salarko/iStock Editorial via Getty Images

It seems like everywhere you look, there’s weakness in this market. It’s been tough out there, and let us not forget that September is a seasonally weak period in equity markets. Risk-off behavior has been the name of the game for most of 2022, and that’s certainly true right now. There are few groups that exemplify risk-on behavior more so than Bitcoin miners, as they are tremendously volatile, and make huge moves in both directions. One such miner is Riot Blockchain (NASDAQ:RIOT), a stock that I think is in no man’s land right now. Below, we’ll discuss some of the factors to consider if you’re looking to trade Riot.

I last covered Riot back in May following Q1 earnings with a ‘buy’ rating. At the time, we hadn’t yet seen the full fury of this bear market, and while Riot has put in much higher prices since that piece, it’s put in some lower ones, too. The idea at the time was that Bitcoin was trading at support, and the valuation of Riot was cheap. Bitcoin has subsequently made lower lows on panic selling during the summer, and Riot’s valuation has moved around a bunch. Let’s take a look at these factors and more below with the knowledge of another four months of price data.

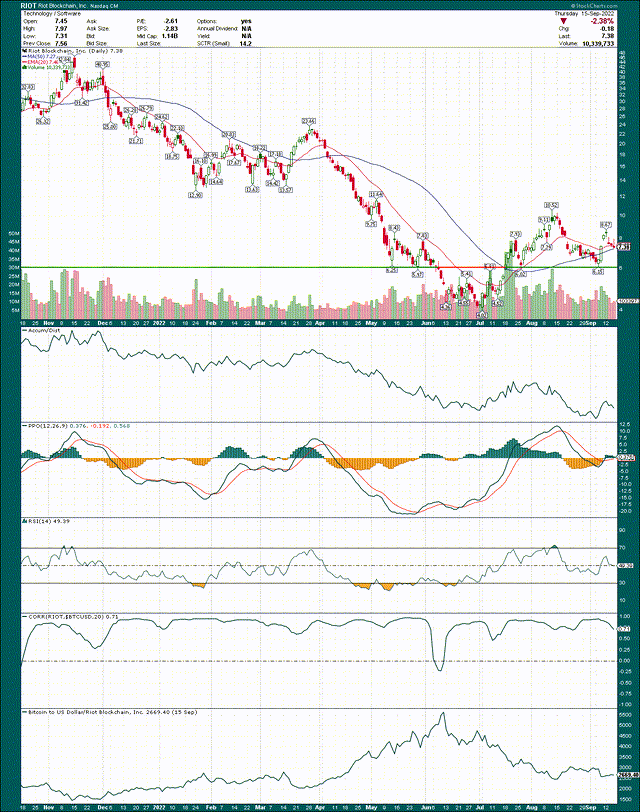

StockCharts

This is the daily chart of Riot, and we can see the stock has done quite well since the summer bottom. In fact, the July to August rally saw the stock ~2.5X, but it has pulled back significantly since the high. It appears the stock is going to lose the 20-day EMA based on this week’s price action, but for me, the line in the sand to watch is around $6, which was the line where relative lows and highs have been made a few different times in the past couple of months. If we see a breakdown of that level, we could quite easily retest the summer lows. It would likely take a big selloff in Bitcoin (again) to get to that level, but this market is hostile to bulls right now, so that may happen.

On the momentum side, Riot’s PPO looks okay with a centerline support test occurring right now. However, unless the stock turns higher quickly, it’s going to struggle to hold that. My stance right now is that I think we’ll see Riot break that centerline support, and make a test of the ~$6 support level. We shall see.

The last two panels show the correlation of Riot’s share price to Bitcoin on a rolling 20-day basis, and the price of Bitcoin relative to the price of Riot. Correlation remains very high, so we can reasonably expect Bitcoin and Riot to trade in the same direction. That’s probably not what Riot shareholders want at the moment given Bitcoin cannot seem to sustain a rally these days, but it is what it is.

In addition, the bottom panel shows that Bitcoin is actually more cheaply valued against Riot than much of 2022, or in other words, Riot is more expensive relative to Bitcoin. That’s not a good situation for Riot as it means that the stock is outperforming Bitcoin, perhaps in anticipation of a turnaround in the price of the coin. That leaves the stock open to a larger correction if Bitcoin breaks down, for instance. In any case, I wanted to point out that Riot’s relative valuation to Bitcoin has deteriorated in the past few months.

Still lots of growth coming

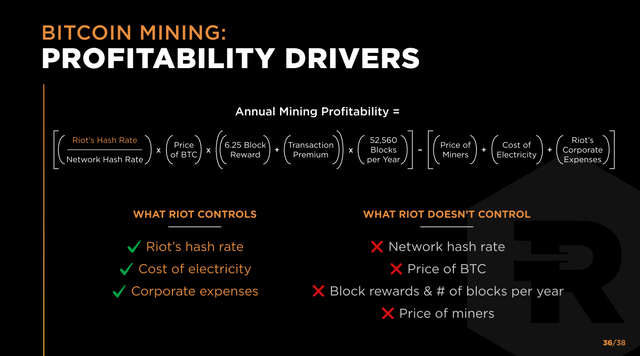

Let’s now turn our attention to the progress the company is making towards becoming one of the largest Bitcoin miners in the market. This slide is a great way to view not only how Bitcoin mining works, but the things Riot can and cannot control.

Investor presentation

I won’t read the slide to you but the three things Riot has substantial control over are its hash rate, its cost of electricity, and its corporate costs. That means that as investors, we can evaluate Riot on those factors, while keeping in mind all of the factors it doesn’t have any control over. Those matter too (a lot), so we don’t want to forget about them. But Riot can control its capacity, for instance, so let’s take a look there given its importance to the growth story.

