Let’s go over the business model of Coinbase and other crypto Tweets of the day.

This Tweet Thread is courtesy of Sam Callahan.

- Allow me to share an article I wrote that looked into how sh*tcoins perform after being listed on Coinbase. After digging into it, I remain highly critical of Coinbase’s questionable listing policies and marketing strategies. TL;DR – Coinbase is the woooooooorst

- I was motivated to write this after Coinbase recommended “Top 10 Picks” to their customers that didn’t include Bitcoin despite Bitcoin outperforming 99.9% of sh*tcoins long term. They even recommended AXS over BTC two weeks AFTER its Ronin Bridge suffered a $625 million hack.

- Since being recommended by Coinbase, these “top 10 picks” are down an average of -37% against Bitcoin. If a customer of Coinbase heeded their advice, they would have lost money on these sh*tcoins instead of simply saving in the less risky asset, Bitcoin, for the long term. [Mish Comment: Chart 1 Below]

- Coinbase’s marketing is highly skewed towards sh*tcoins that are riskier and less secure than BTC. Their education around BTC is atrocious. They don’t want their clients buying and holding BTC cuz they want them to trade themselves into oblivion & collect those sweet tx fees.

- It’s important to note that Coinbase also makes money off of listing fees. They constantly push the sh*tcoins they list on their unsuspecting clients who end up losing their life savings thinking they are buying the “next Bitcoin” Coinbase promoted LUNA.

- In 2017, Coinbase had 4 coins outside of Bitcoin listed on their platform. Fast forward to today, and Coinbase offers 161 cryptocurrencies. Most of them I have never even heard of. (Pawtocol…anyone? lol) Apparently, business has been good in the coin listing business.

- It’s important to understand the game at play here…when a sh*tcoin is created, early investors typically make investments, a development team is formed, and a % of the coins are issued to these insiders at extremely low prices.

- This insider allocation usually occurs in the form of a “pre-mine.” This is an aptly named term to describe coins that are given to early investors & the team before the general public has the ability to mine or buy them. This is similar to a startup issuing equity to investors. [Mish Comment: Chart 2 Below]

- After the launch, if the coin gains in popularity and is listed on a large exchange, the VCs and other insiders then have the opportunity to dump their holdings on retail traders who are sold the narrative that the sh*tcoin is “the next big thing” or is “better than Bitcoin.”

- These VCs and teams typically don’t care about the product or “innovation” of the sh*tcoin. The goal IS to get listed on an exchange. The product IS to dump tokens, that were produced with 0 cost, onto retail investors and 1000x their investment with 0 work. What a product!

- I call this the “The Insider Exchange Dump”. This strategy has been used under many different names such as ICOs, DeFi, and NFTs, but the outcome remains the same — the insiders get richer, and the outsiders lose their life savings. Don’t believe me? Let’s dig into it

- First, let’s look at how the original 4 cryptos listed on Coinbase have performed against BTC since being listed. All were marketed as competitors to Bitcoin. Since being listed, 3 of the coins are down >80% against Bitcoin. Only ETH has outperformed (we’ll get to this later). [Mish Comment: Chart 3 Below]

- Next was the ICO craze. Despite most of these ICO coins having little to no liquidity or even working products, Coinbase listed them on their platform anyways. They looked past the red flags and instead saw it as an opportunity to collect listing fees and expand its product.

- Once the coins were listed on Coinbase and the early investor lock-up periods ended, these insiders had a large platform to dump their positions on unsuspecting investors & walked away with massive profits. Here’s how 10 popular ICOs have performed against BTC after being listed. [Mish Comment: Chart 4 Below]

- As you can see, every single one of these ICOs have underperformed BTC since they were listed on Coinbase. A majority of these hyped ICO tokens are deeply negative against BTC, with an average drawdown of -58%. And yet, Coinbase still rarely markets BTC to clients…weird.

