and $333 as per Finder’s Cryptocurrency Prediction Report.

Cryptocurrency News Of The Week:

Another Bitcoin Scam, But This Time It’s YouTube

Ajey Nagar, who goes by the name Carry Minati’s YouTube account ‘CarryisLive’ recently got hacked, where the attacker posted two gaming videos asking people to donate BTC and ETH to unknown cryptocurrency wallet. The incident comes to light after the Twitter Bitcoin scam, where Twitter handles of high-profile holders Joe Biden, Elon Musk, Bill Gates, Jeff Bezos and Barack Obama was hacked in a similar fashion.

Twitter had said it was embarrassed, disappointed and, more than anything, sorry for what happened with some of its high-profile users as hackers successfully manipulated its employees and used their credentials to access internal systems.

However, in Nagar’s case, the attacker had hacked the YouTube account and changed the description for the content of streaming so that it advertised a donation related to BTC and ETH, along with streaming the gaming video.

Wazirx Adds STORJ To Its Exchange

Binance-owned Indian crypto startup WazirX recently announced that it has listed support for Storj (STORJ), a cryptocurrency that runs on blockchain data storage solution. As part of the marketing strategy, WazirX in its Twitter post stated that it will be giving out 35.59 STORJ each to three lucky users among other details to attract new users on to its platform and promote cryptocurrency trading in the country.

Cryptocurrency Hedge Fund Tetras Capital Likely To Shut Shop After 75% Loss

A New York-based fund recently announced that it is shutting down and returning investors’ money after quarters of low returns. According to CoinDesk, the fund focused on altcoins struggled to perform and posted about a 75% loss since its inception days in 2017. In another report, in 2019, at least 68 cryptocurrency hedge funds were closed worldwide, compared to 35 in 2018.