August is kicking off in the green, with stock futures tracking gains out of Asia, in a week that will finish off with another batch of big U.S. jobs data.

Also on the move is bitcoin

BTCUSD,

which shot past $40,000 this weekend for the first time since mid-May, after two months of sideways trading, but that level seems slippery, judging by early Monday action.

Our call of the day, from Matt Maley, Miller Tabak & Co.’s chief market strategist, who offers some fresh insight into what’s needed for the gains to stick this time.

For starters, he repeats some past advice, for investors to gauge the action during normal market hours. “The markets are much ‘thinner’…and the volumes are much lower…on the weekends, so we’ll want to see [if] bitcoin can remain above $40k once we get into next week before we get too excited,” Maley told clients in a note on Sunday.

If bitcoin holds up, he points to the next target as its 200-daily moving average (DMA), which stands at $44,600. “It got up to/near that level twice since May…and rolled over both times. Therefore, it could/should provide some resistance upon any further rally in early August,” said Maley.

A break above that line would see the crypto “shoot a lot higher rather quickly. In other words, it might need to take a ‘breather’ to digest its gains at its 200-DMA, but if it breaks above that level in any significant way (whether it’s soon…or after a ‘breather’), it should be very bullish for bitcoin,” he said.

But there’s a caveat to that potentially bullish view, as he also notes the crypto is starting to look overbought on a short-term basis, based on its Relative Strength Index, a widely followed oscillating indicator that tracks the magnitude of recent losses relative to the magnitude of recent gains.

“Don’t get us wrong, it got much more overbought before it rolled-over in January and February…and in November of last year. However, it is more overbought than it was at the all-time high in April, so investors and traders alike will have a lot more confidence if this weekend’s move holds into the middle of next week,” said Maley.

Bloomberg/Miller Tabak + Co.

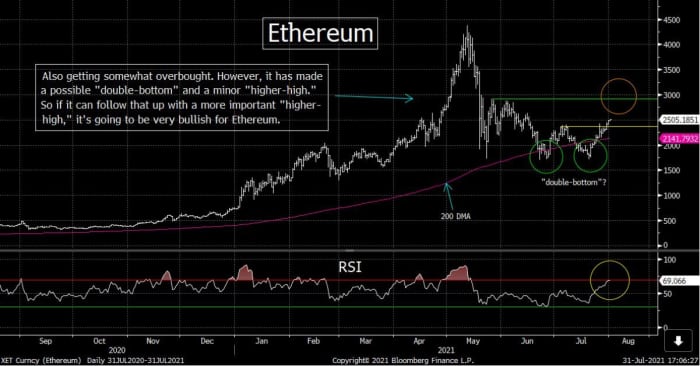

The strategist also weighed in on ether

ETHUSD,

saying a break above the crypto’s 200-DMA would be bullish, and a break above $2,288, the highs from late May and early June “particularly bullish” as it would create a technical indicator known as a “higher high.”

Bloomberg/Miller Tabak +Co.

Deals galore and China stocks perk up

Payment firm Square’s

SQ,

announced a $29 billion all-stock deal to buy Australian buy now, pay later group Afterpay

APT,

Industrial group Parker-Hannifin

PH,

is buying U.K. defense group Meggitt

MGGT,

in a nearly $9 billion deal. And Foot Locker is reportingly spending $1.1 billion for 2 retailers.

Also in deal news, U.S senators over the weekend concluded the text of a $1 trillion infrastructure bill.

Fed. Gov. Lael Brainard suggested late Friday that the central bank likely won’t announce any bond purchase tapering at the Jackson Hole meeting in late August. She’s waiting for the September jobs data when “consumption, school and work patterns should be settling into a post-pandemic normal.”

Meanwhile, some Democratic lawmakers have been carping about how Fed Chair Jerome Powell is too soft on big banks. That may matter when it comes to a new Fed chief appointment in 2022.

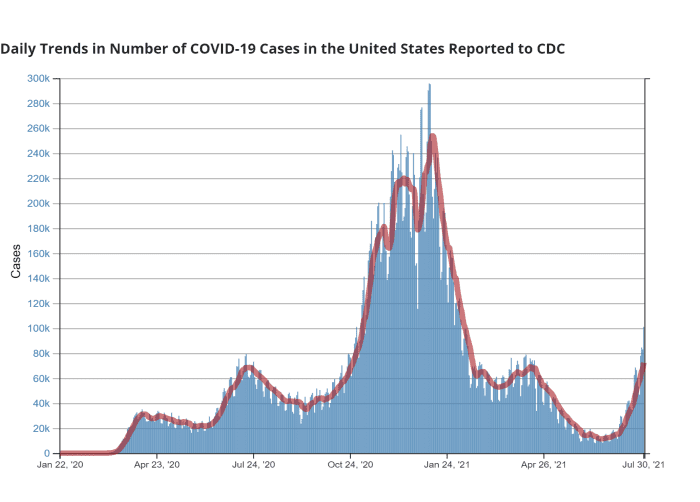

U.S. daily COVID-19 infections on Friday reached over 100,000 cases a day for the first time since February, according to Centers for Disease Control and Prevention data. Dr. Anthony Fauci on Sunday warned of more suffering ahead, but sees no lockdowns like last year. China is also grappling with growing outbreaks.

Centers for Disease Control and Prevention

And some are worried about big crowds at Chicago’s Lollapalooza music festival over the weekend.

Hedge-fund legend Ray Dalio says there’s no need to ditch Chinese stocks.

The markets

Dow futures

YM00,

NQ00,

are leading the way higher, up nearly 200 points, while oil prices

CL.1,

BRN00,

and gold

GC00,

are down. Europe stocks

SXXP,

have hit a record, also thanks to some big gains for China stocks

000300,

despite slowing manufacturing data for the latter.

Random reads

A Belarus Olympic sprinter who claimed she was being forced back home is headed to Poland.

Scientists go wild over discovery of 2,000 year-old intact fruit baskets off Egypt’s coast.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.