Cryptocurrency market intelligence platform Santiment is revealing bullish prospects for the second-largest crypto asset by value.

In a new blog post, Santiment says that the Market Value to Realized Value (MVRV) metric of Ethereum (ETH) over the past seven days (7D) shows that ETH is near the “opportunity zone” where typically the price bottoms out.

The MVRV is used to show the average profit or loss of all coins in circulation at the prevailing price and is calculated as market capitalization over the acquisition costs of the assets in a wallet.

“ETH’s MVRV 7D which measures the short-term profit/loss of holders is showing that we are almost into the opportunity zone, which historically saw a local bottom being developed.”

The crypto market intelligence platform also says that the supply of Ethereum on exchanges is on a downward trend.

“ETH’s supply on exchanges continues to fall since mid-March, regardless of the rally. This may indicate that certain market participants with sizable amounts of ETH are not looking to sell anytime soon.”

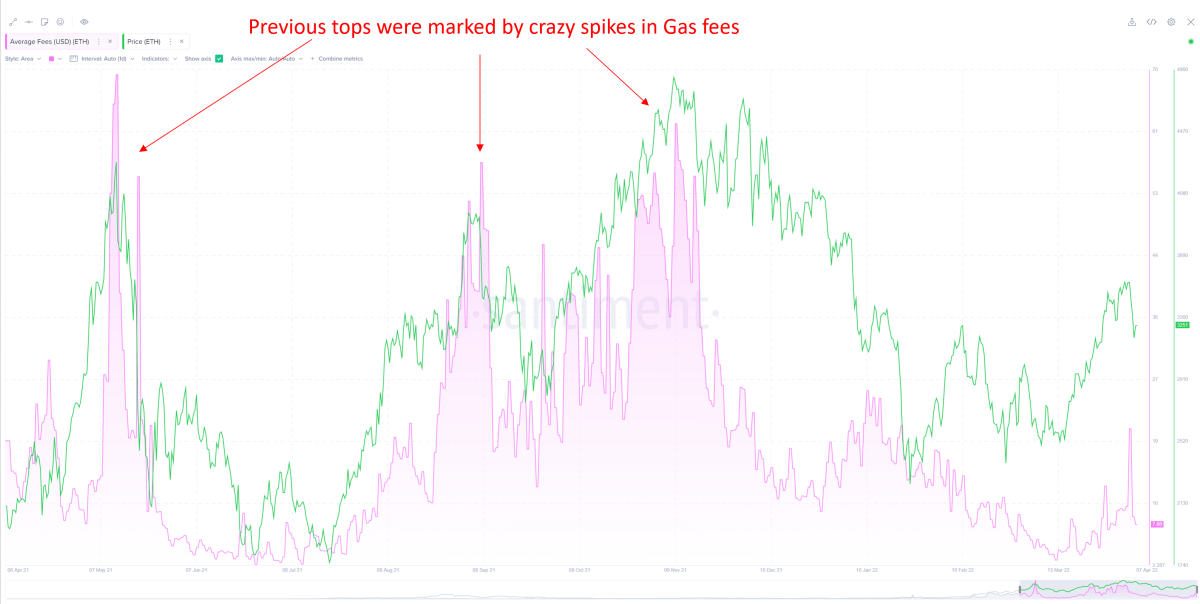

Santiment also says that if the level of Ethereum gas fees is anything to go by, then ETH is nowhere near a price top.

“Previous major tops have seen average gas fees skyrocket as the crowd piled in, which actually makes this metric a decent proxy to spot whether we are close to the top.

Fast forward to today, we are nowhere near the sort of spike we saw back in May 2021 and Nov 2021.”

However, the market intelligence platform says that Ethereum’s social volume, the number of times a given term appears in messaging or social media platforms, is stagnant, and this could suggest that there is no buyer excitement for ETH.

According to Santiment, divergences between the price of Ethereum and social volume are not uncommon though.

“ETH social volume remains rather flat amidst the recent price rally, suggesting that the general market isn’t excited at all and perhaps in disbelief.

That said, ETH social volume has overall been on a downtrend since the start of the year as Ethereum continues to lose its appeal to other Layer-1s or Layer-2s.

Zooming out, we’ll notice that there was another similar ETH price and social volume divergence in the past year.

Could we be seeing the same behavior?”

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong