In September 2022, Ethereum is expected to complete the long-awaited Merge, drastically transforming the blockchain from power-hungry proof of work to a deflationary proof of stake model.

The Ethereum 2.0 Merge is expected to cause disruptions, and risks are expected—as happens with all upgrades of any complex systems.

Coinbase has created cbETH, a new wrapped crypto in preparation for the Merge. But what is cbETH, and how does it work?

What Is cbETH?

cbETH is a wrapped crypto, which is a crypto that represents another crypto that has been “wrapped” or “locked up” in a digital smart contract.

cbETH refers to Coinbase Wrapped Staked ETH (“cbETH”). It is an ERC-20 utility token that Coinbase has created to represent Ethereum 2.0 (ETH2) on its platform. ETH2 is ETH staked through the Coinbase platform. At launch, ETH2 and ETH have the same value, though Coinbase expects the price of cbETH to deviate from regular ETH as each cbETH represents one cbETH plus any accrued staking value.

cbETH, therefore, represents staked ETH on Coinbase, which will eventually become ETH2 when the Merge completes.

Why Was cbETH Created?

The Ethereum blockchain is expected to undergo its Merge in September 2022. The upgrade will transition Ethereum from the proof of work algorithm Ethereum 1.0 uses to the proof of stake algorithm Ethereum 2.0 will use. PoS is the same algorithm used by the more energy-efficient, affordable, and faster Solana.

cbETH was created for two reasons, both relating to locked Ethereum during the Merge.

During the Merge, all staked ETH on Coinbase will be locked and cannot be traded, which means users cannot access their staked ETH for months. Although the Merge is expected in September 2022, staking may not be available (or “switched on”) for many months afterward as the Ethereum development team will ensure network stability before doing so.

So, Coinbase’s cbETH, which is wrapped ETH, allows holders of Ethereum 1.0 tokens to spend or sell their tokens as normal while their “actual” Ethereum is locked up. However, you should note that if you sell your cbETH, which you are entitled to do, you won’t receive anything when the Ethereum Merge completes. The wrapped cbETH isn’t free crypto—it’s a promise of receiving something in the future.

Second, all trades during the merge period will be validated in the “Beacon Chain,” which is the Ethereum 2.0 network (this is why the “Merge” literally refers to merging the Ethereum 1.0 and 2.0 networks).

According to Ethereum, trading will only occur in the Beacon Chain and will be facilitated by validators:

In the initial deployment phases of Ethereum 2.0, the only mechanism to become a validator is to make a one-way ETH transaction to a deposit contract on Ethereum 1.0.

In other words, validators must acquire wrapped cryptos to verify trades on the Beacon Chain. To address this problem, Coinbase has created cbETH and offered it as a wrapped crypto to all holders of staked ETH. cbETH will continue to trade freely on Coinbase and across platforms while ETH remains locked before the Merge is complete.

How cbETH Works

To use cbETH, you need to be in a country where Coinbase allows ETH staking and meet Coinbase’s Know Your Customer (KYC) rules.

