The concept of interest is as old as time. Well not quite…

The first written evidence of compound interest dates roughly 2400 BC, where an annual interest rate of 20% helped fuel the development of agriculture and was important for urbanization.

The concept is simple – lending resources for a desired return which ideally leads to an overall increase in production. Early implementations of interest rates are also tied to a concept that acquired seeds and animals could reproduce themselves, which could justify charging interest.

In modern times, we have our most direct relationship with interest in form of the anemic amount that big banks offer us in our savings account…0.05%…

This, along with collapsing US 10yr treasury rates has led investors to seek other forms of “yield” out in the marketplace.

If you’re part of the online crypto community, there is now an incredibly exciting opportunity in the space called staking. It is the concept of “lending” out to certain parties in order to earn a rate of return.

Some of the percentages being earned are absolutely eye-popping. Which usually means that something is too good to be true. So we know this comes with risk…

Last week, we covered the revolution of the DeFi movement. This week we will first talk about the role of income in a portfolio, the broad lack of yield in the current economic environment, and then we will dive into an interesting “product feature” of the crypto space: staking.

This week, in <5 minutes, we’ll cover crypto staking:

-

Traditional Portfolio Mix ? 60/40, Alternative Assets

-

Historically Low Yields ? Migration of Capital outside of Fixed Income

-

Staking ? What it is, and who is involved

-

Examples in the market today ? Blowups & Grand Slams

-

Risks Associated With Staking ? No such thing as free lunch

Let’s get started!

1. Traditional Portfolio Mix ? 60/40, Alternative Assets

If you crack open any personal finance 101 book, you’ll typically find a suggestion that individual investors hold a mix of stocks and bonds. Stocks have the role of providing higher returns but for a price – higher risk (volatility). Bonds have the role of providing a coupon (interest payment) + any change in the price of the underlying and are seen as lower risk.

A combination of the two ideally dampens risk while providing upside, so it has historically been recommended that investors allocate 60% of their assets to equities and 40% to bonds in order to optimize risk and return.

Another common benchmark that you will see financial advisors use is the 100 – your age approach. If you are 20 years old, you will allocate 80% to equities and 20% to bonds. The idea here is that although stocks are more volatile, they have a better return profile over the long term. A 20-year-old will have a much longer time horizon, and therefore a larger willingness and ability to take on risks.

However, the main argument for bonds in this portfolio is that they will approximately hold their value and they will pay a steady, reasonable coupon which hasn’t quite been the case as of late.

2. Historically Low Yields ? Migration of Capital outside of Fixed Income

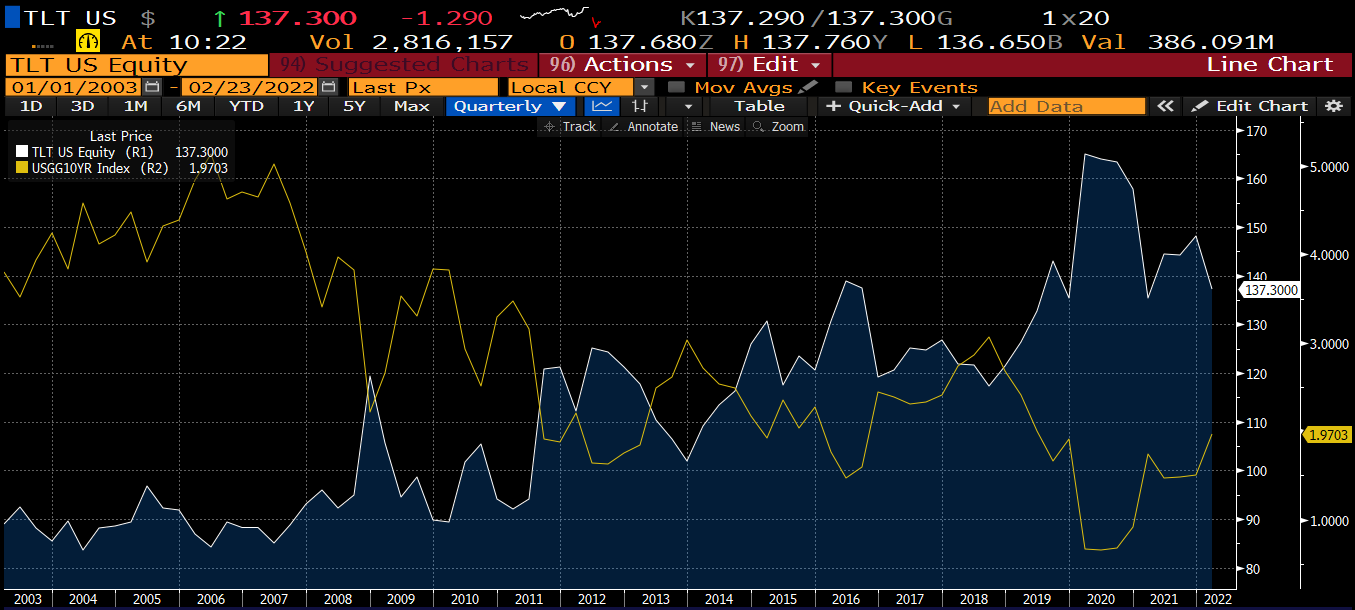

What we have seen instead is a steadily declining interest rate environment, so while bond prices have increased (white line), yields (yellow line) have decreased:

In a steady declining interest rate environment it has been more and more difficult for investors to find yield at a reasonable price anywhere in the market. If we zoom out even further on rates, we can see a better long-term trend in yields:

Every rate hiking cycle since the 80s has not quite gotten back to its high watermark, leading to low yields globally.

This has caused the value of negative-yielding bonds globally to drastically increase.

