In 2021, blockchain and cryptocurrencies continue to be a hot field for banks to be in as they look to capitalize on the emerging asset class. According to new data from Blockdata, a CB Insights company, out of the world’s top 100 banks by assets under management (AuM), 55 have invested in crypto and blockchain companies either directly or through subsidiaries.

With 22 investments into blockchain and crypto companies, Barclays takes the lead and is currently the most active investor in the space, the research found. Barclays has invested in companies such as Everledger, a startup that leverages blockchain and the Internet-of-Things (IoT) to offer supply chain transparency, and R3, a provider of enterprise technology and services and the developer of open source distributed ledger technology (DLT) project Corda.

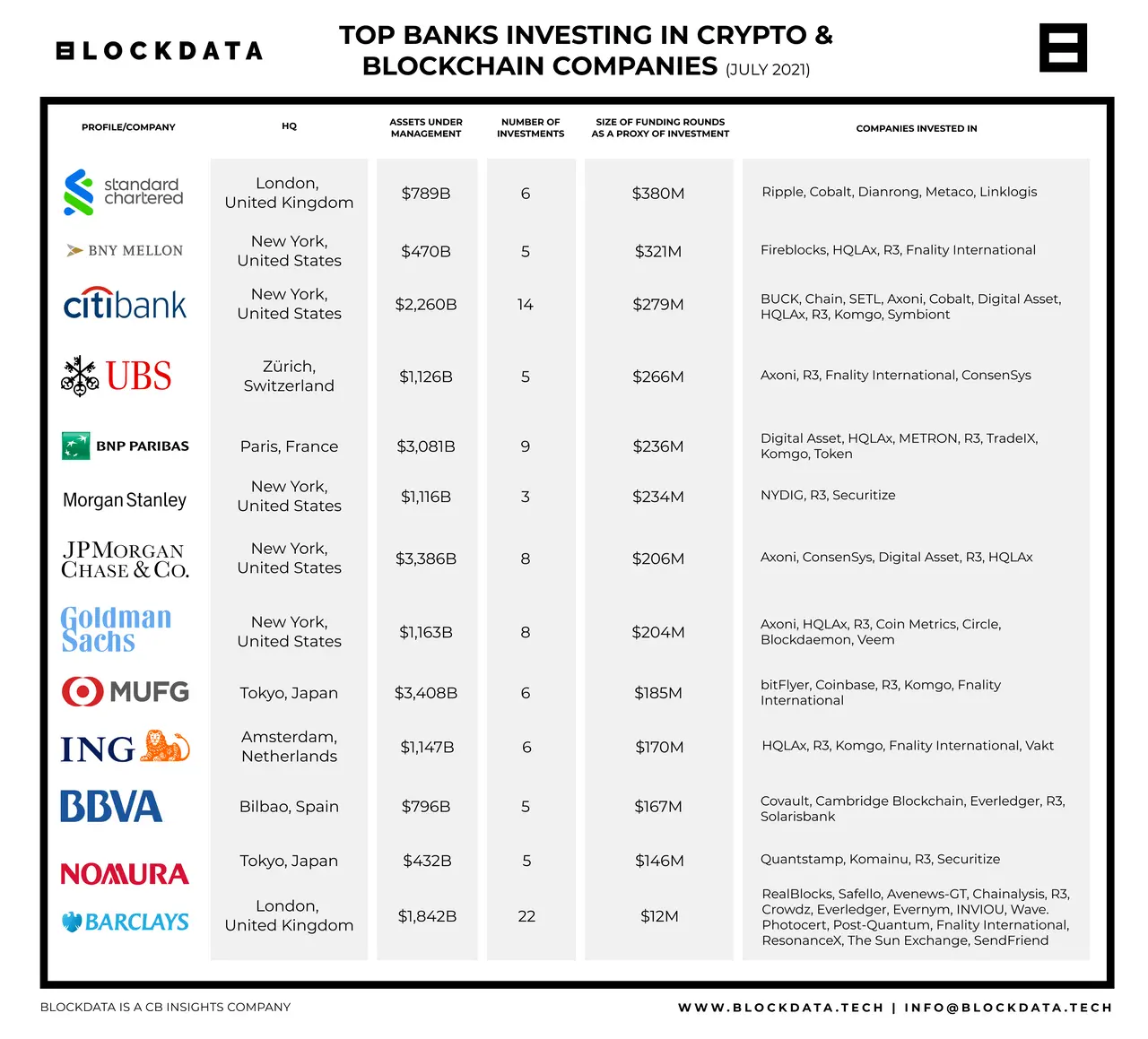

Blarclays is followed by Citibank with 14 investments (e.g. Chain, Digital Asset and Komgo), BNP Paribas with nine (e.g. METRON, TradeIX and Token), and JPMorgan Chase & Co. (e.g. ConsenSys and Axoni) and Goldman Sachs (e.g. Coin Metrics, Circle and Veem), both with eight.

Since funding rounds count numerous investors, it’s not possible to determine how much investment these banks have each committed in total. As a proxy of this, Blockdata looked at valuations of the rounds they participated in to get a sense of which financial institutions are betting big on the space, and ranked them accordingly.

Based on this, Standard Chartered was found to be the most active investor in the biggest funding rounds (US$380 million in six funding rounds). Standard Chartered has invested in the likes of Ripple, a blockchain-based digital payment network and protocol, Dianrong, the provider of a supply chain finance for small businesses, and Metaco, a Swiss digital asset custody startup.

Standard Chartered is followed by BNY Mellon (US$321 million in five funding rounds), and Citibank (US$279 million in 14 funding rounds).

