In this issue

- Reddit rewards frequent posters with crypto coins

- Ripple’s engagement rumors with Bank of America

- Law firms slap crypto exchanges in 16 countries with class-action lawsuits

- In China: Blockchain liquor, and Canaan’s perfect storm

- Funding for fintech startups in Hong Kong, Vietnam and India

From the Editor’s Desk

Like all too many around the world, we at Forkast are facing challenges particular to these Covid times. But our singular focus is to press forward and thrive. Because we presume we will survive, we don’t worry about our survival. Instead, we are focused on our future — the world’s future — and why emerging technologies is one of the most important and critical stories of our age.

The world is changing rapidly and will never be the same again. We are witnessing technology applications to monitor the individual, track our every move and dictate where we can or cannot go, for our communal benefit and survival. This is undoubtedly going to save lives.

Right now, we’re all comfortable with that — or are we? Because memories of what was normal existence are still fresh, many presume these surveillance and anti-assembly measures are temporary. The danger is if we forget to go back. But we can never go fully back, and so now technology must be measured by what’s best for us. Here at Forkast, we believe that information, knowledge and analysis provide these tools of balance. Right now, the power is still in our individual hands. But will knowledge continue to empower us to use technology as a tool for good and not for us to become tools for technology? That’s the fight to come. The future will be decided and defined by those who understand the change that is to come.

To help you stay at the forefront of this rapidly changing world, we bring you our new website, www.forkast.news. More than a different look, it embodies Forkast’s new editorial vision and mission for these times.

You’ll notice the tiny little word, “beta,” which used to accompany the Forkast logo, has been replaced by our new motto: “Future Thinking in Times of Change.”

We at Forkast are leaning in. We lean into our strengths. We lean into disruption.

We lean into what you are telling us you need us to be right now and into the future.

It’s a journey we will take together.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

1. Reddit crypto rewards

By the numbers: Reddit — over 5,000% increase in Google search volume.

Reddit kicks off a week filled with rumors as the online social discussion platform is believed to be rolling out a “Community Points” feature that would give users Ethereum wallets and use ERC20 tokens to reward contributions to subreddits. Redditors and Twitter users have generated multiple threads and subreddits to predict and discuss some of its features.

- According to a Reddit user who says the information can be found on Reddit’s official Android app, community points are “fully controlled by the people who own them,” and live on the Ethereum blockchain.

- Community points will be earned on a monthly basis, by commenting or posting to subreddits. This system differs from Reddit’s Karma scores — which users can earn by posting, commenting and having others upvote posts and comments — as Karma scores are centralized and owned by Reddit.

- Decrypt reports that a Reddit spokesperson has confirmed this rumor.

Forkast.Insights | What does it mean?

Reddit has become synonymous with online messaging boards during the past decade, as the company has enjoyed considerable growth while welcoming virtually everyone into its fold with a long tail of subreddits (topic-devoted sub-forums that exist for virtually every interest or geographic region). However, in 2020, Reddit is fighting a multifront war to regain users’ trust — and their clicks.

Reddit’s user base historically has had a contentious relationship with Reddit management. In 2015, large factions of the site revolted against its then-CEO, Ellen Pao, for what they viewed as the unjustified dismissal of a popular company employee. Reddit has also had a difficult relationship with pro-Trump subreddit “The_Donald,” taking action to limit its accessibility from the site’s general audience — though not ban it outright as it has done to certain alternative-right subreddits — after repeated calls from parts of the Trump-themed subreddit’s user base for violence against law enforcement officers that the posters claimed were acting “unconstitutionally.” However, these comments were removed by moderators who argued that it would be unfair to punish an entire community because of the action of a few, who themselves got banned for violating the community’s rules. Fast forward a few years, and the fears of censorship by Reddit’s brass has only increased, and this time across partisan lines, when Tencent invested $150 million in the company. However, since then, there has been no noticeable change or spin to the platform’s moderation rules, and plenty of criticism of China still exists unabated.

But it’s the perception that matters. Reddit’s growth in its “daily active user” — the ultimate performance metric for the success of an internet product — is effectively flat. In fact, its February 2020 numbers are less than those from May 2019. While this base isn’t growing, the percentage of DAUs compared to its overall base is actually pretty good for a web product, coming in at 47%, whereas anything over 50% would be considered to be God-tier.

