When it comes to choosing the best crypto exchange, eToro and Coinbase are among the top platforms in the industry. Both eToro and Coinbase offer trading on a wide array of cryptocurrencies. They also offer seamless payments, mobile apps, technical trading tools, and much more.

So, which exchange is right for you? In this guide, we’ll compare eToro vs Coinbase head to head to help you decide.

eToro vs Coinbase Summary

eToro and Coinbase are both flexible crypto exchanges that can work well for a wide variety of investors and traders. Both platforms offer beginner-friendly tools in addition to more advanced technical charts and trading features.

- eToro stands out for its low fees and simple pricing structure. At eToro, you’ll pay a 1% transaction fee when you buy or sell cryptocurrency, regardless of what coin is involved in your trade. You can also pay with a credit card or e-wallet, which makes it easier to move between fiat and cryptocurrency.

- Coinbase offers a greater diversity of cryptocurrencies – 100+ compared to 59+ at eToro. Coinbase can be very expensive if you just want to buy cryptocurrency. Whereas eToro charges a 1% transaction fee, Coinbase charges up to 3.99% and the complex pricing structure makes it hard to calculate your cost ahead of time.

We think eToro is the better choice for the vast majority of investors. eToro is easy to use and inexpensive, and it offers plenty of trading tools to help you monitor the market. Coinbase is most suitable if you want to buy altcoins that aren’t available on eToro or need highly customizable charting software.

Cryptoassets are a highly volatile unregulated investment product.

| Fees & Features | eToro | Coinbase |

| Licensing | FCA, CySEC, ASIC | 42 US states, FCA, BaFIN |

| Number of Cryptocurrencies | 59 | 100+ |

| Pricing Structure | Fixed transaction fee | Flat fee + transaction fee |

| Fee for Buying Bitcoin | 1% of purchase | $0.99-$2.99 + 1.49%-3.99% |

| Trading Tools and Features | Technical charts, social network, copy trading | Crypto order book, customizable indicators |

| Mobile App Rating | 4/5 | 4/5 |

| Payment Methods | Debit card, credit card, PayPal, Neteller, Skrill, bank transfer | Debit card, PayPal, bank transfer, Apple Pay, Google Pay |

| Minimum Deposit | $10 | $2 |

| Demo Account | Yes ($100,000) | No |

Cryptoassets are a highly volatile unregulated investment product.

What are eToro and Coinbase?

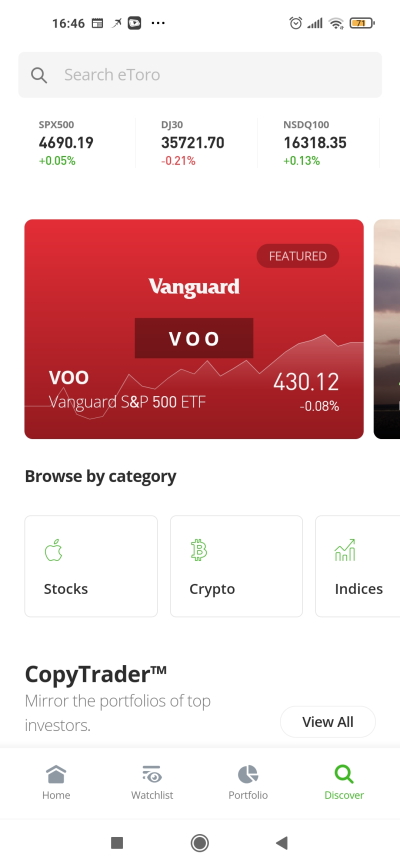

eToro is a multi-asset broker and cryptocurrency exchange founded in Israel in 2007. The platform enables you to buy stocks and ETFs, cryptocurrency, and CFDs (contracts for difference) for commodities and forex. eToro’s goal is to be a one-stop platform for financial assets.

eToro differentiates itself from other multi-asset platforms in a few ways. First, it’s one of the only multi-asset brokerages that serves as a true crypto exchange – that is, you can buy and sell cryptocurrencies outright instead of only trading them through derivatives. Second, eToro offers a built-in social trading network and supports copy trading.

Finally, eToro is regulated by several top-tier financial authorities, including the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Coinbase is a US-based cryptocurrency exchange founded in 2012. It held an IPO on the NASDAQ stock exchange in 2021 and is currently the largest crypto exchange in the US by trading volume.

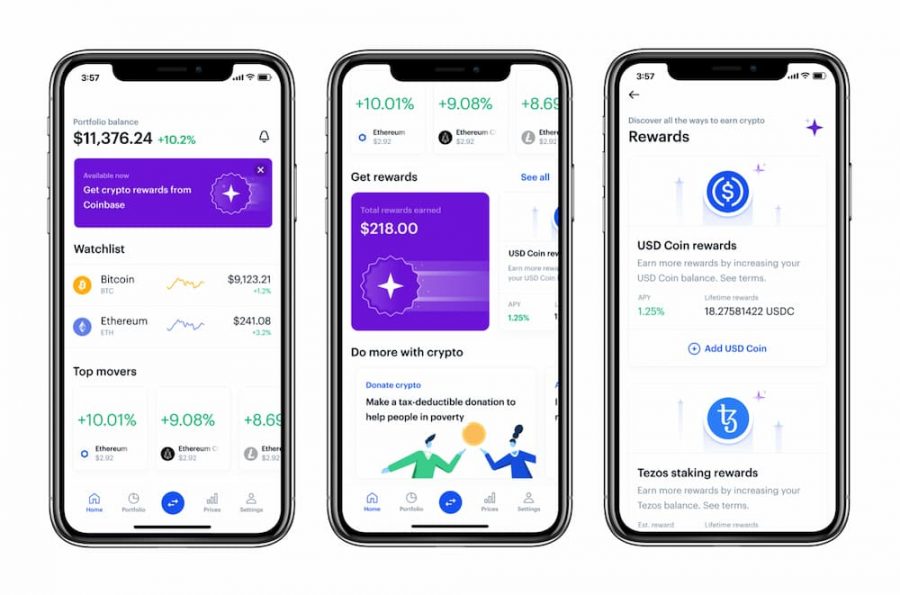

Unlike eToro, Coinbase only offers cryptocurrency and crypto-related assets. You can buy and sell 96 cryptocurrencies as well as borrow cash using crypto and earn crypto interest by lending out your cryptocurrency.

Coinbase has worked hard to cooperate with regulators in the US rather than operate behind the scenes as many similar crypto exchanges do. The exchange holds licenses in 42 US states, including New York, and received an e-money license from the UK’s FCA.

Tradable Cryptocurrencies on eToro & Coinbase

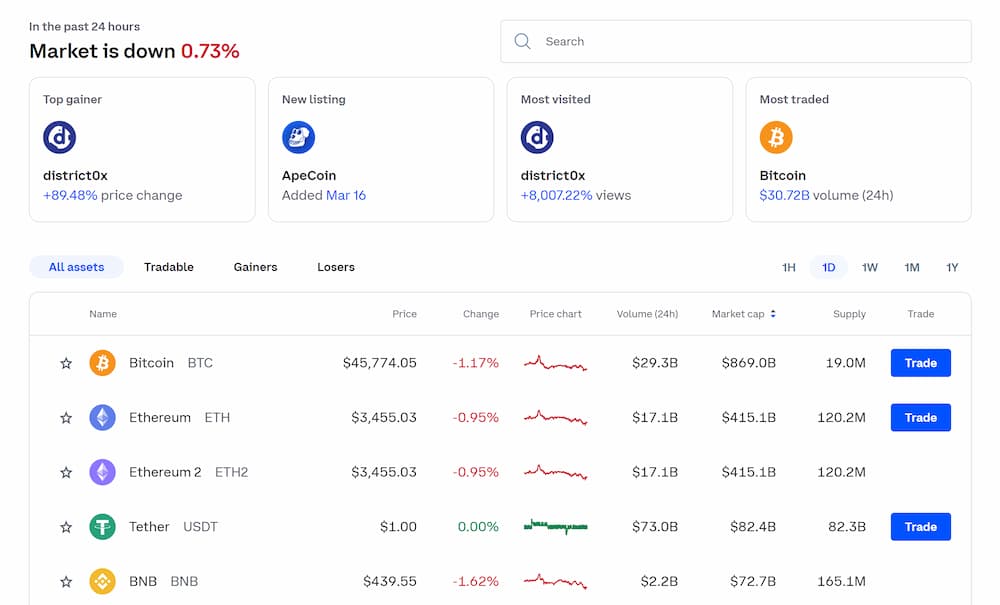

One of the most important differences between Coinbase vs eToro is how many cryptocurrencies you can trade on each of these platforms. Coinbase currently offers over 100 cryptocurrencies for trading, while eToro offers 59 and counting. Coinbase also has its own NFT marketplace.

Importantly, both exchanges offer all of the most popular cryptocurrencies. You can buy Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Dogecoin, Shiba Inu, Dash, EOS, and Avalanche at both eToro and Coinbase.

Notably, only eToro offers trading on Ripple (XRP). Coinbase has suspended XRP trading while Ripple is under investigation by the SEC.

If you want to purchase stablecoins like Tether or USD Coin, you will only find them on Coinbase. Coinbase is also the better exchange to buy DeFi coins.

Both exchanges routinely add new cryptocurrencies to their offerings as coins gain popularity.

Account Types

eToro only offers a single type of trading account, which makes things easy. There are no account fees and the minimum deposit required is only $10. With your account, you can buy and sell cryptocurrency instantly or use eToro’s trading tools to actively trade crypto.

Coinbase offers several different types of crypto trading accounts. A standard Coinbase account gives you the ability to buy and sell cryptocurrency instantly. This is what most beginners will use, but it does not provide access to Coinbase’s advanced trading platform.

A Coinbase Pro account gives you access to Coinbase’s trading platform as well as reduced fees of 0.60% per trade or less. For institutional traders, Coinbase offers additional tools and even lower fees with a Coinbase Prime account.

eToro Fees vs Coinbase Fees

eToro has some of the lowest fees of any crypto exchange in the US. Investors and traders pay 1% of your transaction value when you buy crypto, and an additional 1% when you sell crypto.

There are no additional fees based on what payment method you use to fund your account. However, eToro does charge market spreads for all cryptocurrencies.

