It is not the objective of this article to explain the Bitcoin protocol nor to convince you of its value.

Dear 20-somethings,

This is a message on a subject that many are mystified about: One: Bitcoin is sound money. Two: Our opportunity cost and overall risk increases by not holding this asset. And three: It is not too late to begin buying and learning about bitcoin.

Orientation: Our Fiat Dilemma

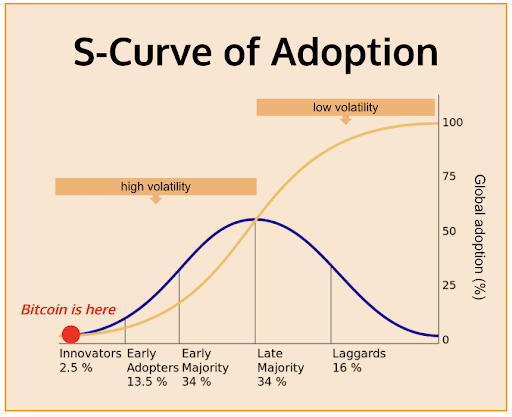

Welcome and congratulations, you have one of the most unique and powerful opportunities granted to individuals who have roamed this planet. You have the opportunity to own and hold the scarcest and best-performing asset of all time while it is still in its infancy. Bitcoin is very much still in a phase of early movers and price discovery. It continues to prove to be a viable alternative to traditional investments (such as fiat) as it barely passes a 1 percent adoption rate worldwide.

Fiat: a government-issued currency that is not backed by a commodity such as gold.

You might be like me, a recent college graduate who has just entered the workforce. Let’s first acknowledge that we have won the lottery of life by being able to read and access this article online.

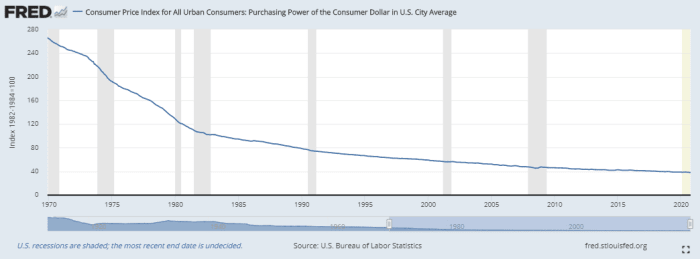

Secondly, as individuals, we are living in unprecedented times with influence and media coming at us from all possible directions. Also, like me, you might be adjusting to the professional world and a new type of personal and financial freedom. I will make the following two assertions that are not original concepts but might be unfamiliar when applied to our new situations. One: We are new members of the broken and overleveraged world of fiat. Two: If we don’t acknowledge our situation and take action, we will fall victim to a cascading hyperinflationary world that will devalue our hard-earned incomes and savings.

Without getting too technical and long-winded, I want to assert that our current framework of money is unsustainable, unbalanced and quite harmful to our population and our future. However, you don’t have to take my word for it. Throughout the history of the United States, we have been continuously warned by our own leaders about this circumstance as policymakers and institutions have continued to worsen our monetary situation. Here are a few examples:

“Paper money is liable to be abused, has been, is and forever will be abused, in every country in which it is permitted.”

“You [delegation of bankers that were pushing for renewal of the Second National Bank charter] are a den of vipers and thieves. I intend to rout you out, and by the eternal God, I will rout you out.

“This [Federal Reserve Act] establishes the most gigantic trust on earth. When the President signs this bill, the invisible government of the monetary power will be legalized…the worst legislative crime of the ages is perpetrated by this banking and currency bill.”

“Mr. Chairman, we have in this Country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks…Some people think that the Federal Reserve Banks are United States Government institutions. They are private monopolies which prey upon the people of these United States for the benefit of themselves and their foreign customers; foreign and domestic speculators and swindlers; and rich and predatory money lenders.”

Almost 20 percent of all existing United States dollars were created just in the year 2020.