- Next was the DeFi craze. Coinbase was quick to list & market these tokens despite the heightened operational, security, and regulatory risks that came with them. SBF was on a recent podcast explaining what DeFi was, and it led Bloomberg Journalist Matt Levine to respond with. [Mish Comment: Chart 5 Below]

- Here’s how these DeFi coins have performed against BTC since being listed on Coinbase. After being heavily pushed on their clients, these DeFi tokens are completely rekt against BTC. Since being listed on Coinbase, the average loss against BTC for these DeFi tokens is -61.6%. [Mish Comment: Chart 6 Below]

- The point here is that Coinbase must hate their clients or something. It’s a platform that provides exit liquidity for insiders to dump their worthless tokens. Once a token gets listed on Coinbase, a majority of the upside has already been made by insiders via backroom deals.

- It’s not just me cherry-picking here. Jump Crypto performed a study that analyzed the performance of 3,759 tokens against BTC over the 8 years between 2013-20021. It concluded that 84% of the tokens analyzed were underwater against Bitcoin, with a median annual return of -78%. [Mish Comment: Chart 7 Below]

- Furthermore, I analyzed all 161 cryptos that have been listed on Coinbase and compared their performance against Bitcoin since listing. The median performance against Bitcoin after their listing is -67.3%, with a median days since listing of 274 days. (Read that again please)

- This data is evidence that BTC and other cryptos should not be considered similar. BTC has unique properties that allows it to hold its value over time. Every other crypto besides Bitcoin is better thought of as a digital penny stock. You won’t hear this from Coinbase though.

- Back to ETH…from its time of listing, it has actually outperformed Bitcoin. But the data above highlights how continued demand for Ethereum has been driven by its switching claims from being a platform for ICOs, to DeFi, and then NFTs (which nearly all underperformed Bitcoin).

- In the beginning, ETH was not marketed as a long-term investment but rather was promoted as “digital oil”. Most ETH holders didn’t hold their ETH long term, but instead traded their holdings for other cryptos that were spawned on Ethereum during these various speculative crazes.

- If Ethereum is, in the end, merely a platform for retail investors to lose money on other digital assets, I would expect its demand and price to eventually go the way of all things that don’t produce any real value for the world.

- It’s important to understand what you own and don’t own when it comes to Bitcoin and the rest of the broader crypto industry. It’s about time we separate Bitcoin from other cryptos and call out the irresponsible, questionable marketing and coin listing practices of Coinbase.

- What retail investors desperately need in today’s macroeconomic environment is a digital sound money that can’t be inflated or censored. They need to be saving in Bitcoin to preserve their wealth — not gambling on unregulated digital penny stocks using bucket shops like Coinbase.

- /the end. If you are sick of being exit liquidity for insiders and getting shilled sh*tcoins, then delete Coinbase and come check out a real Bitcoin companies who will treat you right, like @swanbitcoin (Disclosure: I work there) I think the reviews speak for themselves.

Tweet charts

Charts and images from Sam Callahan Tweet thread

A learning experience

Thanks Sam!

Hopefully, readers will appreciate your insights. I appreciate the fact that Sam follows me (I just found that out today after deciding to post the above Tweet thread).

Anyone who follows me has to know that I am not a fan of crypos, including Bitcoin.

But I especially went after the obvious fraud pretenders including LUNA and DOGECOIN, the latter hyped by Elon Musk.

Perhaps Sam feels the same way that I do and have commented on many times. “I follow lots of people on Twitter I disagree with and learn more for them than I do with people echoing my thoughts.”

Hopefully, the above Tweet thread by Callahan sheds a lot of light on what is happening in the crypto space.

