According to the latest report from IntoTheBlock, two of the best-performing assets this quarter are SwissBorg (CHSB) and Bancor (BNT).

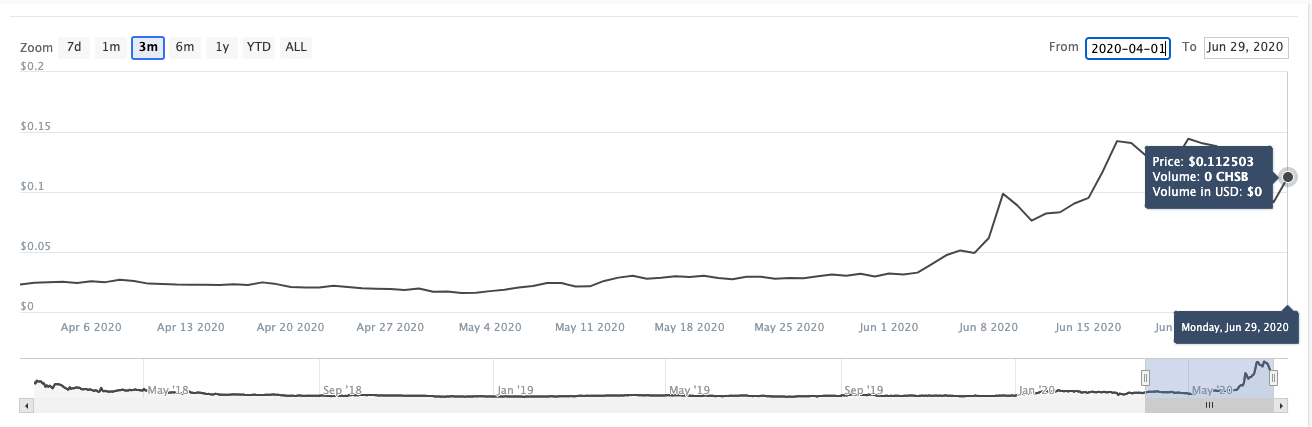

The Swiss cyber bank saw its token rise 395 percent since Apr. 1, while the smart token liquidity provider increased just over 500 percent in the last three months.

Both are in the top 100 cryptocurrencies by market cap.

Two altcoins are this quarter’s biggest gainers

With the state of the crypto industry often being distilled down to the performance of two its largest cryptocurrencies, many other altcoins unfairly get forgotten when analyzing the state of the broader market.

There are two days left before the second quarter of the year comes to an end, but it’s not too early to tell which cryptocurrencies experienced the biggest price rallies in the past three months. According to the latest weekly report from IntoTheBlock, the title of the best performing asset went to Bancor (BNT), a smart token liquidity provider, which was followed closely by Swiss cyber bank SwissBorg (CHBS).

At current prices, Bancor’s price is up 500 percent since Apr. 1, with the coin reaching its YTD high of $1.19 on Jun. 24. BNT currently trades at $1.08.

SwissBorg, on the other hand, saw its price increase nearly 400 percent in the past three months, reaching an all-time high of $0.14435 on Jun. 22. CHSB currently trades at $0.112.

Both top performers show a negative correlation to Bitcoin

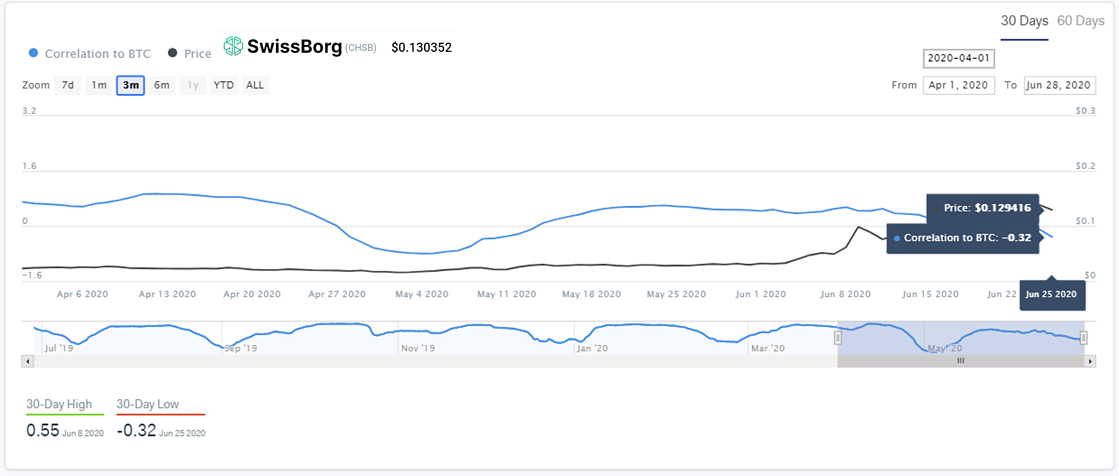

Aside from tracking the increase in price both of these tokens saw, IntoTheBlock’s report revealed another interesting metric both of the quarter’s top performers share—correlation to Bitcoin.

While most of the crypto market tends to move alongside Bitcoin, there are often outliers that tend to go against the tide.

IntoTheBlock’s analysis calculates the 30-day price correlation between the price of a token and the price of Bitcoin. A correlation coefficient (R) between 1 and 0.5 indicates a strong correlation between the token’s price and Bitcoin, which means they tend to move in the same direction. A correlation below 0.5 points shows that there’s a moderate to low correlation, while a negative correlation shows that the token’s price movements move in the opposite direction of Bitcoin.

Out of the two, Bancor seemed to be the one most correlated with Bitcoin, despite seeing its R coefficient dropping to as low as -0.28 on Jun. 25.

Coinbase recently announced it is considering listing Bancor along with 12 other cryptocurrencies.

SwissBorg, on the other hand, currently has a correlation coefficient of -0.32, showing that there is evidence of a slight inverse relationship between its price and Bitcoin.

Like what you see? Subscribe for daily updates.