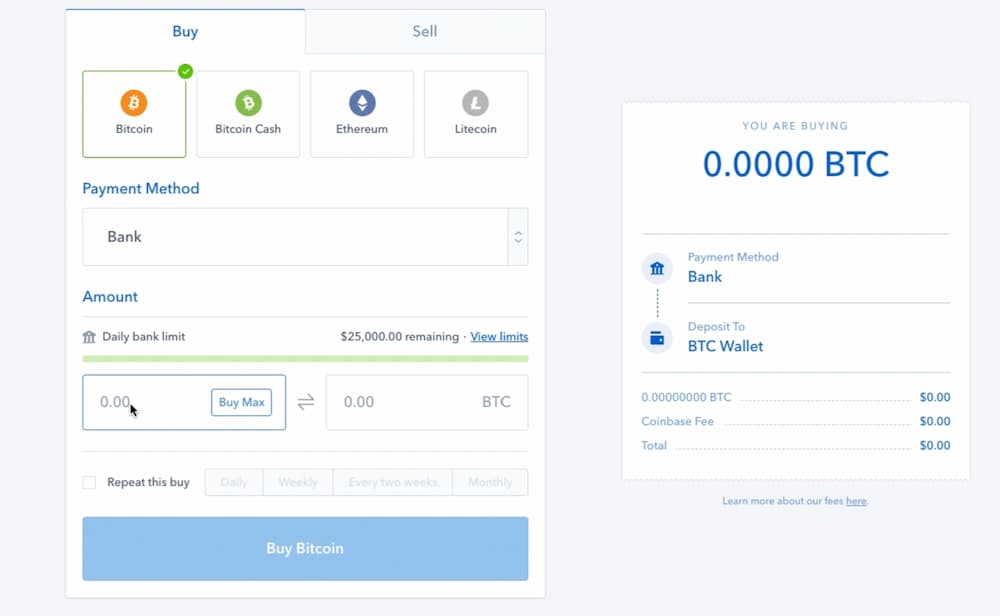

Coinbase’s fee structure is much more complex. If you have a standard Coinbase account and want to buy or sell crypto instantly, there are 2 fees. The first is a flat fee that ranges from $0.99 to $2.99 depending on the value of your transaction. The second is a percentage-based fee that ranges from 1.49% to 3.99% depending on the payment method you use to fund your purchase.

If you trade with Coinbase Pro, the fee structure is entirely different. Traders pay a fee from 0.00% to 0.60% depending on whether you add or remove liquidity with your trade (maker/taker fees). Your fee also depends on your total transaction volume for the previous month.

Here’s how eToro fees vs Coinbase fees break down when trading:

| Fees | eToro | Coinbase |

| Instant Buy Fee | 1% | $0.99-$2.99 + 1.49%-3.99% |

| Trading Fee | 1% | 0.00-0.60% |

| Cost to Buy $100 of Bitcoin with a Bank Transfer | $1 | $4.48 |

Cryptoassets are a highly volatile unregulated investment product.

eToro charges a $5 withdrawal fee when you remove funds from your account. Coinbase does not charge withdrawal or other account fees.

| Non-Trading Fee | eToro | Coinbase |

| Account Fee | None | None |

| Withdrawal Fee | $5 | None |

eToro vs Coinbase User Experience

Both eToro and Coinbase offer excellent user experiences. In fact, the ease of using these platforms is a big part of why they’re so popular among crypto investors and traders.

