Chunumunu/iStock via Getty Images

Quick Summary

HIVE Blockchain Technologies Ltd. (NASDAQ:HIVE) is different compared to many miners because it mines both Bitcoin and Ethereum, whereas most publicly traded miners only mine Bitcoin currently. The differentiation has created a different risk profile, which is even more complex due to the impending switch of Ethereum to proof-of-stake. Compared to the selected peer group, HIVE leads in many ways fiscally and has mixed results operationally.

Transition Away From Ethereum Proof-of-Work “POW”

The merge of the beacon chain and main net otherwise known as staking or proof of stake “POS” is currently slated to happen in June of this year, but if you’ve been following Ethereum you will know this is by no means a certainty. Roughly a third of HIVE’s revenue could be removed overnight once staking is implemented. HIVE has better fundamentals compared to competitors but would quickly deteriorate if a smooth transition away from Ether mining does not occur.

The Kiln testnet, which is the final testnet before the mainnnet merge, has been spun up. The Kiln testnet in essence is a dress rehearsal for the mainnet merger. The Kiln testnet had a client bug on the Prysm client offering bad blocks, but the issue has already been found and corrected. Overall the network was stable.

HIVE is significantly invested in Ethereum POW, once the mainnet merge occurs HIVE’s business will materially change. HIVE’s current forecast stops increasing its Ethereum mining operation March 2022.

HIVE’s Ethereum hash rate is currently 4.88 TH/s for the end of February, which is lower than the expected 5.4 TH/s stated in the FQ3 2021 investor’s presentation. The lower-than-expected hash rate is slightly concerning because losing out on 2 weeks~ of mining time is notable for the potential ~3 months of Ethereum proof-of-work.

Of course, if POS is pushed out it would be a big win for HIVE. Management as of the Q3 earnings call believes POW will last, and POS won’t occur. The issue is if POS occurs management may be wrong-footed.

Estimating Financial Impact of the Merge

Let’s assume for simplicity that HIVE’s entire GPU mining structure is made of RTX 3080s, which can generously produce 100 MH/s. Using that assumption HIVE has 48,800 RTX 3080s. New RTX 3080s retail for $1,100 to $1,550 USD depending on model.

Due to supply constraints GPUs are consistently going for higher prices than MSRP, even used sell for above MSRP. We’ll be generous and assume they have paid $1,100, resulting in 53.7m paid. Then assuming they have depreciated 50% (derived from average accumulated depreciation.), the carrying value is 26.5m. If HIVE decides to liquidate the GPUs at $550 the proposed carry value, over switching to a GPU-centric data centre the balance sheet would not take a severe write-down.

On the income statement, revenue will drop by roughly one-third if no replacement operations are done. If HIVE goes ahead with staking their held Ethereum mining will be partially offset.

HIVE mined 1,814 ETH in February, if able to mine at the same rate would be 23,646 ETH a year or 63.8m USD at $2,700 per ETH.

HIVE currently holds 27,218 Ethereum or USD 73.5m. The current staking rate for self-validating on the beacon chain is 5.4% APY, which will most likely drop once staking is the only option. Let’s be generous and assume HIVE can receive 5.4% APY, which would result in $4.0m in annual revenue. Right now the best of both worlds is happening because HIVE is still mining while being able to stake ETH on the beacon chain. Once POS occurs mining revenue is gone and staking APY will drop.

The revenue HIVE would receive from staking is a fraction of what could be obtained from mining, so it is no surprise management is bullish on POW. The problem is the merge is not in the hands of management, and they cannot afford to bury their heads in the sand when it comes to no more Ethereum mining. Even showing a meme of co-founder Vitalik Buterin (Age 28) in the investor presentation.

Old Man Vitalik (Hive Blockchain Q3 Presentation)

By no means is Ethereum staking guaranteed to happen in Q2, but Executive Chairman Frank Holmes stating “that it [staking] is not going to happen”, is short-sighted regardless of if you believe staking is good or not.

One of the arguments some people will use is they can just mine something else, but the problem is no other GPU mined coin has the same market size as Ethereum. Even at current prices, no other coin is consistently competitive with Ethereum in revenue/GPU. Additionally, many other miners will look to do the same which will lower the income more so.