Top Banks Investing in Crypto and Blockchain Companies (July 2021), Source: Blockdata.tech, August 2021

Focus on crypto custody

A deeper look into investment trends shows that banks are actively investing in crypto custody. Crypto custody solutions are third-party providers of storage and security services for digital assets. Their services are mainly aimed at institutional investors such as hedge funds who hold large amount of bitcoin, ether and other cryptocurrencies.

Booming interest in custody services comes on the back of rising demand from investors for exposure to the new asset class.

In Switzerland, blockchain-focused early stage venture capital (VC) investor CV VC deemed 2021 as “the tipping point” for acceptance of cryptocurrencies and digital assets, noting in its latest industry report that over 14 private, retail and online banks were active in the digital asset space. Interviews with senior executives from the Swiss financial sector revealed that more digital asset offerings were planned to hit the market later this year.

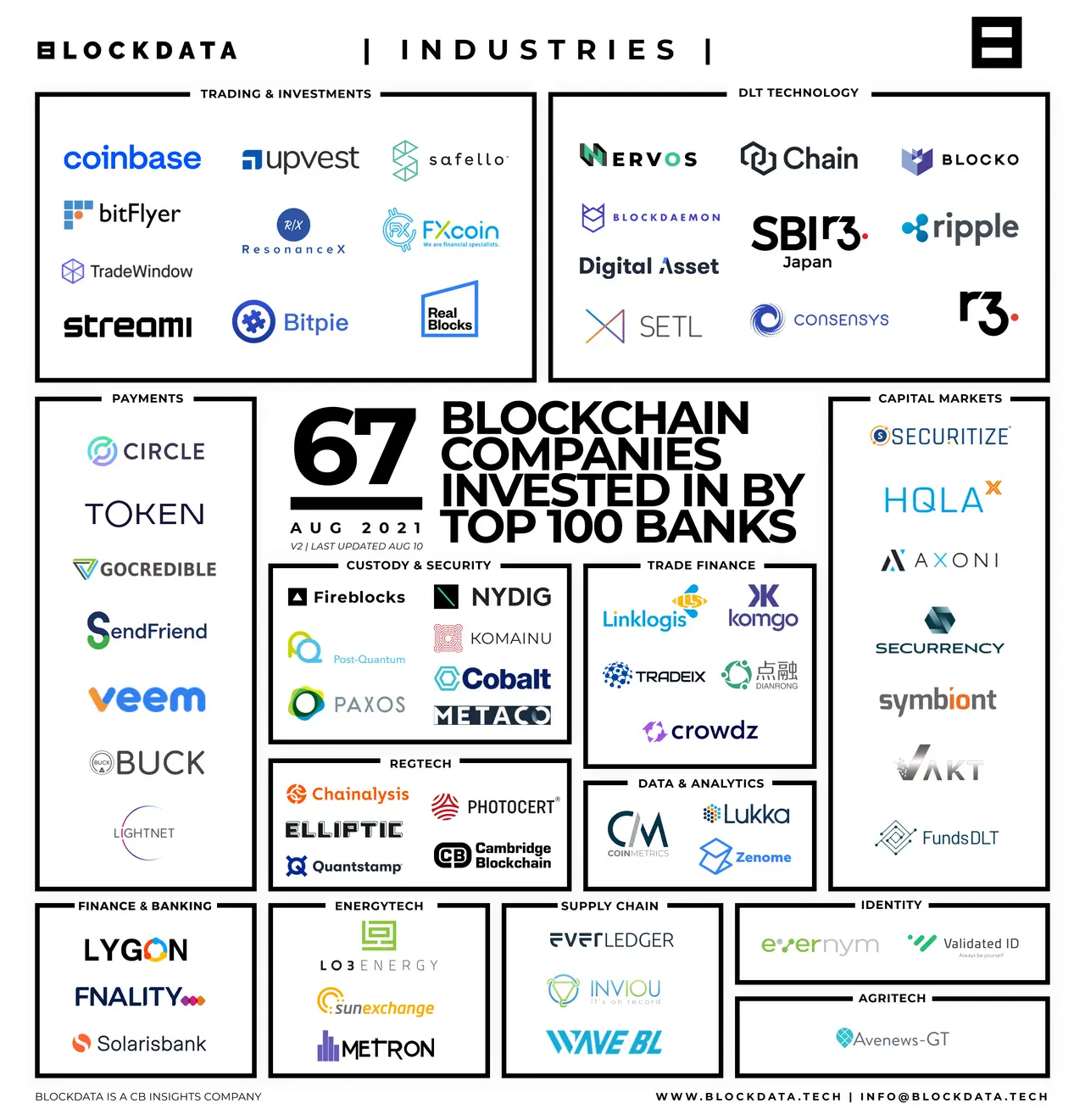

According to Blockdata, 23 out of the top 100 banks by AuM are either building custody solutions, or investing in the companies that provide them. Alongside Metaco, other custody and security services providers that are backed by the world’s largest banks include Fireblocks, Paxos, Nydig and Cobalt.

67 blockchain companies invested in by the top 100 banks, Source: Blockdata.tech, August 2021

Switzerland’s DLT Act came into full force this month, entailing various improvements to the legal framework in connection with the use of decentralized technologies and blockchain. Among other things, the new legislation introduces so-called ledger-based securities, as well as the DLT/Security Token Exchange, a new form of license for trading venues for digital assets.

DLT trading facilities focus on trading DLT-based securities, cryptocurrencies as well as utility tokens. They differ from traditional trading venues and token exchanges in that they are allowed to serve retail customers, can clear and settle transactions with DLT securities, and can hold DLT securities and tokens in safe custody.