“I have zero interest in investing in litigation against the SEC, that is a very bad idea”.

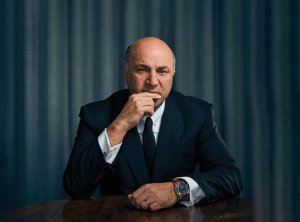

Kevin O’Leary, the celebrity investor known for his leading role on the TV show “Shark Tank” said he’d consult with the SEC rather than invest in litigation.

The billionaire investor, who has recently become a spokesperson for cryptocurrency exchange FTX, indirectly called Ripple a “crypto cowboy”.

“I have no interest in being a crypto cowboy and getting anybody unhappy with me because … I have so many assets in the real world that I’ve invested in already that I have to be compliant”.

Rather than being a “crypto cowboy”, O’Leary would consult with regulators in order to see “what is possible and what isn’t” and choosing litigation instead of a quick settlement seems to be unthinkable for him.

“I have zero interest in investing in litigation against the SEC, that is a very bad idea”.

The U.S. Securities and Exchange Commission filed a complaint against Ripple in December 2020 alleging the blockchain company and its executives sold $1.3 billion worth of XRP in an unregistered securities offering.

One of the key points in the lawsuit is whether XRP can be considered a security. The Howie test says that an investment contract (security) exists when these four conditions are met: investment of money in a common enterprise with the expectation of profit to be derived from the effort of others.

A recent research report by JP Morgan said if the Judge determines that one or multiple points are not met, Ripple will win the suit and if that happens “and trading resumes on major cryptocurrency exchanges like Coinbase, XRP is poised for significant adoption”.

The investment bank will host its J.P. Morgan Crypto Economy Forum on November 30 and Coinbase CEO Brian Armstrong and Lead Independent Director Fred Wilson will participate in the fireside chat.

While Ripple’s defense argued throughout the lawsuit that XRP has utility rather than being a security, SEC Commissioner Hester Peirce explained in June what is the SEC’s intention when filing a complaint against a firm for an unregistered securities offering.

“When we think about a cryptoasset as being a security what we’re doing is we’re saying it’s being sold as part of an investment contract. It doesn’t mean that the asset itself necessarily has to be a security. It means that it was being sold as a security.”

The Commissioner also known as “Crypto Mom”, like other SEC officials, cannot discuss publicly about the ongoing lawsuit, but her words show that, for the SEC, the lawsuit is not about the nature of XRP but about how the digital asset was marketed and sold.

On that, Judge Sarah Netburn has recently ordered Ripple to deliver more recordings of its meetings. The SEC will be looking for whether the individual defendants and Ripple executives talk about XRP more like a share of stock rather than a digital token. This would strengthen the SEC’s case.

On the other hand, the Judge ordered the explain a lot via RFAs on many fronts, from XRP sales offshore to questions relating to the fair notice defense and whether the XRP ledger was “fully functional” when the sales took place in 2013. The Hogan attorneys offered their analysis on this major win for Ripple.

Ripple argues that XRP ledger was fully functional when the sales took place in 2013, which would they weren’t part of an investment contract under the Howie test.

The defendants are also invested in the fair notice defense, claiming that the SEC failed to let them know in due time that what Ripple and its executives were doing could be construed as an unregistered securities offering.

A summary judgment on the fair notice defense could create a precedent that would likely weaken the SEC‘c practice of regulation by enforcement in the digital asset space. For now, the lawsuit is in the middle of the expert discovery.