Why Are So Many Crypto Exchanges Banned in the U.S.?

Crypto regulation is a key reason for so many exchanges being banned in the US. Crypto exchanges are not illegal in the US but the rules are much stricter than in other world jurisdictions.

Cryptos are becoming increasingly popular, but regulation is a hot topic at present as countries around the world struggle to figure out how to regulate them. The US already has some rules in place and is likely to introduce even more.

These existing regulations, both at the state and federal levels prevent some crypto exchanges from operating legally within the United States. Some exchanges must register as MSBs and obtain money transmission licenses.

Many international exchanges have decided that they’re not willing to take the time and effort to comply with U.S. regulations hence you as an American can’t use them. But, worry not – here is a list of crypto exchanges that accept US citizens. And a separate list of exchanges that allow trading crypto with leverage and work in the US.

Here are some of the major challenges facing crypto exchanges in the United States.

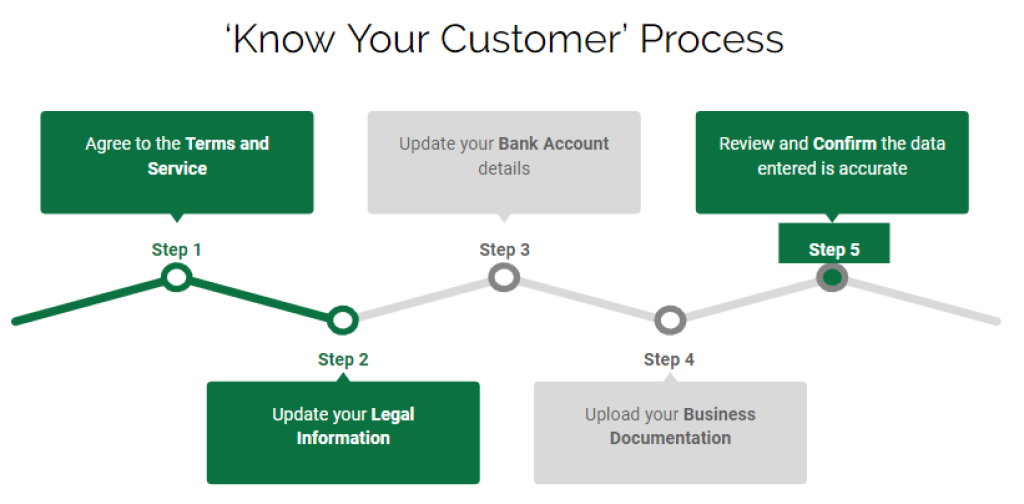

Know your customer (KYC) requirements

With crypto, anonymity has become an issue. It makes it hard for law enforcement agencies to trace criminals who use the currency.

The concern is that anonymous digital currency transactions may be used by criminals to fund illegal activities. Indeed, some countries have already outlawed the use of virtual currencies.

Because of this, U.S. crypto investors must undergo Know Your Customer (KYC) procedures, which include providing personal information such as names, dates of birth, social security numbers, and driver’s licenses.

When we are at it, there are still some exchanges that allow users to use them without going through the strenuous KYC process, and you can see them by clicking here.

For example, Coinbase, one of America’s biggest crypto exchanges, requires its users to provide their personal identification documents (ID) when they sign up for an account. It also asks them to take a selfie holding the ID.

Many exchanges ask for residency and job confirmation as well.

Derivatives and leveraged trading

Derivatives are complex financial products that allow companies and individuals to speculate about the future price of commodities like oil, gold, and even bitcoin. They’re used to hedge against risk or make money off of trends.

Traders can go short (betting that the price will drop) or long (betting that it will rise). In crypto markets, there are futures contracts that track the price of Bitcoin, Ethereum, Litecoin, Ripple, and others.

Crypto exchanges offer leveraged trading, where traders can borrow money to buy more assets, such as Bitcoin. This allows people to invest smaller amounts of capital while still being exposed to large market movements. The US has strict laws and regulations on institutions and platforms that offer this type of trading.

