Leon Neal

Fundamentally Coinbase (NASDAQ:COIN) does look weak for the remainder of this year. There is a glaring highlight on the overall performance of the cryptocurrency market come 2024 and 2025. Do note the forecasted EBITDA, which showcases this.

Negative Outlook for 2023

As the cryptocurrency markets have been very negative and volatile this year, Coinbase has many challenges to worry about for the remaining year. This depends on the performance of significant cryptocurrency coins like Bitcoin (BTC-USD) and Ethereum (ETH-USD). These coins’ value is so tightly correlated to the price of COIN.

We could look forward to a potentially good year in 2024 with explosive growth.

Fundamental Short-Term Data is Weak as Coinbase Relies on Cryptocurrency Market Performance

This EBITDA shows a strong outlook for 2024 and 2025, but this might be the time to dip in the Coinbase and the overall cryptocurrency market.

|

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

EBITDA |

-48 |

169 |

1206 |

4637 |

233 |

Source: Financial Modelling Prep

If this EBITDA guidance holds, one can see that 2022 is not the year to have invested long-term with COIN. Do note the strengths for 2024 and 2025, which might be something about the overall predicted cryptocurrency market. Does this mean we should be invested long-term during those years?

If the highlighted EBITDA guidance holds, this could be a saving grace for Coinbase and similar exchanges for 2024 and 2025. There is no solid explanation for this outlook, but it is something potentially to look forward to.

Based on the EBITDA outlook, achieving this target might take a few years. This stock price could increase along with the overall performance of US-based significant market indices. It is most likely that the share price could be an underperformer until 2024 if the EBITDA outlook is accurate.

The current share price of $71 has a long way to go to reach a target price of $99.91.

Technical Analysis Declines to Flat for the Rest of This Year

Hurst Cycle

Looking at this Hurst Cycle outlook weekly, you can see that the current cycle is at its peak with a quick decline. There appears to be no long-term upswing momentum since crypto’s performance is weak.

Coinbase Hurst Cycle (Motivewave trading platform)

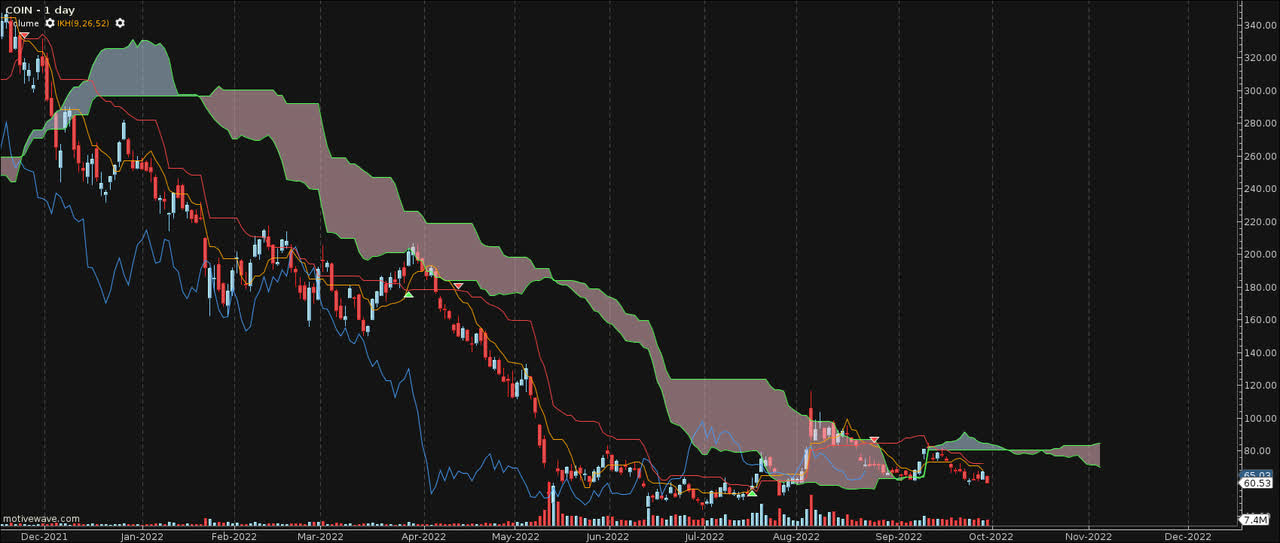

Ichimoku Cloud

This Ichimoku Cloud shows a slight short-term upswing but a further long-term decline. Again, this could be considered unpredictable due to the vast, volatile cryptocurrency market.

Coinbase Ichimoku Cloud (MotiveWave trading platform)

Reverse MACD

This daily Reversing MACD chart showcases how weak the most recent buying signals were false positive. As the stock price has gone flat into a random walk mode since August, this would be a difficult time to put entry orders into the market as they would most likely be unprofitable. This is not a time to invest in COIN as the market conditions weaken long-term.

