Despite bitcoin (BTC) having a reputation for wild price swings, investors shouldn’t necessarily get too concerned about potential bad news surrounding it, suggest the results of a new study on bitcoin’s price volatility.

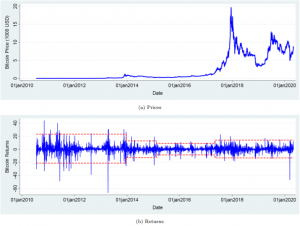

The study went into great detail on the impact of various shocks on the bitcoin market over the past ten years (2010-2020) and examined the asymmetric volatility dynamics of Bitcoin prices under structural breaks.

Structural breaks” are unexpected changes over time that may result in forecasting errors, while asymmetric volatility phenomenon (AVP) is the observed tendency of equity market volatility to be higher in declining than in rising markets.

The study found that the consequences of the shocks to the market were generally less severe than expected and that the market tends to quickly return to its normal after a hit. Besides, it says that other studies have “overestimated the impact of news on volatility due to inadvertently ignoring these structural breaks in Bitcoin volatility.”

Also, the report claims that bitcoin price shocks “die out more quickly” than what has generally been thought, suggesting that news – be they good or bad – may not be such an important driver for the bitcoin price as many have thought. The researchers found that the news’ impact on volatility is not as strong if structural breaks are incorporated into a GARCH-type model, which is used by financial institutions to estimate the volatility of returns for stocks, bonds, and market indices.

However, the report did not look at how news impacts the price of ethereum (ETH) or other digital assets.

Meanwhile, as reported previously, crypto analytics firm Santiment believes that “cryptocurrency is driven by sentiment.” They found that there is a relationship between the rates at which the coronavirus is being discussed on social media channels like Telegram, Reddit, Pro Traders Chat, and Discord, and the price of bitcoin.

It’s also interesting to note that certain type of news circulating within the Cryptosphere seem to have positive influence on the price of digital asset the news is about. This is perhaps especially visible when projects get listed on or enter any sort of partnership with major exchanges, such as Coinbase and Binance – though the increase in price is often temporary.

Nonetheless, the power of these news is so great that sometimes even just an announcement that a project is being considered for listing is enough to pump its price.