How are crypto traders avoiding taxes with a lending loophole?

Yes, you can use this loophole to reduce your tax amount. But, there are some caveats which we discuss further below.

Emerging crypto-based lending companies have created a stupid but rather useful tax loophole by taking advantage of the tax rule that any crypto-to-crypto transfer is to be treated as a taxable event.

For example, some months ago, you made an investment of $50,000 in Ethereum, and now you would like to exchange it for Litecoin. As a rule, purchasing Litecoin requires selling some Ethereum, which constitutes a Capital Gains event. However, Ethereum can be used as collateral for a loan where you get stablecoins (or more ETH or actual USD/fiat currency) which can be used to purchase Litecoin, allowing you to save money on taxes. Taking advantage of a gap in the financing system is called a loophole.

You deposit $50,000 worth of Ethereum into a crypto lending marketplace. They provide a 50% LTV (loan-to-value) ratio (for $50k ETH, you get $25k fiat or stablecoins) and give you $25,000 which you use to buy LTC.

You wait for a year to pass by. Your ability to sell your Ethereum after 12 months does not subject to a tax penalty. You can use some of it to pay off your loan, and you now have Ethereum and Litecoin in your portfolio. The interest rate on your loan is more affordable than the tax penalty you would have had to pay. Indeed, you’ve made a tidy sum. If the value of Ethereum increases during that time, you will have gained twice as much.

How Are Crypto Loans Taxed?

Some investors hold a significant amount of their wealth in cryptos. They might not wish to liquidate these investments into fiat currency because they fear incurring tax liabilities. If they were to sell off their crypto holdings, they would face capital gains taxes.

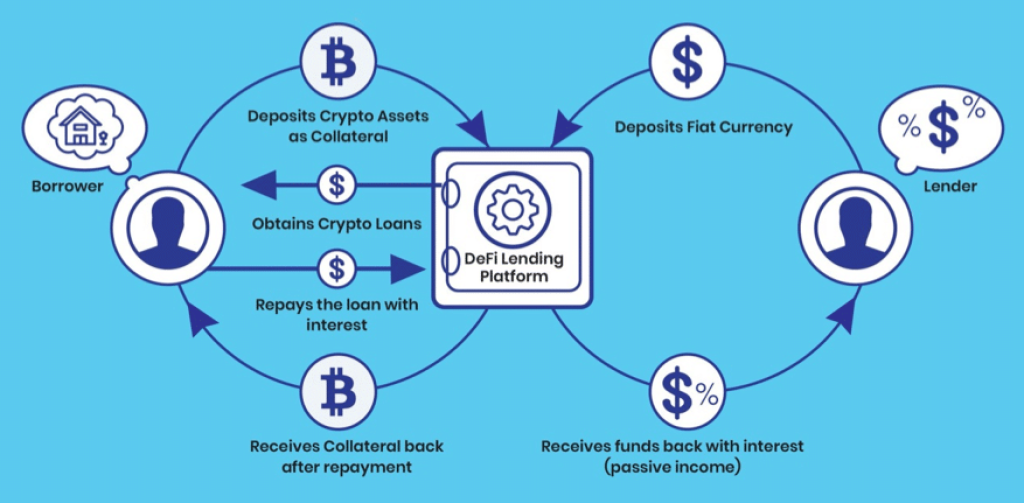

Investors often use their cryptos as collateral to borrow funds. This allows them to get cash for personal use without having to sell their digital assets.

The IRS has traditionally not taxed loans. It’s probably safe to assume the same standard treatment for crypto loans. But there are special cases where getting a crypto loan could result in a taxable event.

Loans are essentially crypto-to-crypto swaps in some decentralized protocols. The IRS has previously stated that crypto swaps are taxable transactions.

Investors use a conservative or aggressive approach. Some of them, the more conservative ones, may count the swap as a taxable event and will report capital gains or losses based on how much the value of their collateral has changed since they first got it. While others take a more aggressive tack and declare this swap as a non-taxable loan, they do not disclose it on their tax forms.

For tax purposes, interest paid on loans is a legitimate business expense for any company that takes one out. In most cases, interest paid on loan taken out for personal reasons is not deductible. The interest you pay on an investment loan is typically tax deductible.

Depending on the details of the deal, any money you make from investment loans will be treated as either capital gains or ordinary income for tax purposes.

Read also:

Risks and cons

Some disadvantages can only be petty annoyances or issues, depending on your risk tolerance. Here are a few of the key drawbacks of crypto loans:

- You may face a margin call from your lender if the value of the crypto you pledged as collateral drops below a specific level.

- Potential gains from price increases in your crypto could be lost if you are unable to sell your collateralized assets.

- The monthly payments can be significant for crypto loans because the loan maturities are often about 12 months or shorter.

FAQs

No, historically, the IRS has not taxed loans. It’s probably safe to assume that crypto loans will receive the same standard treatment. However, there are some unique circumstances where obtaining a crypto loan might lead to a taxable event.

The Cayman Islands are a crypto tax haven for both enterprises and private individuals. Businesses are not subject to corporate taxes under the Cayman Islands Monetary Authority, and residents are not subject to income or capital gains taxes.

Your taxes can be reduced in one of two ways if you report crypto losses: either through income tax deductions or by offsetting capital gains.

You may deduct up to $3,000 of your losses from your income if you incur total capital losses across all of your assets.

Virtual currency losses can be applied to other capital gains, either from the current tax year or future tax years if carried forward, regardless of how well your assets as a whole performed

If the monetary value of the coin declines, you could need to pledge additional crypto. If you default on payments, a lender may start making automated payments or liquidating your crypto holdings.

Most crypto lenders allow borrowing up to 50% of your bitcoin portfolio’s value, although some allow borrowing up to 90%.

No, in the past, the IRS did not tax loans. It’s probably safe to expect that cryptos loans will be handled similarly to other loans. But in some exceptional cases, getting a crypto loan can result in a taxable event.

CaptainAltcoin’s writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com