While stock brokerages have reduced trading fees and various retail brokers like Robinhood offer zero commission trades, digital currency exchanges have increased fees for their lowest tier retail group since a year ago.

US-based cryptocurrency exchange Coinbase who is looking to IPO as soon as this year while being under controversy for selling its blockchain analytics software to the government agencies is one of the most popular exchanges despite having the highest fee level for new customers.

In complete contrast, leading spot exchange Binance charges new customers 80% lower fees than Coinbase and Bitstamp.

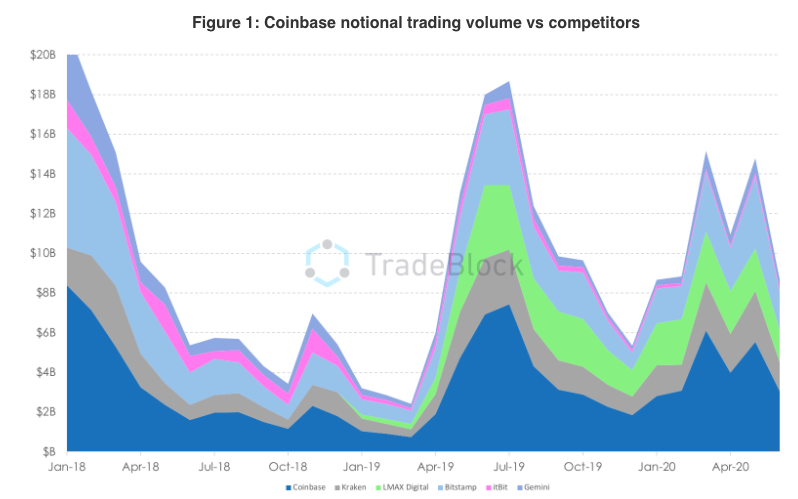

When it comes to volume, Coinbase maintains the largest volume of a US-domiciled digital currency exchange. While it’s the largest in the US, Asian exchanges like Binance transact in higher volumes.

Coinbase has about 45% of the total market share amongst the largest US accessible exchanges. It recorded $3 billion in notional volume for the most recent full month which is below its second-best month in March at $6 billion and more than $8 billion recorded in January 2018, as per TradeBlock.

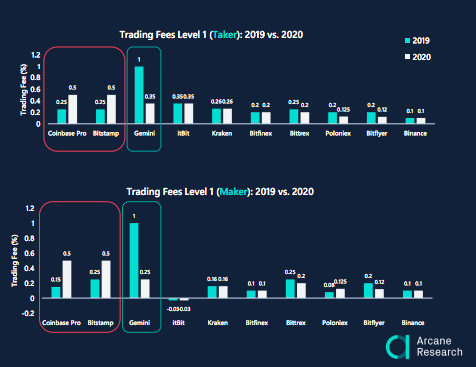

There are two types of fees, maker and taker fees. The maker is the one who places orders and provides liquidity to the order book and the taker initiates market orders and consumes booked liquidity.

Coinbase fees are in the middle to higher fee bracket of US exchanges at 50 bps on both the maker/taker side for the lowest tier.

The taker fees for traders trading less than $10,000 a month are 5x higher on Coinbase Pro and Bitstamp than on Binance. “A trader with a $9,500 monthly trading volume would save $456 a year by switching from Coinbase Pro or Bitstamp to Binance,” states Arcane Research in its report.

While most exchanges have either kept the fees unchanged or reduced them over the past year, Coinbase and Bitstamp have doubled both their taker and maker fees making them the “most expensive exchanges for smaller traders.”

In the short run, they may result in “traders staying with Coinbase and Bitstamp, despite the price increase, and drive revenue for the companies,” over the longer term, “there is a reputational risk, especially for Coinbase that has been getting a lot of heat for other activities lately.”

The pattern in the market is the higher the volume the lower the fees.

Out of the three largest fiat spot exchanges, Kraken offers the lowest taker fees for small traders and the least favorable taker fees for large traders.

While Binance US and BitFlyer offer the lowest initial taker fees among fiat-supported exchanges at 0.1% and 0.12%, both carry a larger additional bid/ask spread than some of the competitors. As for those without fiat-pairs, Binance and Poloniex hold some of the lowest initial fees at 0.125% and 0.1%.

“Arriving late to the party, Binance US seeks to win market shares through competitive pricing.”

As for maker fees, ItBit is the only exchange that offers negative maker fees, essentially paying customers to place trades and fill up the order book.

Besides trading business, Coinbase also has a custody business and offers staking services, both of which “will see continued growth over the next few years.”