A popular crypto strategist and trader is mapping out the levels where Polkadot, The Sandbox and three other low-cap altcoins could bounce and potentially carve out bottoms.

The crypto analyst known in the industry as Altcoin Sherpa tells his 152,600 Twitter followers that interoperable blockchain Polkadot (DOT) might see an influx of demand once it taps the 200-day exponential moving average (EMA), which is currently hovering at $32.

“DOT: More consolidation expected at the $30-$40 range. 200-day EMA should be support here.”

Next up is blockchain-based gaming ecosystem The Sandbox (SAND). According to Altcoin Sherpa, he’s looking for SAND entries around $5.

“Probably one to buy the dip on. The strongest coins get bought back up the fastest.”

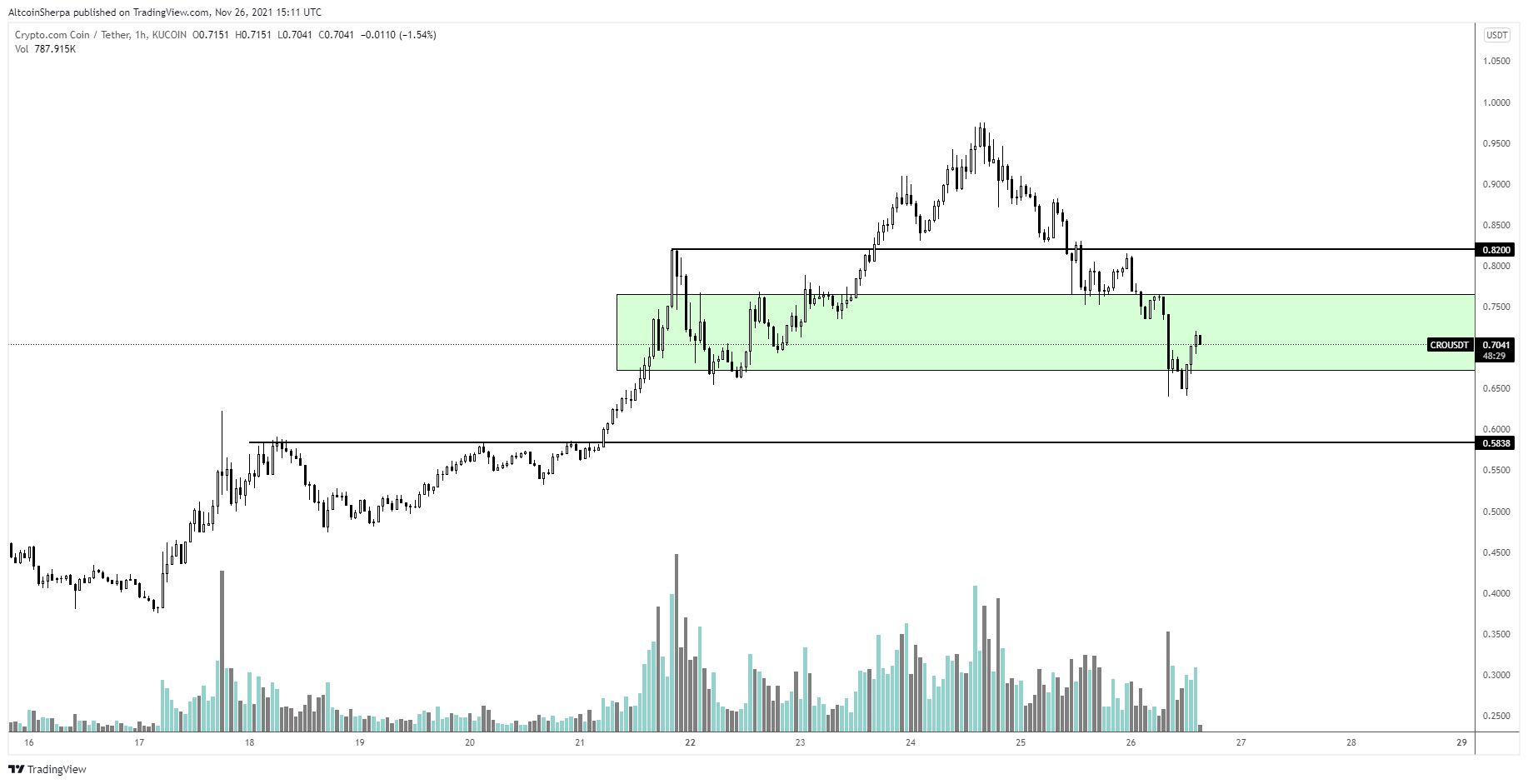

The third altcoin is CRO, the cryptocurrency that powers the Crypto.com payment, trading and financial services platform. According to Altcoin Sherpa, a low timeframe support might provide some relief for CRO.

