Ethereum transactions are seeing transactional activity last seen in 2018—when massive ICO activity dominated the network.

Much of the activity can be attributed to the rise of DeFi and Layer-2 applications. Furthermore, wallet data suggests investors may be accumulating ETH ahead of the network’s upgrade to a staking mechanism.

DeFi pushes Ethereum activity

Data shows Ethereum transactions are nearing 2018’s levels. GAS prices have increased as a result, and are now at a record high.

As seen in the chart below, transactional activity has broken above last year’s 1 million/day level—nearing 1.3 million/day seen in January 2018. Current transaction activity is ranging between the 1.1-1.2 million/day level:

The charts coincide with the rise of DeFi applications this year. Projects like Balancer, Aave, Compound, and Synthetix have gained both a fan following and media interest in 2020—and their rise in popularity is synchronous with the surge in Ethereum transactions.

DeFi tokens now account for 1.44 percent of the total cryptocurrency space, CryptoSlate’s proprietary analytics page shows. Sector volume has been $456 million over July 17-18.

The sector has returned 6.53 percent to investors in the past seven days. This is the most among any other sub-sectors—such as smart contracts, general currencies, and privacy tokens.

There’s promise price-wise too. As CryptoSlate reported yesterday, one economic model has suggested Ethereum’s price will be boosted by DeFi’s growth. This was proposed by analyst Morgan Bennett earlier this week:

Some people think that #Ethereum will be successful but $ETH won’t have any value.

Let me debunk this meme with one single plot. pic.twitter.com/vwfNdZp2tM

— Mo (@MorganTBennett) July 16, 2020

Transaction fees soar

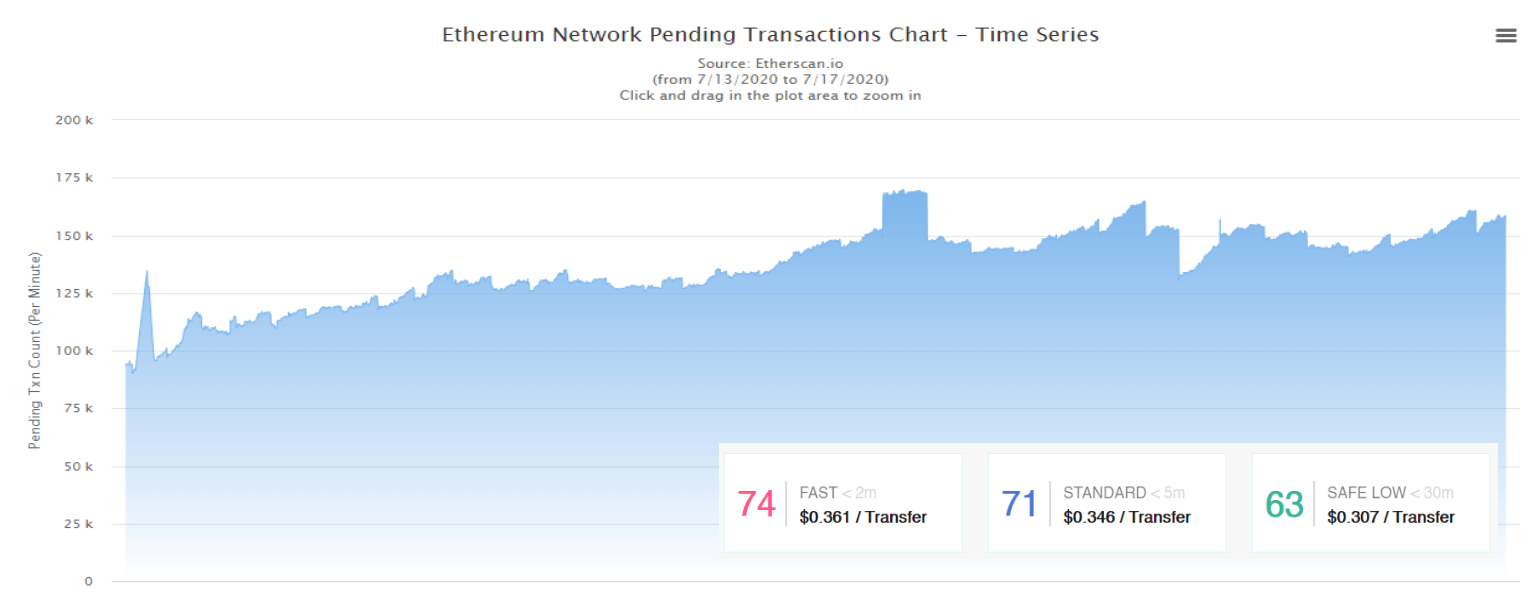

Meanwhile, mempool data on Ethereum is not helping its cause. Transaction fees have soared in the past week; costing over $10 on some smart contract transfers.

This can be traced back to DeFi token usage; the top-10 (DeFi) coins run on the Ethereum mainnet currently:

A relevant Reddit thread captures some of the community sentiment in this regard. “The high gas prices make it really painful (and sometimes confusing) to interact with (a) smart contract,” said one forum member.

But Ethereum’s broader ecosystem is working to solve some of these issues. ConsenSys-backed Starkware reached 9,000 transactions/second in testing in May, while Matic Network reported 7,200 tps in a testnet last week.

As Ethereum’s current tps is a small 12-15; block data shows. Layer-2 designs and rollup tech, once deployed, promise to power the network to over 1 million tps.

And that’s required as well; if at all any decentralized cat meme games arrive on the scene again.

Like what you see? Subscribe for daily updates.