Ripple has urged policymakers to come up with a facilitative legal framework for digital assets

Binance partners with IAMAI to develop an innovative and progressive framework

UNICEF Cryptocurrency Fund backs Hyderabad-based tech startup Sta Twig

As the speculation around India’s cryptocurrency ban continues, global cryptocurrency platform company Ripple recently released a white paper which stated that the Supreme Court judgement offers policymakers an opportunity to design a facilitative legal framework for digital assets premised on technological-neutrality and risk-based approach.

The report highlighted the need to allow dealing with digital assets, which otherwise will have a negative connotation of pushing this ecosystem outside the regulatory perimeter, and perversely, reduce the visibility of regulatory authorities on transactions in digital assets.

“Such a ‘shadow crypto-economy’ is a far greater source of risks to financial stability and law and order of the country,” added Ripple, urging policymakers to make informed decisions by consulting various industry stakeholders in the digital assets ecosystem and the wider public before taking any action touching upon digital assets in India.

In another update, Global cryptocurrency exchange Binance has joined hands with the Internet and Mobile Association of India’s (IAMAI) digital exchange committee. Binance founder Changpeng Zhao said that the company is excited to contribute their expertise in shaping the Indian blockchain industry for sustainable growth and development.

He added that it is hoping to accelerate the progress of blockchain adoption in India and are committed to working with IAMAI on an innovation-led and progressive framework for digital assets and blockchain.

#Binance Joins the Internet and Mobile Association of India ??

“We hope to further accelerate the progress of #blockchain adoption in India and are committed to working with @IAMAIForum.” – @cz_binance https://t.co/K9yJSNzZNn

— Binance (@binance) June 18, 2020

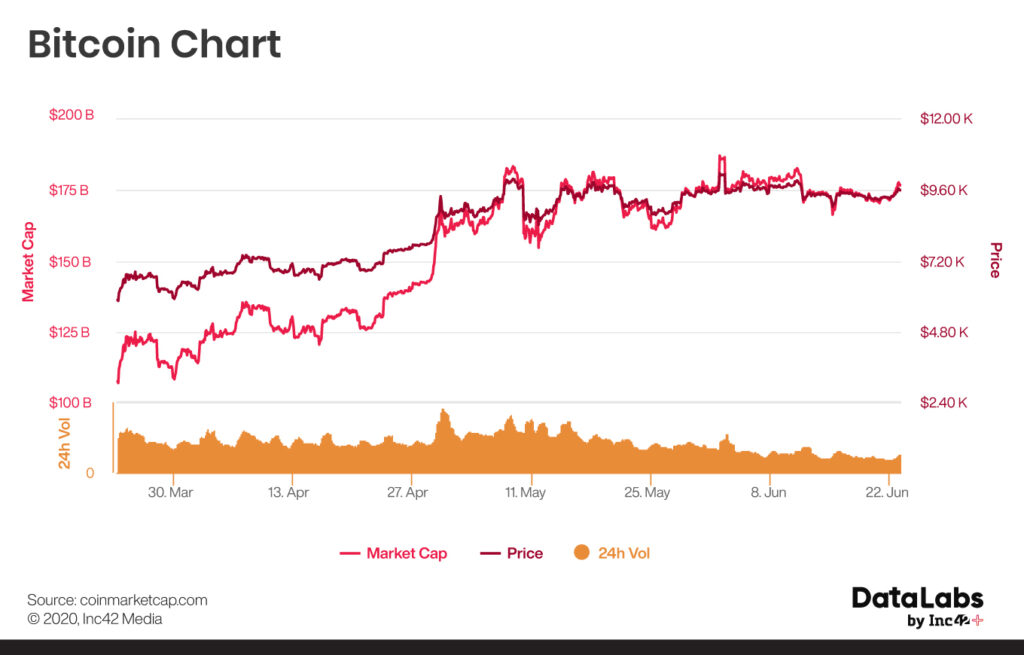

The price of Bitcoin (BTC) at the time of writing was $9628, with a market cap of $177.27 Bn, compared to last week (June 16, 2020) which stood at $9410.74, with a market cap of 173.21 Bn.

