Images we create and what actually happens are always beautiful when we have imagination./iStock Editorial via Getty Images

Investment Thesis

Despite high volatility and increasing competition in the crypto exchange space, Coinbase (NASDAQ:COIN) presents an exceptionally good opportunity to get exposure to the crypto ecosystem with its strong balance sheet and ongoing strategy to diversify its revenue stream. My FCF valuation model indicates 80% undervaluation at a current market price of $200, so I maintain a strong buy view on this stock.

Coinbase Business Model

Coinbase was founded in June 2012 and went public on April 14, 2021. It is the first and so far, the only publicly listed crypto exchange. From its inception COIN took a slightly different trajectory than its competitors. As a US-based VC-backed venture it took the more gradual path and has always tried to have a good relationship with regulators and lawmakers. This characteristic gives it an edge when dealing with institutional clients.

Coinbase’s business model is similar to derivatives exchanges where the main revenue stream is transaction fees. Coinbase transaction revenue accounts to 88% with the rest coming from the subscription and services. The main contributor to the latter is staking ETH2 (7% of total revenue).

Its inflection point happened in 2017 during the first strongest wave of cryptomania with bitcoin surging from sub-$1,000 price levels to $20,000. At that time COIN was signing around 50k new customers a day and its revenue jumped from $16m in 2016 to nearly one billion in 2017. As bitcoin hype subsided, so did Coinbase revenues to approx. $500m in each 2018 and 2019.

Coinbase generated $5.3bn in revenue for the first three quarters in 2021. By the end of Q3-21, they had 73m verified users and $255bn crypto assets held.

In addition to traditional crypto trading, they offer Coinbase Cloud (acquired Bison Trails), Coinbase Wallet, crypto custody services, and a prime professional platform for institutional clients. At the end of last year, they announced that they are planning to enter the NFT space by offering a common NFT marketplace platform that should ease dealings with this product.

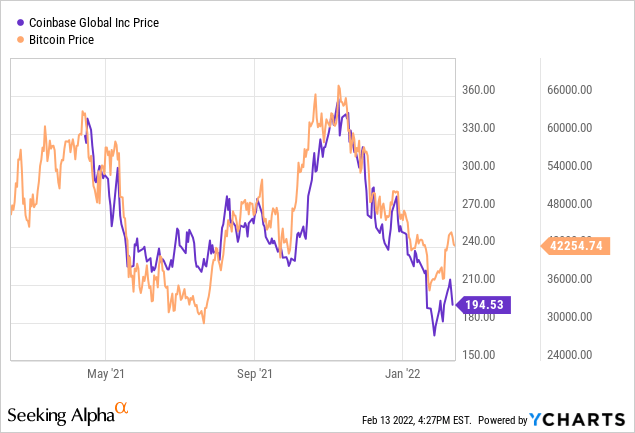

Coinbase’s correlation with bitcoin

Coinbase and Bitcoin (BTC-USD) expose a strong positive correlation as is seen from the chart below.

Normally stock exchanges’ stock prices are not so correlated with the price of any particular asset and instead are correlated with the market volatility but considering that bitcoin remains a dominating asset on the platform it partly explains this phenomenon. As bitcoin dominance has started to diminish over the last year or so, we should see some reduction in correlation and volatility over time if this trend continues.

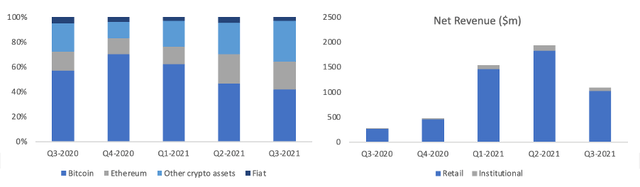

Coinbase Revenue Breakdown (Author’s presentation based on Coinbase Q3 Shareholders letter)

Source: Coinbase Q3 Shareholders letter, Author’s presentation

Another reason for the high correlation is the higher involvement of retail investors. Institutional investors are more committed to their investments while retail traders are more interested in trending assets and as soon as the price of bitcoin or any other altcoin for that matter falls there is a substantial reduction in bitcoin trading activity with the reduction of trading revenue as a result. Despite Coinbase growing its institutional client base over the last year, they still generate around 93% of its revenue from the retail segment.

