Veteran trader Peter Brandt’s latest remarks which mock crypto traders still using laser eyes crypto memes have sparked an immediate and angry response from bitcoiners on Twitter. One very famous bitcoiner, Michael Saylor, reminded Brandt that the laser eyes signify “a long-term commitment to bitcoin based on its ethical, technical, and economic superiority to alternative assets.” Technical analyst and inventor of the Bollinger Bands technical indicator, John Bollinger, suggested that Brandt’s tweet was “a bit mean.”

All BTC Purchased in 2021 is Currently ‘a Losing Trade’

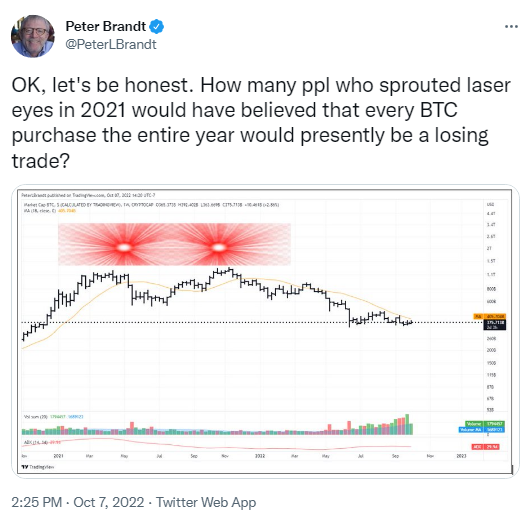

Veteran trader Peter Brandt recently reignited his feud with bitcoiners who use laser eyes crypto memes after he reminded them that every bitcoin purchase in 2021 is at the moment “a losing trade.” Brandt added that even he could not have predicted that the crypto would be trading under $20,000 in October 2022.

In response to the veteran trader’s tweet, Micheal Saylor, who recently left his position as CEO at Microstrategy, explained why he and other bitcoiners are still committed to the laser eyes cause. He said:

Laser eyes signifies a long-term commitment to bitcoin based on its ethical, technical, and economic superiority to alternate assets. All major financial asset classes have been losing trades over the past year. That is why we don’t trade, we hodl.

Saylor’s remarks were echoed by another Twitter user named Stephen Livera who insisted that the key aim of those ascribing to the laser eyes movement is “to increase our number of sats stacked and freedom acquired.” In addition, the user also appeared to attack Brandt’s use of technical indicators when seeking to understand an asset’s future price movement.

“Predicting short-term price movements is a fool’s errand. Growing and advancing the movement is the real goal,” Livera tweeted.

Alex Gladstein, a human rights defender and supporter of laser eyes, reminded Brandt that “the idea was simply to put them on for the journey to $100k.” Gladstein predicted that the laser eyes movement is not going to relent until one BTC is equal to $100,000.

When one Twitter user called Bazooka responded to Brandt’s tweet by claiming to have bought BTC when the crypto asset’s U.S. dollar value was between $17,000 and $18,000, the veteran trader shot back by reminding the user that “BTC never traded under $24,000 in 2021.”

Dangers of Dogmatic Thinking

However, when John Bollinger, a technical analyst and inventor of the Bollinger Bands, suggested that Brandt’s tweet was “a bit mean,” the veteran trader concurred but insisted his aim was to remind supporters of the laser eyes movement of the dangers “of dogmatic thinking.”

During the 2021 crypto bull market, many bitcoin maxis began adding red laser eyes to their social media profile pictures. Using the red laser eyes then signified the holder’s bullishness. As the movement was gaining traction, Brandt became one of the first prominent traders to question the movement, which he compared to a cult.

For instance, on March 31, 2021, when bitcoin was trading above $58,000, Brandt said:

“I will use my laser eyes when $BTC experiences a $50,000 correction and many of you swap your lasers for tears.”

Months after Brandt said this, bitcoin went on to hit an all-time high of $68,789.63. However, since then, the top cryptocurrency has trended downwards and has primarily traded between $23,000 and $18,000 since September 1, 2022.

What are your thoughts on this story? Let us know what you think in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.