The option which management has mentioned before is converting to ‘High-Performance Data Centers’ or HPC, which is branching out of cryptocurrencies. HIVE states the HPCs may be used for AI, rendering, or remote gaming. The idea has not been fleshed out, at least publicly. But competitor Hut 8 Mining (HUT) is deploying a similar plan, so by no means is it an unrealistic plan.

If HPC conversion is successful, the risk-reward structure of HIVE will change. HIVE will no longer be purely reliant on cryptocurrency which will lower the volatility of the company’s finances. The trade-off is HPCs are generally lower margins but more predictable income than Ethereum mining.

If HIVE is unable to convert to an HPC, HIVE will most likely be scrambling to replace the GPUs which are worthless for Bitcoin mining with ASICs compatible with Bitcoin. One of the main operational goals of mining operations is to time electrical capacity with mining arrival, if scrambling to find miners to fill excess capacity an operational failure has occurred.

In summary, I hope management follows the idiom, “hope for the best, but prepare for the worst”.

Intel ASICs

A common critic of Bitcoin miners is the reliance on Chinese manufacturing when functionally and ideologically Bitcoin was set out to be distributed.

Recently HIVE announced a supply agreement with US-based semiconductor manufacturer Intel (INTC) for their upcoming blockchain accelerators, and additionally a manufacturing agreement with an undisclosed original design manufacturer. Shipments should start in the second half of 2022, and continue for a year.

The Intel-based ASICs should provide roughly 1.8 Exahash/s, roughly 40k units. On the assumption of the ASICs arriving linearly, HIVE should achieve 3.9 Exahash/s by the end of 2022.

Diversifying the supply chain to include Intel is a great move. Lower reliance on Chinese-based manufacturers lowers geopolitical risk. The one thing investors should remember from the recent Russian invasion of Ukraine is, geopolitical risks cannot be overlooked.

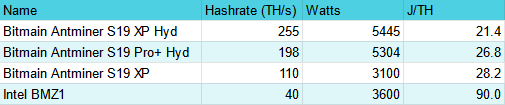

Compared to industry leader Bitmain, Intel’s solutions hold no weight.

Select Bitcoin Miners (asicminervalue)

Efficiency (J/TH) is extremely important to miners as electricity is the main variable cost. Intel falls behind Bitmain’s current offering S19 XP, and the discrepancy only gets worse when the S19 Pro+ Hyd. gets released in May, followed by the S19 XP Hyd. being released Q1 2023.

The upside for HIVE may occur in pricing, Bitmain is known for its price elasticity as demand increases. If Intel can offer a significantly cheaper upfront cost, the ASICs may be beneficial.

The other benefit is HIVE creating a relationship with Intel, which may be beneficial if Intel’s solutions are more competitive down the line.

In the same press release, a letter of intent for Compute North to host 100MW of mining capacity in Texas. If operating at capacity, the location would provide power for over 27k Intel BMZ1 or 1.11 Exahash/s, which is significantly lower than the ~1.8 Exahash/s. Since pre-ordered Intel exceeds the Compute North facility either more capacity will need to be purchased or more likely the use capacity currently under construction. As well in the HIVE press release, they expect 4.0 Exahash/s in the Compute North facility which means either an upgraded Intel miner or a different brand.

Not HODLing Ether

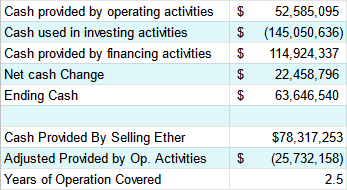

Cash flow management has been a point of differentiation among crypto miners. Some like Marathon Digital (MARA) have not sold any Bitcoin in over a year and elected for stock and debt issuance to fund operations. HIVE on the other hand has sold Ether and issued stock in the past year to fund operations.

However, HIVE announced the end of its at-the-market issuance on the TSX Venture Exchange, which sold 27,236,000 shares for USD 99.5m. The program had a cap of raising USD 100m, which was effectively met. The question is now will a similar equity program be initiated or will it rely on selling Ether.

