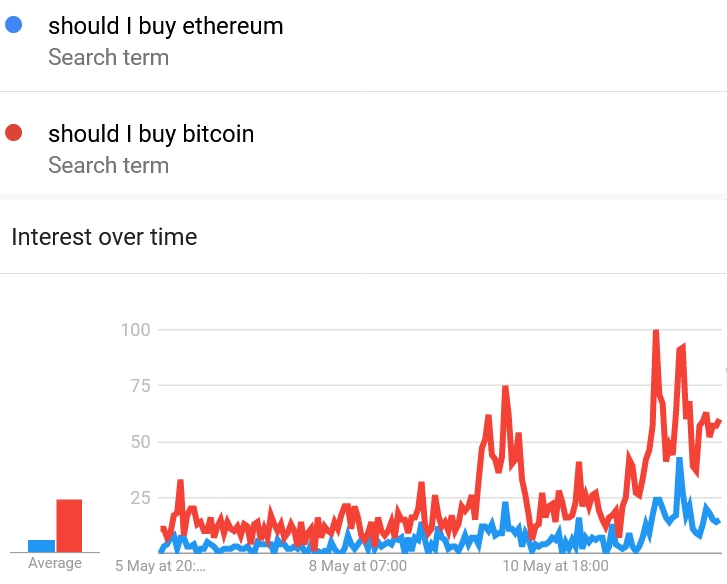

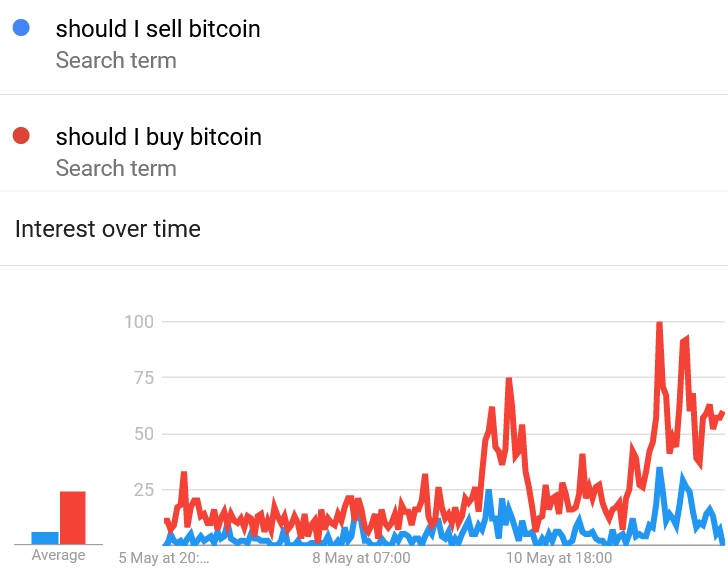

Data by Google Trends suggests that there is an increase in interest among people who seek to buy top cryptoassets like bitcoin (BTC) and ethereum (ETH) as prices hit multi-month lows.

The interest in search terms “should I buy bitcoin” and “should I buy ethereum” have increased by more than 70% and 50% over the past week, respectively.