TAM and Industry Growth

Cryptocurrencies and blockchain applications continue to grow in popularity and they have already surpassed their experimental stage and are starting to capture more interest from all sorts of market players. In January 2020 there were approximately 10,000 active developers working on cryptocurrency platforms, right now there are more than 18,000 and the number is growing.

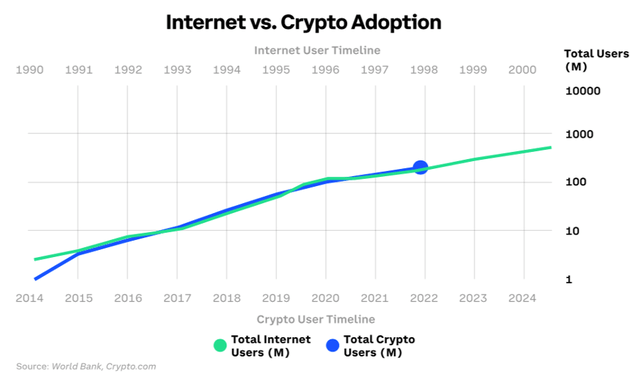

As this market is still in its infancy (bitcoin has only come into existence in 2009) we are probably going to observe several years or might be even a decade of remarkably high growth of adoption of blockchain technology. If the internet adoption could serve as some sort of guidance here, then the crypto adoption by the number of users is currently at the stage where the internet was in the late 90s.

Internet vs. Crypto Adoption (Coinbase Q3-21 Shareholders letter)

Source: Coinbase Q3 Shareholders letter

As of 4th February 2022, the total cryptocurrencies market cap was approx. $1.7 trillion with bitcoin accounting for slightly more than a half ($850bn). As cryptocurrencies prices are extremely volatile, it is impossible to forecast the size in the short term, but neither we need it for the FCF model as normally an average estimate for the next 5-10 years is used.

It is highly likely that in the mid to long term crypto market size would grow considerably. The main catalyst for that is that crypto is very well positioned to capture a share of several addressable target markets. Some of these include reserve currencies, offshore accounts of private wealth, gold, and online payments that account for $12 trillion, $32 trillion, $7 trillion, and $4.4 trillion respectively. For instance, the Satis group forecasts the major application of crypto in offshore accounts with a penetration rate of more than 90% within the next decade. It makes total sense considering the anonymity feature of bitcoin and other cryptos.

The other segments such as stocks, bonds, and derivatives exchanges are representing even higher opportunities with stock markets alone accounting for $94 trillion.

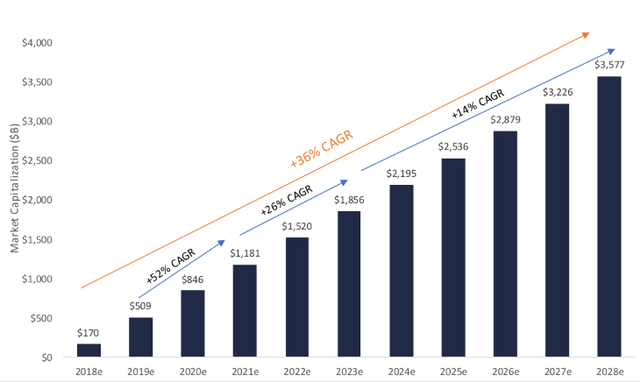

Satis Group estimates the total cryptoasset market size to be $3.6 trillion by 2028.

Cryptomarket size projections (Satis Research)

Source: Satis Research

We cannot attribute all crypto market size to the TAM of cryptocurrency exchanges, but it still can serve as an indication. According to the 2021 Global Crypto User Index data, around 60% of crypto market participants prefer to trade via crypto exchange and I assume this share might grow in the future as more amateur participants are entering the market. In addition, Coinbase is trying to diversify its revenue stream by offering subscription, custody, and other services in the crypto ecosystem, which will allow it to capture the other parts of the market as well.