Even 100 years ago, famous American inventor Henry Ford proposed an energy-backed currency to replace gold. This forward-thinking idea was an eerie precursor to Bitcoin as Ford even mentioned that “this currency would be issued only to a certain definite amount” — just like bitcoin’s 21 million supply cap. Ford claimed that this new form of money would “end all wars forever” stating, “Break the control and you stop war. And the simple way to break the control of these international bankers, the way to end their exploitation of humanity forever is to remove gold as a basis for the currency of the world.”

The Federal Reserve set to print another $1.9 trillion on the morning of this piece’s authoring.

So, we have a choice; we can ignore the countless red flags pointing to a dim hyperinflationary future, or we can initiate exposure to “a better form of money that provides all individuals with a credible path to opt out and to get off the hamster wheel,” as Parker Lewis put it in his famous 2020 article “Bitcoin Is The Great Definancialization.”

I propose that this exposure should be conservative and gradual. As the Bitcoin network grows in size and more people enter the asset class, it’s rate of growth will increase. Similarly, as your overall understanding and confidence in the Bitcoin network increases, your investment exposure would undoubtedly follow suit.

Take Action

Everyone’s Bitcoin story is unique and continuous. I would make the following suggestions to my fellow 20-somethings or anyone interested by the best store of value on the planet:

1. Learn: Start with the resources listed at the bottom of this article. Understand that Bitcoin is:

- Permissionless — anyone can buy, hold and sell

- Decentralized — no central authority can manipulate it

- Scarce — fixed supply of 21 million, preventing dilution

- Highly-fungible — interchangeable and easily exchangeable

- Divisible — infinitely divisible and can be bought in increments. There are 100 million satoshis or “sats” per one bitcoin.

2. Buy: Purchase as little or as much as you are comfortable with. It is not necessary to purchase a full bitcoin, you can buy in small increments. I suggest making your first bitcoin purchase with either Cash App or Swan Bitcoin.

3. Rethink: Rethink about the currency you are rewarded with for your hard work. Once you grasp the finite nature of bitcoin, you might reconsider some of your habitual purchasing decisions in order to secure more of this digital real estate. Try cutting out that daily coffee run, Uber Eats order or any unneeded cost that does not bring direct value to your life.

4. Hold: Often referred to as “HODL,” which simply means to hold and never sell.

5. Bank Yourself: Learn how to custody your own coins allowing for individual financial sovereignty.

6. Collateralize: Once hyperbitcoinization occurs, you will be able to make purchases with bitcoin or even borrow dollars against your bitcoin to leverage its value without reducing your stack.

Addressing The Fear, Uncertainty And Doubt (FUD)

There is no shortage of FUD when it comes to Bitcoin. However, most detractors of the space have not taken the time to fully understand their accusations and are often peddlers of traditional finance. Below, I address a few of the common statements that are asserted by deniers of the protocol:

1. “Bitcoin has no intrinsic value”

- As Austrian economist Ludwig von Mises said, “Value is not intrinsic; it is not in things. It is within us, it is the way in which man reacts to the conditions of his environment.”

- The network effect will generate value for bitcoin because as more people consider it a store of value (especially big financial players such as Elon Musk and Michael Saylor), miners will be further incentivized to secure the network.

2. “Bitcoin mining is wasteful and disproportionately damaging to the environment.”

- This piece of FUD is disingenuous and often broadcasted haphazardly by the mainstream media and traditional finance.

- Bitcoin mining is critical to the operation of the protocol and allows it to operate without relying on a centralized authority. Energy literally secures the value being injected into Bitcoin with each purchase. Everything requires energy according to the first law of thermodynamics. “Claiming that one usage of energy is more or less wasteful than another is completely subjective since all users have paid market rate to utilize that electricity.” – Dan Held, “PoW Is Efficient,” 2018

- Bitcoin’s energy consumption is trivial compared to legacy financial systems. As measured by electricity costs alone, Bitcoin is much more efficient than institutional banking and global mining (see the above article by Held for statistics on this).

