Q2 has proved one of the worst financial hits in cryptocurrency history. Avalanche, according to the company, the fastest smart contracts platform in the entire industry of blockchain, didn’t crash as much as its counterparts.

In other words, this bear market couldn’t destroy the company in Q2. Avalanche continued its expansion even in the times of the blockchain crisis. Even after the recent industry crashes, the Avalanche network’s decentralization stayed strong.

Here’s a detailed analysis: Avalanche Q2 Report 2022.

Avalanche Network Overview

The network usage of Avalanche has declined with respect to Quarter 1. The market capitalization went down drastically, 81.7%, to be precise. Despite this, revenue generation and network usage are not much affected. The average daily transactions are reduced by 37.8%. The total revenue is also impacted. It has shrunk 25%. The price to-sale ratio, or P/S, has skyrocketed. The ratio was 91x in Q1 and has grown to 379x during Q2.

Avalanche Total Locked Value

Total Locked Value in any Defi (Decentralized Finance) system is defined as the number of user funds stored(locked) in the ledger or DeFi protocol. This TVL went down this Quarter while the amount of AVAX locked has surged in DeFi. The Quarter started with $115 million. It eventually ended in $152 million. This statement shows that the crashing of TVL (Total Value Locked) doesn’t necessarily show a decline in utilization. In this case, the going down of pricing reflects the decline in the AVAX market price.

Avalanche Circulating Market Cap

In terms of CMC(Circulating market capitalization), it has been a tough quarter for Avalanche. This statement is about the fact that Avalanche and Fantom have witnessed the greatest drop with respect to their counterparts. Comparatively, this quarter has been stable for blockchain networks like Ethereum, Polygon, and BNB chain. During Q2, gradually, these EVM chains reclaimed their market dominance.

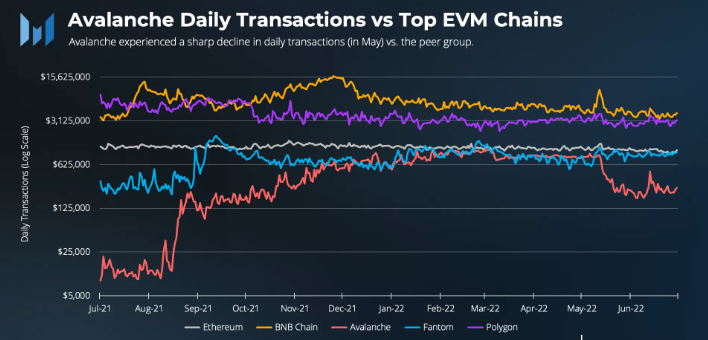

Avalanche Daily Transactions vs. Top Chains

Avalanche gave Ethereum tough competition during the Q1 and the early days of Q2. After May 22, AVAX witnessed a huge drop in daily transactions. Around the end of Q2, AVAX reached just 50% of ETH. One of the major reasons for this drop can be explained by the launch of the Swimmer network subnet. It occurred in May, around the same time the C-chain’s daily transaction count started declining. Ethereum is standing-still in the market with stability. Right now, ETH has a statistic of 1.17 million transactions/day.

Conclusion

Q2 was one of the most challenging Quarters for Avalanche. The bear market and macro forces, like the gravitational force, tend to pull the network and the user activity down. Anyways, Avalanche hopes to drive the growth of the market soon. This will be possible through the incentive programs the community is launching.