- Bitcoin price clearing the resistance of a high probability bottoming pattern.

- Ethereum price scaling the wall of worry in the cryptocurrency complex.

- XRP price renewing tendency for explosive price movement.

Bitcoin price action raises the odds that the longstanding uptrend is intact, as Ethereum balances a bearish momentum divergence with bullish fundamentals, and XRP overcomes the neckline of an inverse head-and-shoulders bottom.

Bitcoin price unveils a new, timely entry price for bullish market speculators

Unlike most other cryptocurrencies, BTC printed a new correction low on April 25 but closed the day with a bullish momentum divergence on the intra-day charts. A bullish momentum divergence occurs when the Relative Strength Index (RSI) does not mark a new low with price, indicating an exhaustion of selling pressure.

Today, BTC is clearing the neckline of an inverse head-and-shoulders pattern, with notable price strength and an uptick in volume. It is fundamental for the longevity of the more significant uptrend that the bellwether cryptocurrency holds today’s breakout and clears the flattening 50-day simple moving average (SMA) at $56,918. A failure will reduce the significance of the pattern and potentially steer BTC towards a reversion to the 100-day SMA at $50,682.

The only noteworthy target beyond the 50-day SMA is the intersection of the wedge’s lower trend line with the 361.8% extension of the 2017-2018 bear market at $63,777.

Lastly, it is essential to note that BTC at the time of writing is virtually unchanged in April with a slight loss of -2.93% after being down almost 30% from the high of the month. A bullish outcome to a month colored with outsized daily losses and noteworthy corrections across the cryptocurrency complex.

BTC/USD daily chart

Market speculators should not overlook the flattening 50-day SMA and the rounding formation on the daily chart that began in mid-April. As long as BTC holds the 100-day SMA at $50,679, the outlook is framed with a bullish bias.

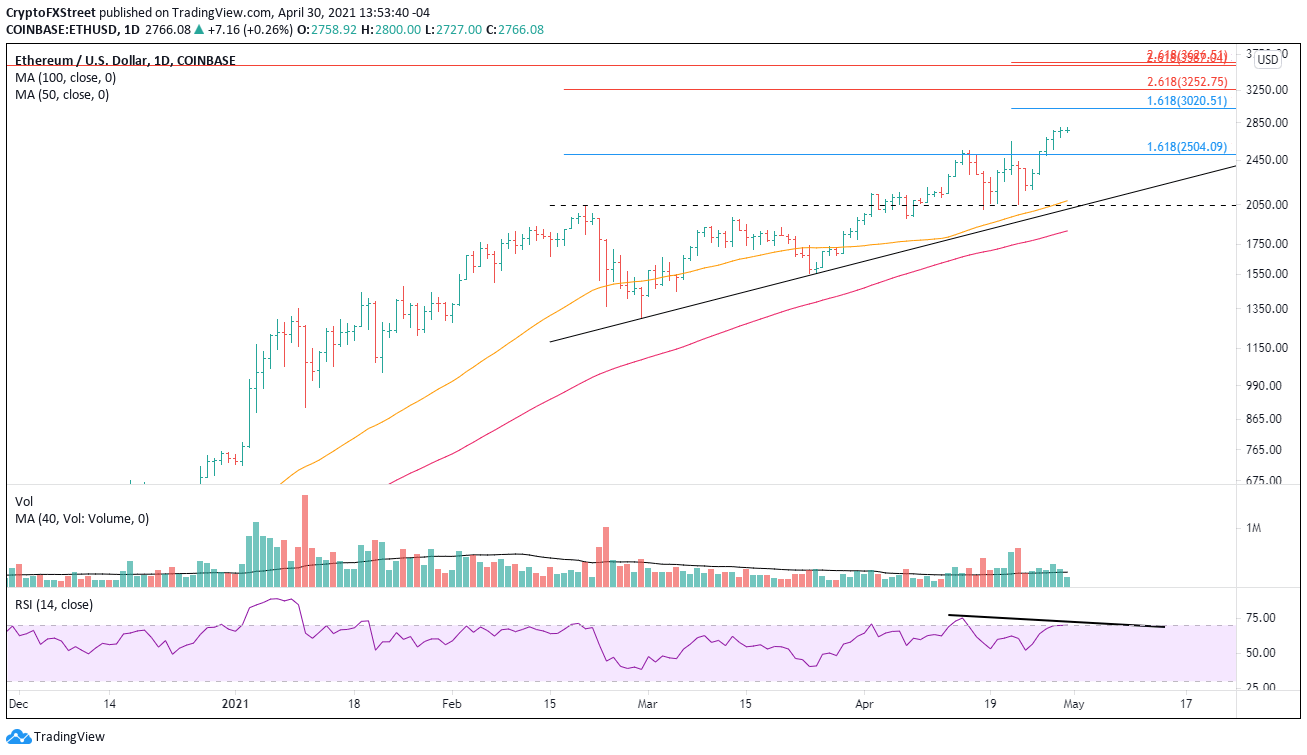

Ethereum price guided the broader market off the lows

The bounce off the April 23 lows has qualified ETH as a leadership cryptocurrency and lifted it convincingly beyond the 161.8% Fibonacci resistance at $2,504, thereby voiding the bearish alternative discussed in an April 25 FXStreet article about a potential head-and-shoulders top pattern. Furthermore, the last five positive days have been supported by above-average volume, making it the longest streak of above-average volume gains since the beginning of January.