Which has in turn caused a flood of capital to seek yield elsewhere, hence the renaissance of “alternative assets” that you might see popping up across a lot of headlines.

And now we’re seeing a new form of yield being introduced on top of the new age of finance: Crypto Staking.

But first, let’s check in with our Outrageous Chartered FinMEME Analyst Dr. Patel!’

3. Staking ? What it is, and who is involved

Crypto staking is the process of “locking up” token holdings in order to earn interest. However, this is very different from how TradFi looks at interest.

As we discussed last week, the traditional big banks have what’s called a reserve ratio. They take deposits in, then don’t actually have to hold that amount on hand—they only have to hold some percentage of the total. They then go out and loan out the remainder to individuals, businesses, etc… and earn a spread on that interest. Essentially pricing out risk and stimulating the economy while earning a rate of return. Fair enough.

Staking is different. Staking is another way of validating transactions that take place on a blockchain. Staking has underlying utility in the overall infrastructure.

As we also reviewed in last week’s letter, there is an interesting migration taking place in the DeFi/Crypto community of Ether moving from the energy extensive “proof-of-work” (PoW) to the much more efficient “proof-of-stake” (PoS).

While both processes help networks achieve consensus when validating transactions and ownership on the network, proof of stake rewards investors who actively hold onto or lock up their crypto holdings in their wallets.

When investors lock up their crypto holdings in a wallet, the network can use those holdings to forge new blocks on the blockchain. The more crypto being staked, the better the odds are that your holdings will be selected for validation.

Information is written into the new block, and the investor’s holdings are used to validate it. Since coins already have “baked in” data from the blockchain, they can be used as validators. Then, for allowing those holdings to be used as validators, the network rewards the staker.

Getting paid to have your crypto sitting in a wallet.

Very familiar concept, but very nuanced application: utility in verifying blocks, rather than the bank turning around to then go lend the maximum amount allowed by the reserve ratio out for a higher rate.

4. Examples in the market today ? Top Staking Tokens

All staking tokens have a lot of intricacies behind them when it comes to validators, utility on the chain, lockup periods, yields, etc… There are certain ones that are worth doing a much deeper dive into. The top staking tokens by market cap are as follows:

Ethereum

Previously employed a PoW system, Ethereum is now moving to PoS. To stake Ethereum on your own, you’ll need a minimum of 32 ETH (~USD$82,000) to become a validator, and you’ll then “be responsible for storing data, processing transactions, and adding new blocks to the blockchain,” according to the Ethereum site.

Solana

Solana, or SOL, can likewise be staked or delegated to a staking pool, assuming an investor uses a digital wallet that supports it. From there, it’s a matter of selecting a validator and deciding how much you’d like to stake.

Cardano

Investors can also delegate Ada—the Cardano network’s cryptocurrency —to staking pools to earn rewards. Cardano users can even set up their own staking pools, too, assuming they have the technical know-how to create and administer one.

Polkadot

Polkadot uses NPoS (Nominated Proof-of-Stake) as its consensus mechanism. The system encourages DOT holders to participate as nominators. Nominators may back up to 16 validators as trusted validator candidates. Both validators and nominators lock their tokens as collateral and receive staking rewards.

5. Risks Associated With Staking ? No such thing as free lunch

Every crypto guru on TikTok also happens to be obsessed with “passive income.” But the buyer HAS TO BEWARE here because passive does not mean risk-free. The concept of passive income as it relates to crypto can be incredibly enticing – earn yield while you wait. But as we’ve seen with project blow-ups, this is not always the case.

The largest risk is the market risk when it comes to staking. For example, if you are earning a 15% APY for staking an asset but the underlying drops 50% in value through the year, you will incur that loss.

This is directly affected by the lockup period. In order to lend out cryptocurrency, the particular network’s protocol locks up the investor’s holdings for a period of time. Since we know crypto is volatile, the exposure to the hold period is a serious and significant risk in the event of a sharp selloff of the underlying.

There is also liquidity risk attached to staking a microcap altcoin that barely has any liquidity on exchanges. It will be difficult to sell the asset or convert the staking returns into bitcoin or stablecoins.

Another risk is validator risk. Running a validator node to stake a cryptocurrency involves technical know-how to ensure that there are no disruptions in the staking process. Nodes need to have 100% uptime to ensure that they maximize staking returns.

If a validator node (mistakenly) misbehaves, you could incur penalties that will affect your overall staking returns. In the worst-case scenario, validators could even have their stake “slashed,” at which point a share of the staked tokens would be lost.

To mitigate the risks that come with staking using your own validator node, you could use a provider such as Trust Wallet to delegate your stake to a third-party validator.

And finally, there is always the risk of loss and theft which as we’ve seen of late is very real.

Wrapping Up…

In a new financial global world order, there are going to be new applications for what we consider to be “money”. The aspect of programmability is absolutely fascinating to me but it definitely comes with valid risks in the system. We’ve seen so many successful fishing (OpenSea recently) and even social engineering hacks where people can get entirely wiped out.

There is also a false sense of security in certain aspects of this system. Should I have to plug in a physical hard drive and store my NFT pictures of animals on a stick? Is this any different than hiding cash in my mattress?

An important distinction to make while looking at these advances will be how much are things really changing. The concepts of DeFi do look awfully similar to TradFi right now, but just like any piece of technology, we will see drastic improvements through the iteration of new and exciting products and procedures.

Until next time. Always Yours. Incessantly Chasing ROI,

-Genevieve Roch-Decter, CFA

P.S. With the crypto market pulling back over 40% after reaching a new record of nearly $3 TRILLION in 2021, we believe NOW is the BEST time to go hunting for opportunities in the alt-coin market!