- Investment and research firm CoinShares estimates that over 70 percent of Bitcoin mining is powered by renewable energy making it one of the largest renewable networks in the world.

3. “Digital currency is not realistic/viable”

- When was the last time you paid with cash instead of using a service like Venmo or Zelle? Our money right now is very much digital.

- Entrepreneur Anthony Scaramucci recently asked Former Director of the National Economic Council Larry Kudlow about Bitcoin on a private Zoom call. Kudlow said two things. One: The Fed and the Treasury don’t like Bitcoin for obvious reason. And two: They know it’s inevitable.

- Worldwide, only 8 percent of currency exists as physical cash.

4. “Bitcoin is too volatile”

- As time passes, and as more institutional wealth enters this asset class, the volatility of bitcoin will stabilize. There will always be some market corrections and short-term retraces in an unfettered market. However, in the long run, bitcoin will continue to outperform everything else with its increasing value.

- I would highly recommend reading Parker Lewis’ “Bitcoin Is Not Too Volatile” if you are interested in learning more specifics.

5. “Local and national governments can dismantle Bitcoin with regulation”

- It is a fundamental misunderstanding of the protocol if you believe regulation will limit the operability of Bitcoin.

- China, India, Nigeria and other countries have already tried to outright ban Bitcoin from being used. In each instance, peer-to-peer adoption of Bitcoin has increased — showing the true power of a decentralized network.

- Even if all of the governments on earth banned Bitcoin, there would still be nodes operating in space, underground and in various hidden places to keep the network alive.

6. “The Bitcoin network and mining will be attacked and become centralized”

- Bitcoin developer Jimmy Song does a fabulous job dismantling this FUD and does it more justice than I ever could. Too long; didn’t read: “Mining is not a single point of failure and Bitcoin will survive.”

7. “Bitcoin will be hacked/affected by quantum computing”

- The quantum computing argument is a non-issue that is often brought up by technically-sound individuals. Here is why:

- If scalable quantum computing is achieved, the whole cryptography infrastructure will need to be reconfigured. Bitcoin would be a low-hanging fruit for a bad actor with quantum access that could essentially infiltrate any infrastructure on earth. Also, I would argue that intellectual property and heavily-restricted data would be the main targets of a quantum attack, not a protocol such as Bitcoin.

- Years down the line, if and when quantum computing is actualized, quantum cryptography will be ushered in by cryptographers to avoid the imminent quantum threat and it would be implemented in the consensus-based Bitcoin Core protocol.

Buyer Beware: Other Cryptocurrencies

There is not another crypto asset that has the potential value, network effect and fundamental properties of Bitcoin. Purchasing other crypto assets is often compared to playing in a virtual casino and I think this is an accurate representation. Sure, you can make some gains by taking a gamble but, in the long run, you are always better off simply holding bitcoin. If you are considering investing in altcoins or other crypto assets, I would recommend reading the second resource at the end of this piece.

Stick to buying and holding bitcoin. One day, it will be the standard of how we exchange and store value.

Sincerely,

Matthew Ball (@matthewrball)

At the time of this writing, bitcoin is valued at $56,679.

Resources: Do Your Own Research

If you are at all interested in learning more about Bitcoin, I implore you to read these articles and resources. Also, feel free to reach out to me to challenge my positions or ask questions.

- “The Bullish Case For Bitcoin” by Vijay Boyapati

- “Bitcoin Obsoletes All Other Money” by Parker Lewis

- “Bitcoin Is The Great Definancialization” by Parker Lewis

- “The Beginner’s Guide Down The Bitcoin Rabbit Hole” by Hanson Birringer

- “The Bitcoin Standard” by Dr. Saifedean Ammous

This is a guest post by Matthew Ball. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.