South_agency/E+ via Getty Images

The world of crypto was shaken to its core last week with the complete collapse of TerraUSD (UST-USD), which lost essentially 100% of its value in a few days’ time. This is but the latest round of unfavorable headlines for alt currencies, and combined with general risk-off preferences from the stock market in 2022, cryptos themselves, and the miners that generate the coins, have had a rough go of it.

One such miner that has had an extremely tough 2022 is HIVE Blockchain (NASDAQ:HIVE), which has lost about two-thirds of its value just this year. However, at the point where it has fallen to, HIVE is, weirdly enough, a bit of a value stock with some crypto-related upside. Let’s take a look.

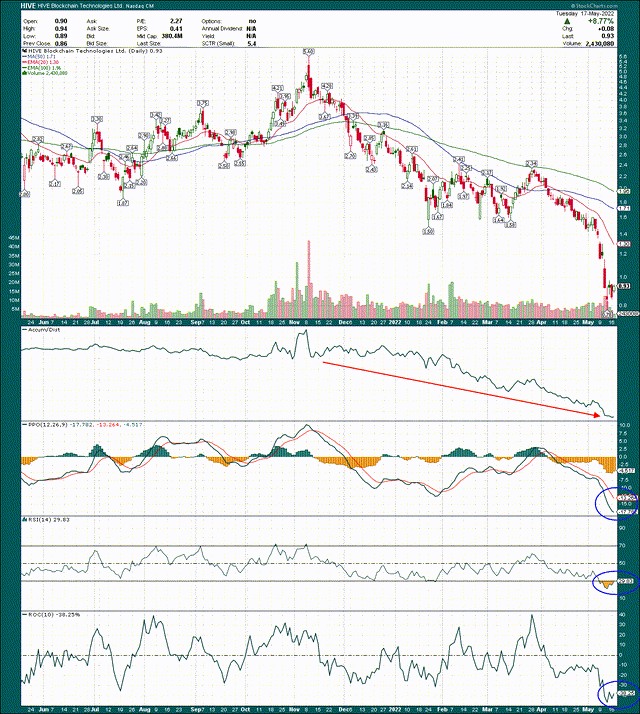

StockCharts

HIVE’s chart is hideous and reflects many months of relentless selling. Crypto miners tend to be leveraged plays on the coins themselves, and HIVE is no different. Bitcoin (BTC-USD) and Ethereum (ETH-USD) have been awful this year, so the miners that mine them have been even worse in most cases. HIVE fits that description and the chart reflects that.

However, I think there is cause for optimism, provided you can stomach the immense volatility that comes with owning a small crypto miner. That’s something you have to be okay with before you proceed, because it’s pretty normal for HIVE and other miners to move 10% or more during one day. If you’re good with that, let’s take a look at what HIVE offers today.

HIVE has been completely dumped this year, as evidenced by its accumulation/distribution line that continues to make new lows. That means investors are selling rips rather than buying dips, which is the opposite behavior from what we want.

On the plus side, this stock is unbelievably oversold, with the PPO at -18, and the histogram at -4.5, which indicates tremendous selling pressure. You’ll struggle to find another asset that has PPO values like this.

The 14-day RSI hit very oversold territory in recent days, but is turning higher to indicate a bounce is underway. And finally, the 10-day rate of change is at -38%, indicating the stock has lost almost two-fifths of its value in the span of two weeks. This is the sort of volatility you’ll run into with crypto miners, but in this case, I think it might be helpful as a place to buy.

Now, if we believe that crypto miners are leveraged plays on the coins themselves, it makes sense to look at Bitcoin for HIVE’s analysis. Let’s dig in.