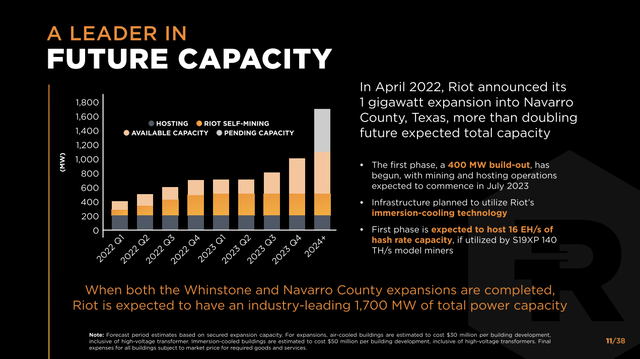

Investor presentation

Riot is very busy expanding its capacity, and is doing so with ever-increasing levels of efficiency. This includes both in power usage (lower is better) and in the speed of its miners. Riot is retiring old miners and buying more efficient ones that will improve both the speed of its ability to mine in the future, as well as the amount of power that’s used, even with higher capacity. The company has ambitious goals of roughly tripling its current capacity by 2024 (give or take), so there’s a big runway here if it can execute.

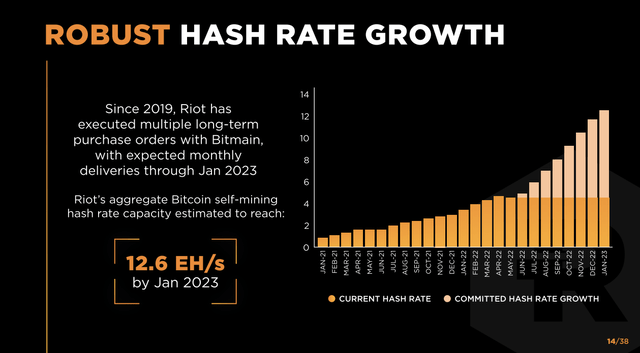

Investor presentation

Viewed another way, the company is committing to massive hash rate growth in the coming years, which it is certainly on its way to achieving. The facility expansions and mix of more efficient miners should turn this plan into reality, and at the moment, I don’t see any reason why Riot would not be able to achieve this. That means there should be more Bitcoin available for Riot, despite the ever-increasing difficulty of mining Bitcoin. So while capacity/efficiency may triple, the number of mined Bitcoin won’t. Still, the gains will be significant and if Bitcoin price starts a new bullish phase at some point, Riot could be a huge beneficiary.

Cause for concern?

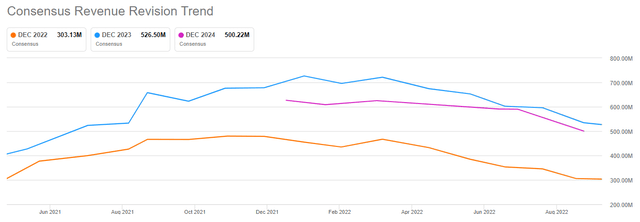

One thing I always look at is revisions for EPS and revenue. Given Riot’s current state of highly variable profitability, EPS has limited use in my view. However, revenue is quite useful, so let’s have a look.

Seeking Alpha

This is not pretty. Estimates for revenue have plunged for the past year or so, and in a big way. For instance, this year’s estimate is off about 40% from its prior high. It’s tough to own a stock that has constantly declining revenue estimates, and that’s certainly true here. Not only is this bad for sentiment, which impacts the multiple investors are willing to pay, but it’s also bad for the valuation itself. After all, even if the multiple is flat, the number on which we’re valuing the stock continues to decline.

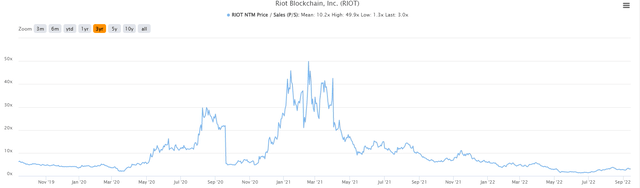

Speaking of, let’s now value the stock based on the price-to-sales ratio for the past three years.

TIKR

It’s pretty easy to spot when Bitcoin was flying to new all-time highs, because miners had some truly nutty valuations. Riot briefly traded at 50X forward sales, which was ludicrous in hindsight. Since then, we’ve seen some much more pedestrian valuations, and today it’s 3X forward sales.

That’s much lower than the average of 10X sales, but unless Bitcoin takes out its ATH, which is more than 3X the current price, I don’t think Riot has any shot of that sort of valuation. Rather, I’d argue for now, 3X is a pretty sizable valuation. Keep in mind revenue estimates continue to decline, so until that stops happening, I see more downside risk to the valuation than upside. If Bitcoin price makes a new low, we could easily see Riot at 1.5X or 2X forward sales again, so there’s meaningful risk today.

So what do we do?

As I said earlier, I think Riot is in a bit of a no man’s land at the moment. The stock is still in the midst of a pullback, and I think it has downside risk towards $6 at the moment. At that point, if you want to own Riot, that would be a favorable risk/reward setup, provided you use stops. Would I buy it at $7? I don’t think I would. There’s still downside risk to revenue estimates, and I don’t think 3X forward sales is particularly cheap. For now, I’m in wait-and-see mode on Riot, particularly given the risk-off behavior we’re seeing in the market today. With this, I’m downgrading Riot from my previous buy rating to a neutral stance.