A leading digital assets manager says that institutional investors have been adding to their short positions on Bitcoin (BTC).

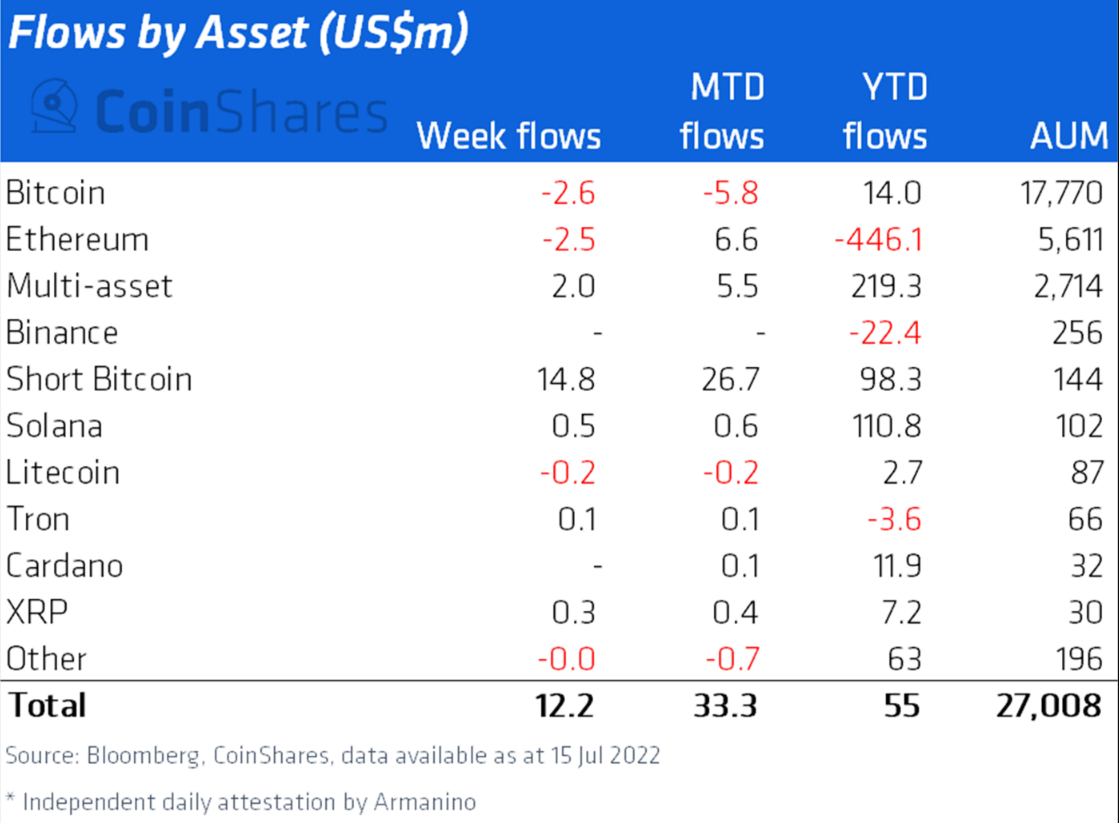

In the latest Digital Asset Fund Flows Weekly report, CoinShares finds that short BTC investment products saw $15 million of inflows last week while long investment products suffered net outflows.

“Digital asset investment products saw inflows totaling $12 million last week, although $15 million of that were inflows into short (inverse price) investment products, with net outflows for long investment products totaling $2.6 million.”

CoinShares interprets the boost in short-BTC products as a sign of investors expecting further downside in crypto markets, but not necessarily wanting to sell out of their long positions.

Long-Bitcoin investment vehicles suffered $2.6 in outflows last week, bringing the year-to-date inflows to $14 million.

After three weeks of inflows, Ethereum (ETH) investment products suffered minor outflows last week.

Litecoin (LTC) also suffered minor outflows last week, with most altcoin products seeing minor inflows during the week.

Solana (SOL), XRP, and Cardano (ADA) investment products took in $0.5 million, $0.3 million, and $0.1 million of inflows respectively, and multi-asset products rose above the rest at $5.5 million inflows.

“Multi-assets investment products, the stalwart during this bear market from a flows perspective, saw inflows totaling $2 million, bringing year-to-date inflows to $219 million, well above any other asset.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/ImageBank4u/Nikelser Kate