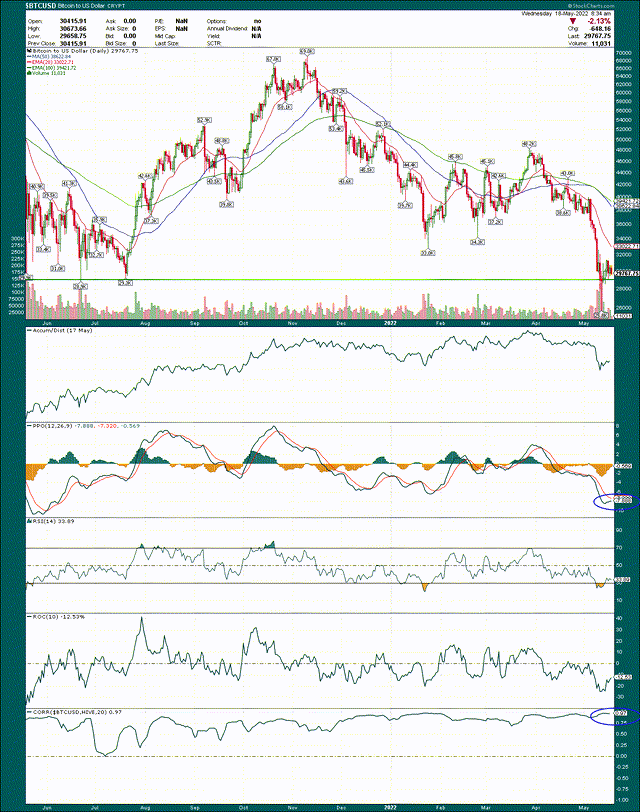

StockCharts

Bitcoin is pretty straightforward right now in that the area around $30k is absolutely critical to hold. We had a brief spike below that last week, but it was quickly recovered, which is a very good sign. However, we’ve been unable to move any higher than that, so the battle rages on.

Bitcoin, like HIVE, is very oversold. That increases the likelihood of a bounce, but guarantees us nothing. I’m still in the camp that unless/until Bitcoin definitively breaks $30k, it is more likely to bounce than break down, so that’s the base case I’m operating with.

Now, if we look at the bottom panel in the chart above, we have the correlation between HIVE and Bitcoin on a 20-day rolling basis, which is about a month’s worth of trading. That correlation is currently 0.97, meaning that Bitcoin and HIVE are essentially moving in lock step with each other. HIVE’s magnitude of moves is higher, but in essence, you’re getting a leveraged Bitcoin proxy with HIVE based upon this data.

The TL;DR on this is that HIVE is extremely oversold, has a nearly perfect correlation to Bitcoin, and Bitcoin itself continues to hold critical support. Based upon those factors, HIVE looks like a reasonable buy here.

Now, let’s take a look at that value case I mentioned earlier.

A crypto value stock?

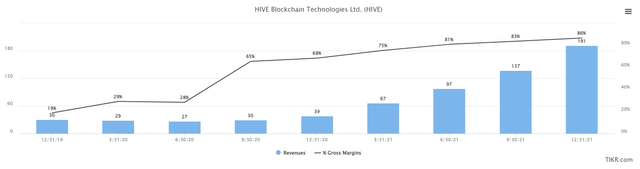

It sounds crazy to even think that “value” and “crypto” can be in the same sentence, but in HIVE’s case, I’m having a difficult time not seeing it that way. The company has been busy ramping capacity in recent quarters, as you can see below. We have trailing-twelve-months revenue in millions as well as the gross margin produced from that revenue going back to the end of 2019.

TIKR

Revenue has ramped higher, and according to estimates, is set to be right at $200 million annually for the foreseeable future. If the company can maintain its 86% gross margins that would mean annual gross profit of ~$170 million, from which HIVE would need to cover SG&A, D&A, production costs, interest expense, etc. At the moment, those costs are pretty small in comparison to gross margins, with the most recent TTM period coming in at ~28% of revenue. That means that if we take gross margins of 86% and subtract 28% of operating costs, we get operating margin of 58% of revenue. That’s outstanding, and while it moves around each quarter, you can start to get a feel for the profitability of this model, and it’s pretty good.

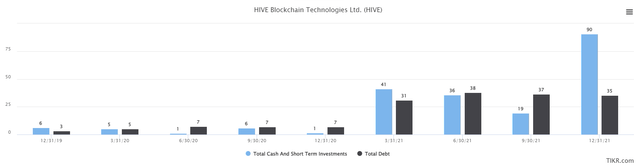

Now, the value part comes in not only with strong margins, but in HIVE’s case, it is actually a bit of a book value play. Let’s start with the balance sheet, with cash and equivalents, as well as total debt plotted below.

TIKR

HIVE has $35 million in debt, but $90 million in cash and equivalents, so its net debt position is -$55 million, which is outstanding. Therefore, there should be no near-term financing concerns as there is plenty of cash right now.

