The ethereum (ETH) options market shows continued strong appetite for bullish bets on ETH among traders, despite falling spot prices. The question now is if this is a sign that smart money is positioning for a future rally, and if now is a good time to start dollar-cost averaging (DCA) into ETH.

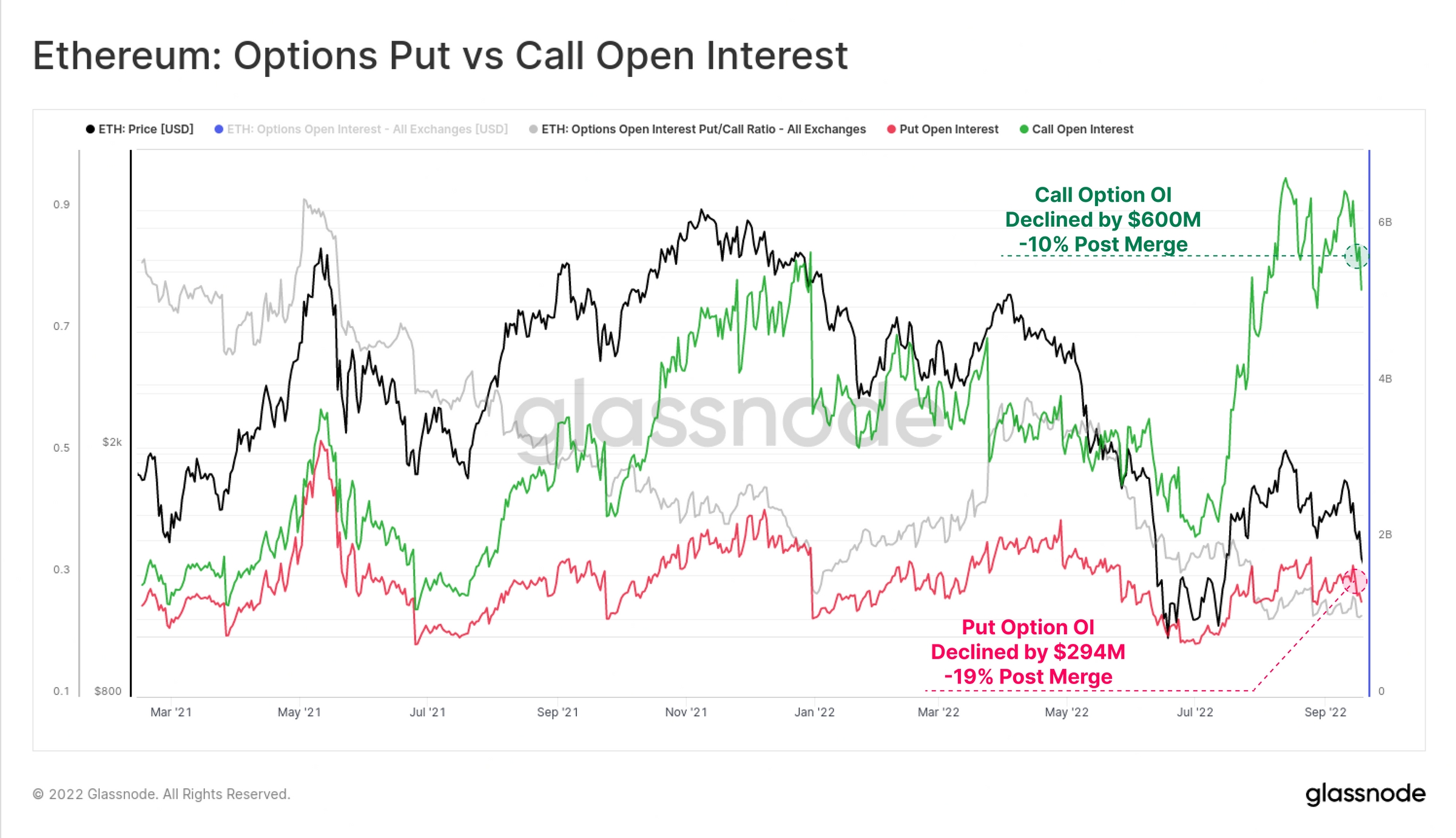

The surprisingly bullish bias in the market for ETH options was pointed out in the latest The Week Onchain report from Glassnode, where the firm noted that the value of outstanding call options remains higher than the norm from 2021.

A call option is a bet that the spot price of an asset will rise, while a put option is a bet that the price will fall.

According to Glassnode, there is now a total of $5.2bn in outstanding call option value for ETH, which is “much higher” than what was the norm last year. At the same time, put option positions have seen a sharper drop in value than call option positions, with $294m in net position value closed.

“In many ways, it appears that ETH markets remain heavily utilized, levered up, and speculating on further upside, despite a -22% ETH price correction,” the crypto analytics firm wrote in the report.

Time to DCA into ETH

With such a heavy bullish bias in the ETH options market, it’s only natural to ask if now is a good time to start moving slowly into ETH, perhaps via the so-called dollar-cost average (DCA) strategy.

The DCA strategy has historically been a good way to take a position in major cryptoassets, and remains popular both in the Ethereum and Bitcoin (BTC) communities as a way to invest without trying to perfectly time tops and bottoms, which very few are able to do.

With ETH spot prices now as low as they are, it seems as if starting to DCA into ETH now could pay off in the long-run. And with the Merge already behind us and widely deemed a success, is it really so surprising that sophisticated options traders have already positioned themselves for a rally?

As Glassnode put it in their report:

“The Ethereum Merge was a success, and a historic one to say the least. Many years of dedicated research, development, and strategy have now come together to achieve a remarkable engineering feat.”

Maybe it’s only a matter of time before the market also realizes this.