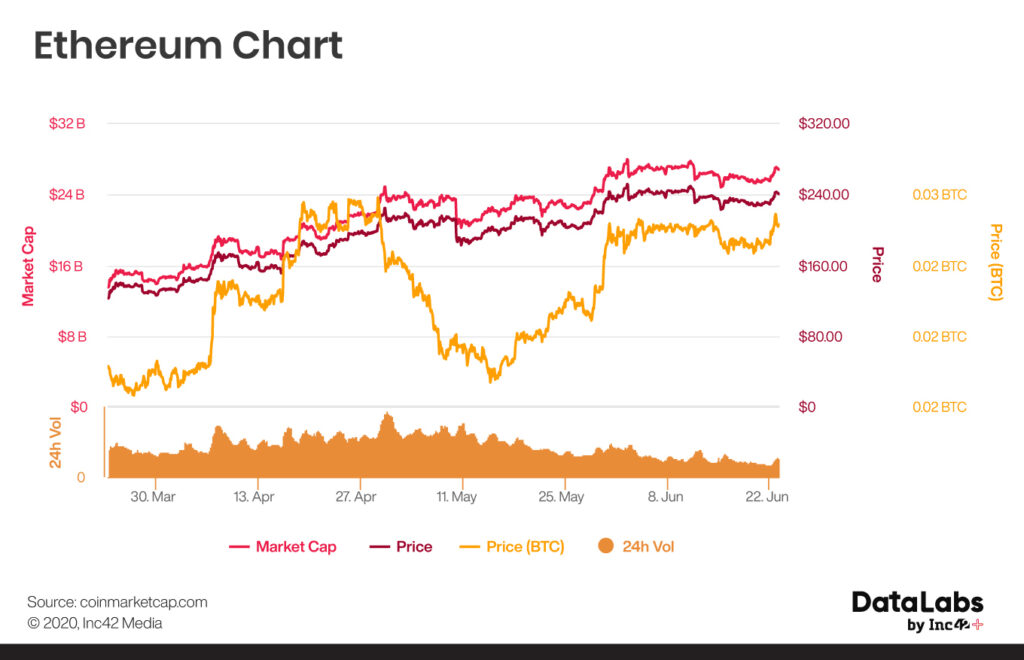

Ethereum (ETH), on the other hand, was priced at $242.35, with a market cap of $27.01 Bn at the time of writing, compared to last week (June 16, 2020), where the price of the cryptocurrency was $230.19, with a market cap of $27 Bn.

Cryptocurrency News Of The Week:

UNICEF Cryptocurrency Fund Invests In Startups To Solve Local, Global Challenges

The United Nations non-profit entity working for underprivileged children, UNICEF, recently announced that it has selected eight startups to develop tech solutions in emerging economies from its UNICEF Cryptocurrency Fund to solve local and global challenges. According to media reports, the CryptoFund will invest 125 ETH in startups from seven countries, including India and globally, to develop prototypes, pilot and scale their technologies in the next six months.

The selected startups include Afinidata, Avyantra, Cireha, Ideasis, OS City, Sta Twig (India), Utopic and Somleng among others. Some of the solutions these startups are working on include improving children’s literacy through remote learning, track effectiveness of rice delivery to vulnerable populations, treat pandemic and isolation-related anxieties among others.

PayPal To Support Cryptocurrency Transactions Soon

Online payments giant PayPal Holdings has reportedly said that it will be supporting users to ‘directly’ buy and sell cryptocurrencies. According to media reports, the company said that it plans to roll out its crypto offering in partnership with Venmo in the next three months or sooner. However, the company has not yet officially announced the launch of any such offerings or the details of the cryptocurrency that it will be integrated onto its platform.

KPMG Launches Crypto Asset Management Tool

In a bid to offer crypto asset services on an institutional scale to fintech companies and banks, Global auditing and consulting giant KPMG recently announced that it has launched a crypto management tool called KPMG Chain Fusion. The new tool leverages a structured data model to combine data originating from blockchain infrastructure and traditional systems in support of analytics for business, risk and compliance objectives. It allows organizations to manage all transactions through a single system, regardless of whether they are a crypto assets or fiat currencies.

Sam Wyner, director and co-lead of KPMG Cryptoasset Services team, in a press statement, said that the regulators and auditors expect fully implemented controls and processes within and across a crypto asset business, including crypto asset or traditional systems. “If you are a blockchain or digital asset-based business, you will have separate systems for everything,” he added.