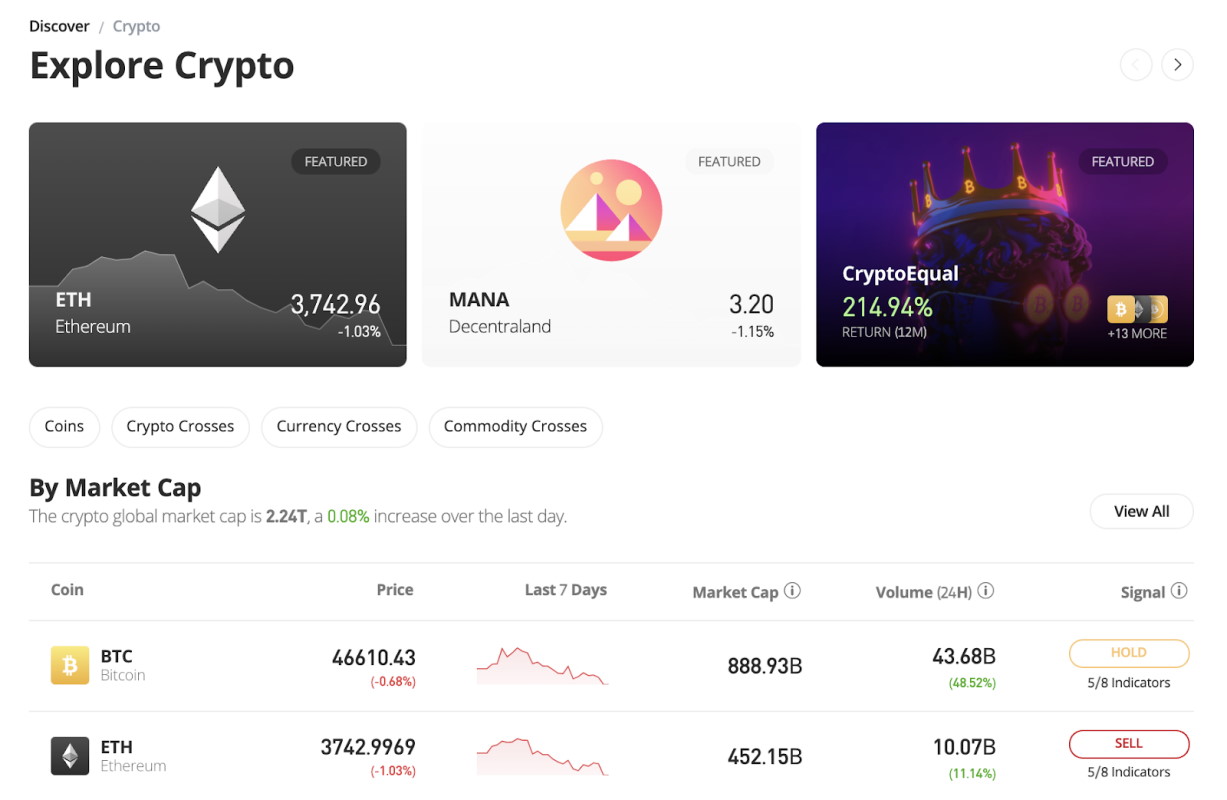

At eToro, you’ll get a personalized dashboard where you can explore the crypto market. The dashboard shows the biggest gainers and losers of the day as well as what cryptocurrencies are most popular among eToro users. Alongside the day’s price movements are color-coded charts showing performance over the past 7 days. The platform also aggregates a series of 8 technical indicators to issue buy, sell, and hold ratings for most cryptocurrencies, making it easy to identify potential trades.

Coinbase offers a similar dashboard with gainers, losers, and most volatile cryptocurrencies. The platform has color-coded price charts similar to eToro, and you can quickly toggle between performance over the past hour, day, week, month, or year. However, Coinbase doesn’t offer buy and sell ratings.

The process of investing in cryptocurrency is similar and straightforward on both platforms. Just click Trade on the cryptocurrency you want to buy to bring up a new order form. Then enter the amount you want to purchase to complete your trade. eToro’s order form has some additional parameters available for trading, but you can safely ignore these if you’re only interested in long-term investing.

eToro and Coinbase Mobile Apps

Both eToro and Coinbase offer free mobile crypto apps for iOS and Android. The apps offer all of the same features you can find on the web platforms. You have the ability to deposit funds, monitor the market, and buy and sell cryptocurrency through the apps.

Notably, since eToro doesn’t separate its technical charts and analysis into a separate platform, you can access charts and details about individual cryptocurrencies through the eToro app. Coinbase has a separate mobile app for Coinbase Pro. This is helpful for active traders since the Coinbase Pro app is dedicated to charting, but it can be annoying to switch between apps if you want to monitor charts and then execute an instant crypto purchase.

eToro also offers one of the best stock apps on the market, allowing users to gain exposure to major exchanges directly via their mobile device.

Trading Tools & Features on eToro & Coinbase

eToro and Coinbase differ widely in the features they offer for active cryptocurrency trading.

