Bitcoin has been struggling to break over the $10,000 per bitcoin level since its highly-anticipated supply squeeze—but that could be about to change.

The bitcoin price, up around 30% since the beginning of the year and on track to be one of the year’s best performing assets, has swung wildly over the last few months.

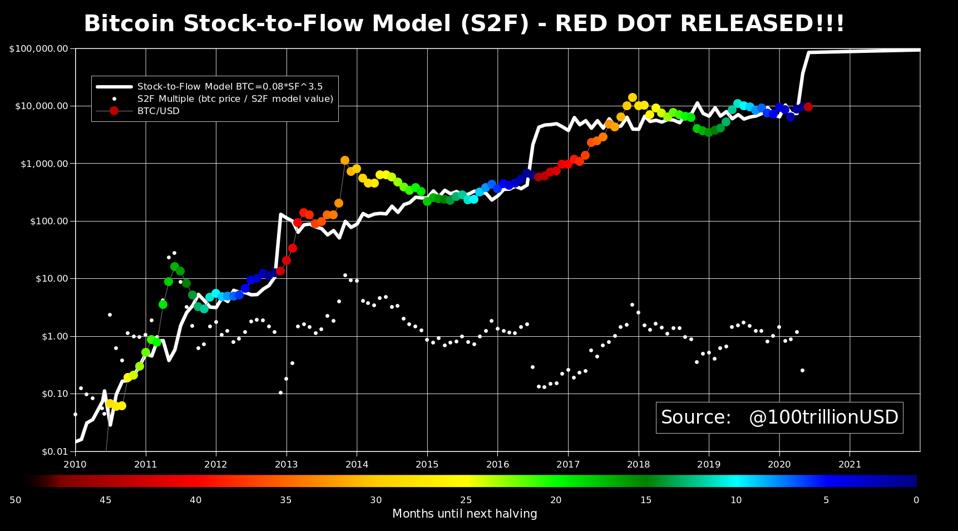

Now, one of the most closely-watched bitcoin analysts, an anonymous strategist who claims to be a member of an institutional investment team that manages around $100 billion in assets, has released an update to his so-called stock-to-flow model, suggesting the bitcoin price could be about to surge to around $100,000.

The bitcoin price has bounced around $10,000 over recent months but bitcoin has failed to hold onto … [+]

Widely-respected bitcoin analyst PlanB, who created the stock-to-flow bitcoin pricing model, revealed a chart update last night.

The update, which has been expected since bitcoin’s third supply halving last month, is thought to signal the beginning of the next 18-month bitcoin price cycle that puts bitcoin at almost $100,000 before 2021.

The stock-to-flow pricing model calculates a ratio based on the existing supply of an asset against how much is entering circulation.

Commodities such as gold–with the largest stock-to-flow ratio of 62, meaning it would take 62 years of gold production to get the current gold stock–have a higher stock-to-flow ratio and are valued by investors for their scarcity.

Silver has a stock-to-flow ratio of 22 years for its production to reach the current silver stock.

Bitcoin’s stock-to-flow ratio is now 50 following bitcoin’s third halving last month, which saw the number of the number of bitcoin rewarded to those that maintain the bitcoin network, called miners, cut by half—dropping from 12.5 bitcoin to 6.25.

“Somewhere between a year and a year-and-a-half after the [May 2020] halving, so say before Christmas 2021, bitcoin should be, or should have been above $100,000,” PlanB said late last year.

“If that’s not the case, then all bets are off and [the model] probably breaks down. I don’t expect that to happen.”

The bitcoin analyst known as PlanB revealed an update to the bitcoin stock-to-flow model last … [+]

Others have also suggested a “fourth crypto cycle” could be on the horizon—signalling the end of the third crypto winter and kicking of a cycle that begins with the bitcoin price rising.

“The 2017 cycle spawned dozens of exciting projects in a wide range of areas including payments, finance, games, infrastructure, and web apps,” Andreessen Horowitz partners Chris Dixon and Eddy Lazzarin wrote in a blog post last month.

“Many of these projects are launching in the near future, possibly driving a fourth crypto cycle.”

Elsewhere, co-founder of social news aggregation site Reddit and early investor in major U.S. bitcoin and crypto exchange Coinbase, Alexis Ohanian, has said he sees the green shoots of a new bitcoin and “crypto spring.”