So if Reddit can’t grow its base of users, how does it get more from its corps of DAUs? Further engage it. This is where the blockchain-based community points scheme comes in. Users are transparently incentivized for their contributions with a possibility of an off-ramp to converting them to fiat currency. There will be no questions about favoritism; the distribution scheme is recorded on the blockchain and available to anyone for inspection. In addition, it can also be seen as a dividend for the top community members who produce content that makes Reddit a valuable web property. Their contributions will be recognized and monetized.

As we’ve discussed before on Forkast Insights, online communities can be fickle. Their value can collapse with lighting speed should the user base stage a rebellion and de-camp for elsewhere. Reddit is in no danger of collapsing like STEEM, so there is not the same urgency to implement user-retention measures. But it’s also not growing like it used to, and that must be concerning to investors.

2. Ripples of change at Bank of America

By the numbers: Bank of America — 1,600% increase in Google search volume.

Another rumor gets confirmed this week, as Bank of America (BofA) head of global banking Julie Harris discusses a partnership with Ripple during the financial giant’s Treasury Insights podcast. Although not discussed in detail, Harris alludes to “platforms and capabilities that we built or partnerships that we have with the likes of Ripple or Swift.”

- Speculations on potential cooperation between the two companies grew after BofA’s October 2019 LinkedIn job listing (since removed) described wanting to hire a product management team leader for the “Ripple Project.”

- A 2019 patent filed by Bank of America titled “Real-time net settlement by distributed ledger system” refers to a “ripple” settlement scheme.

Forkast.Insights | What does it mean?

The remittances sector is big business, and challenger banks are lining up to disrupt this sector and take their piece of this pie. One of the more notable entrants is TransferWise, founded by Skype alumni, which looks to do to the remittance market what the now Microsoft-owned VoIP app has done to the long distance telephone market.

This is on the radar of legacy banks as well. They know that they need to rapidly innovate in order to preserve this cash cow, in some form. People will always need to send money around the world, after all. But until now, as Forkast has reported, traditional banks and cash transfer companies have been gobbling up more than their fair share of the pie, often in some of the poorest regions in the world.

Cross-border remittances is a sector where blockchain can shine. SWIFT transfers, and US-domestic Fedwire payments are slow and archaic because their underlying technology stack is decades old. The computers responsible for payment reconciliation struggle to keep up (and sometimes even still use Jimmy Carter-era tapes for data storage — a technology from well over 40 years ago).

Bank of America knows that if they succeed in developing a cost-effective remittances system as alternatives to challenger banks, and perhaps even offer it to non-BoA customers via a subsidiary, they could both beat back these challengers while capturing a significant chunk of the total remittances market.

But don’t think that BoA is the only bank doing this. Its competitors most certainly are hard at work with their own efforts. Many of these will include stablecoins in some way, making these legacy banks begrudgingly admit that cryptocurrency can be good for their business.

3. Roche Freedman throws legal thunderbolts

By the numbers: Roche Freedman — 5,000% increase in Google search volume.

U.S. law firms Roche Cyrulnik Freedman and Selendy & Gay detonate 11 class-action lawsuits against 42 defendants in 16 countries, as reported by Offshore Alert. The lawsuits filed in the U.S. District Court for the Southern District of New York claims cryptocurrency companies leveraged the market’s vulnerability due to the market’s lack of knowledge of cryptocurrencies, alleging illegal sales of securities.

- Companies sued include such high-profile cryptocurrency giants as Binance, Tron, BitMEX and Block.one.

- Roche Freedman is also representing the estate of bitcoin pioneer Dave Kleiman in a billion dollar lawsuit against Craig Wright, alleging that the self-proclaimed Satoshi Nakamoto tried to seize the deceased Kleiman’s bitcoins.

Forkast.Insights | What does it mean?

Regulatory compliance with U.S. statutes in the crypto world spans a broad spectrum, from best efforts to not bothering at all and sheltering everything offshore. In America’s litigious world, just because a firm is named in a lawsuit certainly doesn’t mean it is guilty of anything, or should be seen as a pariah. But that being said, this collection of lawsuits does expose some problematic elements in the crypto exchange and trading industry.