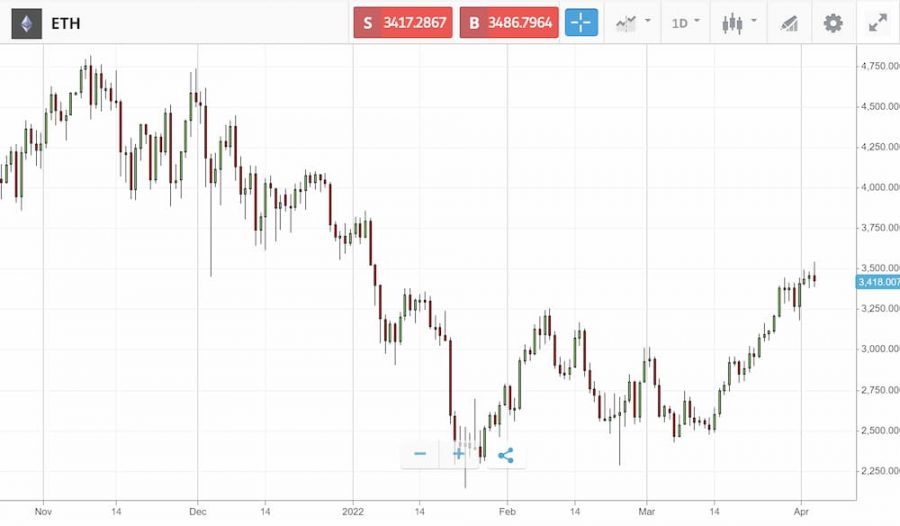

Technical Charting

Both eToro and Coinbase offer technical charting platforms. However, the charts at eToro are designed to be beginner-friendly and are limited in scope. The charts at Coinbase are much more complex and are tailored for experienced traders.

At eToro, you can choose from candlestick, bar, and line charts. Heikin-Ashi candlesticks are supported. There’s a good selection of drawing tools and technical indicators, including moving averages, Bollinger Bands, RSI, MACD, and more. The timeframe of each indicator can be customized, and you can compare 2 cryptocurrencies on the same chart.

Overall, traders won’t find much lacking in the technical charts at eToro. That said, it’s not a dedicated charting platform and the interface is less fluid than what we would expect from a purpose-built platform. You also can’t set price alerts or trade directly from charts.

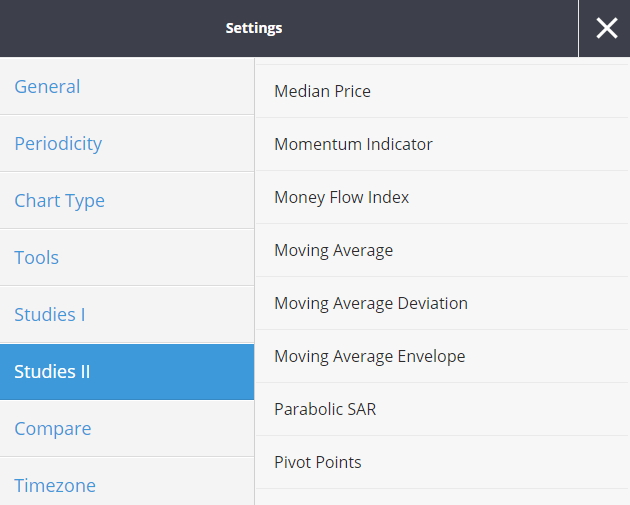

At Coinbase, technical charts require you to use Coinbase Pro. This is a dedicated charting platform, and an impressive one at that. Coinbase Pro has more than 100 built-in technical studies, all of which can be customized. What’s especially nice about Coinbase Pro is that you can enter orders in the same window as your charts and see all of your open orders in a pane below your chart.

Notably, Coinbase Pro also offers a few features that eToro leaves out. You can see the full order book for any cryptocurrency as well as a real-time trade history feed. The platform can also display depth-of-market charts, which help to spotlight shifts in bid and ask prices that can signify a shift in momentum. These features can be very useful for day trading crypto, but they’re just as likely to be overwhelming for beginners.

| Features | eToro | Coinbase |

| Candlestick Charts | Yes | Yes |

| Customizable Indicators | 75+ | 100+ |

| Trading from Charts | Yes | Yes |

| Price Alerts | Yes | Yes |

| Depth of Market | No | Yes |

Cryptoassets are a highly volatile unregulated investment product.

Crypto Analysis

eToro offers proprietary research into the crypto market to help you make trading decisions. This research includes a breakdown of everything you need to know about a cryptocurrency, including its history, market cap, and how much buying and selling activity is going on around it. eToro also analyzes several common technical indicators and presents this data in simple buy, sell, or hold ratings that anyone can understand.

