Adrian Black/iStock Editorial via Getty Images

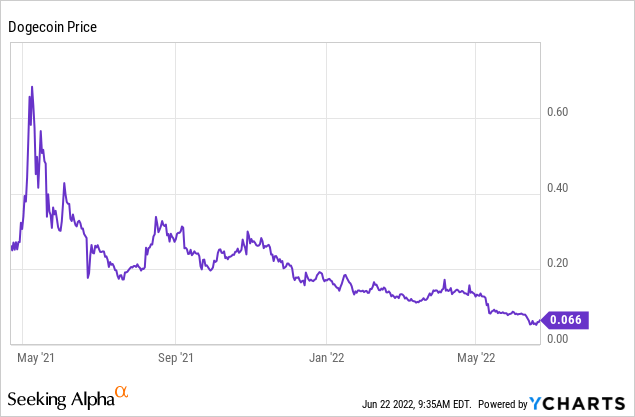

Elon Musk has been tagged with a $258 billion class action lawsuit. The claim is for damages as a result of Musk’s promotion of Dogecoin (DOGE-USD) on social media. Since Dogecoin’s market cap never actually reached $90 billion, you could argue this lawsuit’s request for damages is pretty dubious. That said, it does bring Musk’s online excitement for Doge back into the public consciousness. Musk has been a fan of Dogecoin in the past. He’s tweeted about DOGE quite a bit and even accepts it as payment for goods purchased from his Tesla store already. Since Musk’s May 2021 appearance on SNL though, the coin has done horribly.

Doge is down 90% since Musk’s appearance on Saturday Night Live. Interestingly, the decline started the day of the show’s broadcast with Dogecoin dropping 30% during the telecast. For better or worse, there’s clearly a link between Elon Musk and Dogecoin. Despite DOGE’s top 10 crypto market capitalization, I’ve never covered it on Seeking Alpha. In fairness, I have what could probably be considered an antagonistic view toward Dogecoin. In this article, I’ll support that view with my rationale.

What is Doge supposed to be?

I think to really understand what Dogecoin is in 2022, we have to know the full history of the coin. Dogecoin was created by Billy Markus and Jackson Palmer roughly 8 years ago. DOGE was forked from the Litecoin (LTC-USD) blockchain and was meant as a parody of cryptocurrencies. As the coin’s existence was largely intended to be a joke, a picture of a dog was chosen for the logo to highlight the whimsical nature of the coin. Since the coin’s development, Palmer has distanced himself from the project entirely and is a very vocal skeptic of just about anything related to cryptocurrency; including initial coin offerings and NFTs.

While the core function of DOGE as a blockchain-based asset now is supposedly as a medium of exchange, in reality, the token has been better at fulfilling its original intention of being a parody. You’re not going to get any argument from me that Dogecoin has become an incredibly successful meme in crypto and on Twitter (TWTR). However, I will not attempt to value Dogecoin as a meme. I don’t know that Dogecoin’s “meme value” is truly quantifiable beyond what the market cap says it is. As a payments network, we have real, verifiable data that shows it simply isn’t being widely used as a currency for peer-to-peer payments.

On chain metrics

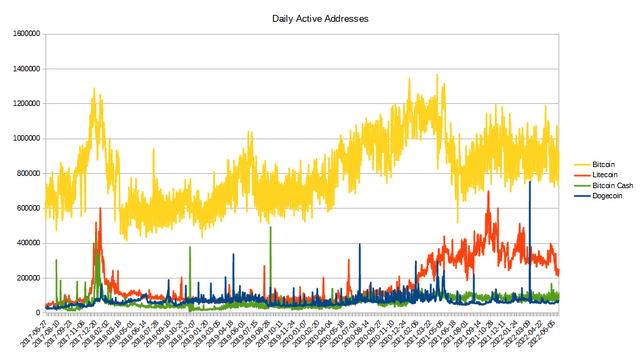

As a PoW (proof of work) cryptocurrency with several years of price history, Dogecoin’s biggest peers from a payments perspective are probably Bitcoin (BTC-USD), Litecoin, and Bitcoin Cash (BCH-USD); the latter two of which are Bitcoin forks. And again, Dogecoin is a fork of a Bitcoin fork. So there’s a relationship between all of these coins that I think justifies them as payment network peers. The first thing that I like to look at to judge if a network has any real adoption is active addresses. While raw addresses aren’t synonymous with unique users, active addresses give us a rough idea of how many people are using the networks for value transfer.

Daily Active Addresses (Messari)

As would be expected, Bitcoin is the obvious leader in daily active addresses. Though, recently, Litecoin has clearly distanced itself from the rest of the pack as an alternative coin payment network. Since this data is a little noisy, we can instead look to annual averages.