One of the key allegations in the lawsuits is that the named companies “leveraged the market’s vulnerability due to lack of knowledge of cryptocurrencies.” This is where things look dicey for some of these exchanges. Often, these exchanges will advertise features that mimic the nomenclature of traditional equities exchanges by offering services such as “custody” or “margin trading.” Without employing custody services — which are regulated entities and separate from exchanges — settlement of a trade isn’t guaranteed, as these firms collect enough money from each buyer and seller to cover potential losses incurred if either party fails to follow through on an agreed trade, or if the exchange itself has technical problems or liquidity issues (see: BitMEX outage).

This is important when credit and leverage are involved, as margin orders cover the open positions in derivatives that would potentially lose money if the deal fails to close. Losses could compound faster, and gains build up slowly as the market moves away from the initial position. As you don’t trade bitcoin on BitMEX, but rather an option, this can become highly problematic during a period of intense market volatility as the underlying asset of the option, owned by BitMEX, could see its value depleted.

But it’s not like these exchanges aren’t cognizant of what they are doing. BitMEX has an insurance fund and others have similar products. There are some safeguards in place so that retail investors don’t get totally wiped out. But these aren’t the same safeguards that are in place for exchanges within the traditional equities market. Crypto exchanges aren’t regulated, aren’t insured, aren’t subject to government certification and oversight. But, by borrowing some of the nomenclature of traditional finance, they may seem like they are to unwitting investors. That, in itself, doesn’t bode well for any firms that want to argue they are not leveraging the market’s lack of knowledge of cryptocurrencies.

4. In China: blockchain in high spirits, prominent mining company racks up big losses.

China’s famously fiery liquor producer Wuliangye Yibin announces a new strategic collaboration with Sina Weibo. The internet giant known for its flagship social media platform Sina Weibo, will help Wuliangye Yibin promote “Wuliangye Digital Liquor Tokens.” (五粮液数字酒证)

- Information on each bottle of Wuliangye will be stored on a decentralized digital ledger and will each have a unique digital certificate of authenticity on “Zhenjiu,” a blockchain-based liquor-buying retail platform produced by Sina’s sub-company, Chengdu Shangtong Time Digital Technology.

- The Zhenjiu platform provides services such as traceable delivery history, online ownership transfer and also product verification on arrival.

Forkast.Insights | What does it mean?

As tastes mature within China’s domestic consumer market, so do the quality of its products. Just as many Chinese no longer want to buy shanzhai (knock off) consumer goods and prefer the real thing, they also are losing their taste for the cheap liquor of yore. Domestic superstar Moutai, for instance, has made baijiu a luxury good, selling the traditional liquor at a handsome profit.

But with this newfound high-end market comes counterfeiters, and with liquor this can have a devastating effect. Bathtub booze can cause blindness, and in some cases even death.

Blockchain can allow consumers to track their product from distillery to table, giving drinkers confidence that their baijiu from Wuliangye Yibin is what it claims to be and not a liquified imposter. As companies like Wuliangye Yibin and Moutai move ever more upmarket, the incentive for crooks to try and pass off counterfeits grows, and the need to protect their brands becomes more important.

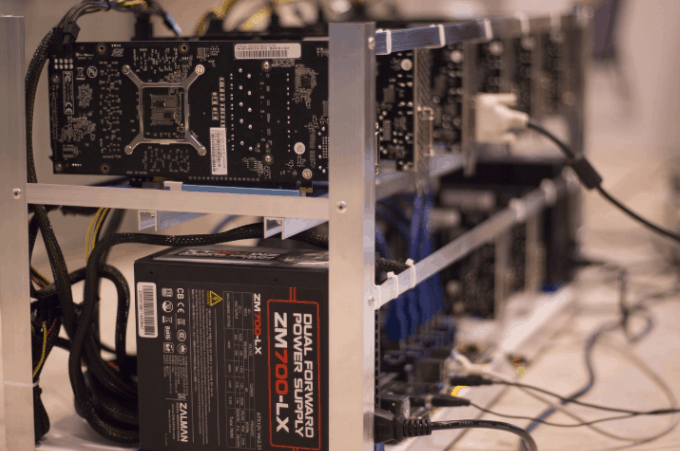

Chinese bitcoin miner manufacturer Canaan reports $148.6 million net loss for 2019.