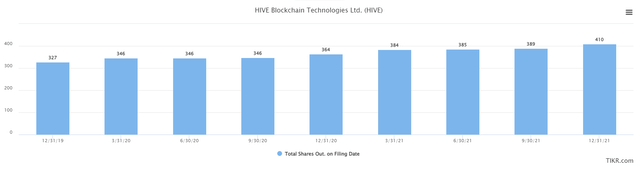

However, one reason HIVE has cash is because it is a serial issuer of common stock to finance growth, employee compensation, and acquisitions. The share count has risen significantly over time, with just the two-year period shown below coming in at 25% dilution.

TIKR

That’s a lot of dilution, so that’s something you need to be aware of as well if you’re buying this stock. Management has no problem doing 100% stock acquisitions, or issuing shares to employees as compensation, all of which dilutes your stake in the company. This is an unequivocal negative for shareholders, so certainly keep this in mind.

Valuing HIVE

Now that we’ve seen the technical analysis and value proposition of the business, let’s see how the market is valuing it today. One note to make is that HIVE is undertaking a 5-for-1 reverse stock split later this week, simply because its share price is below a dollar. That low of a share price can reduce the pool of buyers for a stock because some institutions have lower bounds on the share prices of stocks they’re willing to buy. Reverse stock splits are always done from a position of weakness, and weakness is something HIVE has had plenty of this year. Whether it works or not to buoy support for the stock remains to be seen, but something to keep in mind.

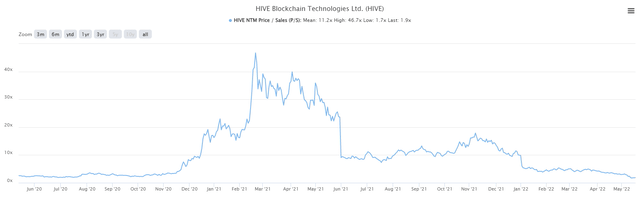

Below we have the price-to-sales ratio on a forward basis for the past couple of years, which helps us get an idea of how HIVE has been valued by the market.

TIKR

The stock traded with a low-single digit sales multiple prior to the big Bitcoin breakout that occurred in late-2020, after which its P/S ratio hit a stratospheric level of 47. That’s a ridiculous multiple so don’t expect that, but today the stock trades for just 1.9X forward sales. That’s a pre-pandemic valuation, but not only that, HIVE has ramped revenue and margins higher since the last time it was valued this way. In other words, the revenue and margin growth we looked at earlier appear not to be priced in at all. It is as though the market is ignoring all the progress HIVE has made in the past two years, and is valuing it like a crypto miner with almost no revenue again. HIVE isn’t that, so it shouldn’t be valued that way.

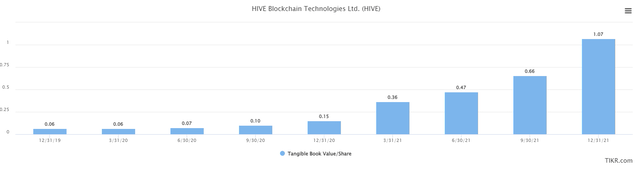

Don’t fancy P/S to value the stock? I see the same sort of thing happening with book value as well. Below we have tangible book value per share, which I like because it removes intangible assets with fuzzy valuations and boils the company’s value down to hard assets with real market values.

TIKR

The stock ended the most recent quarter with a TBV $1.07 per share, and if you’re keeping score at home, that’s 15% higher than the current share price. Now, either HIVE has burned through a bunch of book value in the past couple of months, or, this stock is very cheap. I think it’s the latter, and based upon the P/S ratio, as well as sustained high levels of revenue and margins, I think the risk on this one is to the upside, not the downside.

I’ll reiterate again that investing in crypto miners is not for everyone, so it’s certainly a viable strategy to just pass on this one. HIVE is going to move around a lot in both directions, so if you’re watching every tick, it may not be the right stock for you. However, I think there’s the potential for HIVE to see 4X to 6X forward sales again, which would still be a low P/S multiple based upon its historical tendencies, but would see the stock 100% to 200% higher from here. That sort of return would require Bitcoin to hold $30k and move meaningfully higher, but that’s my base case for the moment. This stock is too cheap no matter how you look at it, unless you think Bitcoin is going to collapse. I don’t, so I’m bullish on this speculative stock.