Price targets moving forward are $3,000, the 161.8% extension of the April decline at $3,020, and the cluster of 261.8% extension levels related to the 2018 bear market, the February decline, and the April decline beginning at $3,252 and extending to $3,626.

ETH/USD daily chart

In the short-term, it is necessary to forewarn there is an emerging bearish momentum divergence on the daily chart, and the tight price ranges of yesterday and today imply rising indecision in the bullish ranks.

Do not be surprised if there is a tempered pullback. As long as ETH holds the 161.8% extension at $2,504 on a daily closing basis, the uptrend should continue over the medium term.

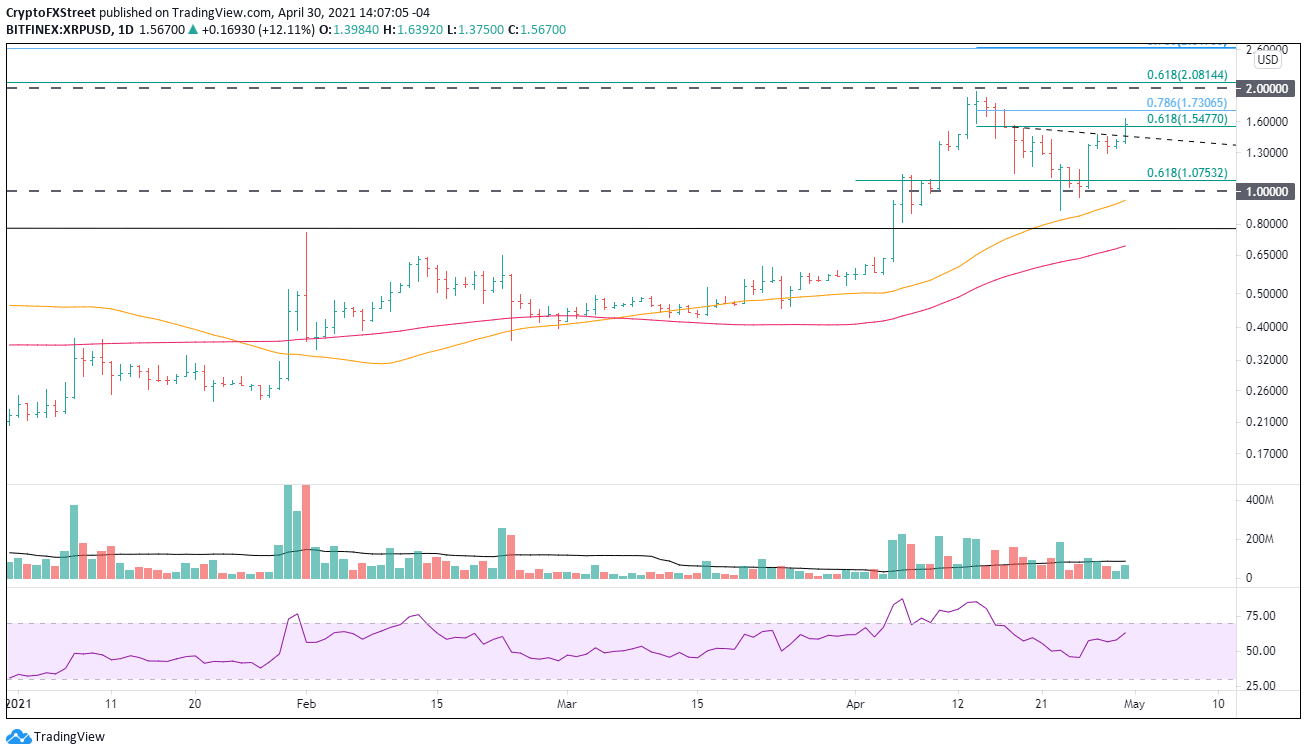

XRP price reminds speculators to brace for anything

Ripple has been a wild ride in April, beginning with a rally of nearly 250%, followed by a 50% crash, and now an 85% rebound. Chart technicals have been tossed like a salad, but today’s breakout from a bullish inverse head-and-shoulders bottom brings some clarity.

XRP price has conquered the neckline and the 61.8% retracement of the April decline at $1.55. The 78.6% retracement at $1.73 will be a challenge, but bullish Ripple speculators are fixated on the psychologically important $2.00 and the 61.8% retracement of the 2018-2020 bear market at $2.08.

XRP/USD daily chart

The bullish outlook can be overturned by a restart of a collective decline in the cryptocurrency complex or negative development in the SEC lawsuit. Some support will manifest around $1.30, but the legitimate support rests at $1.00.

An incremental rally underpins the bullish outlook, but there is no space for underestimating Ripple volatility. Staging entries with discipline and elevating risk management to the forefront is the right investment approach for the digital token.