Hive is holding 2,374 Bitcoin and 27,218 Ether. In 2021 HIVE held all of its Bitcoin opting to sell Ether to fund operations. In 2021, HIVE sold $78.3m worth of Ether, signalling management is more bullish on Bitcoin over Ethereum, at least at the time of sale.

Selected Cashflows (Author – HIVE)

If HIVE were to cease sales of mined Ethereum operating cash flow would be a loss of 25.7m, and HIVE would have the cash to cover current operations for 2.5 years. Meaning if HIVE wishes to ‘Hodl’ all crypto, cash would only be needed to be raised for CapEx for 2.5 years.

Bitcoin Equivalency

Miners like HIVE that mine multiple cryptocurrencies commonly use Bitcoin equivalency, this helps with comparison but problems also exist with this method.

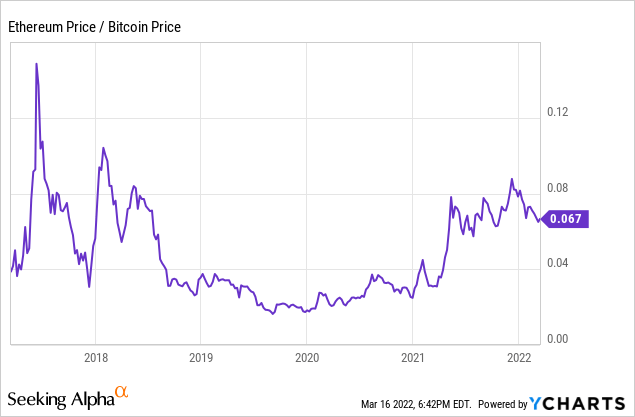

Using Ethereum as an example, price movements are the first major variable.

As seen above just converting Ethereum to Bitcoin based on price can dramatically change over time. If you were just converting holdings at a particular point in time equivalency works fine, but if you are forecasting equivalency of mined Ethereum the rate of exchange can dramatically change over time.

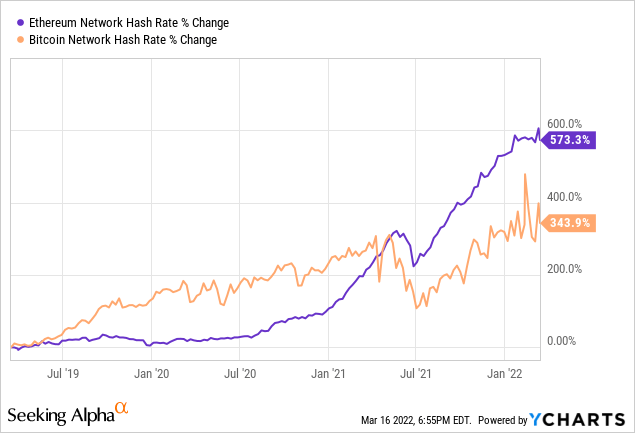

The next major risk relates to directly mining, network hash rate and block difficulty are extremely unpredictable.

Notice, over the three years the Ethereum network hash rate has grown ~6x versus Bitcoin’s ~3x. If you had grown both your hash rates by 3x, you would be receiving a similar rate of Bitcoin, while only receiving half of the Ethereum. The overall point is when a company like HIVE displays Bitcoin equivalent hash rates it may be true at the publication time but rapidly changes.

Due to the issues of equivalency, we will compare operations both with and without equivalency.

Operations Comparison

Using a peer group of HIVE, Hut 8 Mining (HUT), Bitfarms (BITF), Marathon Digital (MARA), and Riot Blockchain (RIOT).

HUT runs Ethereum mining operations but receives Bitcoin as payment at the prevailing market price, while BITF, MARA, and RIOT solely mine Bitcoin.