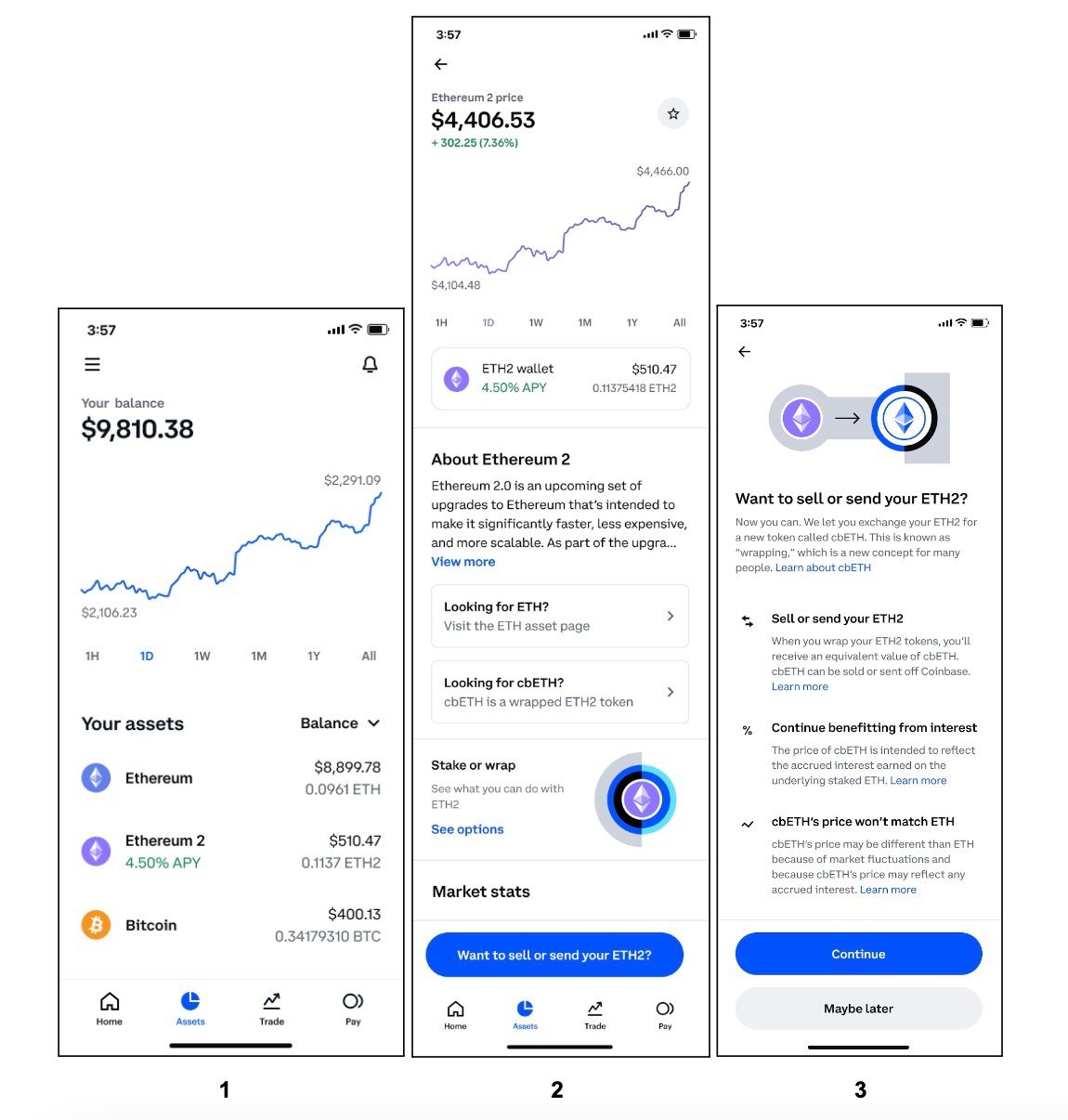

- Log in to your Coinbase account, Navigate to the Assets page

- Under Your Assets, select Ethereum 2

- At the bottom of your screen, select Want to sell or send your ETH2

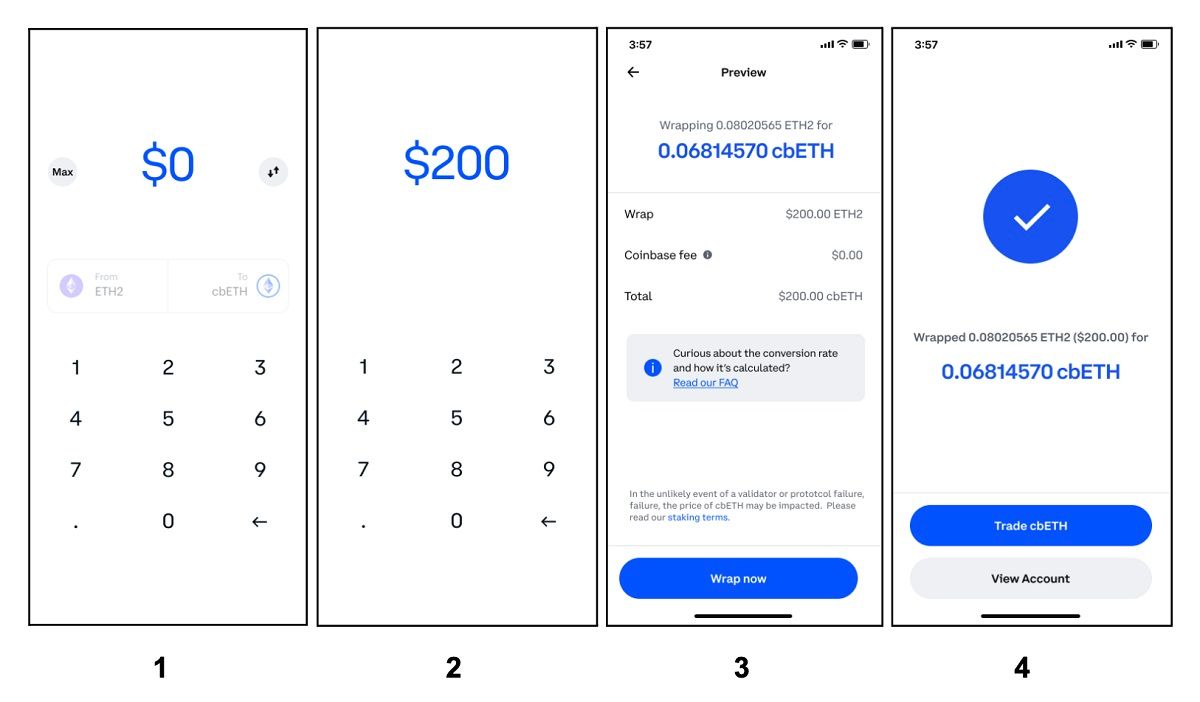

- Select Continue and enter the dollar amount or absolute value of ETH2 you wish to wrap.

- Select Preview to view how much cbETH you will receive

- Select Wrap now

- Navigate to the completion page to see how much ETH2 you have wrapped and the cbETH you have received.

- Choose Trade cbETH if you wish

- To return to your account, select View Account

It will not be immediately possible to unwrap your cbETH to get your ETH2 back, but it should be possible in the future. However, Coinbase has offered a workaround:

If you’d like to hold ETH2 instead of cbETH, you can trade your cbETH for ETH and then stake it to receive ETH2.

It is important to note that Ethereum is expected to actually physically merge its 1.0 and 2.0 networks sometime before September 20, 2022. The official Ethereum Merge will occur at the “total terminal difficulty” of 58,750,000,000,000,000,000,000, which the Ethereum development team expect to hit on or around 14 or 15 September 2022. Coinbase paused withdrawals of ETH and ERC-20 during this period “as a precautionary measure” to mitigate the migration risks.

How Will cbETH Impact the Ethereum Merge?

cbETH should have at least three impacts on the Ethereum Merge.

1. cbETH Will Be Worth More Than ETH

According to Coinbase, cbETH and ETH will not be valued 1:1.