You just don’t understand

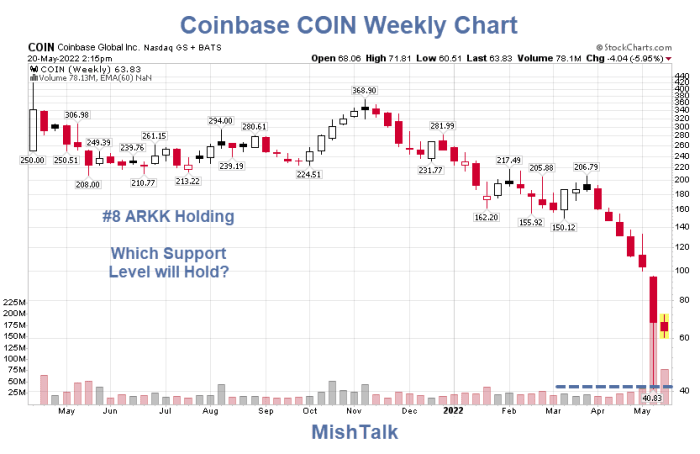

Coinbase chart

Coinbase chart courtesy of StockCharts.Com, annotations by Mish

Coinbase is the 8th largest position of Cathie Wood’s ARK fund. Will Coinbase even survive?

For discussion, please see Cathie Wood Provides Lesson of the Day: Don’t Invest in Fairytale Stocks

Where is Bitcoin headed?

I have frequented commented “I do not know and nor does anyone else.” The same applies Ethereum and all the rest of the coins.

That said, I suspect Dogecoin has a date with zero. It was started as a joke. It’s now down to $0.085 from a Musk-inspired hype high of $0.74.

Anyone who got in on the “Musk high” is down 88% with almost no chance of recovery in my estimation.

More noteworthy Tweet discussion

Retail distribution is the coinbase model

A word about the future

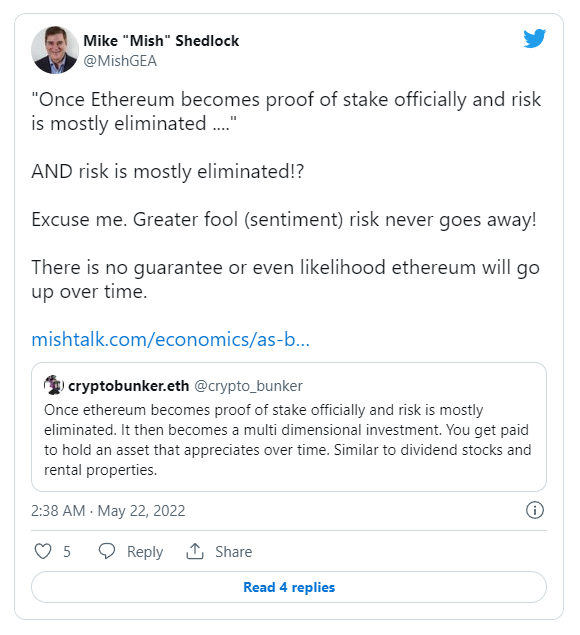

Pretending to know the unknowable

No one knows where these coins are headed or in what timeframe. Yet, every day people pretend to.

The subject came up again today.

“Once Ethereum becomes proof of stake officially and risk is mostly eliminated ….“

AND risk is mostly eliminated!?

Sorry, that’s either ignorance or a lie. I see similar statements about Bitcoin all the time.

Crypto beginnings

Bitcoin launched in January of 2009. It has never seen any environment than endless Fed pumping, low interest rates, and extreme QE liquidity supporting all asset prices.

Liquidity also explains the rise of hundreds if not thousands of altcoins, all inherently worthless.

Even if we give Bitcoin and Ethereum first mover advantage, no one can possibly know how either will perform in an inflationary environment in which the Fed is hiking and for the first time stating an aggressive QT (Quantitative Tightening) policy.

Coin supply myth

Contrary to popular myth, the supply of Bitcoins does not decrease when it halves,

A Bitcoin halving is when the payout for mining a new block is halved. This happens after every 210,000 blocks (approximately four years).

Halving limits the increase in the number of Bitcoins over time, but that does not decrease the supply. Instead, halving decreases the rate of increase of supply.

The supply of Bitcoin is every coin ever mined minus those with lost keys.

Every second of every day interested parties have to address a simple set of questions.

Decision time 100% of the time

- Holders: Do I hold Bitcoin or would I rather hold something else?

- Potential Buyers: Do I buy Bitcoin, something else, or nothing at all?

It’s important to understand there is nothing unique about Bitcoin.