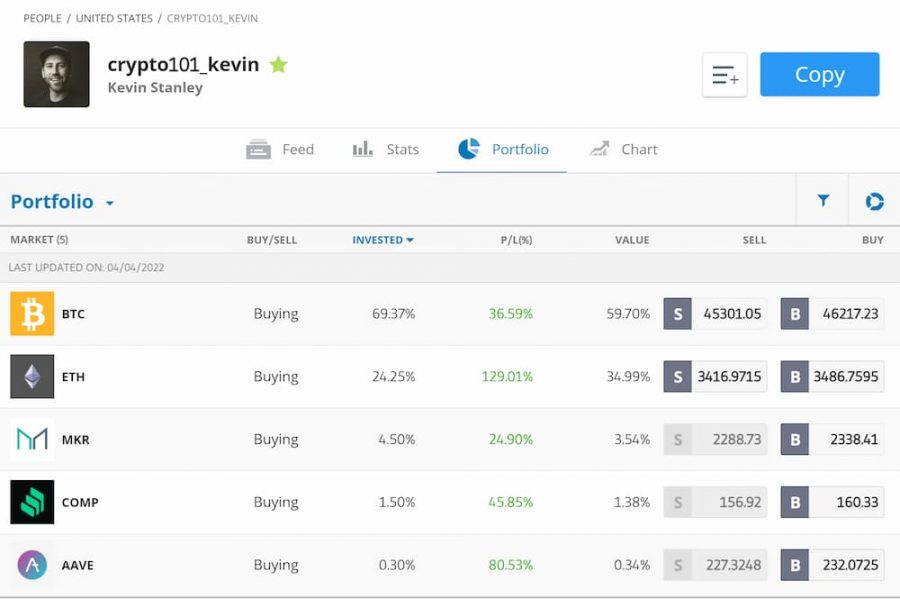

Social and Copy Trading

The features that most distinguish eToro from Coinbase and other crypto exchanges are its social and copy trading capabilities. eToro includes a built-in social network that enables traders to follow each other and start discussions. The platform allows you to comment on news or share ideas about specific cryptocurrencies, making it easy to see what other traders think about a coin’s prospects.

In addition, eToro collates all of the buying and selling activity on the platform into a simple sentiment indicator. For any cryptocurrency, you can see at a glance what percentage of eToro users are buying that coin vs the percentage who are selling it.

eToro also offers copy trading, a unique feature that enables users to mimic the positions of experienced crypto traders and investors. There are thousands of traders on eToro available to copy, and the platform displays their holdings and past performance to help you decide who to copy. Many traders focus specifically on cryptocurrencies, while you can also find long-term investors who build portfolios of the most promising new tokens.

When copying a trader on eToro, you get to decide how much money you want to commit to the copied portfolio. The minimum amount you can copy with is just $200. There are no fees for copying a portfolio on eToro and you can stop copying or switch to another trader at any time.

Cryptoassets are a highly volatile unregulated investment product.

Demo Accounts

Demo accounts are great educational tools for both beginners and experts alike. Otherwise referred to as a paper trading account, you can learn the ins and outs of cryptocurrency trading without risking any real capital. Moreover, you’ll have access to all supported financial instruments and markets in a simulated trading environment.

eToro offers a demo trading account with $100,000 in virtual currency to trade with. You can also request to reset the demo account at any time. A demo account offers access to all of eToro’s features, including copy trading.

On the other hand, Coinbase does not offer a demo trading account.

eToro vs Coinbase Payments & Minimum Deposit

eToro and Coinbase each accept a wide variety of payment methods. At eToro, you can fund your account with a Visa or Mastercard debit card or credit card, Neteller, Skrill, or a bank transfer. eToro is one of the best places to buy Bitcoin with a credit card.

At Coinbase, you can pay for an instant crypto purchase or fund your trading account with a debit card, bank transfer, Apple Pay, or Google Pay. Notably, you can also buy Bitcoin with PayPal at either exchange.

