Crypto analytics firm Santiment says that an Ethereum (ETH)-based altcoin with one of the highest supply on exchanges will see increased price swings after trading sideways for some time.

Santiment says the price of the native token of the automated market maker (AMM) Bancor (BNT) is rallying as the token’s supply on exchanges increased by 46% from three months ago.

“Bancor’s price has been spiking today, jumping above $0.4556 for the first time in two weeks. As an altcoin with one of the highest level of coins on exchanges within the top 200, there can be massive volatility breaking out for BNT at any time.”

At time of writing, BNT is changing hands for $0.426.

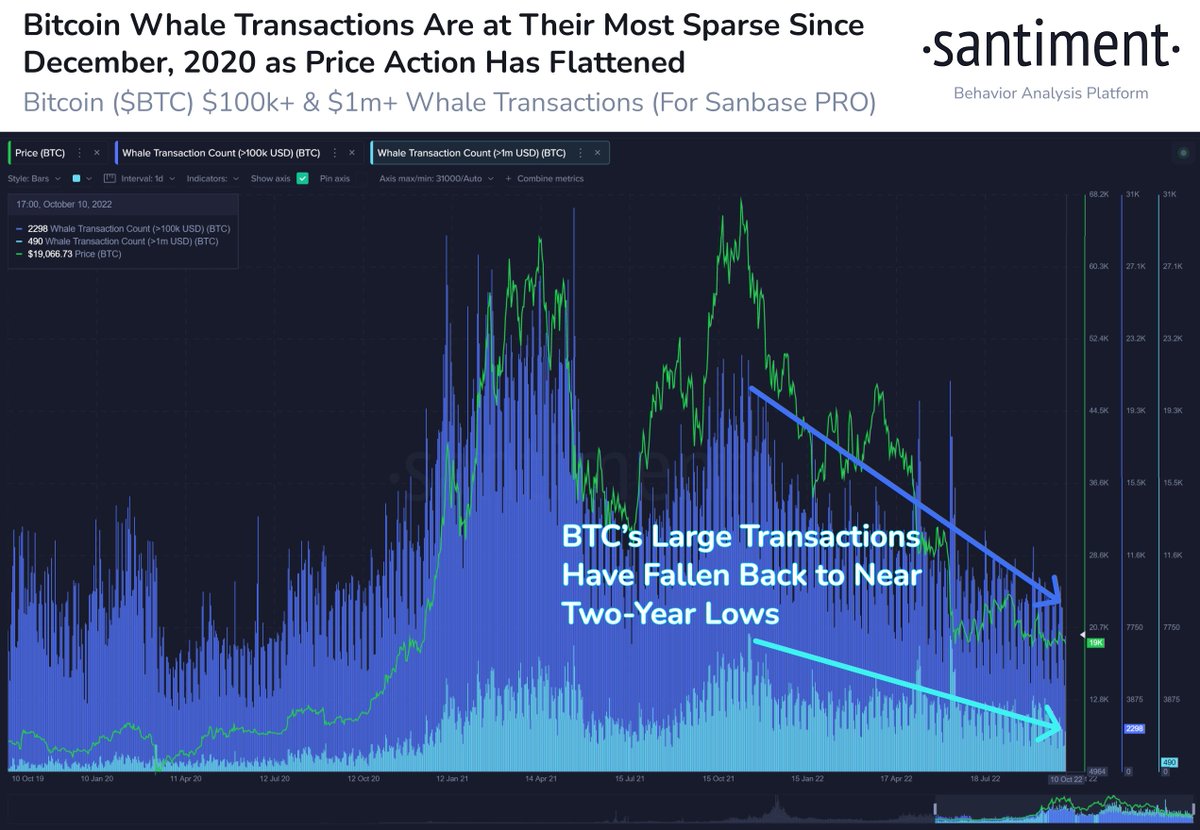

As for Bitcoin (BTC), Santiment says the flagship crypto asset, which currently trades for $19,173, is seeing lower volatility in the past few months due to a decline in large trades.

“As Bitcoin’s price action has become relatively “boring” the past four months, we see that the lack of whale presence has had a lot to do with this lower volatility. BTC transactions valued at $100,000+ and $1,000,000+ have fallen to levels last seen in 2020.”

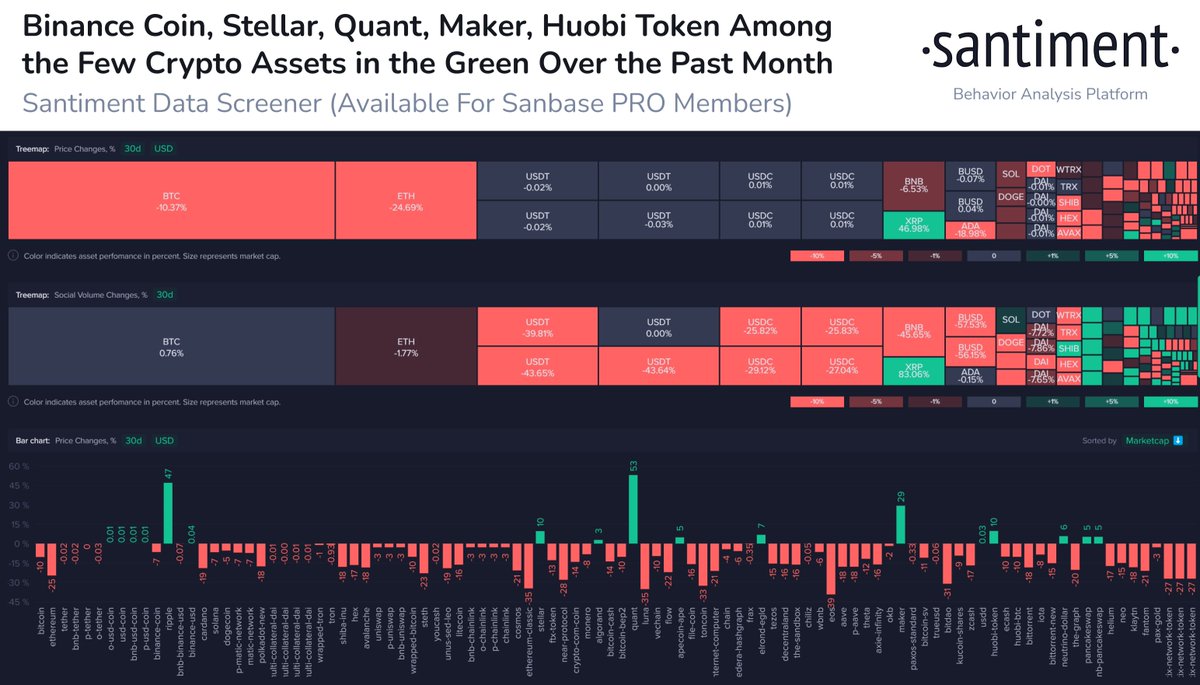

The analytics company says the broader crypto market is experiencing shrinking popularity amid plummeting prices of tokens.

“There has been quite a lot of blood in the streets. Unless your portfolio mainly consists of BNB, XLM, QNT, MKR, HT, or other scarce positive altcoins the past 30 days, you’re down. This reflects in the shrinking group of individuals still interested in cryptocurrency.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal