Leon Neal/Getty Images News

Coinbase Long-Term Opportunity

About 6 months ago, in an article titled “Coinbase – More Than An Exchange“, I made the case that Coinbase (NASDAQ:COIN) had an opportunity to create the first American ‘super-app’. This opportunity still stands, and Coinbase is acting on it right now with the launch of its NFT marketplace.

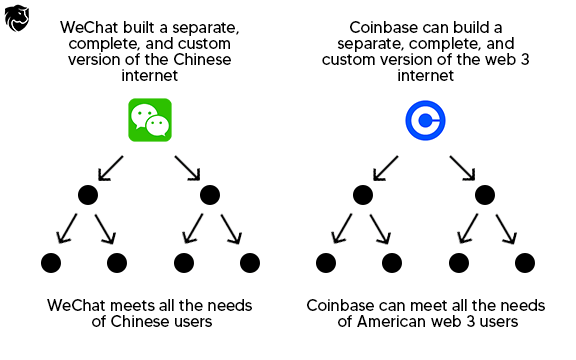

In my previous article from October 2021, I explained how Chinese super-apps WeChat, owned by Tencent (OTCPK:TCEHY), and Alipay, owned by Alibaba (BABA) grew to reach a combined over 1.6 billion users. I additionally stated that Coinbase had a chance to grow in a similar fashion, provided that the US regulator allows them to offer Web3 applications to their end users:

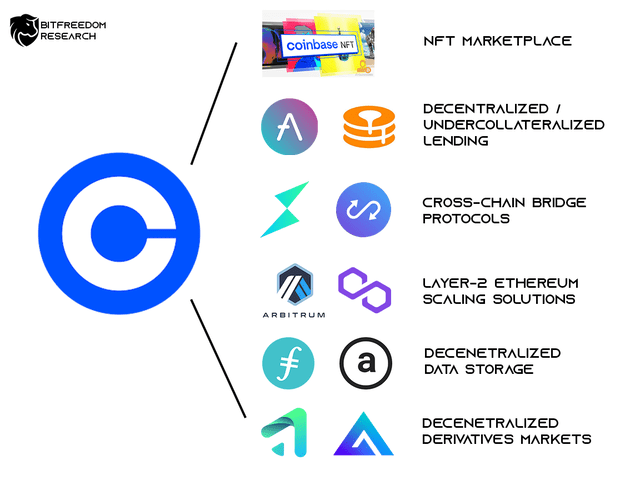

dApps that could be offered through Coinbase (Author)

The ability to offer Web3 applications represents a massive revenue opportunity for Coinbase. If given regulatory approval, Coinbase can potentially become another ‘all-in-one’ internet platform, similar to WeChat or Google (GOOG). The difference, is that rather than offer Web2 functionalities (search, email, social media, YouTube) Coinbase can offer Web3 functionalities (blockchain transfers, token staking, personal data storage, NFT trading, lending, derivatives, and microtransactions):

Coinbase platform (Author)

We can infer from Coinbase’s 89 million verified users that there is a massive population of people willing to use web 3 applications if the process is simplified. The problem, however, is that current Web3 applications suffer from:

- Lack of trust (due to frequent hacking and scams)

- Poor UI (as the necessity of browser wallets to interact with applications creates a large barrier to entry)

- No regulatory clarity (as governments are resistant to realize the future of digital ownership is decentralized)

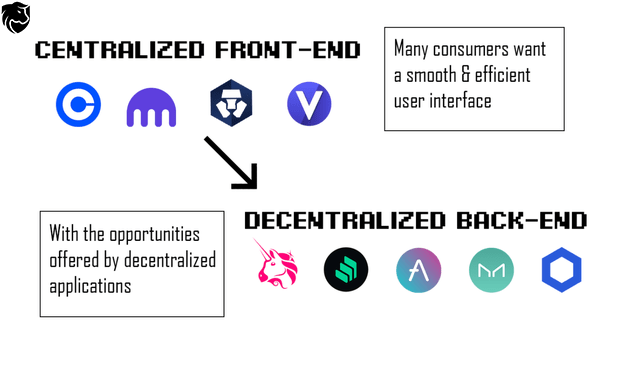

As I said in an article from September 2021 here, cryptocurrency exchanges have a unique opportunity to solve these issues by acting as trusted intermediaries between retail users and Web3 applications:

centralized front-end decentralized back end (Author)

Currently, lack of regulatory clarity and lack of security (which both create a lack of trust) are preventing Web3 dApps from expanding. Eventually, these applications should be available through centralized platforms. If this occurs, then Coinbase stands to benefit big-time.

COIN Elliott Wave Structure

From a fundamental point of view, heavy headwinds have negatively impacted COIN. Many analysts estimate that Coinbase will only post marginal profits this year or even end 2022 with a loss. Various competitors such as Bitfinex or FTX recorded large increases in users in the past year, and compared to Coinbase they offer more competitive commissions and trading rates.

At its IPO, Coinbase was overvalued and the issue price of $381 was too high. Large investors also saw this, and the stock has experienced massive distress due to increased short interest. The future will show if and how Coinbase can maintain and expand its growth.