Taxation and other reporting

Money service businesses must keep detailed records and file reports with the IRS if they handle more than $10,000 in cash transactions per year. These include money transmitters, currency exchange operators, check cashers and others.

The Internal Revenue Service (IRS) believes that many people are failing to report crypto income because they believe it isn’t taxable. This is despite the fact that the IRS considers digital currencies such as Bitcoin and Ethereum to be commodities.

Last year, the agency obtained a court order to obtain the records of Kraken, one of the world’s largest Bitcoin trading platforms. The same happened earlier with Coinbase.

Exchanges must report U.S. taxpayers with crypto transactions exceeding $20,000.

The IRS wants to see information on U.S.-resident individuals who bought cryptos with fiat currency and transferred those funds into other wallets. For example, if someone buys $5,000 worth of Bitcoin with a credit card, they could transfer some of the coins to another wallet and convert the rest into USD. If the IRS sees that the person has done this, they might consider it a capital gain.

The government plans to treat crypto transactions like cash in the future. If new proposals are passed, any crypto transaction worth more than $10,000 will require reporting.

All of this requires substantial resources from exchanges which many are not willing to invest in and hence don’t allow US users to use their platforms.

State-specific regulations

There are some differences between the various states when it comes to regulating cryptos. That’s one reason you may see certain exchanges operating in some states but not others.

States that have adopted crypto whatever-friendly laws include Wyoming, Colorado, and Ohio. They want to attract the budding crypto industry.

Other states, like New York and California, require companies to comply with Know Your Customer (KYC) laws and report any suspicious activity.

New York’s Bitlicense regulates how exchanges hold funds and which coins they can trade.

The NYDFS aims to protect consumers from fraudulent activities while allowing legitimate businesses to thrive.

Can non-licensed exchanges still operate in the U.S.?

Crypto exchanges are regulated under the CFTC, meaning they must comply with certain requirements. However, there are plenty of unregulated platforms out there, including those based outside the United States. This raises a question: Can anyone operating an unregistered exchange still do business in the U.S.?

The answer is yes, but there are risks involved. For example, exchanges may freeze access to customer funds, pursue criminal charges against individuals associated with the business, and even shut down altogether. In addition, U.S. regulators may take enforcement actions against companies that don’t follow the law.

According to the CFTC, the agency doesn’t want to see people lose money due to fraudulent activities on crypto exchanges. To help prevent such losses, the CFTC requires exchanges to register with the agency. If an exchange fails to meet registration requirements, the agency can seek injunctive relief, impose civil penalties, or close the firm.

Why use unregistered exchanges?

Mostly because of some coins people want to buy and trade that are not available on the US-allowed exchanges. Also, many unregistered exchanges offer innovative services like Earn, staking, leveraged trading, DeFi liquidity mining, etc.

Another reason why traders might consider trading on foreign exchanges is because they can help avoid taxes. Many countries around the world have strict laws regarding capital gains taxation. This includes the United States.

The IRS considers virtual currencies to be property rather than currency. As a result, anyone who buys or sells digital assets must report those transactions to the government. If you fail to do so, you could face steep fines.

Because of this, many Americans prefer to buy and sell cryptos via peer-to-peer markets where buyers and sellers meet directly. But doing so isn’t easy since even these platforms enforce KYC procedures and prevent US users from joining.

Can US citizens use foreign crypto exchanges?

Yes, but they risk a lot. How come, you ask?

Even though most major crypto exchanges outside the United States don’t allow American customers to buy bitcoins, some smaller foreign exchanges take the risk of being shut down by U.S. authorities and turn a blind eye to US users being present on their platform.

Most of them decide to use a VPN, a virtual private network, to connect to a server located somewhere else in the world. However, it turns out that while a VPN might help you hide your IP address and location, it won’t protect you from law enforcement agencies tracking your activity. Also, VPNs are relatively easy to spot by the exchanges, and you could be banned at any time without prior warnings.

FAQs

CaptainAltcoin’s writers and guest post authors may or may not have a vested interest in any of the mentioned projects and businesses. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin.com