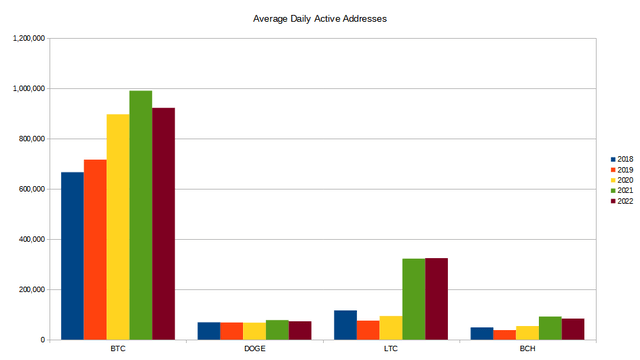

Annual Average Daily Active Addresses (Messari)

Obviously, 2022 is incomplete, and it remains to be seen how the rest of the year plays out. But Litecoin is actually the only cryptocurrency from this sample that is averaging more daily active addresses than last year. For a longer-term perspective, we can compare the YTD 2022 averages to the 2018 averages. I think this is a good comparison because it gives us crypto winter comps:

| Average | 2018 | 2022 | Vs 2018 |

| BTC | 665,700 | 921,956 | 38.5% |

| DOGE | 68,862 | 72,883 | 5.8% |

| LTC | 115,599 | 323,651 | 180.0% |

| BCH | 48,113 | 83,488 | 73.5% |

Source: Messari

Despite all of the popularity and all of the mentions from influencers like Elon Musk, Dogecoin’s network adoption is barely ahead of where it was 4 years ago. Part of the problem might be the concentration of the coin.

The centralization is concerning

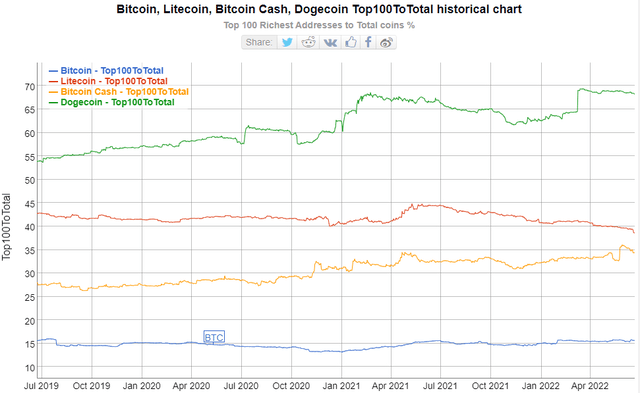

For real adoption as a peer-to-peer medium of exchange, you’d want to see a currency that doesn’t suffer from wallet holder concentration. The more a currency is concentrated to top wallet holders, the more centralized that currency really is. In the case of Dogecoin, it’s a highly centralized currency with the top 100 wallets holding 68% of the token supply.

Top 100 Holder Concentration (bitinfocharts)

This is far and away the worst of the payment network crypto peers that we’re highlighting in this article. Of the four, Dogecoin and Bitcoin Cash are the only two coins that have actually seen top 100 holder concentration grow considerably over the last 3 years.

| Coin | 06/22/19 | 06/22/22 |

|---|---|---|

| BTC | 15.58% | 15.63% |

| DOGE | 53.85% | 68.25% |

| LTC | 42.85% | 38.59% |

| BCH | 27.99% | 34.41% |

Source: bitinfocharts

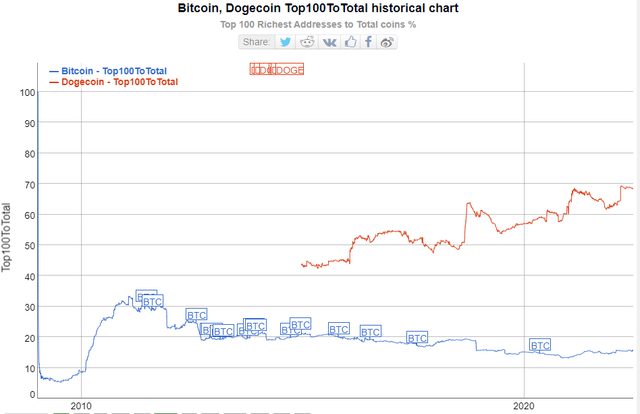

While it’s also fair to point out that Bitcoin’s top 100 holder concentration is slightly above where it was 3 years ago, zooming out further shows Bitcoin’s concentration has been gradually falling over time while Dogecoin’s has been doing the opposite.

Longer Concentration Trend (bitinfocharts)

Summary

What is the value of a meme? That’s the question Dogecoin holders should ask themselves. Despite its relatively low fees, Dogecoin isn’t really being used as a currency on-chain. While I don’t personally think Elon Musk has much to worry about from a class action lawsuit perspective as it pertains to Dogecoin, I do wonder if the added heat from joking about DOGE on Twitter means we can expect Musk to tone it down when it comes to Dogecoin posts and memes.

Since the lawsuit news, Musk has said on Twitter that he’d still support Dogecoin. But supporting a coin’s development and constantly tweeting about it aren’t necessarily the same thing. Musk does seem to have his hands full with other projects and probably doesn’t need the added grief of potentially problematic Dogecoin posts. Does that mean the price of Dogecoin comes down? I’m not sure. Again, it depends on how much you value a joke and its cultural significance.

I don’t personally think Dogecoin is worth anywhere close to $8.3 billion either as a meme or as a payments network. For the purpose of investing in crypto assets, I like dozens of other coins a lot better. You’re not going to find Dogecoin in my shared portfolio on BlockChain Reaction. However, if the network activity in Dogecoin changes drastically for the better, I’ll certainly keep an open mind.