“CRO: patiently waiting for $0.60.”

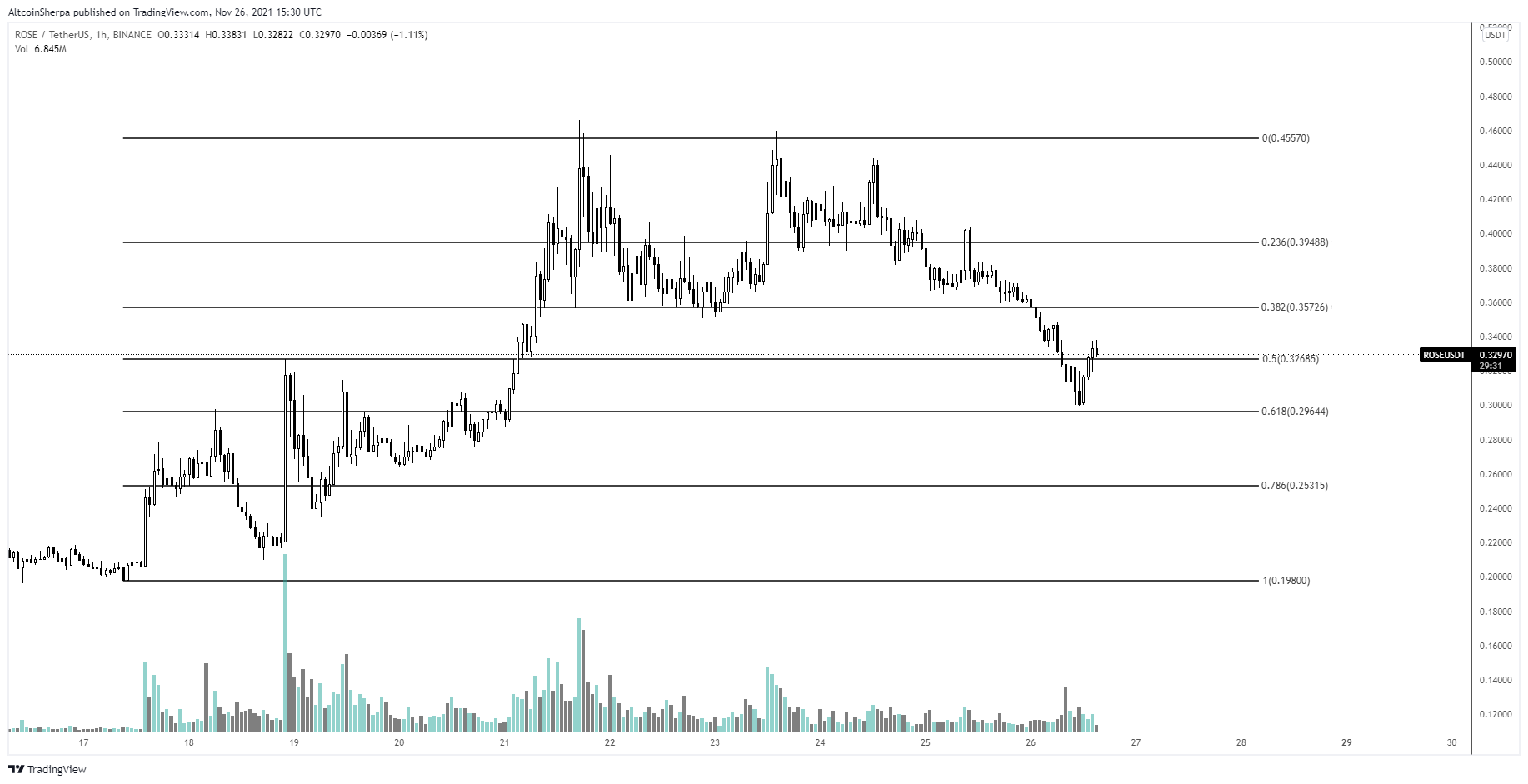

Another coin on the trader’s list is Oasis Network (ROSE), a smart contract platform that prioritizes privacy for open finance. The crypto analyst says he’s expecting ROSE to carve out a bottom around $0.29.