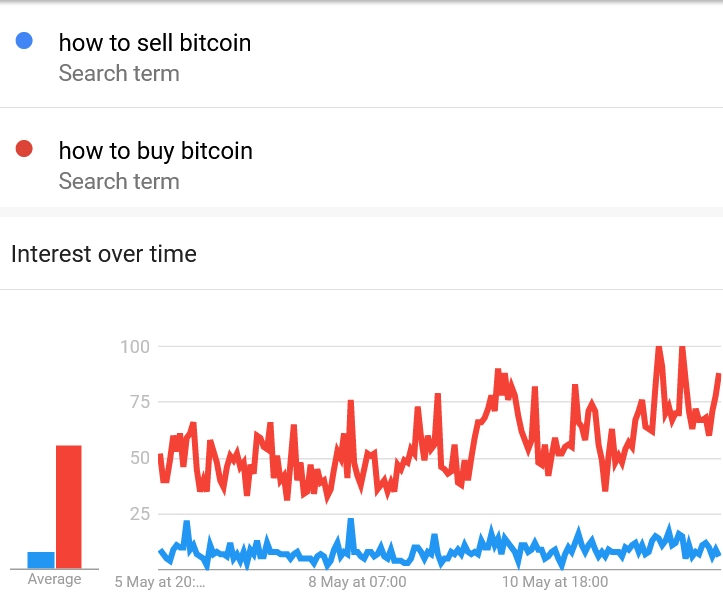

Other searches indicate an increased interest too.

___

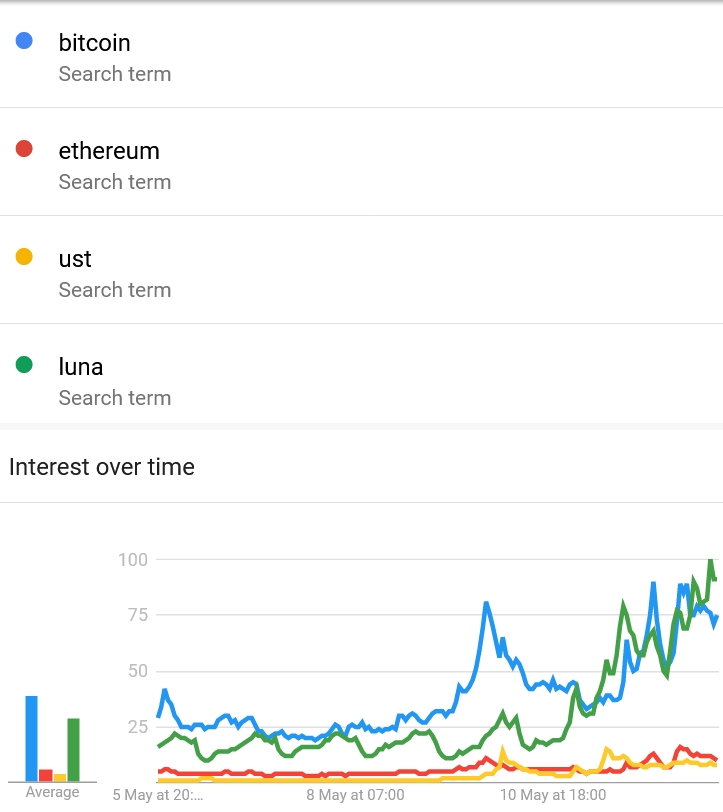

Notably, there has been a spike in Terra‘s LUNA and UST-related search terms, which should not come as a surprise since a huge part of the current market crash is said to be related to the fear emanated from stablecoin UST losing its peg.

Ostensibly, with LUNA down by more than 99% from its all-time high, some are wondering if it is the right time to buy the coin (or buy the dip). The interest in the search term “should i buy luna” has risen by 750% over the past week.

On Twitter, the hashtag “buythedip” is also currently trending.

All this is happening as the crypto market is seeing major losses across the board. Looking at just the top two cryptoassets by market capitalization, at 14:03 UTC on Thursday, BTC’s price was down nearly 10% in a day, trading at USD 28,124. It was also down 29% in a week and more than 50% in a year. Last November, BTC saw its all-time high (ATH) of USD 69,044, per CoinGecko.com, while the last time it saw the current level was July 2021.

At the same time, ETH was trading at USD 1,906, down 18% in a day, 35% in a week, and more than 54% in a year. Like BTC, in November last year, it hit its own ATH of USD 4,878, and the last time ETH was on the current level was last July.

____

Learn more:

– Bitcoin Dominance Rises as ETH/BTC Breaks Down

– Bitcoin On-Chain Metrics Strongest Among Peers – Kraken

– Market Panic Puts Tether Peg Under Pressure

– Citadel Securities, BlackRock Claim They Had No Role in the UST Collapse