The same applies to the stock market, the bond market, currency traders, even home owners.

Questions abound

Do I want to hold this asset or something else?

If someone is willing to sell you a Bitcoin for $30,000, ask yourself why. What is it that they think they know that you think they don’t.

Are the sellers “Bitcoin Whales” deciding to cash out? Newbie greater fools who has had enough?

I don’t know, and you don’t either. Yet, the pretending goes on: “Bitcoin always will rise.”

Anyone who makes that statement is a liar, a fool, or a charlatan hoping you are their greater fool.

Cash isn’t trash

Even in inflationary environments, cash is not trash.

- Cash is down about 10% this year to price inflation (except vs assets).

- Bitcoin is down about 56%.

- LUNA is down about 100%.

- ARKK is down about 74%

- The Nasdaq is down about 30%

- The S&P 500 is down about 20%

The clear winner this year is cash. It will generally buy more of generally any risk asset even if it buys less food or gasoline.

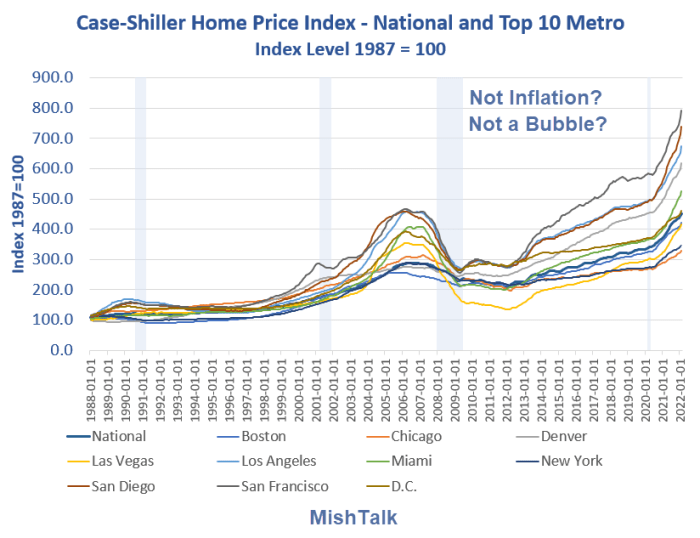

A word about asset bubbles and inflation

The Fed has no idea what inflation is or how to measure it. Neither the Fed nor economists in general put assets in their model.

If that chart is not a measure of inflation then what is it? A tuna fish sandwich?

But if inflationary bubbles are the upside beneficiaries of Fed policy, the downside risk is a deflationary bust.

We are in asset bubble deflation now.

Top idea of the month: What needs to happen before stocks bottom?

Please consider Top Idea of the Month: What Needs to Happen Before Stocks Bottom?

History suggests markets bottom after the yield on the 10-year treasury note drops significantly.

That has ominous implications for all asset classes, especially the riskiest of asset classes.

And Bitcoin has generally been following the Nasdaq. There is no reason to believe that stops, nor any reason to believe we are close to a bottom in anything.

Bitcoin margin calls, waterfall events, and people pretending to know the unknowable

“You just don’t understand”.

Crypto advocates certainly understand the inner workings of cryptos far better than me.

But most of them are naïve about supply and demand, bear market liquidity, the true driving force behind cryptos (speculation), and what they believe they know that is simply unknowable.

On May 12, I discussed Bitcoin Margin Calls, Waterfall Events, and People Pretending to Know the Unknowable

On May 14, I noted El Salvador’s bonds Sell for 40 Cents on the Dollar, What About Bitcoin City?

El Salvador has models. President Nayib Bukele tried to sell bonds backed by Bitcoin but there were no takers. But he is buying the coins.

Michael Saylor, CEO of MicroStrategy (MSTR) bet his company on Bitcoin. El Salvador president Nayib Bukele bet the country.

Both did so with Bitcoin above $30,000.

Curiously, Saylor blew up his company once before and now smack in the midst of a liquidity crunch may do so again.

Not to worry, I am told “It cannot happen” by charlatans pretending to know the unknowable.