Coinbase Reverse MACD (MotiveWave trading platform)

Risks Persist for Coinbase

Historically, Coinbase has underperformed its target price as major coins as Bitcoin have crashed over the summer. Coinbase has gone sideways despite its most recent news of an Amazon documentary called Coin.

Coinbase Missing Target Price (Trading Platform) (Business Insider)

Based on the recent trading of Cathie Wood’s ETF, one can see the recent significant shares were sold in the summer with no follow-up of current orders since then.

Ark Trades

|

Date |

Shares |

Weight |

Fund |

Direction |

Everything. Profile. Company Name |

Close ($) |

Total ($1M) |

|

2022-07-26 |

1133495 |

0.6833 |

ARKK |

Sell |

Coinbase |

nan |

nan |

|

2022-07-26 |

174611 |

0.6768 |

ARKW |

Sell |

Coinbase |

nan |

nan |

|

2022-07-26 |

110218 |

0.6793 |

ARKF |

Sell |

Coinbase |

nan |

nan |

|

2022-07-14 |

90861 |

0.052 |

ARKK |

Buy |

Coinbase |

53.41 |

4.85 |

|

2022-07-06 |

240963 |

0.1444 |

ARKK |

Buy |

Coinbase |

51.70 |

12.46 |

|

2022-07-05 |

6905 |

0.0042 |

ARKK |

Buy |

Coinbase |

55.40 |

0.38 |

Source: Cathie’s Ark

If one was to analyze future estimates carefully, it appears Coinbase should struggle with the years 2022 and 2023. It is expected that 2024 and 2025 will be highly lucrative years for crypto, which Coinbase shall benefit from. It might be wise to invest long-term into COIN at that time.

As you see, it is expected that EBITDA, net profit, EPS, cash flow from investment, and so on will show a negative year with some reversal towards profit in 2023.

The key metric to pay attention to here is free cash flow per share, which shows negative results for this year but slight improvement moving into 2024.

|

Yearly Estimates |

2022 |

2023 |

2024 |

2025 |

2026 |

|

EPS |

-11.55 |

-5.68 |

-1.41 |

6.26 |

-2.97 |

|

P/E Ratio |

-5.71 |

-11.61 |

-46.87 |

10.54 |

-22.20 |

|

EBIT |

-2,875 |

-1,271 |

-159 |

2,785 |

7 |

|

EBITDA |

-485 |

166 |

1,206 |

4,637 |

233 |

|

Net Profit |

-2,634 |

-1,413 |

-414 |

1,763 |

-903 |

|

Net Profit Adjusted |

-655 |

-721 |

-233 |

-883 |

-140 |

|

Pre-Tax Profit |

-3,209 |

-1,439 |

-720 |

26 |

-181 |

|

Net Profit (Adjusted) |

-3,057 |

-1,813 |

– |

– |

– |

|

EPS (Non-GAAP) ex. SOE |

-2.72 |

-0.21 |

-1.55 |

-3.84 |

-0.17 |

|

EPS (GAAP) |

-11.55 |

-5.68 |

-1.41 |

6.26 |

-2.97 |

|

Gross Income |

2,951 |

3,375 |

3,010 |

7,183 |

– |

|

Cash Flow from Investing |

-722 |

-107 |

-172 |

-125 |

– |

|

Cash Flow from Operations |

-2,786 |

719 |

2,978 |

1,878 |

182 |

|

Cash Flow from Financing |

-158 |

-48 |

-47 |

0 |

– |

|

Cash Flow per Share |

-27.59cash f |

9.92 |

– |

– |

– |

|

Free Cash Flow |

-2,763 |

164 |

958 |

1,550 |

-889 |

|

Free Cash Flow per Share |

-1.65 |

1.29 |

5.05 |

5.99 |

– |

|

Book Value per Share |

22.77 |

20.99 |

21.22 |

3.71 |

– |

|

Net Debt |

-2,222 |

-2,192 |

-2,502 |

-3,497 |

– |

|

Research & Development Exp. |

2,278 |

2,310 |

2,272 |

2,496 |

– |

|

Capital Expenditure |

40 |

42 |

60 |

49 |

80 |

|

Selling, General & Admin. Exp. |

3,939 |

3,904 |

2,359 |

5,050 |

– |

|

Shareholder’s Equity |

5,483 |

5,287 |

6,677 |

10,165 |

– |

|

Total Assets |

13,056 |

13,855 |

15,191 |

11,109 |

– |

Source: Business Insider

Conclusion

I believe there should be selling on COIN for the remainder of the year. Depending on the performance of both large cryptocurrency coins of Ether and Bitcoin, one might see the improvement of potential profitability for Coinbase. So far this year, both currencies have shown excessive volatility on the downside. If so, this could strengthen in 2024 and 2025, meaning that COIN should see a strong buy recommendation.