At eToro, the minimum deposit is $10 for most payment methods. A bank transfer requires a minimum deposit of $500. Credit, debit, and e-wallet deposits are available instantly, while bank transfers take 3-5 days to process. At Coinbase, the minimum deposit is $2 for all payment methods. All instant purchase payments are processed immediately.

There are no deposit fees at eToro, but the platform does charge a $5 withdrawal fee. Coinbase doesn’t technically charge deposit fees, but you’ll pay 1.49%-3.99% for an instant crypto purchase depending on the payment method you use.

| Brokers | eToro | Coinbase |

| Payment Methods | Debit card, credit card, PayPal, Neteller, Skrill, bank transfer | Debit card, PayPal, Apple Pay, Google Pay, bank transfer |

| Minimum Deposit | $10 ($500 for bank transfers) | $2 |

| Processing Time | Instant (3-5 days for bank transfers) | Instant |

Cryptoassets are a highly volatile unregulated investment product.

Customer Service

eToro and Coinbase both provide excellent customer support.

You can contact eToro’s customer support via its ticketing service. The customer service team will then respond via email. eToro’s website also has a detailed online knowledgebase with detailed articles about how to open an account, payments and fees, trading features, and more. eToro Academy offers a series of video tutorials that explains the basics of the crypto market and highlights popular cryptocurrencies.

Coinbase offers 24/7 phone, email, and live chat support. Getting in touch by phone is faster since you need to work through a chatbot before being connected with a representative by live chat. The Coinbase website has a detailed support centre to help you troubleshoot your account.

eToro vs Coinbase Regulation & Security

Both eToro and Coinbase are regulated crypto exchanges with strong track records when it comes to keeping clients’ funds secure.

eToro is regulated by the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). All client funds are kept in tier 1 banks and cash deposits are insured by the FDIC for up to $250,000. All data is encrypted and eToro supports 2-factor authentication to protect your account.

Coinbase is regulated in the US and holds licenses from 42 states as well as Puerto Rico and the District of Columbia. It also holds an e-money license from the UK’s FCA. Coinbase holds all client funds in US banks and cash deposits are FDIC insured for up to $250,000. Coinbase also says that all cryptocurrencies held by clients on its exchange are insured. The platform supports 2-factor authentication.

eToro vs Coinbase – Which is the best option for beginners?

eToro and Coinbase are among the most popular crypto exchanges in the US and both platforms have a lot to offer for crypto investors and traders. It’s hard to go wrong with either eToro or Coinbase.

Both eToro and Coinbase offer trading on a variety of cryptocurrencies. Coinbase is more suitable if you want to trade uncommon altcoins or stablecoins, while eToro offers all popular cryptocurrencies and is currently one of the few crypto exchanges in the US where you can buy Ripple.

- eToro stands out for first-time crypto investors for several reasons. First, it offers significantly lower fees and a simpler pricing structure than Coinbase. At eToro, you’ll pay just 1% per crypto purchase, whereas fees at Coinbase can run to 4% or more for buying crypto.

- Secondly, eToro offers more beginner-friendly trading tools. Navigating technical charts in eToro is easier than in Coinbase, and you can access all of eToro’s features through a single mobile app. eToro also offers clear-cut research and buy, sell, and hold ratings to help you hone in on trades.

- Finally, eToro offers a built-in social trading network and supports copy trading, while Coinbase does not. These features not only make trading crypto on eToro more enjoyable, but allow you to lean on the experience of other traders to gather information or even to automate your trades. At Coinbase, it’s up to you to do all of your trade research on your own.

eToro vs Coinbase – The Verdict

Overall, our eToro vs Coinbase comparison found that eToro is the better crypto exchange for the majority of traders. Coinbase is most suitable for experienced traders and for trading less common altcoins. For everything else – including low fees, user-friendly trading tools, and straightforward payments – eToro comes out on top.

Ready to start buying and selling cryptocurrencies with low fees in 2022? Follow the link below to open an eToro account today!

Cryptoassets are a highly volatile unregulated investment product.