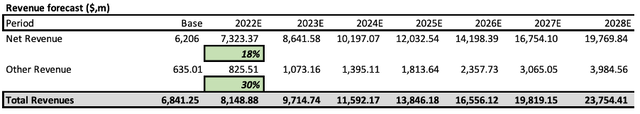

The projections of TAM directly impact revenue projections in the FCF model. I assume revenues from trading fees to grow in line with the crypto market, i.e. at a CAGR of 18% whereas other revenues at a pace of approx. 30%. By the end of 2028, the other revenue share will increase to 16% from the current 9%. In my opinion, these projections are very conservative.

Coinbase Revenue Projections (Author’s calculations)

Competition and Peer Comparison

The top-line projection is based on the assumption that the market share of Coinbase will remain constant, but as it operates in a highly competitive industry this will only be possible if it continues to invest heavily in technology and security against cyber threats. It directly impacts R&D costs, so my projection is that these will grow to 20% of sales from the current 16%.

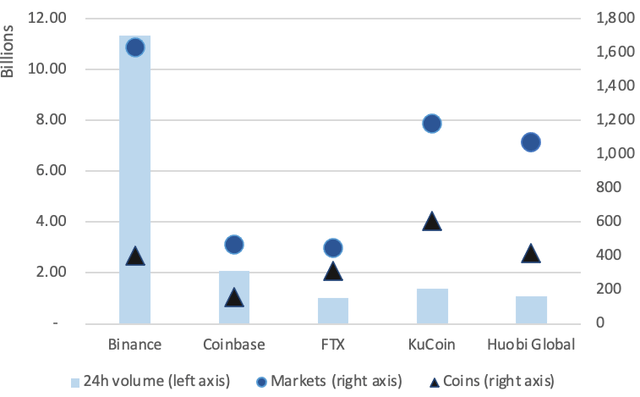

The CoinMarketCap currently lists 457 crypto exchanges with the total 24h trading volume of $58.1bn as of 6th February 2022. As you can see from the chart below Binance is the dominating crypto exchange in this field by the trading volume. Coinbase normally is in the top five by 24h trading volume and weekly visits.

Top-five Crypto Exchanges by volume, markets, coins (CoinMarketCap data as of 6th February 2022)

Binance is offering much more altcoins and much lower trading fees than Coinbase. It is, however, currently banned in the US. There is a Biance.US exchange, but it is very limited. Binance’s revenue has increased almost fourfold in 2021 to $20bn from $5.5bn in 2020. Coinbase revenue growth rate was even more impressive (460%), but in absolute terms, its revenue was approx. $6.8bn[1] in 2021.

It is a bit tricky to compare Coinbase financials with its direct competitors such as Binance or FTX due to a lack of reliable data as neither of the other crypto exchanges are listed. Using some of the conventional derivatives exchanges, such as CME Group (NASDAQ:CME) and ICE (NYSE:ICE) as a peer group, we can see that Coinbase has more attractive comp measures.

Its enterprise multiple (EV/EBITDA) is by no means cheap at 13x, but stands out in comparison to the peer group average of 24x. COIN also outperforms by its EPS of $11.8 which is twice higher than the conventional exchange’s average of $6.1. COIN P/E 19 is also attractive vs. peers’ average P/E of 29. Naturally, I expect its ratios to be slightly lower as Coinbase has a very high beta than more traditional and matured businesses such as CME or ICE, so it offers a higher premium.

Financials

For the first three quarters of 2021, Coinbase recorded $5.3bn in revenues and $2.2bn in operating profit, producing an operating margin of 40%. The company has recorded a tax benefit in 2021, so its net income was higher, standing at $2.8bn. COIN has a strong balance sheet with $6.4bn in cash, which partly consists of $3.4bn in long-term debt they issued in 2021. Its market cap is approx. $50bn and it currently trades at 13x EV/EBITDA.

After analysing bitcoin and altcoins volume in Q4 I think we will see some improvement from the last quarter as the trading volume increased somewhat, but it still will be far from the record volumes seen in the first two quarters. I project revenues in the range of $1.5-$1.6bn with total annual revenue of around $6.8bn. COIN is due to report Q4 earnings on the 24th of February.

Valuation

To estimate the value of the business I’ve used the FCF model based on the forecast of cash flows seven years out. My revenue projections have already been outlined earlier and I assumed its gross and profit margins to be on average 85% and 50% respectively.

