Bitcoin intraday returns exceeded those of altcoins as the global cryptocurrency market cap rose 0.9% to $1.3 trillion at press time.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin BTC/USD | 1.4% | -3% | $29,609.99 |

| Ethereum ETH/USD | -0.1%% | -5.8% | $1,977.28 |

| Dogecoin DOGE/USD | -0.01% | -8% | $0.08 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Kava (KAVA) | +12.6% | $2.88 |

| Tezos (XTZ) | +11.5% | $2.09 |

| Ethereum Classic (ETC) | +9.2% | $23.99 |

See Also: How To Get Free Crypto

Why It Matters: Risk assets still remain unattractive for investors. On Tuesday, the S&P 500 and Nasdaq posted losses of 0.8% and 2.35%, respectively.

The slowing growth in the economy is now visible in the earnings numbers of listed businesses like Snap Inc SNAP, particularly those operating in the technology sector.

Tuesday marked a return of risk aversion across asset classes with the exception of gold, noted Edward Moya, a senior market analyst at OANDA.

“Everything is weakening at a faster clip than anyone expected and that does not bode well for the US consumer and for short-term outlooks for equities,” said Moya, in a note seen by Benzinga.

Moya is pessimistic on cryptocurrencies in the near term. “Bitcoin is in the danger zone as sentiment for risky assets have fallen off a cliff. Normally plunging Treasury yields makes crypto attractive but right now no one wants to buy this dip,” he said.

Benchmark 10-year note yields fell to 2.738%, the lowest since April 27, according to a report from Reuters.

The analyst said the apex coin could test the $25,424 level as the stock markets capitulation may not yet have taken place with the $20,000 level acting as a support zone.

The losses on the equities side have been more stark, cryptocurrency trader Michaël van de Poppe reminded his Twitter followers. He pointed out that Amazon.com, Inc AMZN alone has lost $900 billion in value in the past 6 months. The entire market cap for Bitcoin, on the other hand, is $550 billion.

Remind yourself that $AMZN has lost $900 billion in value in the past 6 months.

The entire market capitalization of #Bitcoin is $550 billion only. pic.twitter.com/OXTBfdd8N1

— Michaël van de Poppe (@CryptoMichNL) May 24, 2022

The gulf between Bitcoin price movement and altcoins has widened as investors lose their appetite for risk amid the erosion of positive sentiment.

This can be seen in the stark gap between the 7-day price movements of Bitcoin and Ethereum. While BTC is down 3%, Ethereum’s decline over the week has been almost double that.

Over the quarter, Bitcoin domination has crept up to 44.51%, from 42.61%, according to data from CoinMarketCap.

Major Cryptocurrencies By Percentage Of Total Market Cap — Courtesy CoinMarketCap

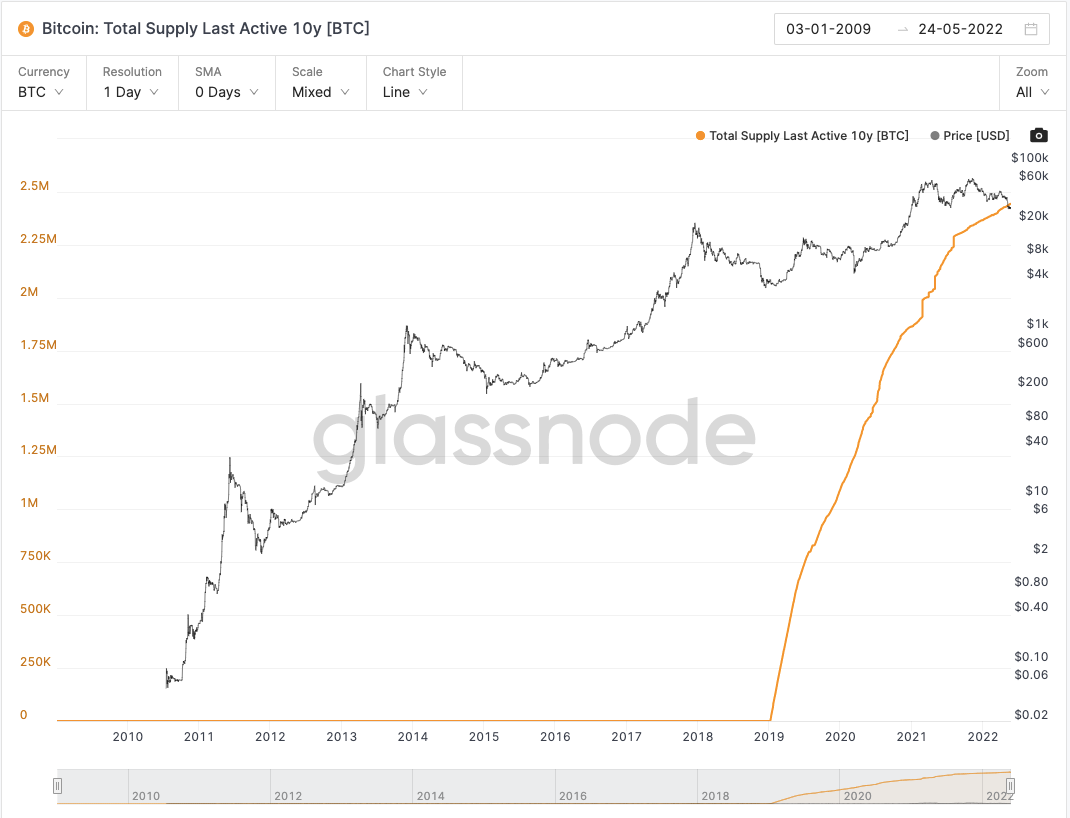

Holder conviction in Bitcoin still remains intact as can be seen from the amount of supply last active greater than 10-years chart posted by Glassnode. This metric reached an all-time high of 2,443,600.434 BTC on Tuesday.

Bitcoin Total Supply Last Active >10 Yrs — Courtesy Glassnode

Bitcoin Total Supply Last Active >10 Yrs — Courtesy Glassnode

Meanwhile, Ethereum’s average fee has dipped to just $2.54 per transaction, tweeted Santiment. The market intelligence platform pointed out that historically, ETH prices rise after the average transaction fee goes below the $5 mark, but warned that this is by no means automatic.

#Ethereum‘s average fees are at an extreme low, costing traders just $2.54 per transaction currently. This is the lowest $ETH cost level since July. Historically (but by no means automatically), $ETH prices rise after average transactions dip below $5. https://t.co/JS3paxdfwz pic.twitter.com/hsc9BoGwPx

— Santiment (@santimentfeed) May 24, 2022

Read Next: This Bitcoin Knockoff Is Up 24% With Massive Volumes Even As Major Cryptos Slide