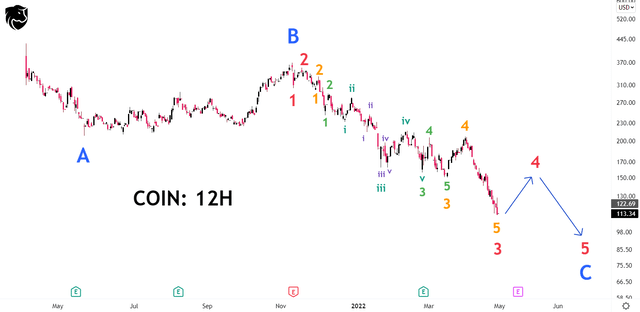

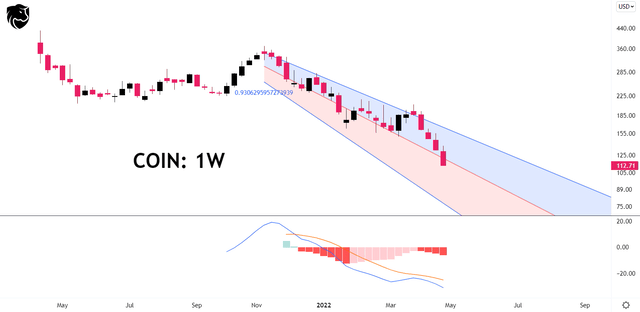

From a technical perspective, COIN is within a long term ABC pattern. Since November, COIN has been in a severe downtrend in which a total of 5 different downward 1-2 wave setups have formed. These impulses explain the rapid sell-off of the stock.

COIN Elliott Wave (TradingView)

According to the charted Elliott waves, the correction could be over in the next few weeks. Currently, the price has completed the orange impulse wave, and based on the red wave (4) a surge towards $140-$160 is likely.

After a final reflexive rally, we expect a harsh sell-off to complete the largest red wave (5). The final target of the correction is difficult to estimate, but a drop towards $115-$90 seems realistic.

In the long term, the selling volume in the weekly chart should slowly decrease. We’re using the weekly MACD oscillator along with a 25-week linear regression channel to determine potential trend reversals:

COIN: Weekly Chart (TradingView)

Coinbase NFT Marketplace (Revenue Projection)

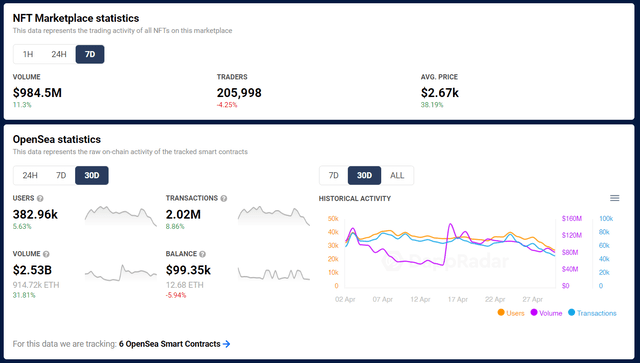

Coinbase’s NFT marketplace currently has 4 million people on its waitlist. To put this number in perspective, OpenSea (the largest NFT marketplace) reports has 382k monthly users and $2.53 Billion monthly volume, according to Dapp Radar:

OpenSea Statistics (Dapp Radar)

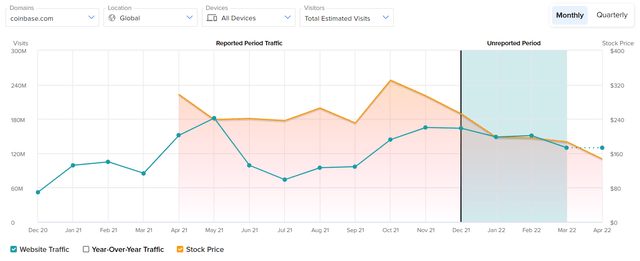

If we assume that Coinbase can maintain the same amount of NFT volume as OpenSea while charging a 2.5% commission fee, then this would increase Coinbase’s annual revenue by around $700 million. There is even a possibility that Coinbase’s marketplace can reach higher volume than OpenSea, as TipRanks data shows that Coinbase’s domain (coinbase.com) receives over 120 million visits per month:

Coinbase total monthly visitors (TipRanks)

The question is how many of Coinbase’s 120 million monthly visitors will transfer to become NFT traders? If 0.05% convert, then this would translate to 600,000 monthly visitors for Coinbase’s NFT marketplace (57% larger than OpenSea’s 380k monthly visitors).

The Coinbase NFT marketplace uses Ethereum (ETH-USD) as its medium of exchange, which is by far the most common currency for trading NFTs. Interestingly, Coinbase plans to add a ‘social dimension’ to its marketplace, including individual profiles, personal feeds, and showcases for NFT collections.

If Coinbase acts fast, we believe it can capture huge portion of the emerging NFT market. Such an opportunity has the potential to expand Coinbase’s annual revenue drastically, as the total NFT market-cap is forecast to reach $80 billion by 2025, according to investment bank Jefferies.

Key Takeaways

- Alongside trade commissions, Coinbase can also earn from interactivity with Web3 dApps and staking offerings.

- Coinbase’s Elliott wave structure (which began in November 2021) can bottom in the next 5 – 7 weeks.

- While the near-term outlook for COIN remains bearish, the long-term projection is still firmly bullish.

- Contrarian investors should look to accumulate COIN below $100.