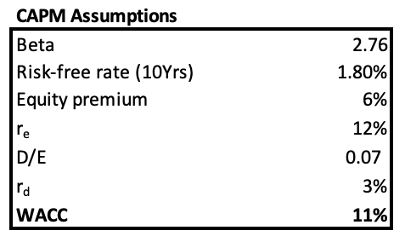

I have used the WACC model to estimate the discounting rate. As you can see from the table below due to high beta, the CAPM rate is quite high, at 12%. The company has borrowed $3.4bn in 2021 in a form of senior notes at approx. 3% coupon so I have used it to calculate the debt portion of WACC, but due to the debt portion in capital structure is insignificant the WACC rate came up quite high at 11%.

FCF model CAPM assumptions (Author’s calculations)

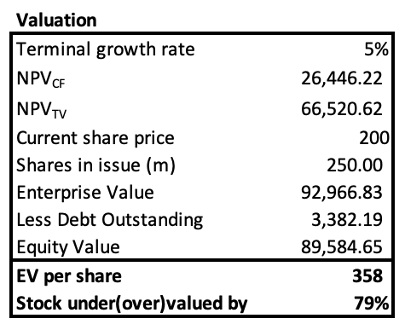

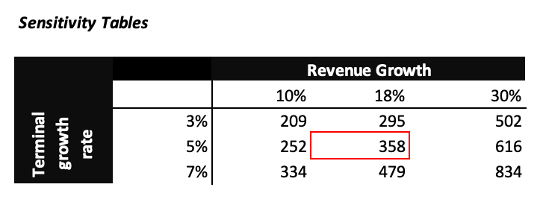

Using a terminal growth rate of 5%, which I believe is conservative considering some matured businesses continue to grow at a much higher rate (ICE at average 20%, CME at average 5% for the last ten years), the target price comes up at $358, representing 80% undervaluation at the current price of $200.

FCF Valuation Coinbase (Author’s Calculation)

I understand that some may find these projections quite optimistic due to the uncertainty surrounding the future development of cryptocurrencies, so here is a sensitivity table based on more bearish and bullish outcomes.

Target price sensitivity table (Author’s calculations)

Risks

I see three main risks to cryptocurrency exchanges such as Coinbase – high correlation with bitcoin, regulation, and cybersecurity threats. As I have already covered the correlation topic in the previous section, I am going to focus on the other two points.

According to Binance Research, the main concern and defining factor when choosing the crypto exchange is security. The biggest incident Coinbase has had so far happened in Q2 last year when at least six thousand Coinbase customers had funds removed from their account as a result of a cyber-attack. One reason hackers succeed was due to a flaw in Coinbase’s SMS Account recovery process. Obviously, the more incidents of such nature are going to happen the fewer customers will be attracted to this platform. This risk, however, prevails when using any trading platform. In general, Coinbase is considered to be a safe platform as it offers security layers such as 2FA, time-based one-time password and a hardware security key.

With regards to the crypto regulation topic, while it has been on the radar of US lawmakers and regulators for some time now it is still up in the air. We don’t know exactly the extent to which it will be implemented, but that it will come in some form is a certainty. Some of possibilities are that the definition of brokerage business would be expanded to include crypto trading platforms which will increase tax reporting responsibility to help IRS catch tax evasion. For Coinbase it means higher expenses and lower profit margins.

Conclusion

Coinbase is the only publicly listed crypto exchange with a strong balance sheet and high prospects for growth. Its TAM is expected to grow at a CAGR of 18% for the next decade but considering bitcoin and other altcoins can capture a market share of other financial assets such as gold and stocks, the much higher growth over many years to come is quite likely.

Although it is currently undervalued by 80% according to my FCF model and I maintain a strong buy view on this stock, I think it should not be looked as a short-term play due to its high volatility and correlation with its dominating asset bitcoin. Moreover, if one is maintaining a balanced portfolio and currently holds bitcoin in it, I’d take this correlation into account to make sure portfolio risk is not too skewed towards crypto. As the company continues to diversify its revenue stream and increases its institutional client base its volatility will likely subside, but highly unlikely it will continue to trade at such attractive levels. As always one faces a trade-off between high risk and high reward.

[1] Author’s projections