“Good first reaction to the 0.618 [Fibonacci level]. It’s likely this makes a lower high if it continues up strongly. I would rather see this consolidate for a bit at 0.618 and then form a solid bottom for continuation.“

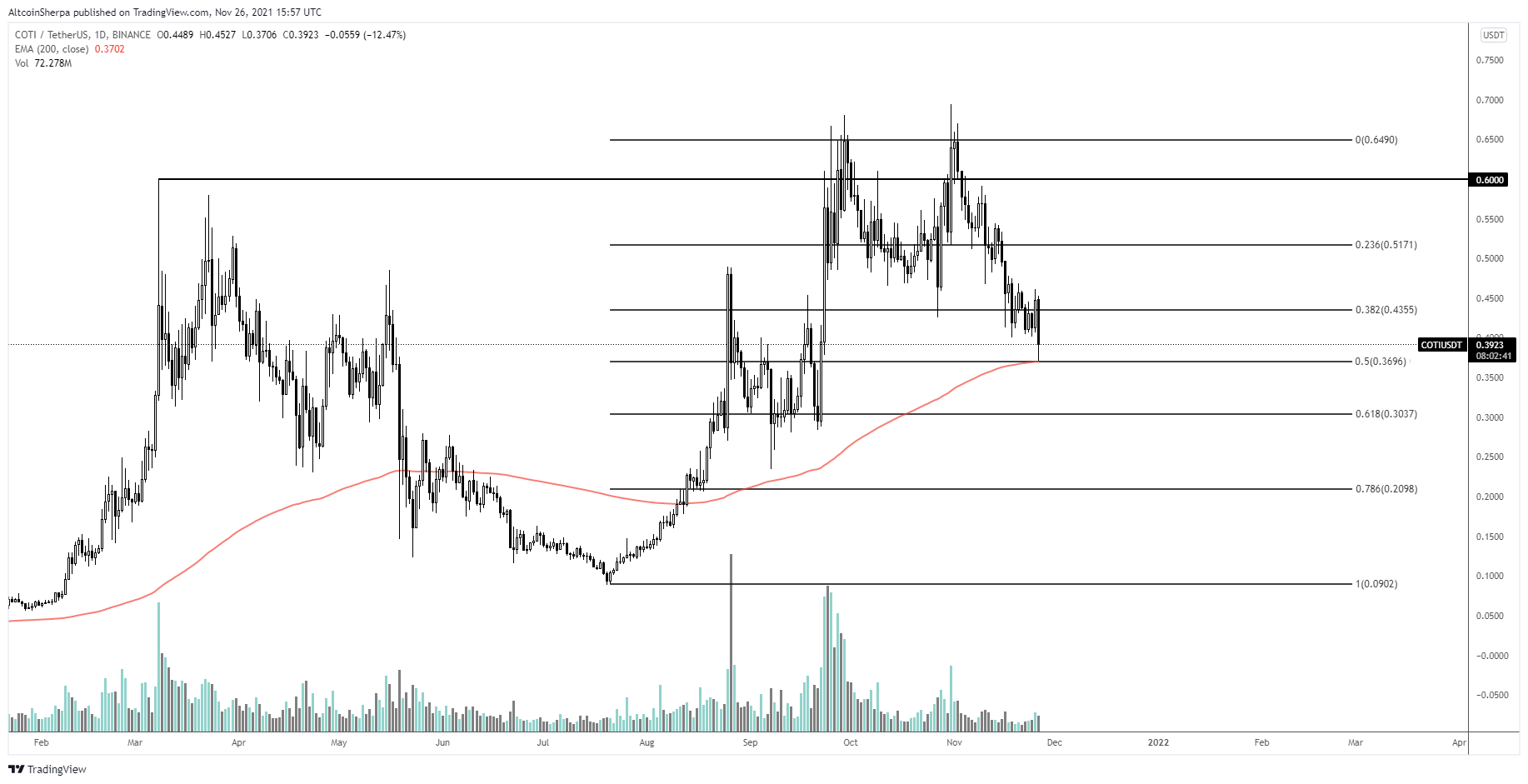

The last coin on Altcoin Sherpa’s radar is payments infrastructure platform COTI. The crypto analyst says that COTI is currently respecting the 200-day EMA as support ($0.37) but adds that a new sell-off event can push the token down to $0.30.

“First good tap of the 200-day EMA. I think that this one will find a short-term bottom around here. More support at the 0.618 [Fibonacci level] though.”

Check Price Action

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Joshua Aucoin/stockphoto-graf