ETH and cbETH are not pegged or expected to be interchangeable 1:1. In fact, as the underlying staked ETH continues to accrue rewards, each cbETH token is expected to represent more staked ETH, which may result in a divergence in prices for these assets over time.

In other words, although risks are involved, the price of cbETH may eventually be higher than ETH.

2. cbETH Will Enable Trade In DeFi Apps During Merge

cbETHs are ERC-20 tokens widely compatible with DApps across the Ethereum ecosystem. Coinbase hopes its cbETH will boost the DeFi sector while the Merge is underway by enabling users to continue to access and sell their Ethereum.

Our hope is that cbETH will achieve robust adoption for trade, transfer, and use in DeFi applications.

3. cbETH Will Boost Staking

According to data firm Messari, Coinbase is the second-largest holder of staked assets on the Beacon Chain.

Coinbase may attract more users to stake Ether by issuing its own staking version of ETH. Indeed, since cbETH enables users to potentially earn additional income on top of the staking rewards of ETH itself, this will very likely be the case.

cbETH Is Good For Coinbase’s Business

Ethereum currently consumes more electricity than the countries of Israel and Belgium. The switch from proof of work to proof of stake will reduce this consumption by a staggering 99.9%, in addition to eventually reducing network speeds.

While this transformative transition is underway, all trading platforms will need a solution to keep trading staked-ETH safely until the Merge is completed.

cbETH is Coinbase’s solution and should help it stay relevant to its users during the merge period.