- Canaan’s fourth-quarter net loss is $114.7 million USD. Compared with the net loss of $3.9 million in the same period of 2018, its net loss increased by 2,800%.

- Canaan was the first mining company in the world to have an IPO and is still the only one in the sector to be publicly traded.

- Its IPO came after the company was rejected multiple times previously. Canaan’s attempt to go public in Hong Kong triggered a remark from Hong Kong Stock Exchange CEO Charles Li: “cryptocurrency mining machines fail to meet the Hong Kong Stock Exchange’s listing principle of ‘suitability.’”

Forkast.Insights | What does it mean?

As covered in Forkast, Canaan is being battered by a perfect storm on three fronts: a precipitous drop in crypto commodity prices in this coronavirus economy, the upcoming bitcoin halving when the rewards from mining will be greatly reduced, and its own chronic mismanagement. Its IPO back in November 2019 was not well-timed — but was there ever a good time for this particular company? Canaan’s IPO on the Nasdaq followed three prior failed attempts at completing a listing in China and Hong Kong.

Canaan promises to change its business strategy away from being reliant on bitcoin mining to new markets like AI. But when it spends far less on R&D than its competitors, the chances of a successful pivot are slim. More likely than not, regulators will catch up to the company first, as there’s plenty of “Canaan Fodder” to go around.

5. Funding roundup: fintech startup in Hong Kong, microinvesting in Vietnam, and challenger bank in India

Hong Kong: Neat, Series A funding, $11 million USD

Neat, a Hong Kong based fintech startup, announced this week that it had secured a Series A round of $11 million, bringing the total raised to $18 million. The company targets the unbanked, offering low-friction approvals via facial recognition for prepaid MasterCards. Banks in Hong Kong don’t commonly issue debit cards, preferring credit cards, as they see debit cards as less profitable due to their low fee structure. Its business product, Neat Business, offers startups and SMEs prepaid credit cards so they can pay bills or expenses that would normally require using a personal credit card.

Vietnam: Finhay, seed funding, greater than $1 million USD

Finhay, a Vietnam-based micro-investing firm, raised an undisclosed seven-figure amount of funding provided by Thien Viet Securities, a Ho Chi Minh City-based investment bank and angel investor Jeff Cruttenden, cofounder of Acorns Financial.

Finhay’s mission is to dramatically lower the bar for investing in mutual funds, as it only requires a minimum of $2.30 to invest. In a country where the average monthly salary is just over $148 a month, and where a well-paying job nets someone just $500 a month, low-barrier investing is a key to helping build equity — especially when more traditional assets like real estate investment are out of reach.

India: Navi Technologies, VC funding, $394.7 million USD

Navi Technologies, an Indian fintech and financial services agency headquartered in Bangalore, announced a round of capital funding totaling just under $395 million. With its seed round from 2018, this brings the total funds raised to just over $555 million.

Navi is another challenger bank that seeks to build accessible and affordable banking and credit services in India.

Forkast.Insights | What does it mean?

This week’s closed funding rounds have a strong and resounding theme: banking as a service (BaaS) and challenger financial institutions. Although venture capital activity has slowed down in this Covid-19 economy, investors still have cash at hand and it needs to be deployed somewhere. Challenging the incumbent banks and financial institutions, especially in markets that are still maturing, makes a lot of business sense. India and Vietnam, for instance, are still poised for growth despite the ravages of the coronavirus on the world economy. Having a low-barrier investment opportunity via fractionalized investment vehicles would set these companies up for a solid long-term play.

However, this doesn’t mean that all challenger banks are a good investment. Ones that target mature, developed markets, such as Revolut, Monzo and N26, are not yet profitable given their higher liabilities and may have trouble with their next funding round.

In an uncertain environment, fast and nimble is always better. Low overhead and a cheap cost of entry allow a greater guarantee of success, if competitors are burdened by their balance sheets. Let’s hope the class of April 2020 understands this.