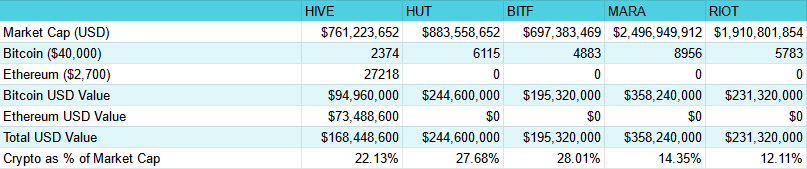

First, we will look at taking a quick look at cryptocurrency holdings

Cryptocurrency Holdings (Author – Using Data from Respective Companies)

HIVE holds significantly less Bitcoin than the peer group, but if Ethereum is included HIVE is middle of the group in terms of % of market cap. The reason why it is important to consider the market cap is that for every dollar you buy in the respective equities you will receive x% direct exposure to cryptocurrencies in HIVE’s case 23.11%. Another way of looking at it is x% of the company’s value is based on past operations or investment.

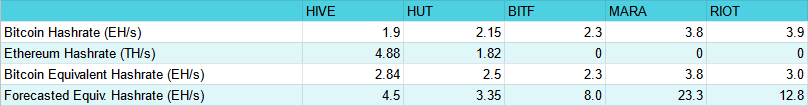

Next, let’s compare mining operations.

Cryptocurrency Hashrates (Author – Using Data from Respective Companies)

For comparison, it should be noted HUT’s forecast hash rate only extends to Q1 2022, whereas the others extend to the end of 2022, or into early 2023.

HIVE trails the pack in raw Bitcoin mining hash rate at 1.9 Exahash/s, while being middle of the pack for current Bitcoin Equivalent operations. If ignoring HUT’s public forecast due to ending in Q1, HIVE is last in the pack for forecast hash rate as well.

Hashrates per $B Market Cap (Author – Using Data from Respective Companies)

HIVE looks better once the market cap is taken into consideration, the higher the number the better. HIVE leads the pack in current operations when their Ethereum operations are included, but falls behind the pure Bitcoin miners in forecast values.

The key takeaway, HIVE’s Ether operation allows them to have better current operations but falls behind in forecast values.

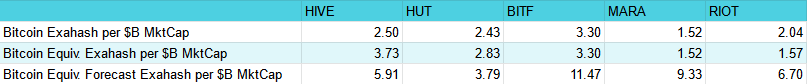

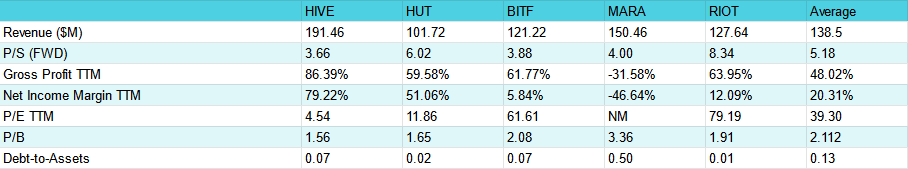

Financial Comparisons

Selected Financials (Seeking Alpha)

Selected data from Seeking Alpha

HIVE leads profitability metrics while having a strong balance sheet with minimal debt.

Highlighting revenue, HIVE despite being the second smallest market cap is the leader in revenue. The higher revenue is largely due to the increase in Ethereum price relative to Bitcoin. As well Ether mining is more profitable compared to Bitcoin mining per dollar of CapEx. Ultimately, HIVE benefited over the last year due to the exposure to Ethereum.

HIVE unlike MARA has taken on no significant debt, which leaves the possibility of acquiring debt without heightened risk if desired. A reason for issuing debt is if HIVE follows in HUTs footstep of acquiring at an HPC company.

The relatively low market cap and great profitability have led HIVE to be the leader in P/E.

Concluding

HIVE holds higher risk due to the Ether mining operations, but this has led to higher profitability over the last year. The downside of risk is coming in the next few months as the likelihood of Ethereum switching to POS has increased with the relatively successful Kiln testnet results. If in the unlikely case Ethereum stays POW for a long time HIVE is set up, but in the more likely case of switching HIVE loses a significant value proposition. The potential switch to HPC will flip the current relative risk profile to a lower risk profile compared to Bitcoin-only miners. If you are looking for the Ethereum differentiation and are willing to take on the risk of the POS changes HIVE is a great choice. On the other hand, if you want known operations HIVE is not for you.